Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

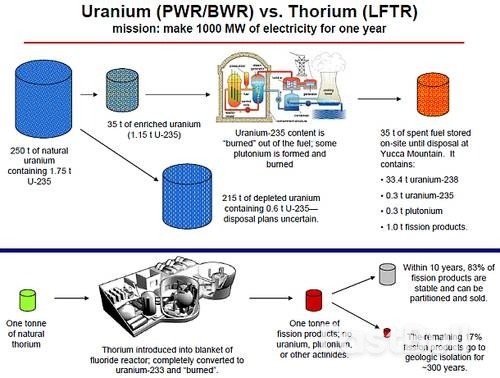

An experimental Chinese nuclear plant reportedly just crossed a historic threshold, successfully operating the world's first thorium-based molten salt reactor (TMSR).

An experimental Chinese nuclear plant reportedly just crossed a historic threshold, successfully operating the world's first thorium-based molten salt reactor (TMSR). The Chinese Academy of Sciences' Shanghai Institute of Applied Physics has broken a major scientific barrier by successfully converting thorium to uranium in a historic first.

The Hong Kong-based South China Morning Post reports that the breakthrough, which took place at an experimental reactor out in the Gobi Desert, is "poised to reshape the future of clean sustainable nuclear energy."

The process works by using a "precise sequence of nuclear reactions" in which naturally occurring thorium-232 absorbs a neutron, becoming thorium-233. Through a decay process, that isotope breaks down into protactinium-233 and then finally into uranium-233, a potent form of nuclear fuel that can sustain chain reactions for nuclear fission.

While this breakthrough was just publicized this month by a report by Science and Technology Daily, the TMSR has apparently been operational for years. Li Qingnuan, Communist Party secretary and deputy director at the Shanghai Institute of Applied Physics, told the outlet that "since achieving first criticality on October 11, 2023, the thorium molten salt reactor has been steadily generating heat through nuclear fission".

If the reports are true, this breakthrough would signal an incredible leap forward in a nuclear technology race that China is already winning handily. Although the United States is still the world's biggest producer of nuclear energy, that status won't last much longer. In the same time period that the United States built the overdue and over-budget Plant Vogtle, China built 13 reactors of similar scale, and has 33 more on the way. Beijing is also making major forays into the nuclear sectors of emerging economies, with particularly concerted efforts in Africa.

"The Chinese are moving very, very fast," Mark Hibbs, senior fellow at the Carnegie Endowment for International Peace and expert on the Chinese nuclear sector, told the New York Times. "They are very keen to show the world that their program is unstoppable."

But while China has invested huge sums of money and manpower into becoming a global nuclear energy innovator and superpower, the nation lacks sufficient uranium to power its lofty goals. While nuclear power production growth is dominated by China, uranium supply chains are dominated by Russia, which is home to nearly half (approximately 44 percent) of all global uranium enrichment capacity.

China has been buying up more and more of Russia's uranium, but reliance on exports is both risky and antithetical to China's ethos of domestic energy independence and international energy dominance. Russia's outsized presence in the nuclear fuel supply chain has resulted in some degree of risk and market volatility, as the Kremlin has shown that it is not afraid to use enriched uranium for political leverage.

"The nuclear energy supply chain sits atop the clean technology risk pyramid," warned a recent article from the Carnegie Endowment for International Peace. "Beyond standard supply chain considerations, nuclear exports are subject to a suite of safety and security concerns, and overreliance on a single technology or fuel provider can create significant dependencies given the limited number of suppliers and distinct intellectual property (IP)."

By sidestepping the uranium supply chain issue by using thorium instead, China is leaping over a critical hurdle and straight over the finish line for global nuclear power sector domination. Thorium is much more accessible and abundant than uranium, and could theoretically solve all of China's nuclear fuel problems. According to the South China Morning Post, just one mining site in Inner Mongolia " is estimated to hold enough of the element to power China entirely for more than 1,000 years."

There is no need for a rupture between Europe and the U.S. over Washington's new Security Strategy warning of "civilizational erasure" in the Old World, Germany's spy chief said on Monday.

