Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Canada’s GDP contracted 0.1% in June and 1.6% in Q2, its first decline in seven quarters, pressured by U.S. tariffs. Markets raised BoC rate-cut odds, while USD/CAD stayed steady.

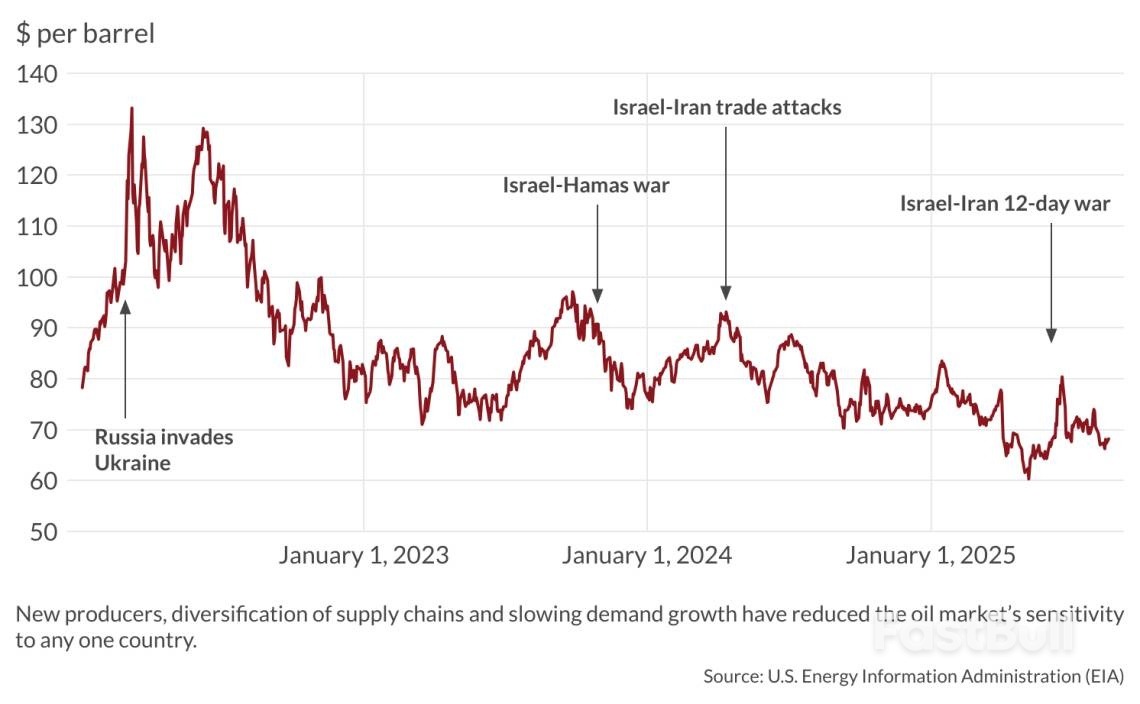

Iran remains a major oil producer, but its actual influence on global oil markets has declined considerably. This stems not only from sanctions, which have often fallen short of their goals, but also from fundamental structural changes in the global oil landscape. The rise of new producers, the diversification of supply chains and slower demand growth have all reduced the market’s sensitivity to any single country, including Iran.

This shift was evident during recent tensions involving the United States, Israel and Iran. While the rhetoric and military posturing raised concerns, oil markets remained largely calm. Critically, there were no direct disruptions to oil production or trade routes – particularly the Strait of Hormuz, which Iran itself relies on to export crude. As a result, there were no significant supply losses. Oil prices spiked briefly, but the reaction was modest and short-lived. The oil market’s restraint reflected not Iranian deterrence or strength, but an increasing global capacity to absorb shocks.

Nevertheless, Tehran was eager to project an image of resilience and victory. Yet behind the political narrative, its sway in oil markets and its ability to influence prices or global supply dynamics has steadily eroded. The strong cards it once held as a producer have been weakened by internal issues, including chronic underinvestment, and more importantly, by external factors beyond its control.

