Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Euro Zone M3 Money Supply YoY (Dec)

Euro Zone M3 Money Supply YoY (Dec)--

F: --

P: --

Euro Zone 3-Month M3 Money Supply YoY (Dec)

Euro Zone 3-Month M3 Money Supply YoY (Dec)--

F: --

P: --

South Africa PPI YoY (Dec)

South Africa PPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Chicago Federal Reserve President Austan Goolsbee on Thursday expressed hesitation about lowering interest rates further because the government shutdown has resulted in a blackout on key inflation data.

Chicago Federal Reserve President Austan Goolsbee on Thursday expressed hesitation about lowering interest rates further because the government shutdown has resulted in a blackout on key inflation data.

While Goolsbee has otherwise been an advocate for gradually lowering rates, the central bank official said during a CNBC interview that he has concerns over the lack of important price reports, particularly with general inflation recently trending higher.

"If there are problems developing on the inflation side, it's going to be a fair amount bit of time before we see that, where if it starts to deteriorate on the job market side, we're going to see that pretty much right away," Goolsbee said. "So that makes me even more uneasy ... with front-loading rate cuts and counting on the inflation that we have seen in the last three months to just be transitory and assume that they're going to go away."

Goolsbee spoke as the Chicago Fed updated its own dashboard of labor market indicators. The data set indicated a stable unemployment rate in October and a steady pace of hirings and layoffs. The Chicago Fed's unemployment rate indicator was at 4.36% for the month, up just one one-hundredth of a percentage point from September.

However, the Bureau of Labor Statistics won't release its consumer price index report for October, which had been scheduled for next week.

The BLS did put out a report for September despite the shutdown, as that particular count is used for Social Security cost of living adjustments. That report showed inflation running at a 3% annual rate, compared to the Fed's goal of 2%. Whether the Commerce Department releases its personal consumption expenditures price index, the Fed's preferred gauge, depends on getting the lockdown resolved.

Goolsbee said the lack of inflation reports concerns him, as three-month trends prior to the shutdown showed core inflation, which excludes food and energy prices, running at a 3.6% annualized pace.

"Medium-run, I'm not hawkish on rates. I believe that the settling point for rates is going to be a fair bit below where it is today," he said. "When it's foggy, let's just be a little careful and slow down."

Goolsbee will get a vote when the Federal Open Market Committee meets in December to decide whether to cut rates again following reductions at the prior two meetings. However, he will rotate to being an alternate in 2026 before returning to a voting role in 2027.

Indonesia is scouting fresh markets including North Africa for its small-scale coffee and cocoa farmers at risk of losing access to the European Union under the bloc's new deforestation rules, according to a senior government official.

"We are helping now to find other markets," Indonesia Vice Minister of Foreign Affairs Arif Havas Oegroseno said in an interview on Thursday. "There are new markets for coffee and cacao in North Africa."

Officials are also working with Egypt to increase Indonesian commodity exports to the country and exploring Libya and Syria as potential markets, Havas said.

The EU Deforestation Regulation, which goes into full effect at the end of the year, aims to reduce the felling of trees for production of soy, cocoa, coffee, beef and palm oil. The Southeast Asian country is the world's biggest palm oil supplier and a major grower of cocoa and coffee.

While large-scale farming operations can deploy tree geo-tagging systems to prove their crops are deforestation-free, smallholders often can't shoulder the cost, he said. In East Bali, Havas added, cooperatives spent about $30,000 to geotag just 200 hectares of cocoa farms.

Furthermore, it's unclear if European buyers would pay a price premium for sustainably-produced goods, he said.

"Complying with the EU means cost, and the cost of just being compliant is probably even more than the cost of trying to find new markets," Havas said. "While they are incurring costs, the price is not guaranteed."

The government is also trying to boost the domestic market for palm oil by increasing the use of the commodity in biodiesel and sustainable aviation fuel, he said.

European nations are throwing their weight behind a $2.5 billion plan to save the Congo rainforest, a document seen by Reuters showed, launching a conservation scheme that may steal some thunder from the flagship initiative of COP30 host Brazil.

Mobilizing more money to protect and restore the world's last remaining rainforests is a central goal of the U.N. climate talks, deliberately held in the Brazilian Amazon this year to focus on the need to fight emissions from rampant deforestation.

The French-led initiative -- backed by Germany, Norway, Belgium and Britain -- is called "The Belem Call for the Forests of the Congo Basin." Backers expect to mobilise resources to help countries protect the second-largest rainforest in the world. The document written in French, dated November 6, was signed by the five European nations.

"The donors are ... committing to mobilize more than $2.5 billion over the next five years, in addition to the domestic resources that will be mobilized by Central African countries for the protection and sustainable management of the forests of the Congo Basin," said the document.

