Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

On Dec 29, 1989, the Nikkei 225 stock index reached an intraday high of 38,957.44 points, having grown sixfold during the decade.

On Dec 29, 1989, the Nikkei 225 stock index reached an intraday high of 38,957.44 points, having grown sixfold during the decade. That day marked the end of the Japanese bubble, which began in 1985 when the yen weakened to a record low of 260 against the US dollar in February, causing the September Plaza Accord to increase the rate “voluntarily”. The rapid appreciation of the yen to 123 by November 1988 saw a massive rise in real estate and stock market prices, when Japan reported GDP growth of 6.7% that year. In the Lost Decades after 1990, Japanese growth averaged around 1% per year, even as the population began to age and the stock market began to fall to a record low, to 7,695 points by February 2009, before recovering to its 1989 peak in December 2024.

The stock market was so weak that beginning in 2011, the Bank of Japan (BoJ) started buying Nikkei 225 exchange-traded funds, and owned as much as 75% of all Nikkei 225 ETFs issued by 2017. By 2021, it owned roughly 10% of the free float of Nikkei 225 stocks. Buying stock ETFs and massive Japanese government bonds (JGBs) was the Abenomics quantitative easing policy launched by the legendary BoJ governor Haruhiko Kuroda to revive the Japanese economy. The BoJ shifted the huge JGB portfolio out of the long-term pension funds to its books, causing the outflow of yen funds to earn higher US interest rates and dividends.

In September 2025, the BoJ announced the unwinding of its total ETF purchases by roughly US$2.5 billion annually, out of its book value holdings of ¥37.1 trillion (US$250.7 billion). The market value of the BoJ’s holdings is estimated at ¥85 trillion. So far, the looming sales have not affected Japanese stock prices. Why?

The broader trend of low yen exchange rates, low interest rates and slow and steady balance sheet reforms in the Japanese economy in the last two decades has caused a gradual return to greater productivity and revival. When the yen is on a downward trend, the carry trade, in which the borrower borrows yen to invest in US markets with higher interest rates, will earn positive carry, being a higher interest rate return and higher foreign exchange profits because the yen is expected to depreciate against the US dollar. The risk is that the yen suddenly appreciates, so hedge funds and speculative housewives who manage the bulk of Japanese household savings (the apocryphal Mrs Watanabe) are mainly responsible for taking such risks. Since Kuroda launched his unusual monetary policy, the yen has depreciated from a peak of 77.3 against the US dollar in January 2012 to 160 by July 2024, before higher inflation and interest rate hikes caused some appreciation back to the 145 to 150 range today.

During this period of a weak yen, Japanese holdings of long-term US Treasuries went from US$1.1 trillion at end-2012 to US$2.5 trillion at end-2024, according to US Treasury data. However, according to the Japanese Ministry of Finance’s net international investment position data, Japanese gross holdings of foreign portfolio investments grew from ¥308.1 trillion (US$4 trillion at an exchange rate of 76) to ¥693.9 trillion (US$4.4 trillion at an exchange rate of 157). If the dollar were to depreciate against the yen, Japanese holders of US dollars would start diversifying out of the greenback.

The size of Japanese flows into US dollar assets annually has been a significant factor in global liquidity and market prices. Japan alone held 13.5% of long-term US Treasuries in 2012, and even after the rise of Chinese holdings, the ratio at end-2024 was still 11%. Thus, if Japan were to reduce its holdings of US Treasuries or repatriate dollar holdings back to yen assets, the impact on the exchange rate and US financial assets would be significant.

The rise of the Japanese stock market reflects that portfolio rebalancing. If Japanese corporations and investors were to repatriate dollars to yen assets, what would they buy? The largest portion should be bonds, but bond prices are very high because of the current low interest rates. If inflation increases, at the current rate of 3% per annum, then bond prices would suffer capital depreciation. Land prices are still depressed except in key urban areas due to the ageing population and decline in birth rates. Thus, Japanese corporations have begun to buy back their own stock with their cash flow.

According to the latest available information, Japanese corporations bought back ¥14.9 trillion of their own stock in 2024, which was 1.7 times the previous year’s level. In the first half of 2025, they already bought back ¥9.4 trillion and may exceed ¥20 trillion for the full year of 2025. Thus, in addition to foreigners buying Japanese equity due to reasonable earnings valuation and the prospect of a stronger yen, it is the Japanese companies themselves that are driving up their own share prices.

