Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Mexico’s planned tariffs on Chinese goods add pressure as Beijing battles U.S. trade levies, testing China’s export resilience and 5% GDP growth goal.

Key Points:

China’s economy faces a pivotal test this quarter as tariff developments challenge the growth outlook. Recent economic indicators have raised concerns about Beijing achieving its 5% GDP growth target for 2025.The US and China extended the trade war truce in August, leaving Chinese goods exposed to US tariffs averaging 55%. In contrast, Beijing maintained the 10% levy on US shipments bound for China.

Avoiding a sweeping 145% US tariff on shipments to the US was critical. However, the US administration’s proxy trade war via third-country tariffs continues to gain momentum. Reports of Mexico’s plans to raise tariffs on Chinese goods signal another roadblock, challenging efforts to bypass US tariffs.Mexico has become a crucial hub for Chinese automakers targeting the US. BYD, Chery, and MG Motors have reportedly invested over $700 million in local plants. New tariffs on shipments to Mexico, coupled with existing US tariffs on Mexican exports, could dent demand for Chinese autos and parts.

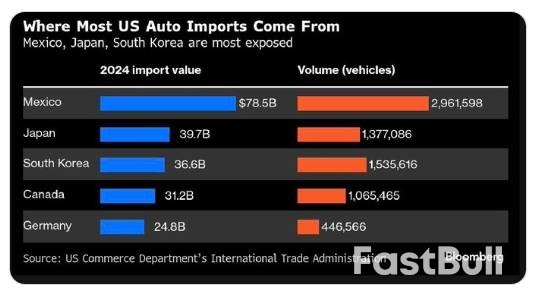

For context, Mexico accounted for the largest share of US auto imports, underscoring Mexico’s importance for auto manufacturers.

Bloomberg – US Auto Imports By Country

Bloomberg – US Auto Imports By CountryIn July, the US administration targeted another of China’s key trade routes, Southeast Asia. A 40% US levy on transshipments from Vietnam and a 19% tariff on Indonesian goods could affect Chinese exports. Chinese exports surged 7.2% year-on-year in July, up from 5.8% in June, with Southeast Asia driving growth. But August data will show whether fresh tariffs start to bite.

CN Wire commented on July’s trade data, stating:

“This export resilience persists despite high U.S. tariffs, indicating strong global demand continues to support China’s economy. […]. However, whether this momentum will last remains uncertain, as front-loading effects may fade.”Mexico’s tariff news follows reports of the US administration planning to impose rules of origin for indirect shipments.Natixis Asia Pacific Chief Economist Alicia Garcia Herrero commented on China’s outlook for terms of trade, stating:

“Rerouting will be much harder in the second half. So that’s going to hit Chinese exports indirectly. So, that’s why the second half is tougher and the government has been preparing.”The latest trade developments came as the US and China prepare for the next round of trade talks. China’s chief trade negotiator Li Chenggang plans to return to Washington to discuss trade terms. The outcome of trade talks could be crucial given China’s reliance on ‘third countries’ and tariffs targeting Chinese shipments.

On Wednesday, August 27, Mainland China’s CSI 300 and the Shanghai Composite Index pulled back 1.49% and 1.76%, respectively, after briefly reaching new year-to-date highs.Despite the retreat, optimism over Beijing’s 5% GDP growth target, supported by policy measures, continues to bolster demand for Mainland-listed stocks. The CSI 300 and the Shanghai Composite were up 1.19% and 0.58%, respectively, during the August 28 morning session.

Both indexes continue to outperform the Nasdaq Composite Index but trail the Hang Seng Index year-to-date. CSI 300 gained 9.4% in August and 12.7% YTD. Shanghai Composite rose 8.5% in August and 14.1% YTD. The Hang Seng leads, up 24.8% YTD, well ahead of the Nasdaq’s 11.8%Trade developments and Beijing’s next stimulus measures remain crucial to market momentum. An escalation in US-China trade tensions and delays in fresh stimulus could unravel the bullish sentiment.

CSI 300 – Nasdaq Composite Index – Daily Chart – 280825

CSI 300 – Nasdaq Composite Index – Daily Chart – 280825The next moves in US-China trade talks and Beijing’s stimulus drive will set the tone for markets in the coming weeks.However, crucial economic indicators will also affect market trends. August’s NBS private sector PMIs on Sunday, August 31 and September 1 will draw interest. The PMIs will reveal whether tariffs added more pressure on China’s manufacturing sector midway through Q3. Weak numbers could raise expectations of fresh stimulus from Beijing.

Fewer Americans sought unemployment benefits last week as employers appear to be holding onto their workers even as the economy has slowed.

Applications for unemployment benefits for the week ending Aug. 23 dropped 5,000 to 229,000, the Labor Department reported Thursday.

