Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

China complained to Malaysia and Cambodia about the trade deals they signed with the US last month, underscoring the delicate balance countries must strike in the rivalry between Beijing and Washington.

China complained to Malaysia and Cambodia about the trade deals they signed with the US last month, underscoring the delicate balance countries must strike in the rivalry between Beijing and Washington.

Beijing has "grave concerns" with certain portions of the US-Malaysia trade deal, Chinese Ministry of Commerce officials said in a meeting with Malaysia on Tuesday. "We hope Malaysia will fully consider and properly handle this matter in light of its long-term national interests."

The readout added officials from the Malaysia's Ministry of Investment, Trade and Industry explained and clarified the issues of China's concerns, without elaborating on what those are.

The meeting follows a similar sitdown between Chinese and Cambodian officials last Tuesday, where China's trade envoy Li Chenggang also urged Phnom Penh to handle concerns and the Cambodians clarified some issues.

China's Commerce Ministry didn't respond to a request for further details. Malaysia's trade ministry and Cambodia's government spokesperson didn't reply to a request for comment.

Both deals, signed last month during President Donald Trump's visit to Malaysia, include language that encourages the countries to align with Washington on national security issues, including export controls, investment screening and sanctions. Beijing has repeatedly warned countries against signing deals with the US that undermine its interests, but this appears to be the first instance of direct complaint.

The public criticisms demonstrate the tight space Southeast Asian nations navigate between the world's two largest economies. China is a key economic and trade partner, but Trump's tariff threats have forced countries to make more trade concessions and investment deals with the US.

The deals were part of a flurry of trade pacts unveiled last month during Trump's first Asia tour since he was reelected, including with Vietnam, and Thailand. As part of its deal, Kuala Lumpur will provide preferential access for US goods and services, while the White House exempted some Malaysian goods from Trump's 19% reciprocal tariffs.

But also under the agreement, Malaysia is expected to follow Washington's trade restrictions on countries for economic or national security reasons. It also commits Malaysia to align with US export controls and sanctions on sensitive technologies, and to prevent its companies from helping others circumvent those measures.

Malaysia should also explore a mechanism to review inbound investment for national security risks, including in relation to critical minerals and critical infrastructure.

For Cambodia, the pact affirms that the country will drop all tariffs on US food and agricultural imports, as well as industrial products. In exchange, the White House identified hundreds of goods it planned to exempt from its 19% tariff.

Similar to Malaysia, Cambodia is required to comply with the US export control regime and so-called entity list of banned firms. In addition, it will cooperate with any US request for information about investment activity by third countries.

Both Malaysia and Cambodia will also enhance defense trade with the US, and promise to crack down on transshipment of goods, the agreements show.

Switzerland has delayed implementing rules that would automatically exchange crypto account information with overseas tax agencies until 2027 and is still deciding which countries it will share data with.

Crypto-Asset Reporting Framework (CARF) rules will still be enshrined into law on Jan. 1, 2026, as originally planned, but will not be implemented until at least a year later, the Swiss Federal Council and State Secretariat for International Finance said on Wednesday.

It added that the Swiss government's tax committee "suspended deliberations on the partner states with which Switzerland intends to exchange data in accordance with the CARF," as the reason for the delay.

The Organisation for Economic Co-operation and Development (OECD) approved CARF in 2022 as part of a global push to share crypto account data with partnered governments in a bid to curb tax evasion via crypto platforms.

The Swiss government's announcement also highlighted a series of amendments to local crypto tax reporting laws, and transitional provisions "aimed at making it easier" for domestic crypto firms to comply with CARF rules.

In June, the Swiss Federal Council had moved forward with a bill to adopt the CARF rules in January 2026, and said at the time that the first exchange of crypto account data would happen in 2027, but it's now unclear when it plans to exchange information.