In the new document, unveiled late last week, the Trump administration upends postwar assumptions about Europe's close relationship with the United States and takes European countries to task for continuing to rely heavily on the U.S. for their defence. Reuters reported on Friday that Washington wants Europe to take over the majority of NATO's conventional defence capabilities, from intelligence to missiles, by 2027.

"I would not draw from such a strategy the conclusion that we should break with America," Sinan Selen said at an event in Berlin, "and I also do not believe that our partners will break with us."

"But one important point is that we naturally have to continually review our alliances and further develop them, and that applies in particular to European networking."

Europe needs to become more independent overall, including in its security architecture, Selen said, alluding to concern over reliance on U.S. technology.

Europe "must be able to generate alternatives" for example to the crime-fighting software of CIA-backed Palantir Technologies (PLTR.O), opens new tab so it could then select the best solution, taking into account geostrategic considerations.

"We have industries and companies that can do these things. Perhaps they simply need more support," he said.

German security services also need expanded digital surveillance powers to better unmask people hiding behind fake profiles, map their online networks, and analyse their communications, before anything happens, said Selen.

The government is already working on this, he said.

"Other partners — I look specifically at France and the Netherlands — are far ahead of us in this regard," said Selen.

Germany has traditionally maintained some of the strictest data-privacy protections in Europe, shaped by its history of two dictatorships in the 20th century.

UK homes worth more than £2 million ($2.7 million) could drop about 5% in value next year as the market adjusts to a so-called mansion tax, according to forecasts from Hamptons.

The broker said it expected these homes — most of which are in London — to see a "one-off adjustment" in 2026 based on price reductions that factor in a new levy coming into force in April 2028. Chancellor of the Exchequer Rachel Reeves last month unveiled a tax on homes valued at more than £2 million, with a surcharge starting at £2,500 a year and rising to as much as £7,500.

A 5% price correction would be the largest annual drop in values since 2009 for homes that have maintained a value of more than £2 million during those years, according to Hamptons' data. The broker said it expected London to be the only region in Britain to see house prices fall in 2025, predicting a 0.5% decline in the year compared to growth of as much as 5% in other regions.

"It's hard to ignore the growing drag of taxation and politics," Aneisha Beveridge, head of research at Hamptons said in a report. London "is being held back by higher stamp duty and broader tax anxieties, locking some owners into their homes and others out of buying them."

The housing market has endured disruption partly caused by hikes to stamp duty and the abolition of a system that allowed wealthy foreigners, or so-called non-doms, to avoid UK taxes on their overseas earnings. The changes have disproportionately impacted activity in London, where the market has also been affected by fiscal worries, as Labour raises revenue to pay for higher public spending.

The new mansion tax targets less than 1% of all properties in England. However, most homes worth more than £2 million are in London, where property agents are warning the tax could amplify turbulence in the city's market.

London's already weak house price growth is set to significantly trail the rest of Britain for at least the next two years. Hamptons predicts London will be the only region to not see house prices rise next year, and says it will lag behind other UK regions in growth by as much as roughly 16 percentage points between 2024 and 2028.

The broker expects house prices to rise by 2.5% across Britain in 2026, followed by 2% growth in 2027 and a further 1.5% in 2028. It said political uncertainty will become a more prominent driver of property sentiment in 2028 — the year before the next planned general election.

Based on market views on interest rates, the base rate could move further downwards next year and "settle" at about 3.25% at the end of 2026, Hamptons said. This should increase Britons' chances of securing mortgage deals below 4%, it added.

"Inflation is easing, mortgage rates are falling, and affordability is improving," Hamptons' Beveridge said. "At the same time, the balance of power is shifting: the Midlands is forecast to have seen more price growth than London since prices bottomed out after the 2008 financial crash."

Thailand said its fighter jets struck Cambodia on Monday in an attempt to cripple its military capability, as a re-eruption of border hostilities derailed a fragile ceasefire brokered by U.S. President Donald Trump.

Each side blamed the other for starting clashes that broke out during the night and intensified before dawn and spread to multiple locations, with one Thai soldier and four Cambodian civilians killed, according to officials.