Sanctions have undoubtedly constrained Iran, but they are porous. China’s continued purchases of Iranian oil, often at a discount, and its role in helping Iran circumvent restrictions have kept export volumes afloat. Nonetheless, this has not translated into real market power. With enforcement spread thin and global supply tightening at times, Iran has remained relevant but not dominant.

If sanctions on Iran are lifted, neither a rapid surge in production nor exports is likely. The country is already producing and exporting at relatively high levels, and any further increase would require substantial investment and time. Conversely, if sanctions are tightened, Iran’s economy would face further strain, but the global oil market would be unlikely to experience a major disruption, particularly if other Organization of Petroleum Exporting Countries (OPEC) members continued to raise output.

If stricter sanctions on Tehran coincide with a substantial curtailment of Russian oil, the world’s third-largest producer, Iranian barrels could temporarily gain strategic value. Still, this effect would probably be short-lived, as other producers, including the U.S. and Gulf states, can compensate. In short, the global oil market is well-supplied.

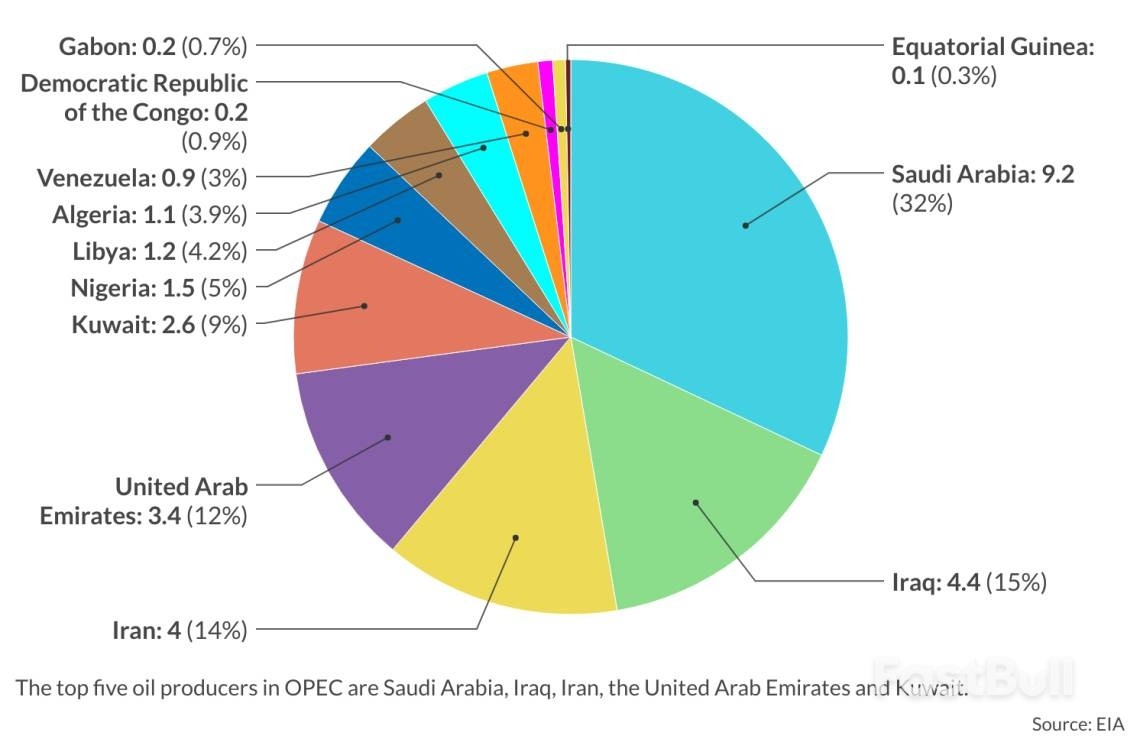

Iran possesses the world’s fourth-largest proven oil reserves, accounting for 9 percent of the global total, behind Venezuela, Saudi Arabia and Canada. It also has the second-largest proven natural gas reserves, with a 17 percent share, second only to Russia. It is the third-largest crude oil producer within OPEC and is the fourth-largest exporter.

