Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Industrial Inventory MoM (Oct)

Japan Industrial Inventory MoM (Oct)A:--

F: --

P: --

Japan New Housing Starts YoY (Oct)

Japan New Housing Starts YoY (Oct)A:--

F: --

P: --

Japan Construction Orders YoY (Oct)

Japan Construction Orders YoY (Oct)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Oct)

Germany Actual Retail Sales MoM (Oct)A:--

F: --

France PPI MoM (Oct)

France PPI MoM (Oct)A:--

F: --

Germany Unemployment Rate (SA) (Nov)

Germany Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada GDP MoM (SA) (Sept)

Canada GDP MoM (SA) (Sept)A:--

F: --

Canada GDP YoY (Sept)

Canada GDP YoY (Sept)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

China, Mainland NBS Manufacturing PMI (Nov)

China, Mainland NBS Manufacturing PMI (Nov)A:--

F: --

P: --

China, Mainland Composite PMI (Nov)

China, Mainland Composite PMI (Nov)A:--

F: --

P: --

China, Mainland NBS Non-manufacturing PMI (Nov)

China, Mainland NBS Non-manufacturing PMI (Nov)A:--

F: --

P: --

South Korea Trade Balance Prelim (Nov)

South Korea Trade Balance Prelim (Nov)A:--

F: --

South Korea IHS Markit Manufacturing PMI (SA) (Nov)

South Korea IHS Markit Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

BOJ Gov Ueda Speaks

BOJ Gov Ueda Speaks China, Mainland Caixin Manufacturing PMI (SA) (Nov)

China, Mainland Caixin Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Nov)

India HSBC Manufacturing PMI Final (Nov)A:--

F: --

P: --

Italy Manufacturing PMI (SA) (Nov)

Italy Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.K. Mortgage Lending (Oct)

U.K. Mortgage Lending (Oct)A:--

F: --

U.K. M4 Money Supply YoY (Oct)

U.K. M4 Money Supply YoY (Oct)A:--

F: --

P: --

U.K. M4 Money Supply MoM (Oct)

U.K. M4 Money Supply MoM (Oct)A:--

F: --

P: --

U.K. Mortgage Approvals (Oct)

U.K. Mortgage Approvals (Oct)A:--

F: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Nov)

Canada Manufacturing PMI (SA) (Nov)A:--

F: --

P: --

U.S. ISM Inventories Index (Nov)

U.S. ISM Inventories Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Nov)

U.S. ISM Manufacturing New Orders Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Nov)

U.S. ISM Manufacturing Employment Index (Nov)A:--

F: --

P: --

U.S. ISM Output Index (Nov)

U.S. ISM Output Index (Nov)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Nov)

U.S. ISM Manufacturing PMI (Nov)A:--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China set a much weaker yuan fixing to slow the currency’s rapid appreciation, signaling a desire for gradual gains that support sentiment while avoiding pressure on exporters and maintaining stability.

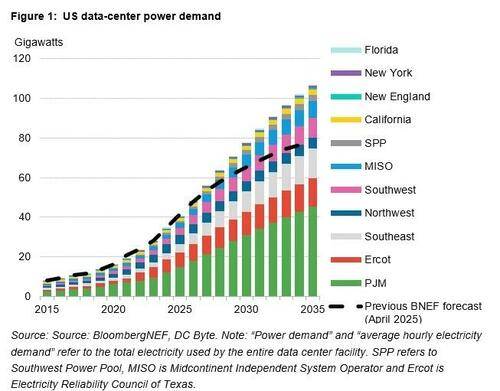

BNEF's report comes as some energy industry analysts and executives warn that an artificial intelligence bubble or speculative data center proposals could be fueling excessive load growth projections.

A report from Grid Strategies released last month said utility forecasts of 90 GW additional data center load by 2030 were likely overstated; market analysis indicates load growth in that time frame is likely closer to 65 GW, it said.

