Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Hsi Closes Midday At 26724, Down 109 Pts, Hsti Closes Midday At 5347, Down 119 Pts, Tencent Down Over 3%, Xinyi Glass, Techtronic Ind, Wharf Reic, Yankuang Energy, China East Air Hit New Highs

[Polymarket Predicts 78% Probability Of "Bitcoin Falling To $65K By 2026"] February 4Th, The Probability Of "Bitcoin Falling To $65,000 In 2026" On Polymarket Has Risen To 78%. Furthermore, The Probability Of It Falling To $55,000 Is Currently At 55%, The Probability Of Rising To $100,000 Is Currently At 56%, And The Probability Of Rising To $110,000 Is Currently At 42%

Marubeni CEO: Coking Coal Prices Are Rebounding, But Iron Ore Market Is Expected To Remain Largely Flat In Next Fiscal Year

Goldman Sachs Says Timing Indicates Western Flows Rather Than Chinese Speculation Drove Much Of The Price Volatility In January

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)A:--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)A:--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)A:--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)A:--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Brazil IHS Markit Composite PMI (Jan)

Brazil IHS Markit Composite PMI (Jan)--

F: --

P: --

Brazil IHS Markit Services PMI (Jan)

Brazil IHS Markit Services PMI (Jan)--

F: --

P: --

U.S. ADP Employment (Jan)

U.S. ADP Employment (Jan)--

F: --

P: --

The U.S. Treasury Department released its quarterly refinancing statement.

The U.S. Treasury Department released its quarterly refinancing statement. U.S. IHS Markit Composite PMI Final (Jan)

U.S. IHS Markit Composite PMI Final (Jan)--

F: --

P: --

U.S. IHS Markit Services PMI Final (Jan)

U.S. IHS Markit Services PMI Final (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Jan)

U.S. ISM Non-Manufacturing Price Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Jan)

U.S. ISM Non-Manufacturing Employment Index (Jan)--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Jan)

U.S. ISM Non-Manufacturing New Orders Index (Jan)--

F: --

P: --

No matching data

View All

No data

Canada plans to buy stakes in projects that will produce and process key minerals, the country's natural resources minister said, as part of a broader effort to secure supplies of materials that are controlled by China.

Canada plans to buy stakes in projects that will produce and process key minerals, the country's natural resources minister said, as part of a broader effort to secure supplies of materials that are controlled by China.

Tim Hodgson said the government has already started studying projects that will receive these equity investments, including mining operations and processing facilities. Those entities would be "deemed in the national interest, but for some reason they aren't able to find the equity," he said in an interview with Bloomberg News.

"For example, some of the rare-earths processing facilities that are being talked about — unless they receive equity-like support, given the stranglehold that certain countries have on those markets, they're unlikely to happen."

Critical minerals like lithium and graphite, along with rare earth metals like terbium and dysprosium, are essential to motor engines, consumer electronics and weapons manufacturing. But the bulk of the mining and processing of these materials is controlled by China.

It's an unusual move for the Canadian government to make equity investments, but it follows the Trump administration's decision to buy stakes in miners including MP Materials Corp., Lithium Americas Corp. and Trilogy Metals Inc. this year to expand production of rare earth minerals and other metals on domestic soil. The latter two of those companies are headquartered in Canadian mining hub of Vancouver.

Canada has unveiled a suite of measures to shore up access to critical minerals, including fast-tracking mining projects deemed to have national importance. The government said Thursday it will try to accelerate the approval of projects including the Nouveau Monde Graphite Inc. phase 2 project in Quebec, Canada Nickel Co.'s Crawford project in Ontario and a tungsten and molybdenum mine in New Brunswick.

Shares of Nouveau Monde jumped nearly 12% on Wednesday after a report of the government's plan, while Canada Nickel has surged 48% this week.

Prime Minister Mark Carney's government also introduced a C$2 billion ($1.4 billion) "critical minerals sovereign fund" in its latest budget that will provide the money for equity investments, loan guarantees and offtake agreements to support mining projects. Hodgson said the Canada Growth Fund, a separate investment vehicle, has started studying projects eligible for equity investments.

The minister said the government will look to expand stockpiling of minerals to support producers of niche metals dominated by China. Canada has already begun stockpiling scandium and graphite, he said, and is now looking at other minerals. Group of Seven allies last month announced measures aimed at securing mineral supplies outside of China.

"We're doing a whole mapping exercise, looking at what Canada's needs are relative to what Canada's production and sourcing capability is," Hodgson said. "Where we see a significant deficit, we will absolutely look at stockpiling as a way to protect Canadian industries and the economy."