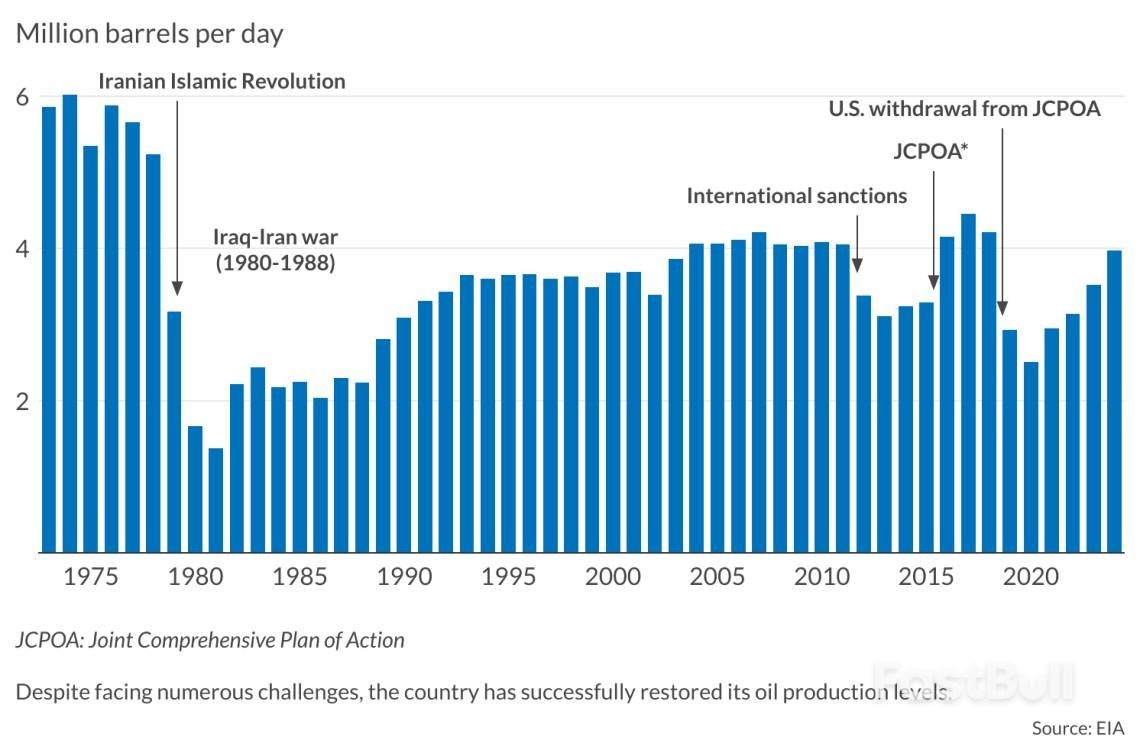

As a founding member of OPEC, Iran once held considerable influence within the organization, at times nearly rivalling Saudi Arabia’s dominance. At its peak in 1974, Iran was producing over 6 million barrels per day (mb/d), second only to Saudi Arabia’s 8.4 mb/d, while Iraq trailed at just 1.9 mb/d. However, the Iran-Iraq War (1980-1988), prolonged sanctions and limited foreign investment have since constrained the country’s production potential.