Japanese companies have a reputation of being modest in their publicity of their achievements in reforms, mainly because of two decades of struggling with keeping jobs and improving their product quality and innovation. Nevertheless, foreign manufacturers appreciate that Japan has world-class research and development and high quality labour but ageing corporations, due to retiring owners/entrepreneurs. So, private equity firms have been buying up Japanese companies with good intellectual property rights and engineering skills. Japanese conglomerates have also begun to appreciate that instead of having a mixed group of subsidiaries under one umbrella, it would be more profitable to separately list their semiconductor or specialist engineering arms to get higher valuations.

With geopolitical tensions rising, Japan will increase its spending in defence and military technology, which will also drive the economy forward. Broadly speaking, we see a general rebalancing of global financial markets creating higher prospects for the Japanese stock market as the world needs to de-dollarise due to the growing and unsustainable US fiscal debt. The problem with forecasting the Japanese economy is that the yen has been far more volatile due to the carry trade that can swing the market up and down. One shrewd market observer thinks that at the end of year, the yen could be either 120 or 180 against the US dollar. So what you make on the stock market could be offset by the yen depreciation.

With the recent election of the first Japanese female Liberal Democratic Party leader Sanae Takaichi, the Nikkei 225 hit a record high of 48,000 points. The yield on the 30-year JGBs touched 3.333%, also an all-time high. Will prospectively the first female prime minister in the history of Japan undertake major reforms to revive its economy? That is the big question facing not just investors in Japan, but will have an impact on global financial markets in the days to come.

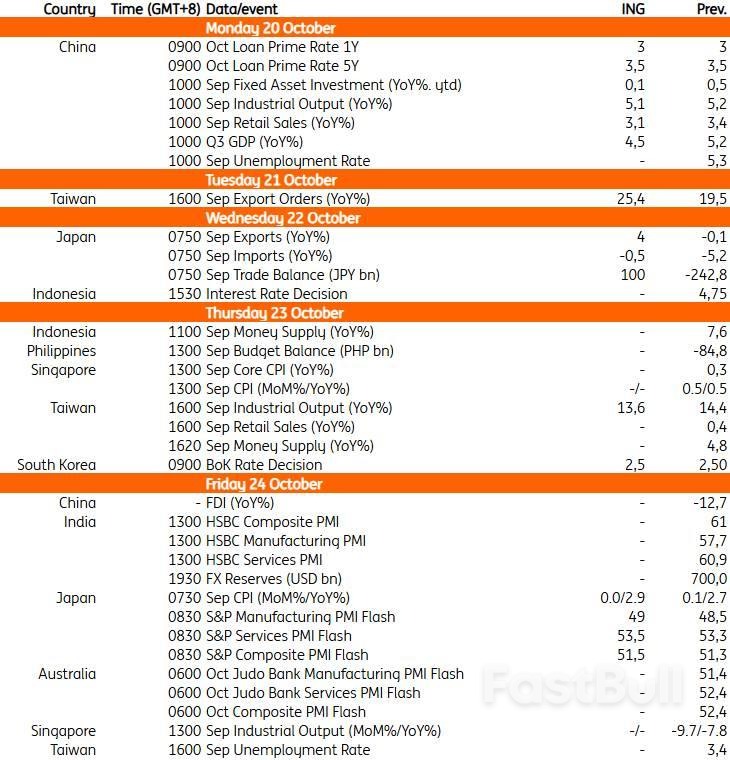

It will be a busy start to the week in China. The Fourth Plenum meetings run from Monday to Wednesday, with the primary focus expected to be the discussion of China’s 15th Five-Year Plan. It will cover the key development plans for China between 2026 and 2030. While the full Five-Year Plan likely won't be available until next year's Two Sessions, we will likely get some information on the key themes discussed. Of particular interest are priorities for development, including how to expand consumption, foster innovation, and the strategic focusses going forward.

Monday morning kicks off with a decision on loan prime rates. No change is expected after the People’s Bank of China stood pat. Also Monday, China reports third-quarter GDP. Barring a stronger-than-expected rebound in September -- we are currently expecting slight slowdowns in retail sales, industrial production, and fixed asset investment growth -- the data is likely to show China slowed substantially to 4.5% year-on-year. We will also get September property price data. Prices have been on a negative trajectory in recent months. With no fresh stimulus, there's little reason to expect a significant turnaround.