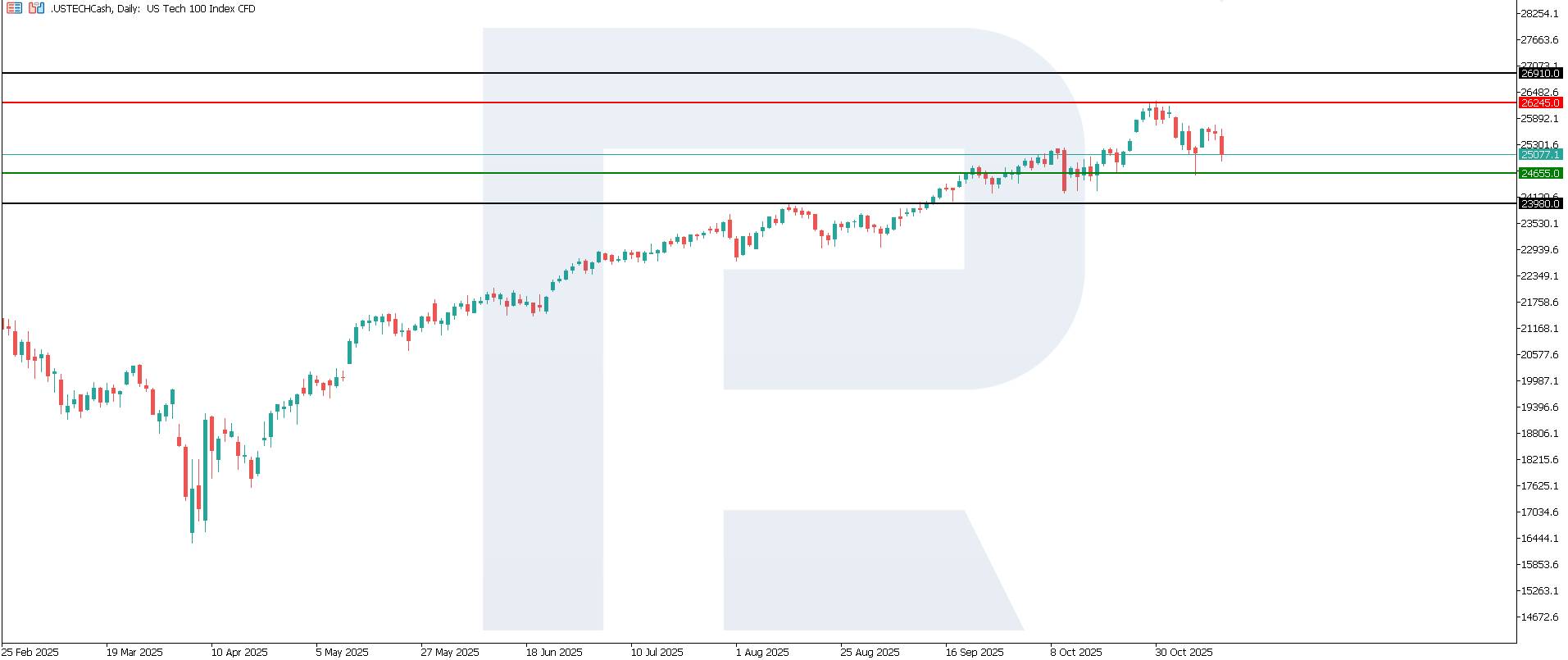

The correction in the US Tech index has intensified. The US Tech forecast for the upcoming week is negative.

The US ISM non-manufacturing PMI came in at 52.4, above the forecast of 50.7 and the previous reading of 50.0. This indicates that the services sector not only remains in expansion territory (readings above 50.0 signal growth) but is also accelerating compared with the previous month, beating analysts' expectations. As services represent the largest part of the US economy, the data indicates stable domestic demand and suggests that businesses are more confident than anticipated.

On the other hand, stronger employment metrics compared with consensus forecasts raise concerns that the disinflation process might proceed more slowly than desired by the Federal Reserve. For the Fed, this is a signal for caution when considering further rate cuts. For the US stock market, the overall impact tends to be positive. Stronger service sector activity suggests potential revenue and profit growth for companies focused on domestic consumption – retail, transport, hospitality, restaurants, and financial services. At the same time, recession fears are reduced: since services usually weaken before an economic downturn, the rebound above stagnation levels indicates a resilient economy.

For the US Tech index, the effect is moderately positive. A robust services sector supports demand for digital infrastructure, cloud computing, software, online advertising, and e-commerce. Many tech companies derive a significant portion of their income from corporate and consumer services. When services in the economy are growing, IT budgets are cut less frequently, and in some segments, they are even expanded. This strengthens expectations for tech companies' revenue and profits and, in theory, should support the US Tech index.

The US Tech index continues to decline within its ongoing correction, while the broader uptrend remains intact. The nearest resistance level is located at 26,245.0, and a new support zone has formed around 24,655.0. The next potential upside target is 26,910.0.

The US Tech price forecast outlines the following scenarios:

The expected increase in tech-sector revenues and demand may partly offset the pressure from higher or prolonged interest rates. In the medium term, the direction of the US Tech index will depend on what investors consider more important: the sustained business growth of tech companies or the potential persistence of high borrowing costs and bond yields. From a technical perspective, the next upside target for the US Tech index could be 26,910.0.

The US and Switzerland have "essentially" reached a trade agreement to lower tariffs on Swiss goods to 15% and the White House plans to reveal details on Friday, US Trade Representative Jamieson Greer said.