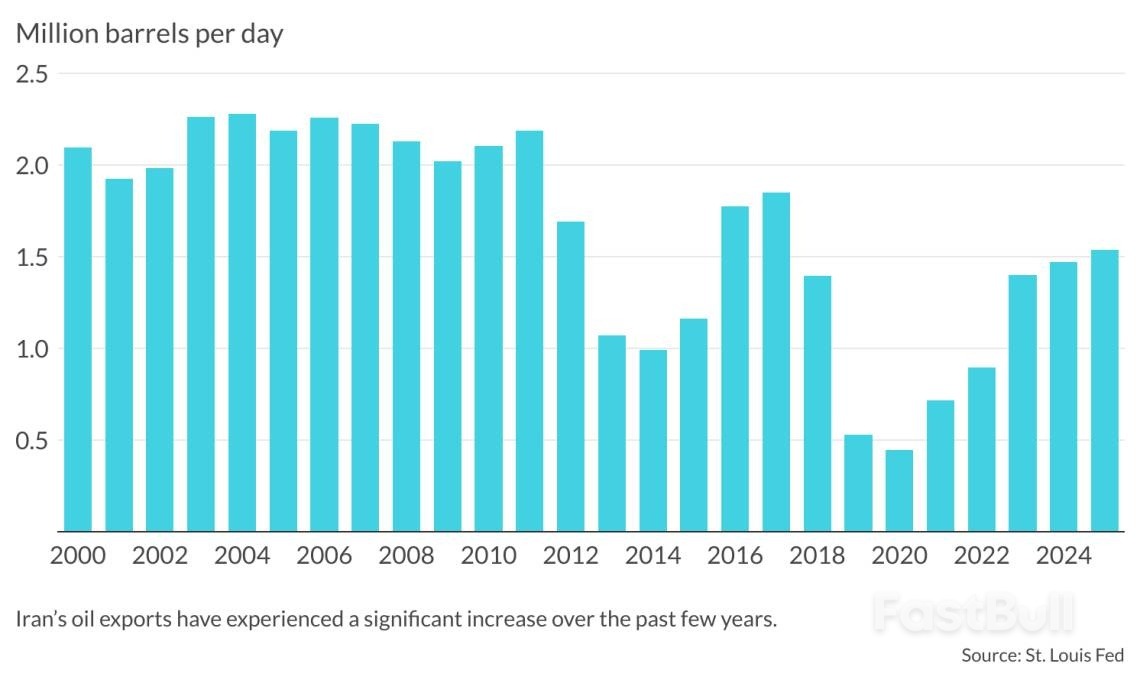

Despite these setbacks, Iran has repeatedly demonstrated resilience. Following the imposition of sanctions on its energy sector by the U.S. and the European Union in 2011 and 2012, the country’s oil exports were cut in half by 2015. But after the Joint Comprehensive Plan of Action (JCPOA) was signed in 2015, where Iran agreed to limit its nuclear program in exchange for the lifting of economic penalties, oil production rebounded swiftly. Within two years, output rose by 1.3 mb/d, and crude oil exports increased by over 1 mb/d within a year, returning to pre-sanctions levels.

The U.S. withdrawal from the JCPOA in 2018 during the first administration of President Donald Trump and its reinstatement of unilateral sanctions targeting Iran’s oil sector caused another sharp decline. Production fell by 1.9 mb/d within a year, and in October 2020 reached its lowest level since 1989.

Even so, Iran has gradually rebuilt output, recording one of the largest increases in oil production among OPEC members between 2021 and 2024. Notably, Iran is exempt from OPEC production quotas due to the ongoing sanctions, allowing it to maximize production and exports. In 2024, its oil output reached a post-sanctions annual high of 4 mb/d.

Iran’s oil exports have surged in recent years, tripling from approximately 400,000 barrels per day during the height of the Trump administration’s “maximum pressure” campaign to around 1.5 mb/d in 2024. This resurgence has been enabled by a combination of lax sanctions enforcement and Iran’s persistent efforts to circumvent restrictions, often with the support of key trading partners such as China, the world’s largest crude oil importer.

Today, China is the primary destination for Iranian oil, while smaller volumes are also directed to countries like Syria, the United Arab Emirates and Venezuela. To avoid detection and obscure the origin of shipments, Iran relies heavily on a so-called “shadow fleet” of tankers that operate without transponders and often engage in ship-to-ship transfers, tactics that Russia has since emulated.

Financial transactions related to these exports are typically conducted in yuan through smaller Chinese banks, a system that limits the ability of Western authorities to track payments and enforce sanctions. Once Iranian oil reaches China, it is reportedly rebranded – often as Malaysian or Middle Eastern crude – and sold to independent Chinese refineries, known as “teapots,” which operate with fewer regulatory constraints.