The signatories said they also aim to help African nations reduce deforestation through technology, training and partnerships.

The Congo, the Amazon, the world's biggest rainforest, and the Borneo-Mekong-Southeast Asia basin, the third-largest, all face threats from expanding farm frontiers, logging, mining, and other industries.

While protecting the Congo has drawn attention because it now absorbs more net greenhouse gases than other forests, the timing of the news threatened to compete with Brazil's focus on a global forest fund at the center of its COP30 agenda.

Brazilian President Luiz Inacio Lula da Silva has touted the Tropical Forests Forever Facility (TFFF), as the future of climate finance because it replaces grants with a more scalable investment model.

"In theory, both initiatives are very different," said a diplomat familiar with both proposals, noting that the TFFF would offer annual payments to rainforest nations with no strings attached. Still, the optics of two rival rainforest funds may be unhelpful, the source added.

Norway also pledged $3 billion to the TFFF on Thursday, the biggest contribution so far. France said it could contribute up to 500 million euros to the Brazilian-led initiative.

The Bank of England's committee decided to keep their main interest rate (Bank Rate) at 4%, which is what most people expected. However, the vote was close (5 members for keeping it, 4 members wanted to cut it by a small amount), showing that more people on the committee are leaning towards lowering rates.

They believe that the worst of inflation is over and prices are starting to slow down. This slowdown is due to their current high rates, slower wage increases, and weaker price growth in services. They also noted that a slow economy and a less tight job market are helping to push inflation down.

The committee now thinks the risks of missing their 2% inflation target are more balanced; they are less worried about high inflation sticking around and more worried about the economy being too weak. Still, they emphasized they need to see more proof that this trend will continue.

Future rate cuts will happen gradually and will depend entirely on the new economic data that comes in.

Optimism that the Bank of England (BoE) might cut interest rates this year is rising, causing UK 10-year bond yields to drop significantly since mid-October. Just a month ago, the market doubted the BoE would cut rates again soon. Now, the view is changing because inflation, currently at 3.8%, appears to have peaked.

Even though the full drop won't happen until next year, encouraging signs are appearing: food price inflation is easing more quickly than expected, and service sector inflation is slowing down. This is being helped by private sector wage growth also falling, which is on track to end the year below 4% after starting much higher.

This confidence is also boosted by expectations that the upcoming Autumn Budget will be viewed positively by the financial markets.

UK Chancellor Rachel Reeves welcomed today's BoE cut to inflation forecast.

According to the BoE "Progress on disinflation indicates bank rate likely to continue a gradual downward path: "gradual and careful approach" to further withdrawal of monetary policy restraint".

On the subject of inflation, Governor Bailey stated "It is encouraging that the inflation peak in September was 0.2 percentage points below our August forecast". All in all signs appear positive on the Inflation front.

There is another inflation print due out on November 19, which could have a major impact on pricing of a BoE rate cut in December, before attention turns to Chancellor Rachel Reeves' budget.

The UK budget will become the main area of focus as the month progresses. Fiscal sustainability remains key and will likely determine the impact the budget speech has on the GBP.

If Chancellor Reeves adopts more fiscal tightening the implications could lead to further weakness for the GBP. A budget which delivers tax hikes but pushes up 2026 inflation could potentially boost the GBP while a budget that under-delivers on fiscal sustainability could prompt a severe sell-off in the GBP.

Chancellor Reeves really has an unenviable task ahead of her with markets paying close attention.

Markets saw the GBP weaken in the aftermath of today's rate decision with a 30-40 pip selloff in GBP/USD.

However, cable has since reversed this and pushed higher to trade around the 1.3100 handle at the time of writing.

A break above the 1.3100 handle and four-hour candle close could embolden bulls and push GBPUSD toward the 1.3250 handle and the 100-day MA which rests around the 1.3270.

If cable fails to find acceptance above 1.3100 handle, a retest of the crucial 1.3000 level may be in the offing.

GBP/USD Four-Hour Chart, November 6, 2025

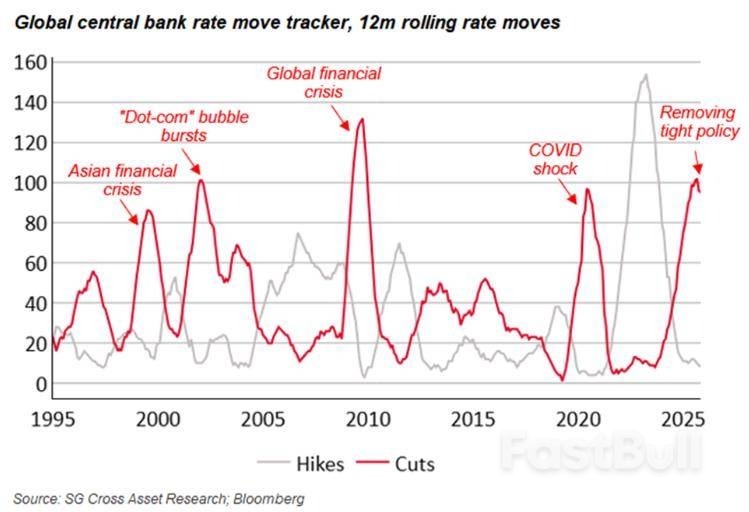

The global interest-rate cutting cycle has likely peaked. The question now is when, or if, today's high-flying markets will start to feel the pinch.

