Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The market has grown crowded with cut-throat price competition and most companies sustaining heavy losses.

Just when the calm of Ramadan had settled in, U.S. President Donald Trump dropped the bombshell: “reciprocal” import tariffs that cut short everyone’s well-earned break and threatened to upend global trade with staggering losses.

The Tax Foundation summarized the reason for the reciprocal tariffs on imported goods at the U.S. Congress Joint Economic Committee Hearing on December 18, 2024: the relative decline in competitiveness of U.S. industries compared to other nations, widening inequality, insufficient job creation, and other domestic economic issues. These concerns have driven a high-risk protectionist practice that may ultimately harm all parties involved.

The trade-balance deficit with various partners is not sufficient justification for raising trade barriers. Researchers conclude that permanent import tariffs have only a modest impact on reducing trade deficits at best and suggest temporary tariffs can trigger a recession, an effect that deepens if trading partners retaliate.

Although Trump’s 90-day postponement of the reciprocal tariffs (though not a 10 percent baseline tariff) is encouraging, uncertainty persists due to the unpredictability of Trump’s directives and his questionable judgment. MacroMicro’s Trade Policy Uncertainty Index in April rose to nearly ten times its level from last September, underscoring the growing need for negotiation strategies to ensure trade stability.

There are indications that this tariff scheme was premeditated by the administration, given that the 10 percent rate far exceeds the prior average tariff of 2 to 3 percent. Trump has achieved his objectives, apart from China, which has resisted pressure and compelled him to relent amid potential economic consequences – yet he framed the outcome as a victory.

In this context, the current tariff war more closely resembles Trump’s first administration policies with elevated duties that provoke retaliation and serve as bargaining chips in negotiations, now applied to a wider array of countries.

During Trump’s previous term, the United States steadily increased its import tariffs on Chinese goods from around 3 percent in January 2018 to almost 20 percent by February 2020, while tariffs on the rest of the world rose only modestly from 2 to 3 percent.

Despite these levies, the U.S. trade-balance deficit with both China and the rest of the world failed to shrink. Two key factors drove this: China sidestepped U.S. tariffs by rerouting exports through third countries such as Mexico and ASEAN nations, and U.S. domestic industries could not fully substitute for imports. Instead, import barriers disrupted production and stoked inflation.

Despite not being as successful as fellow ASEAN countries such as Vietnam, Indonesian products supplanted Chinese goods in the U.S. market and export-oriented Chinese foreign direct investment (FDI) flowed into Indonesia. Moreover, Indonesia accelerated the signing of bilateral and regional trade agreements such as ASEAN Plus Three and Regional Comprehensive Economic Partnership (RCEP) to diversify its export destinations and bolster supply-chain resilience.

On reflection, there might be a chance for Indonesia to convert this disaster into an opportunity. But is it?

Learning from the limited impact of Phase One, this second salvo imposes extremely high rates on a vast array of trading partners simultaneously, an all-out effort to squeeze global imports.

The mechanics of fallout are straightforward. First, exports from nearly every country to the U.S. will contract. Next, China’s persistent overcapacity is likely to flood global markets, including Indonesia, with surplus goods. U.S. investors, deterred by harsher trading conditions abroad, will redirect capital back home, while rest-of-world investors chase lower-tariff jurisdictions.

China may shift more FDI toward Indonesia’s domestic market, but export-driven projects will wane. Major industrial powers could resort to dumping surpluses at cut-rate prices, and if large economies retaliate in kind, global trade volumes may plunge further, dragging down growth worldwide.

For Indonesia, the consequences are immediate and stark. The previous influx of export-oriented Chinese investment may slow while the domestic market is still uncertain. Indonesia can strengthen its trade defense and remedies in anticipation of the surge of dumping and illegal imports.

It is unclear how U.S. tariffs on Chinese and Indonesian products will differ beyond the 90-day postponement and if Indonesia still holds the competitive advantage it once enjoyed. It is also unclear whether Indonesia can rely on substituting Chinese goods in the U.S. market. In response, Indonesia must brace for a drop in U.S.-bound exports of key products due to hefty reciprocal duties and prepare for higher global production costs.

Although the outlook is bleak, there are still windows of opportunity. Exports to the U.S. account for less than 10 percent of Indonesia’s total shipments, lower than most of its ASEAN peers, hence offering greater flexibility to diversify Indonesia’s markets.

Indonesia can proactively pursue bilateral negotiations with the United States, mirroring moves by other ASEAN members while refraining from retaliation.

To make a difference, Indonesia may consider initiating preferential trade agreements or bilateral limited free trade agreements with the U.S. Indonesia can also leverage its status under the U.S. Generalized System of Preferences to seek a limited preferential/free trade agreement.

Contrary to U.S. assertions, Indonesia’s average Most Favored Nation tariffs in 2023 were moderate and applied uniformly at around 8 percent. Notably, the United States enjoyed a services-trade surplus of $1.6 billion in 2023 despite a goods-trade deficit, underscoring mutual benefits that should guide bilateral negotiations.