"Switzerland is probably the next one," Greer said on CNBC, one day after meeting with a Swiss delegation in Washington. "We've essentially reached a deal with Switzerland. So we'll post details of that today on the White House website."

Greer told reporters that the duty on products from Switzerland would fall from 39% to 15% and that the European country has committed to investing $200 billion in the US.

Greer said that Switzerland is "going to send a lot of manufacturing here to the United States, pharmaceuticals, gold smelting, railway equipment. So we're really excited about that deal and what it means for American manufacturing."

Switzerland has also committed to buying more Boeing Co. planes, Greer told reporters.

Key points:

When Thailand cut power supply to Myanmar across its western border this year, it intended to curb online scam centres linked to regional networks trafficking hundreds of thousands of people.

However, the move also hit the wider community, pushing hospitals and some offices to install solar panels, said Zaw, a rescue worker in Myawaddy town just across the Thai border. Homes, too, made the switch.

"Three out of four people now rely on solar panels, with businesses using multiple panels," said Zaw, who did not want to disclose his full name, fearing retribution.

Myanmar's electricity supply has deteriorated since the 2021 military coup and ensuing civil war, exposing millions to chronic blackouts, with a cash-strapped government hit by Western sanctions unable to maintain power infrastructure.

The World Bank estimated the country's operating power capacity plunged to 2015 levels in 2024, describing electricity supply in conflict-affected areas as "catastrophic".

Chinese firms have helped fill the gap, supplying cheap solar panels.

Light intensity data - a proxy for economic activity and electricity access - analysed by the United Nations revealed an average 8% annual decline after the 2021 coup.

The drop is largely due to a shortage of natural gas, Myanmar's main generation fuel, as domestic production has declined and the government has halted imports of liquefied natural gas due to a foreign exchange shortage, the World Bank said in a June 2024 report.

Former U.S. President Joe Biden's administration froze about $1 billion of Myanmar assets and imposed sanctions, some of which have been eased by the Trump administration. Western sanctions have restricted access to technical support, spare parts, and expertise to maintain infrastructure, such as transmission lines damaged in the civil war.

Myanmar's junta said earlier this year generation capacity had plunged by nearly half from pre-2021 levels. Data on the Ministry of Electric Power's website shows output has not changed much since 2018.

The information ministry did not respond to detailed questions on power supply and demand, and the junta's spokesperson did not answer calls from Reuters.

To combat the power crisis, households and businesses are embracing solar, according to interviews with a dozen residents, business owners and panel and battery sellers across the Southeast Asian country.

"Unlike most of Asia, where we're seeing corporate demand drive solar growth, energy security concerns and fuel shortages are the key drivers in Myanmar," said Linda Zeng, renewables analyst at Fitch Solutions unit BMI.

Solar panel imports from China, Myanmar's largest supplier, more than doubled in the nine months through September to about $100 million, according to Chinese customs data. Shipments have risen over eightfold from pre-pandemic levels, the data showed.

Shops, restaurants, and workshops seeking reliable power for lighting, refrigeration and electronic payments, as well as water kiosks, clinics, and schools increasingly use small solar systems, said an official from an international development agency working in Myanmar.

"I have about 10 refrigerators. The electricity here is not regular, so I had to use solar panels," said an ice cream seller from the ancient city of Mawlamyine, who declined to be named due to fear of retribution.

Household solar installations have surged from a few hundred in 2019 to roughly 300,000 in 2025, as users switch from diesel generators to solar panels with storage, said Ken Pyi Wa Tun, chairman of Parami Energy, which sells solar panels and diesel generators in Myanmar.

"A household solar-plus-battery-plus-inverter can be acquired for under $1,000 and power essentials, run for four to five hours and power 2 AC units," Ken Pyi Wa Tun said.

While that is too expensive for most homes, it is cheaper than the roughly $7,000 for a small diesel generator, plus fuel costs of $50 to $100 per week, he said, predicting solar could potentially power 2 million to 2.5 million Myanmar households.

Myanmar's surging solar imports mirror a trend of increased solar adoption to escape erratic power supply in lower- and low-middle income countries such as Pakistan, Iraq, Sri Lanka, and Afghanistan.

They are among the fastest-growing markets for panel exports from China, the world's dominant solar manufacturer, data from energy think-tank Ember showed.

"If the grid is not reliable or the prices too high, then people will do it themselves. And now they can, thanks to solar," said Richard Black, director of policy and strategy at Ember.

Solar adoption, driven by necessity rather than policy, could disrupt traditional utility models, challenge forecasts about fossil fuel demand and complicate grid management, analysts say.

In Pakistan, a surge in affluent residents ditching the country's costly grid power by installing solar panels has forced utilities to raise prices even further for remaining customers.

Diesel imports by Myanmar declined 11% in the first 10 months of 2025, data from analytics firm Kpler showed, while solar panel purchases grew.

"It is not like we are using them for clean energy or for some environmental reasons. We are a country with civil war. We are just using them out of necessity," said a resident in the Bago region.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up