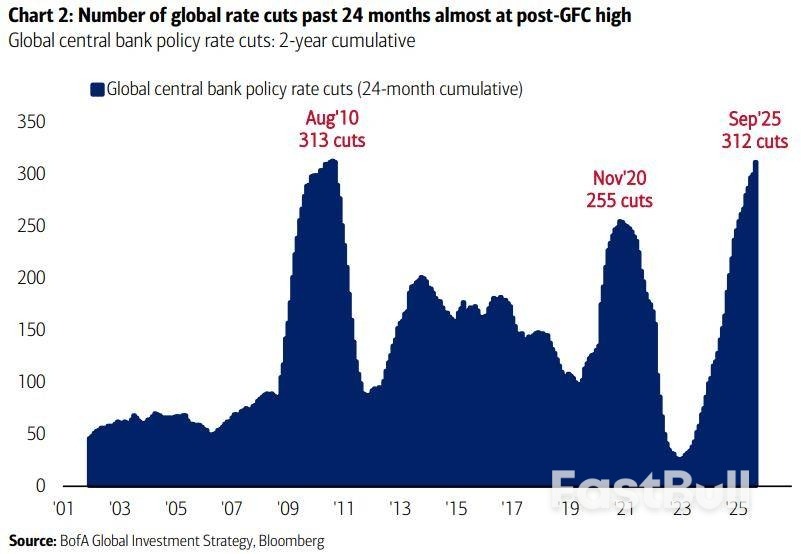

Remarkably, there have been more rate cuts around the world in the last two years than during the 2007-09 Global Financial Crisis, according to Bank of America. Although that's the number of cuts and not the magnitude of easing, it reflects the scale of the historic inflation-fighting rate hikes in 2022-23.

But the cycle now appears to have turned. This doesn't mean global easing has stopped. Central banks – most notably the U.S. Federal Reserve – are still expected to cut further. Rather, the number of cumulative cuts will decline moving forward.

On the face of it, the end of super-easy monetary policy should mean less accommodative financial conditions ahead.

But, perhaps counterintuitively, history suggests otherwise. Peaks in the last three major global easing cycles were followed by a broadening of the earnings cycle and solid equity market gains.

Are we about to see this again? Maybe, but given the frothy valuations in many of today's markets, it's not a given this time around.

The peak of the easing cycle could be a bullish signal for Wall Street, say analysts at Societe Generale, who argue that it is a sign that earnings growth is going to broaden out and accelerate.

Manish Kabra, head of U.S. equity strategy at SocGen, says the cycle peak is a "powerful signal" to diversify into other areas of the market like small caps and less levered stocks. He notes that reducing equity exposure would typically come later when investors start pricing in the start of the hiking cycle.

"When the easing cycle peaks, it's traditionally a sign of market conviction that earnings growth is going to accelerate," Manish says, pointing to previous "peaks" in August 2020 and September 2009 - which were both followed by strong equity performance.

Of course, there's a big difference between now and these episodes, namely today's stock prices and valuations. Wall Street was only beginning to emerge from historic crashes in September 2009 and August 2020, whereas now it has never been higher.

This might suggest that a more defensive risk profile may be warranted today.

Kabra downplays talk of bubbles, however. S&P 500 earnings growth this year is running at around 12%, but if you exclude 'AI boom' stocks, that falls to only 4%.

Almost every major asset class has risen this year, apart from oil, the dollar and some long-dated bonds. Even unloved and much-maligned U.S. Treasuries have gotten a bounce.

But globally, these rallies have had many different drivers. In equities, the AI boom has been rocket fuel for Wall Street, bets on a defense spending splurge have boosted European stocks, and the prospect of significant fiscal easing has lifted stock prices in Japan and China.

However, the unifying force that has lifted all these boats, according to Standard Chartered, is liquidity. And plenty of it.

Eric Robertsen, the bank's global head of research and chief strategist, says the broad rally from the April lows, impacting stocks, bonds, commodities and cryptocurrencies, can be deemed a 'financial conditions trade'. How else can nearly every asset class rise together in a world of extreme economic and geopolitical uncertainty?