The Bank of Korea's policy meeting on Thursday should be the highlight of the week. Due to rising housing prices in the Seoul area, the USD/KRW exceeding 1,400, and ongoing uncertainties related to tariff negotiations with the US, the BoK's rate cut cycle may be postponed to November -- or even to next year. The government announced updated measures on mortgage and housing purchases this week, but it will take time to see their impact. Also, the outcome of the $350 billion investment pledge is another major factor influencing both the currency and the BoK's policy stance. Thus, the BoK may monitor developments in the housing market and tariff discussions before making further decisions. We believe growth and inflation are likely to stay close to the BoK's current projections. Yet, downside risks have notably increased recently.

Ahead of the Bank of Japan’s meeting on 30 October, this week’s updates on exports, following the 15% US tariff deal and recent inflation developments, are of great interest. We expect exports to rebound to 4.0% YoY, as shipments of automobiles and chip-producing machinery return to normal. Imports are likely to decline 0.5%, mostly thanks to lower global commodity prices. We expect further export normalisation in the coming months after the trade agreement reached in September. Meanwhile, inflation is expected to rise to 2.9% YoY in September, with core prices likely to stay above 3.0%. The recent deceleration of inflation is largely thanks to government subsidies for energy and social welfare programs.

It’s a quiet week ahead in Taiwan. September export orders, out Tuesday, are expected to have rebounded to 25.4% YoY. Trade data has generally held up better since the reciprocal tariffs took effect. Taiwan also publishes its industrial production data on Thursday, which is expected to have moderated to 13.6% YoY.

In a dim warehouse in Kojima, a rural port town at the heart of Japan’s denim industry, the deafening clatter of automated looms doesn’t seem to bother Shigeru Uchida as he bends over the machines to ensure they’re running smoothly.The 79-year-old is used to the loud rattle of the wooden shuttles shifting back and forth, as cotton fibers drift through air that’s thick with the acrid smell of oil. Five decades spent weaving textiles have stained his fingertips a deep blue.

“You have to rely on intuition,” says Uchida, who trained for more than a decade to master the looms and is one of a shrinking cohort of artisans left in the southern town. “Without learning the ways of the older people who are here now, these machines won’t stay in motion.”The gloomy factory feels far-removed from the glamor of fashion runways in Tokyo and Paris, where Japanese denim is in vogue.Long cherished by connoisseurs for its textured yarns and the unique way it fades, the patiently crafted fabric is gaining global recognition with fashion houses such as Christian Dior and Balenciaga using it in their collections. Celebrities including Andrew Garfield and Joe Jonas have fueled the hype, boosting a market that’s projected to grow by more than 85% to $5.2 billion by 2035.

Yet just as Japanese denim enjoys global attention, its future looks fragile. With a rapidly aging population, Japan faces a labor shortage that’s particularly acute in Kojima’s denim workshops, where few young people are willing to endure such punishing conditions.

Uchida, who’s worked in the textile industry since he was in his 20s, recalls being chased around a factory floor when he was younger by a mentor wielding a hammer. He says only about half a dozen artisans remain in the town; the handful of recent apprentices all quit within six months of being hired.“It’s a harsh job and the path you have to take isn’t easy,” says Masataka Suzuki, president of Japan Blue Co., which employs Uchida and is one of the town’s main denim producers. “The workplace is the same as it was in the old days,” he adds from his air-conditioned office, removed from the cacophony of the looms.

Most Japanese denim is made by a handful of companies based in the southwestern prefectures of Okayama and Hiroshima. High-quality cotton is spun into yarn, then dipped repeatedly into vats of natural indigo dye to create the rich blue color. Each step is often handled by people who have spent decades perfecting the craft.The denim is then made using looms invented in the early 20th century by Sakichi Toyoda, whose company, Toyota Industries Corp., later diversified into engines and vehicles and spun off its automotive division into Toyota Motor Corp.

The looms work at a slower pace than modern machines, allowing for a denser, tighter weave. The shuttle passes the yarn back and forth in a continuous line, locking in the fabric as it turns back to create a clean, self-finished edge known as selvedge. Modern looms, which are faster, cut the weft, or horizontal, thread at each pass, leaving fraying edges that require overlocking or stitching.The neat border of selvedge denim is often marked by a red yarn that, along with the indigo dyes that fade distinctly over time, gives the denim a signature look adored by aficionados.