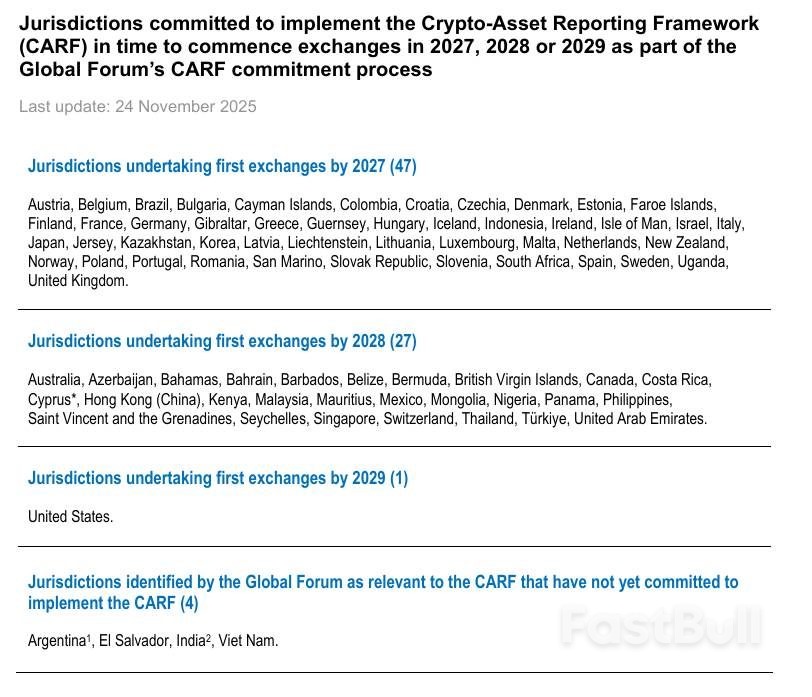

OECD documents show 75 countries, including Switzerland, that have signed on to enact CARF over the next two to four years.

Meanwhile, it has earmarked Argentina, El Salvador, Vietnam and India as countries that have yet to sign on.

List of jurisdictions implementing CARF. Source: OECD

List of jurisdictions implementing CARF. Source: OECDEarlier this month, Reuters reported that the Brazilian government was weighing up a tax on international crypto transfers as part of push to align domestic rules with CARF standards.

Meanwhile, the US White House also recently reviewed the Internal Revenue Service's proposal to join CARF as part of a push to enact more stringent capital gains tax reporting rules for American taxpayers using foreign exchanges.

Brazilian state-run oil firm Petrobrashas lowered its dividend forecast and cut expected investments by almost 2% in a new five-year business plan announced Thursday, as it grapples with lower crude prices.

Petrobras expects to dole out between $45 billion and $50 billion during the 2026-2030 period in ordinary dividends, a filing showed. In its previous five-year plan to 2029, released last year, the firm had expected to give shareholders up to $55 billion.

There was no mention of extraordinary dividends in the new plan, while the previous one estimated up to $10 billion could be disbursed during the 2025-2029 period.

The cut in investments to $109 billion comes as Petrobras faces lower Brent oil prices, that it now expects to hover around $63 a barrel for next year, below the $77 estimate it had set for 2026 in the previous plan.

This marks the first drop in investments of the state-run firm under President Luiz Inacio Lula da Silva's current administration.

The last time investment was cut was the 2021-2025 plan, under former President Jair Bolsonaro's administration, when Petrobras was undergoing a series of divestments.

Reuters reported on Wednesday, citing sources, that Petrobras' expected investments were set to drop to around $109 billion in the new plan.

Since taking office, Lula has pushed the oil firm to invest more in order to boost the country's economy. Next year, the leftist leader is set to seek a fourth, non-consecutive term as president.

Despite lowering investments overall, Petrobras raised investments in exploration and production activities by about $1 billion to $78 billion for the period, while keeping refining, transportation and marketing investments at around $20 billion.

Petrobras also said it expects to reach peak oil production within the period of 2.7 million barrels per day (bpd) in 2028.

Peak total production within the plan's timeframe would be 3.4 million barrels of oil and gas equivalent per day (boed) in 2028 and 2029, based on annual projections with a margin of variation of plus or minus 4%.

The India rupee is poised to open weaker on Friday, with the imbalance between robust importer hedging and hesitant exporter flows making it vulnerable to a lifetime low and dependent on central bank support.

The 1-month non-deliverable forward indicated the rupeewill open in the 89.40-89.42 range versus the U.S. dollar, having settled at 89.3050 on Thursday, and within striking distance of last week's all-time low of 89.49.

The Reserve Bank of India stepped in heavily at the beginning of the week in a bid to break the cycle of weakness that threatened to deepen after last week's breakdown.

Its intervention briefly lifted the rupee back through the 89 handle, offering a short-lived reprieve. The relief, however, faded with persistent dollar demand from importers, hesitant exporter hedging and lacklustre portfolio flows eroding much of the RBI-spurred recovery.

The fact that the rupee is back under pressure despite the RBI's support is noteworthy considering the softness in the dollar.

The dollar indexis headed for its worst week in four months on mounting confidence that the Federal Reserve will deliver a third straight rate cut next month, a tailwind that would normally offer rupee some respite.

Fed funds futures now imply an 86% chance of a 25-basis point rate cut on December 10, up from about 40% just a week ago, according to the CME's FedWatch tool.

"You don't get this kind of this slow relentless push higher (on dollar/rupee) unless corporate flows are skewed and there is nothing to offset it," a currency trader at a private sector bank said.

For speculators, there's no macro trigger to chase USD/INR higher, he added.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up