Of course, 'liquidity' is not solely or even primarily a function of monetary policy. Bank reserves, the availability of and demand for private sector credit, and general risk appetite are key factors that contribute to the rather amorphous concept that is 'liquidity'.

But if interest rate changes can be viewed as a loose proxy for liquidity or at least a directional signal, then we are at an inflection point.

Robertsen posits that the "abundant" liquidity from well over 150 rate cuts in the last 12 months has more than offset investors' concerns over growth. Their risk appetite may be put to the test if the liquidity taps are being turned off, even if only gradually.

"Can markets thrive at this altitude without additional oxygen?," Robertsen asks.

We may be about to find out.

Key points:

The number of Americans filing new applications for unemployment benefits increased marginally last week, Haver Analytics estimated on Thursday, pointing to stable labor market conditions in October despite a surge in announced layoffs.

Initial claims for state unemployment benefits rose to a seasonally adjusted 229,140 for the week ended November 1 from 219,520 in the prior week, Haver Analytics calculated. The figure matched estimates from Citigroup, JPMorgan and Nationwide.

The shutdown of the federal government, now the longest on record, has halted the collection, processing and publishing of official economic data.

Claims data was unavailable for New Mexico and assumptions were made in line with what the Labor Department would normally do when data is not available. The claims data could assuage fears stoked by private reports earlier on Thursday showing job losses in October and a surge in announced layoffs amid cost-cutting and adoption of artificial intelligence by businesses.

"The claims data stand in stark contrast to this morning's sharply negative Challenger job cuts news and show the labor market isn't falling off a cliff," said Oren Klachkin, financial market economist at Nationwide. "It's encouraging to see the labor market remaining stable, albeit soft, in the opening month of the fourth quarter."

With the government shutdown, the Labor Department's closely watched employment report will not be published for an unprecedented two straight months on Friday. But states have continued to collect weekly unemployment claims data, submitting it to the Labor Department.

Haver Analytics and Wall Street economists are taking the data and applying seasonal adjustment factors the government published earlier to make the weekly claims estimates.

Economists have cautioned against placing too much emphasis on some of the private-sector surveys, noting the limited scope of coverage and history. A Bank of America Institute analysis of internal deposit data on Thursday suggested "no further deceleration" for now in the pace of job growth that "has taken place since the summer."

The labor market has slowed considerably from early this year, with economists blaming economic uncertainty, tariffs on imports and AI for the low demand for workers. A sharp reduction in labor supply because of raids on undocumented immigrants is also hurting hiring, most evident in small-business surveys.

A survey from the National Federation of Independent Business on Thursday showed the share of small businesses reporting labor quality as their single most important problem jumped to a four-year high in October.

Stable labor market conditions could allow the Federal Reserve to keep interest rates unchanged next month. The U.S. central bank last week cut its benchmark overnight interest rate by another 25 basis points to the 3.75%-4.00% range, and Fed Chair Jerome Powell said "a further reduction in the policy rate at the December meeting is not a foregone conclusion."

The number of people receiving unemployment benefits after an initial week of aid, a proxy for hiring, increased to a seasonally adjusted 1.962 million during the week ending October 25, from 1.955 million, JPMorgan estimated. That was broadly in line with the calculations from Citigroup and Haver Analytics.

"This likely reflects hiring remaining slow and implies downside risk for employment data in October," said Gisela Young, an economist at Citigroup.

Earlier, the Chicago Fed estimated the unemployment rate climbed to 4.36% in October - a four-year high of 4.4% on the rounded basis typically reported by the Bureau of Labor Statistics - from 4.35% in September.

Federal Reserve Bank of St. Louis President Alberto Musalem said on Thursday the U.S. central bank has been right to cut interest rates to help the job market.

The cuts have been "appropriate" but "we have to be very careful to continue to lean against above-target inflation, while continuing to provide some insurance" to the employment sector, he said at a gathering of the Fixed Income Analysts Society in New York.

"Monetary policy is somewhere between modestly restrictive and neutral, and it's getting close to neutral in terms of financial conditions," Musalem said.

His assessment that financial conditions are helping the economy is based on a broad-based read on markets and credit availability, Musalem said. These conditions "are rather supportive of economic activity and rather supportive of the labor market as a ... byproduct of that," he added.

In late October, the Fed lowered its interest rate target by a quarter percentage point, to between 3.75% and 4%, after easing by the same amount in September. Fed officials believe inflation is too high but have lowered the cost of short-term credit to help support a job market that has cooled.

Musalem said U.S. trade tariffs have been drivers of inflation but their impact has been blunted as companies held off passing costs to consumers. He expects the impact will start to dissipate in the second half of next year, allowing inflation to restart its retreat back to the 2% target.

Musalem said his outlook is based on tariffs remaining in place. The legality of President Donald Trump's sweeping levies is being considered by the U.S. Supreme Court.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up