A July report from the Department of Energy estimated an additional 100 GW of new peak capacity is needed by 2030, of which 50 GW is attributable to data centers. Those facilities could account for as much as 12% of peak demand by 2028, according to Lawrence Berkeley National Laboratory.

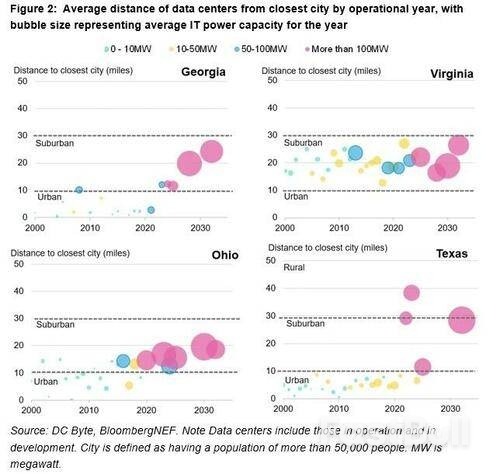

BNEF's data center project tracker shows the industry diversifying beyond traditional data center hubs like Northern Virginia, metro Atlanta and central Ohio into exurban and rural regions served by existing fiber-optic trunk lines for data traffic.

A map of under-construction, committed and early-stage projects shows gigawatts of planned data center capacity spreading south through Virginia and the Carolinas, up through eastern Pennsylvania and outward from Chicago along the Lake Michigan shore. More data centers are also planned for Texas and the Gulf Coast states.

Much of the capacity is poised to materialize on grids overseen by the PJM Interconnection, the Midcontinent Independent System Operator and the Electric Reliability Council of Texas. BNEF predicts PJM alone could add 31 GW of data center load over the next five years, about 3 GW more than expected capacity additions from new generation.

With the expected surge, the North American Electric Reliability Corp. warned late last year of "elevated risk" of summer electricity shortfalls this year, in 2026 and onward in all three regions.

Some experts disputed NERC's methodology, however. MISO's independent market monitor said in June that the group's analysis was flawed and that MISO was in a better position than grid regions not expected to see exponential data center growth, like ISO New England and the New York Independent System Operator.

Other technology and energy system analysts expect a significant amount of proposed data center capacity to dissipate in the coming years due to chip shortages, duplicative permit requests and other factors.

In July, London Economics International said in a report prepared for the Southern Environmental Law Center that meeting projections for U.S. data center load in 2030 would require 90% of global chip supply — a scenario it called "unrealistic."

Patricia Taylor, director of policy and research at the American Public Power Association, told Utility Dive earlier this year that it's common for data center developers to "shop around" the same project across neighboring jurisdictions.

Still, U.S. grid operators face an "inflection moment" as they balance the desire to accommodate large-scale data centers with the obligation to ensure reliable service for all customers, BNEF said.

Last week, Bitcoin (BTC) rose nearly fifteen percent to over $93,000. However, this recovery didn't last. BTC experienced heavy selling on Monday, falling to $84,000, marking a rough start to both the week and December, the last month of the year.

However, this selling wave was short-lived. Bitcoin and altcoins quickly recovered after two days of declines.

As BTC surged back above $93,000, these sudden price swings have divided the market. Some analysts say the decline could continue, while others argue that Bitcoin is holding onto a strong support area and a bottom is near.

At this point, Bitfinex analysts also took the side that argued that the bottom was near.

Bitfinex argued in its weekly Alpha report that the Bitcoin price is showing signs of bottoming out.

The exchange pointed to several indicators, including excessive deleveraging, capitulation by short-term holders, and seller exhaustion, where selling pressure is rapidly diminishing, suggesting that Bitcoin is very close to the cycle bottom.

"The recent recovery aligns with our previous view that the market is approaching a local bottom in terms of time, although we don't yet know if we've seen a bottom in terms of price."