Cambodia accused Thailand of "inhumane and brutal acts" of aggression, stressing it had not retaliated, while Bangkok said it carried out air strikes on military targets after its neighbour mobilised heavy weaponry and repositioned combat units.

"The objective of the army is to cripple Cambodia's military capability for a long time to come, for the safety of our children and grandchildren," Thai army chief of staff General Chaipruak Doungprapat said, according to the military.

The fighting was the fiercest since a five-day exchange of rockets and heavy artillery in July that marked their heaviest clashes in recent history, when at least 48 people were killed and 300,000 displaced before Trump intervened to broker a ceasefire.

Tensions have simmered since Thailand last month suspended de-escalation measures that were agreed at a summit in Trump's presence, after a Thai soldier was maimed by a landmine that Bangkok said was newly laid by Cambodia.

Some of the mines that have wounded seven Thai soldiers since July were likely newly laid, Reuters reported in October, based on expert analysis of material shared by Thailand's military.

Cambodia has denied laying the mines and Thailand has said it will not implement the ceasefire terms until Cambodia apologises.

Thai Prime Minister Anutin Charnvirakul on Monday said his government would do whatever necessary to protect its territorial integrity and would not engage in dialogue with Cambodia.

"There will be no talks. If the fighting is to end, (Cambodia) must do what Thailand has set," he said, without elaborating.

Cambodia's defence ministry said its forces came under sustained attack but were committed to the ceasefire and did not retaliate.

"Cambodia calls on the international community to strongly condemn Thailand's violations ... as well as demands that Thailand take full responsibility for such brazen acts of aggression," it said in a statement.

Thailand's army said Cambodia used drones to drop bombs on Thai bases and fired truck-mounted BM-21 rockets towards civilian areas.

A Thai military official told Reuters targets of air strikes included long-range Chinese-made rockets.

The U.S. embassy in Thailand did not immediately respond to a request for comment on the unrest. Malaysian Prime Minister Anwar Ibrahim, chair of the regional bloc ASEAN who helped Trump broker the truce, called for calm and for communication channels to stay open.

"The renewed fighting risks unravelling the careful work that has gone into stabilising relations," Anwar said in an X post.

This map shows locations of military clashes along the disputed border between Thailand and Cambodia.

This map shows locations of military clashes along the disputed border between Thailand and Cambodia.Cambodia's former longtime leader Hun Sen, the influential father of current premier Hun Manet, said Thailand's military was seeking to provoke a retaliatory response.

"All frontline forces must remain patient because the aggressors have been firing all kinds of weapons," he said on Facebook.

Thailand evacuated 438,000 civilians across five border provinces and authorities in Cambodia said hundreds of thousands of people had been moved to safety. Thailand's army said 18 soldiers were wounded and Cambodia's government reported nine civilians injured.

In Cambodia, bottlenecks of trucks and cars formed on country roads and streams of motorcycles and farming vehicles were leaving border areas, local television showed. A verified eyewitness video showed a plume of smoke rising after a Thai airstrike.

Thai television showed footage of people packed into evacuation camps and others sheltering in bunkers or large concrete water pipes, and the military released a video of what it said was exploding Cambodian artillery.

Phichet Pholkoet, a resident of Thailand's Ban Kruat district bordering Cambodia, said he had heard gunfire since early morning.

"It startled me. The explosions were very clear. Boom boom!" he said via telephone. "I could hear everything clearly. Some are heavy artillery, some are small arms."

The use of fighter jets demonstrates Thailand's military advantage over Cambodia, with an armed forces that dwarfs its neighbour in terms of personnel, budget and weaponry.

Thailand and Cambodia have for more than a century contested sovereignty at undemarcated points along their 817-km (508-mile) land border, with disputes over ancient temples stirring nationalist fervour and occasional armed flare-ups, including a deadly week-long artillery exchange in 2011.

Tensions rose in May following the killing of a Cambodian soldier during a skirmish, which led to a major troop buildup at the border and escalated into diplomatic breakdowns and armed clashes.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up