It is widely believed that this trade arrangement has allowed Chinese companies to save billions of dollars. At the same time, Tehran has greatly benefited from the continued revenue. According to the U.S. Energy Information Administration (EIA), Iran’s oil export revenues reached an estimated $43 billion in 2024, marking a $1 billion annual increase. This accounted for more than 57 percent of the country’s total export revenue in 2024, the highest share since the reimposition of U.S. sanctions in 2018, according to the World Bank.

Despite its apparent resilience, Iran remains far more vulnerable than it appears. Although it continues to bypass sanctions, the crude oil it exports is sold at steep discounts, raising questions about the accuracy of reported revenue figures. As confirmed by the EIA, official estimates of Iran’s oil income do not reflect the price reductions offered to buyers of sanctioned crude. Iran has further increased its discounts to remain competitive with Russia in the Chinese market.

This reliance is compounded by the concentration of Iran’s export destinations. While Beijing has a diversified portfolio of energy suppliers, Iran is heavily reliant on China for its oil exports. The same vulnerability applies to non-oil trade. According to the World Bank, Iran’s top three trading partners, China, Iraq and the UAE, account for 60 percent of its exports and 70 percent of its imports.Iran’s oil revenues in the financial year 2023-2024 reportedly fell well short of expectations, covering only about half of the amount projected in the national budget.

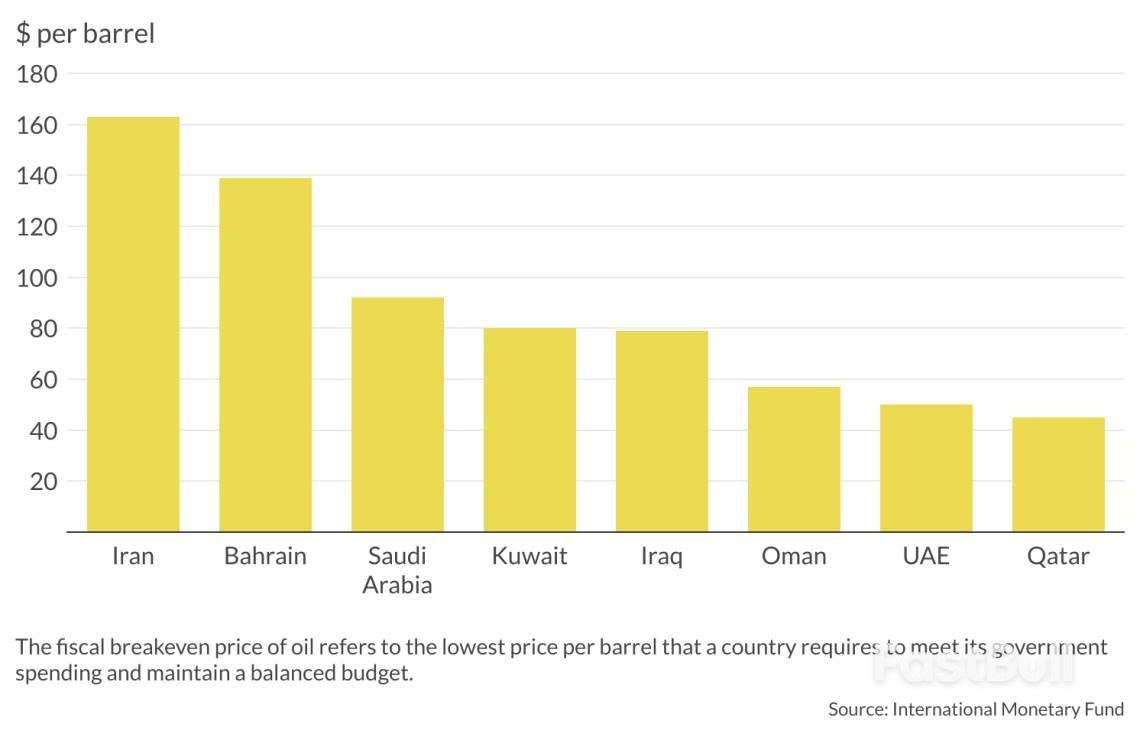

As a result, the government was forced to reduce spending to help contain the deficit. According to the International Monetary Fund, Iran would need oil prices to exceed $163 per barrel to balance its budget in 2025, the highest fiscal breakeven oil price among Middle Eastern oil exporters.