According to Bitfinex analysts, these factors suggest that the Bitcoin price has entered a stabilization phase, creating the necessary conditions for a sustained recovery in the short term.

While Bitfinex analysts stated that there are many indicators pointing to a bottom in Bitcoin, one analyst said that it is too early to say that Bitcoin has reached the bottom.

It's Too Early to Talk About a Bottom in Bitcoin!

Cryptocurrency analyst Ted Pillows argued in his latest analysis that it is too early to confirm a bottom has formed for Bitcoin because the asset has not yet established clear support.

Pillows noted that his bottom predictions were weakened as BTC failed to hold key support levels like $100,000, $95,000, and $90,000 and easily fell below them.

Stating that BTC is currently stuck at the $93,000-$94,000 level and cannot create a stable support, the analyst said that an upward break of this level again would open the door to $100,000.

On the other hand, a rejection from this level could push Bitcoin back below the $90,000 level.

Saudi Arabia cut the price of its main crude grade to Asia to the lowest level in five years, amid persistent signs of a surplus in global oil markets.

State producer Saudi Aramco will reduce the price of its flagship Arab Light crude grade to a 60 cents premium to the regional benchmark for January, according to a price list seen by Bloomberg. That's the lowest since January 2021. The cut was fractionally bigger than an expected 30 cents a barrel reduction, according to a survey of refiners and traders.

The Organization of the Petroleum Exporting Countries and its allies affirmed over the weekend a previous decision to pause production increases in the first quarter of next year. They will then consider resuming a program to roll back output quotas as the group seeks to reclaim market share. OPEC+ is eyeing weaker seasonal demand during winter months across much of Asia, Europe and North America.

Crude prices are down about 16% this year as booming supply from the Americas in tandem with hikes from the OPEC+ grouping itself exceeded subdued demand growth. The International Energy Agency has predicted a record glut in 2026, while Wall Street banks including Goldman Sachs Group Inc. see futures heading lower. Oil markets have also had to navigate the impacts of global trade disputes, wars and sanctions through this year.

President Donald Trump pardoned longtime sports and entertainment executive Tim Leiweke after he was criminally charged in July with bid-rigging related to the development of an arena at the University of Texas.

The Justice Department posted a notice of the pardon on its website on Wednesday afternoon. The notice was dated Dec. 2. The move stands out because the pardon comes just months after Leiweke was charged by the Justice Department under Trump's administration.

Leiweke expressed "profound gratitude" to Trump. "The president has given us a new lease on life with which we will be grateful and good stewards," he said in a statement.

The pardon also comes just before Leiweke is scheduled to be deposed by lawyers for the Justice Department and Live Nation Entertainment Inc. on Thursday in the DOJ's separate civil antitrust case against the company and its subsidiary Ticketmaster, according to people familiar with the matter who asked not to be named discussing a confidential matter.

Leiweke earlier unsuccessfully tried to avoid the deposition, citing liability from then pending criminal charges, according to court records.

A trial in the DOJ's antitrust case against Live Nation is set to start in early March in New York.

Spokespeople for the White House, DOJ and Live Nation didn't immediately respond to requests for comment. A spokesperson for Leiweke had no immediate comment on the deposition.

Leiweke's former company, Oak View Group LLC, entered into a non-prosecution agreement with the Justice Department that was announced in July and agreed to pay a fine of $15 million. Leiweke stepped down from his post as Oak View chief executive officer shortly after the charges were filed.

"We are happy for Tim that he can now put this matter behind him," Oak View Group said in a statement. "OVG has remained steadfastly focused on delivering exceptional outcomes for our clients under the leadership of our CEO Chris Granger."

The criminal case against Leiweke related to allegations that Oak View illegally coordinated with its rival Legends on the bidding to develop and operate the Moody Center, a $338 million arena at the University of Texas in Austin. Oak View ultimately won the contract in 2018 and the venue opened in 2022. Legends also signed a non-prosecution agreement with the Justice Department, resolving its case.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up