At the same time, the Indonesian government must reassess its own non-tariff measures, since U.S. sanctions have cited both Indonesia’s import duties and regulatory barriers. Moderating these policies with prudent review will help improve American perceptions while simultaneously addressing asymmetric liberalization effects.

In the short term, Indonesia can step in to supply goods that complement exports from heavily tariffed nations, capturing new opportunities in global supply chains.

To diversify risk, Indonesia can deepen production partnerships over the long term by attracting FDI into intermediate-goods manufacturing with countries facing lower U.S. tariffs such as Japan and expand its diplomatic outreach by accelerating cooperation frameworks including BRICS and OECD accession among others.

Internally, sweeping reforms to enhance the business climate, raising productivity and lowering high-cost economic structures are essential, as is an active role in World Trade Organization reform to revitalize multilateral trade.

Upgrading logistics and industrial infrastructure can target broad competitiveness rather than aligning with any single foreign investor’s supply chain and ensure that any re-export of foreign-origin goods satisfies Rules of Origin requirements with substantial value additions compared to mere goods in transit. Stronger enforcement against illegal imports and more robust anti-dumping measures will protect domestic industries from unfair competition.

By maintaining an independent foreign policy, Indonesia can preserve diplomatic flexibility and preparing for non-economic conditions such as domestic politics, foreign policy and defense commitments will round out its readiness.

Negotiations are still underway, but rising tensions and disputes over key issues could drive tariffs even higher. No one knows exactly what the Trump administration has in mind. As Bob Dylan famously said, the times they are a-changin’. One can remain hopeful and act on what we can control.

US President Donald Trump and First Lady Melania Trump are greeted by California Governor Gavin Newson upon arrival at Los Angeles International Airport in Los Angeles, California, on Jan. 24, 2025, to visit the region devastated by the Palisades and Eaton fires.

President Donald Trump on Tuesday threatened to strip "large scale federal funding" from California if the state goes against his executive order banning transgender athletes from participating in women's sports.

That funding could be withheld "permanently" if California continues to flout the Feb. 5 order, Trump warned on Truth Social.

The president's post complained that a trans athlete who qualified to compete against women in an upcoming competition is "practically unbeatable."

He wrote that he will order "local authorities, if necessary, to not allow the transitioned person to compete in the State Finals."

Trump added that he will speak with California Gov. Gavin Newsom, a Democrat, later Tuesday "to find out which way he wants to go" on the issue.

Trump did not name the athlete whose participation in women's sports drew his ire. AB Hernandez, a California high school student and transgender athlete competing in girls track and field, has recently received media attention.

Trump's threat to shut off federal funding could be significant for California, the world's fourth-largest economy.

Over one-third of the state's budget comes from the federal government, according to the California Budget and Policy Center. The state's 2025-2026 budget includes more than $170 billion in federal funds.

The threat also carries weight in light of Trump's increasing willingness to cancel billions of dollars in federal funds to universities, cities and other entities whose whose conduct he opposes.

Earlier Tuesday, Trump moved to cancel all remaining federal government contracts with Harvard University — reportedly totaling roughly $100 million — in the administration's latest salvo against the elite institution.

Trump has previously threatened to withhold federal funds from Maine over the state's compliance with Trump's executive order barring transgender women and girls from participating in female sports.

Newsom, widely seen as a contender for the 2028 Democratic presidential nomination, has been a vocal critic of a number of Trump policies, including on tariffs and immigration.

He downplayed the debate over trans athletes in April, saying the issue has been "weaponized by the right to be 10x, 100x bigger than it is."

But he also suggested in March that trans athletes participating in girls' and women's sports was "deeply unfair," separating himself from many of his fellow Democrats.

"I think it's an issue of fairness. I completely agree with you on that," Newsom told conservative influencer Charlie Kirk on his podcast.

Newsom's office did not immediately provide a comment in response to Trump's post.

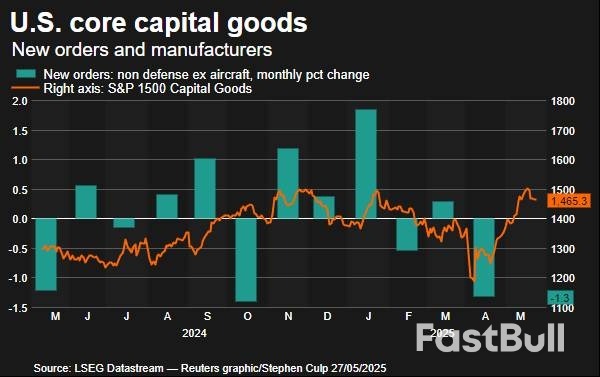

The report from the Commerce Department on Tuesday also showed shipments of these goods falling last month. Economists said President Donald Trump's flip-flopping on import duties was making it difficult for businesses to plan ahead. That has been evident in the deterioration in sentiment among businesses.

"I have predicted for months that business investment will be the main driver of a softer economic performance this year, as executives postpone their capital projects until they have more clarity on policy," said Stephen Stanley, chief U.S. economist at Santander U.S. Capital Markets. "These data offer the first confirming evidence of that hypothesis."