Japan’s textiles industry had as many as 300,000 shuttle looms in 1975, according to Japan Blue. But after cheaper imports hollowed out the industry and aging machines broke down, fewer than 400 are now being used in denim mills — with about a third under the control of Japan Blue, Suzuki says. Replacement parts have to be painstakingly sourced if a machine breaks down, and are mostly cannibalized from other broken looms. Finding workers who can operate, maintain and repair the machines is an added challenge.

Nevertheless, demand is booming — helped by inbound tourism that hit a record high in the first half of 2025 and a weak yen that’s increasing visitor spending. Suzuki says sales have tripled in the past year, much of it driven by tourists flocking to Kojima’s Jeans Street, a 400-meter (quarter-mile) strip with many denim stores, workshops, cafes and galleries.

The origins of Japanese denim trace back to American GIs who introduced jeans to the nation after World War II. The Japanese made the garment their own through traditional artisanry. But despite taking off globally at the turn of the century, it remains a relatively exclusive product, according to Aaron Ward , a lecturer at Toyo University in Tokyo who researches cultural consumption and aesthetics. Many brands have websites that are only in Japanese and don’t sell their products overseas — giving those that do serve international demand an added scarcity appeal.

“They’re clearly not out to make huge amounts of money,” Ward says. “Whether or not the local community keeps it up will determine whether or not it survives.”Consumers are prepared to pay a premium for authentic Japanese denim. Levi Strauss & Co. launched its Blue Tab collection earlier this year. A pair of jeans in the collection can cost more than $250, which is about twice the price of a standard pair of Levi 501s.

In another sign of the denim’s growing cultural cachet, L Catterton, a private equity firm backed by LVMH Moet Hennessy Louis Vuitton SE, last year invested in Japanese denim brand Kapital, which was founded in Kojima in 1985. The price for a pair of Kapital jeans is anywhere between a few hundred dollars to well over $1,000.

Among selvedge denim’s growing legion of fans is Jeff Yamazaki, a model and content creator who frequently travels to Japan from his home in Los Angeles to discover new brands. “Japanese denim is like the greatest in the world,” says Yamazaki, whose Instagram feed is full of recommendations on the best places in Tokyo to shop for denim. He says a consumer backlash against the environmental impact of fast fashion could be contributing to demand for Japanese denim, which exemplifies quality and longevity.

Despite its growing popularity, the industry’s future is in doubt.

“In 10 years, we won’t be able to make denim like this anymore,” says Kenichi Iwaya, chief executive officer of Pure Blue Japan, based in Kurashiki, Okayama. The company sells roughly 20,000 pairs of jeans per year — up more than 50% since the 1990s — and 90% of them are exported to the US. But production costs have doubled over that period. Iwaya says that between running the business, visiting storefronts in Tokyo and flying abroad to attend fashion shows, he doesn’t have the bandwidth to find and train replacements for aging artisans.

“There’s no time to teach,” he says.

About 40 kilometers to the west in the town of Fukuyama, Ryoichi Sakamoto has similar concerns.He grew up roaming the factory floors of family-run Sakamoto Denim Co., where ribbons of white cotton are pulled through simmering vats of indigo dye by a vast machine, adopting hues of green and blue before taking on a rich, dark navy at the end of the process. A stench of boiling sulfur fills the air and blue residue clings to every exposed surface, including workers’ hands.

“I always wanted to stick my hands into the indigo,” says Sakamoto. Now in his 70s and company president — the fourth generation of his family to run the business — he’s afraid for the future. The plant is operating at full capacity and can’t keep up with orders. Hiring became difficult about 10 years ago and has only gotten harder since. “It’s a huge problem,” he says.

At the Yamaashi Orimono textile mill in the nearby town of Ibara, much of Sakamoto’s dyed yarn will be woven into denim. But the mill is also facing a labor crunch. Hideo Yamaashi, 67, its third-generation president, says it takes anywhere between six months and five years to learn how to operate a loom, and up to a decade to become capable of maintenance and repairs.It’s been five years since Sachiko Kouzu joined the company, which has about three dozen looms, most of them located in an unassuming block near the edge of a small forest. Now in her 40s, she skips from loom to loom inside the humid building, checking to make sure each one is humming.

Finding people willing to endure the grind and grit of the craft has become difficult, Kouzu says. “It’s tough — it gets hot, the noise is loud, and then there’s the oil,” she says. “If young people don’t take up the work, and with the machines being so old, I’m not sure how much longer this can continue.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up