Measures of the job market are being closely watched on Wall Street and by the Federal Reserve as the most recent government data suggests hiring has slowed sharply since this spring. Job gains have averaged just 35,000 a month in the three months ending in July, barely one-quarter what they were a year ago.

Weekly applications for jobless benefits are seen as a proxy for layoffs and have mostly settled in a historically healthy range between 200,000 and 250,000 since the U.S. began to emerge from the COVID-19 pandemic more than three years ago.

While layoffs are low, hiring has also weakened as part of what many economists describe as a “no hire, no fire” economy.

Growth has weakened so far this year as many companies have pulled back on expansion projects amid the uncertainty surrounding the impacts of President Donald Trump’s tariff policies. Growth slowed to a 1.3% annual rate in the first half of the year, down from 2.5% in 2024.

The weakness in the job market is a key reason that Federal Reserve Chair Jerome Powell signaled last week that the central bank may cut its key interest rate at its next meeting Sept. 16-17. A cut could reduce other borrowing costs in the economy, including mortgages, auto loans, and business loans.

The US economy expanded in the second quarter at a slightly faster pace than initially estimated on a pickup in business investment and an outsize boost from trade.

Inflation-adjusted gross domestic product, which measures the value of goods and services produced in the US, increased at a 3.3% annualized pace, the second estimate from the Bureau of Economic Analysis showed Thursday. That compared with an initially reported 3% increase.

Net exports added nearly 5 percentage points to GDP, the most on record after weighing on GDP in the first three months of the year. Goods and services that aren’t produced in the US are deducted from the GDP calculation but counted when consumed.

Gold keeps firm tone and cracks very significant $3400 resistance zone (psychological / Aug 8 peak), trading at the highest in nearly three weeks on Thursday.

Bulls are driven by uncertainty after President Trump’s attempts to fire Fed Governor and persisting tensions over potential replacement of Chair Powell, as well as expectations for Fed rate cut in September.

Although Chair Powel showed a dovish shift in his latest speech, he did not commit to any action in the near future, implying that coming economic data (US PCE index, due on Friday and August Labor report, due next week) will provide more details about inflation and condition in the labor sector and contribute to the central bank’s decision in September’s policy meeting.

While the fundamentals move into desired direction (PCE index is expected to keep steady rise by 2.6% in July, while recent strong drop in US employment and rise of unemployment) and contribute to rising bets for rate cut.

Technical picture remains predominantly bullish on daily chart (MA’s in full bullish configuration/break above triangle upper boundary / long tail of Wednesday’s daily candle) but positive signals are partially offset by strongly overbought Stochastic and flat 14-d momentum.

This implies that bulls will face difficulties to break critical $3400 zone, with consolidation likely to precede fresh push higher.

Broken Fibo 76.4% barrier ($3385) should ideally contain, with extended dips expected to find solid ground above broken triangle’s upper boundary ($3373) to keep bulls in play.

Firm break of key obstacles at $3400/08 to signal bullish continuation and expose targets at $3438/52 (tops of July 23 / June 16 respectively).

Res: 3400; 3408; 3438; 3452.Sup: 3385; 3373; 3367; 3356.

Russian President Vladimir Putin and North Korea's Kim Jong Un will attend a military parade in Beijing, marking the first public appearance of the two leaders alongside President Xi Jinping in a show of collective defiance amid Western pressure.No Western leaders will be among the 26 foreign heads of state and government attending the parade next week with the exception of Robert Fico, prime minister of Slovakia, a European Union member state, according to the Chinese foreign ministry on Thursday.

Against the backdrop of China's growing military might during the "Victory Day" parade on September 3, the three leaders will project a major show of solidarity not just between China and the Global South, but also with sanctions-hit Russia and North Korea.Russia, which Beijing counts as a strategic partner, has been battered by multiple rounds of Western sanctions imposed after its invasion of Ukraine in 2022, with its economy on the brink of slipping into recession. Putin, wanted by the International Criminal Court, last travelled in China in 2024.

North Korea, a formal treaty ally of China's, has been under United Nations Security Council sanctions since 2006 over its development of nuclear weapons and ballistic missiles. Kim last visited China in January 2019.Those attending the parade marking the formal surrender of Japan during World War II will include Belarus President Aleksandr Lukashenko, Iran's President Masoud Pezashkian, Indonesian President Prabowo Subianto and South Korea's National Assembly Speaker Woo Won-shik, said Chinese Assistant Foreign Minister Hong Lei at a news conference.

The United Nations will be represented by Under-Secretary-General Li Junhua, who previously served in various capacities at the Chinese foreign ministry, including time as the Chinese ambassador to Italy, San Marino and Myanmar.On the day, President Xi Jinping will survey tens of thousands of troops at Tiananmen Square alongside the foreign dignitaries and senior Chinese leaders.The highly choreographed parade, to be one of China's largest in years, will showcase cutting-edge equipment like fighter jets, missile defence systems and hypersonic weapons.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up