Non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, tumbled 1.3% last month. That was the largest drop since last October and followed an upwardly revised 0.3% gain in March, the Commerce Department's Census Bureau said. Economists polled by Reuters had forecast these so-called core capital goods orders dipping 0.1% after a previously reported 0.2% drop in March.

Core capital goods shipments slipped 0.1% after increasing 0.5% in March. Nondefense capital goods orders slumped 19.1%. Shipments of these goods rebounded 3.5% after falling 1.1% in March. Front-running by businesses eager to avoid higher prices from Trump's sweeping tariffs on imports contributed to business spending on equipment, mostly information processing equipment, surging at its fastest rate in 4-1/2 years in the first quarter.

That helped to limit the drag on gross domestic product from a flood of imports. Trump has delayed higher import duties on most countries until July. The White House this month announced a deal with Beijing to slash tariffs on Chinese goods to 30% from 145% for 90 days.

The truce in the trade war between Washington and Beijing helped to lift consumer confidence in May after deteriorating for five straight months. Consumers, however, continued to worry about tariffs raising prices and hurting the economy.

The Conference Board's consumer confidence index increased 12.3 points to 98.0 this month, blowing past economists' expectations for an improvement to 87.0.

But concerns about the labor market lingered, even as consumers planned to spend more over the next six months on big-ticket items such as motor vehicles and household appliances, take vacations and buy houses.

The survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, narrowed to 13.2 from 13.7 in April. This measure correlates with the unemployment rate in the Labor Department's monthly employment report.

Trump last week ratcheted up his trade war, proposing a 50% tariff on European Union goods starting June 1 and threatened Apple (AAPL.O), opens new tab with a 25% duty on any iPhones manufactured outside the United States. Trump at the weekend, however, backed off his threat against the EU, restoring a July 9 deadline.

Stocks on Wall Street were trading higher. The dollar rose against a basket of currencies. U.S. Treasury yields fell.

Economists are anticipating a period of volatility for business spending, with the pauses in higher tariffs for Chinese and EU products seen unleashing a fresh round of front-loading. Ultimately, they expect investment to soften this year.

Trump sees tariffs as a tool to, among other things, revive a long-declining U.S. industrial base, a feat that economists argue would be difficult to achieve in the short-term because of structural issues, including labor shortages.

While orders for computers and electronic products rebounded 1.0% last month, bookings for communications equipment decreased 2.6%. Electrical equipment, appliances and components orders fell 0.2%. But orders for machinery increased 0.8% as did those for fabricated metal products.

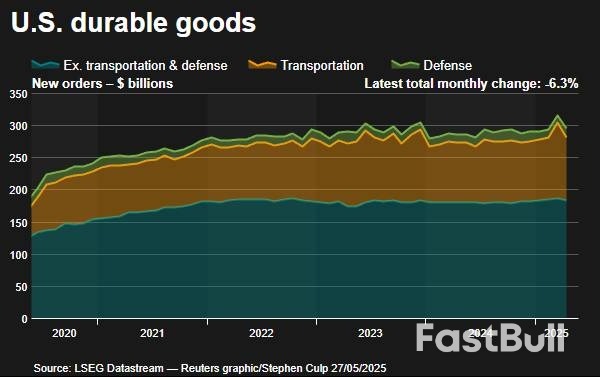

Orders for durable goods, items ranging from toasters to aircraft meant to last three years or more, dropped 6.3% last month after a slightly upwardly revised 7.6% rise in March.

Durable goods orders were previously reported to have jumped 7.5% in March. They were last month weighed down by a decline in orders for commercial aircraft as well as the fading boost from the tariff-related front-running.

Boeing (BA.N), opens new tab reported on its website that it had received only eight aircraft orders in April, down from 192 in March. Orders for motor vehicles and parts decreased 2.9%.

Overall transportation orders plummeted 17.1% after soaring 23.5% in March. The Atlanta Federal Reserve lowered its second-quarter GDP growth estimate to a 2.2% annualized rate on the data from a 2.4% pace earlier. The economy contracted at a 0.3% rate in the January-March quarter.

Some economists expect business spending on equipment to hold up if companies more or less maintain the first quarter's robust pace of front-running of imports.

"It is not until this import-driven boost fades later this year that we expect investment growth in that category to slow sharply," said Thomas Ryan, an economist at Capital Economics. "We expect business equipment investment to flatline in the second half of the year."

The tariff-driven economic uncertainty and higher mortgage rates are weighing on demand for homes, resulting in a rise in supply that is curbing house price growth. New housing inventory is at levels last seen in 2007, while the supply of previously owned homes is the highest in more than four years.

A third report from the Federal Housing Finance Agency showed house prices increased 3.7% in the 12 months through March after advancing 3.9% in February.

"Prospects for house prices do not look strong," said Carl Weinberg, chief economist at High Frequency Economics. "A new slowing trend is emerging as the economy slows and real incomes falter."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up