Although Iran’s oil production has increased in recent years, it remains well below its peak levels of the 1970s, even with the country’s large reserves and the advancements in drilling and extraction technologies since then.Iran nationalized its oil industry in 1951, and the sector remained open to foreign investment for several decades. This changed after the 1979 Islamic Revolution, when international investment in oil and gas was largely prohibited under the Iranian Constitution. The Iran-Iraq War further devastated the oil sector, leaving it in urgent need of rebuilding.

In response, the government adopted a more flexible stance toward foreign investment and introduced a new contractual framework known as the buyback contract. Under this model, international oil companies were permitted to invest only up to the point of first production, at which time the project would be transferred to the National Iranian Oil Company in exchange for a pre-agreed fixed fee.

However, these terms have historically been unattractive to international investors. Even after the JCPOA agreement in 2015, Tehran struggled to secure major international deals. This was due in part to internal divisions over the role of foreign capital in the energy sector, as well as lingering U.S. secondary sanctions that continued to limit access to global financial and banking systems.

In the absence of foreign investment, especially in recent years, Iran has increasingly relied on domestic firms to develop its oil projects. But these companies often lack the capital, advanced technology and technical expertise required to sustain output, particularly from mature fields. Sanctions have further exacerbated these challenges by limiting access to financing, curtailing technology transfers, raising trade costs and reducing overall competitiveness.

Meanwhile, as its production capacity has stagnated, other OPEC members, such as Iraq and the UAE, have expanded their market share, often at Iran’s expense.One strategic asset Iran still controls is the Strait of Hormuz. Disruption to this key maritime passage could significantly affect worldwide energy supplies and prices, especially for major importers like China. Regardless of occasional threats from Iranian officials to block the strait, such actions have never materialized.

Good morning. Indian Prime Minister Narendra Modi meets Vladimir Putin today after he reset relations with China. German Chancellor Friedrich Merz sees the war in Ukraine dragging on with no clear end in sight. And the UK wins a £10 billion deal from Norway’s navy. Listen to the day’s top stories.Indian Prime Minister Narendra Modi was due to meet Vladimir Putin in Tianjin, China, today after resetting relations with Chinese President Xi Jinping, as the three countries seek to strengthen ties amid trade tensions with the US. The trio last met in 2024.

German Chancellor Friedrich Merz warned the Ukraine war may “go on for a long time.” Now in its fourth year, Russia’s full-scale invasion of Ukraine is the longest war in Europe since World War II. In an interview with ZDF, he also rejected a coalition partner’s call to raise taxes in Germany.Norway picked the UK as the supplier of frigates for its navy, in what would be its biggest ever defense investment. Norway had considered France, Germany and the US as a potential strategic partner for the deal, which the UK defense ministry said on Sunday was worth £10 billion.Former Barclays executive Naguib Kheraj is among candidates being considered as a potential successor to HSBC Chairman Mark Tucker, according to Sky News. Kheraj spent more than a decade at Barclays, including as group finance director and vice chairman. He has also been CEO of JPMorgan Cazenove and deputy chairman of Standard Chartered.

France accused Italy of fiscal dumping, sparking a heated exchange between the two nations. Italian Prime Minister Giorgia Meloni's office vehemently denied the allegations, asserting Italy's economic attractiveness stems from stability and credibility. The dispute risks reigniting tensions between Rome and Paris, potentially impacting their previously improved relations.

Check out our Markets Today live blog for all the latest news and analysis relevant to UK assets.A €2 trillion upheaval looms for European bond markets as the Dutch pension system undergoes reform.Russian President Vladimir Putin's assaults on Ukraine have worn down the will, the magnificent defiance, of the Ukrainian people, writes Max Hastings. Almost all now recognize, as they did not a year ago, that they will be obliged to cede the east of their country to win any hope of peace. This is monstrously unjust.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up