Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)A:--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)A:--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)A:--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)A:--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)A:--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)A:--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)A:--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)A:--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)A:--

F: --

P: --

Japan PPI MoM (Nov)

Japan PPI MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)A:--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)A:--

F: --

P: --

China, Mainland CPI YoY (Nov)

China, Mainland CPI YoY (Nov)A:--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)A:--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)A:--

F: --

P: --

Indonesia Retail Sales YoY (Oct)

Indonesia Retail Sales YoY (Oct)A:--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

Italy 12-Month BOT Auction Avg. Yield

Italy 12-Month BOT Auction Avg. Yield--

F: --

P: --

BOE Gov Bailey Speaks

BOE Gov Bailey Speaks ECB President Lagarde Speaks

ECB President Lagarde Speaks South Africa Retail Sales YoY (Oct)

South Africa Retail Sales YoY (Oct)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Nov)

Brazil IPCA Inflation Index YoY (Nov)--

F: --

P: --

Brazil CPI YoY (Nov)

Brazil CPI YoY (Nov)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

U.S. Labor Cost Index QoQ (Q3)

U.S. Labor Cost Index QoQ (Q3)--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

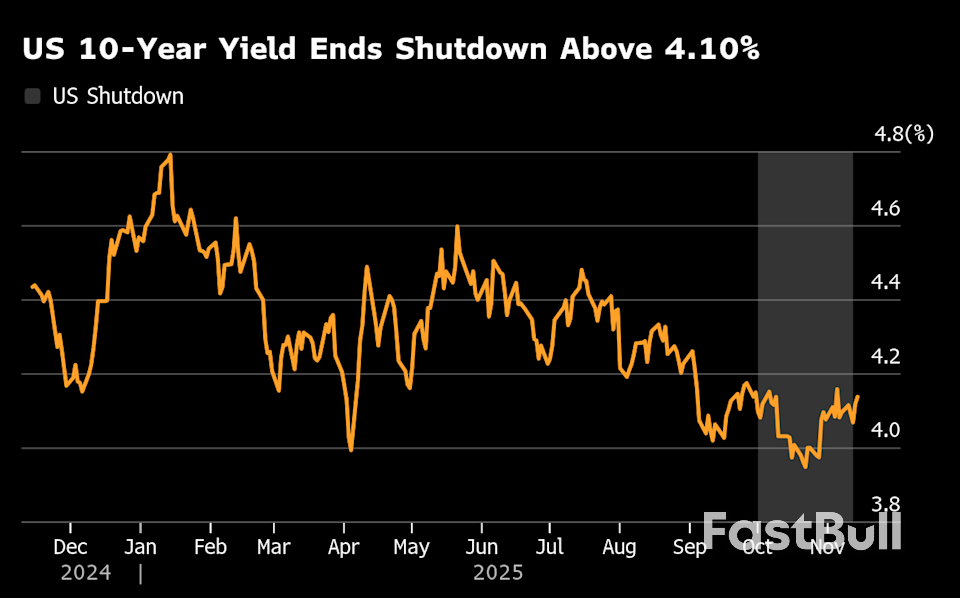

Bond traders await delayed U.S. data to gauge Fed policy after shutdown. Stronger-than-expected labor figures could reduce December rate-cut odds, lifting yields, while cooling growth keeps markets broadly bullish on Treasuries.

Federal Reserve Vice Chair Philip Jefferson said on Monday the U.S. central bank needs to "proceed slowly" with any further interest rate cuts as it eases policy towards a level that would likely stop putting downward pressure on inflation.

In remarks prepared for delivery at a Kansas City Fed event, Jefferson said he agreed the central bank's quarter-percentage-point rate cut last month was appropriate, given increased risks to the job market and the likelihood that inflation risks "have declined somewhat recently."

"The current policy stance is still somewhat restrictive, but we have moved it closer to its neutral level that neither restricts nor stimulates the economy," Jefferson said. "The evolving balance of risks underscores the need to proceed slowly as we approach the neutral rate."

Fed officials are divided over the need to cut rates further, with different opinions about the level of inflation risk and whether the job market is likely to erode further.

The lack of government data has made analysis all the more complicated, and Jefferson said "it remains unclear how muchofficial data we will see" before the December 9-10 Fed policy meeting.

The Bureau of Labor Statistics will release its key monthly employment report for September on Thursday, but the full publication schedule for other data disrupted by the now-ended 43-day government shutdown has not been announced.

US stocks shuffled between small gains and losses on Monday, kicking off a packed week that will include earnings results from artificial-intelligence darling Nvidia Corp. and the release of long-delayed economic data.

The S&P 500 Index was up less than 0.1% as of 9:38 a.m. in New York, on track to extend a 10-week streak of winning Mondays. The Nasdaq 100 Index rose 0.2%, after falling at the opening bell. A basket of the Magnificent Seven megacap companies was flat, although Nvidia fell 1%. Alphabet Inc. rose 4.5% after a regulatory filing showed that Warren Buffett's Berkshire Hathaway Inc. said it took a stake in Google's parent company last quarter.

The week's marquee event: Nvidia earnings on Wednesday after the market closes. While a strong report could boost Nvidia shares and lead the market higher, any miss — real or perceived — could stop the rally in its tracks and add significant weight to the downside. Options traders are pricing in a roughly 6.5% swing in either direction for the stock, which would be its highest implied move in a year, according to data compiled by Bloomberg.

Among other individual stocks, Quantum Computing Inc. rallied 7.5% after reporting third-quarter net income of $2.4 million, or 1 cent per share, versus a loss of $5.7 million, or 6 cents per share, in the quarter last year. Aramark fell 5.5% after the food and facilities management company reported revenue and adjusted EPS for the fourth quarter that missed consensus estimates. EW Scripps soared 15% after Sinclair took an 8.2% stake.

Investors get a long-delayed bit of economic data on Thursday when the US jobs report for September is released, more than a month late because of the government shutdown. It's part of a data deluge that will guide expectations for how quickly the Federal Reserve will continue its interest-rate cuts. Scrutiny of Walmart Inc. and Target Corp. results will be heightened as investors seek clues on consumer appetite and the broader economy.

Investors are looking to Nvidia to "quell the recent uptick in AI skepticism that is behind this decline in tech and the S&P 500," wrote Tom Essaye, founder of The Sevens Report newsletter.

Elsewhere, Gap Inc. shares were little changed after Barclays upgraded the apparel retailer's stock to overweight, seeing "durable brand recovery" when looking past tariff pressures. Meantime, Zymeworks surged 27% after the drug developer gave topline results from a late-stage trial of its experimental combination therapy for cancer of the stomach and esophagus. Shares of partner Jazz Pharmaceuticals jumped 19%.

Government funding resumed days ago following the longest shutdown in US history, but agencies are running behind on most data collection for key October reports on employment and inflation. The process of catching up will likely stretch well into November on economic information that in any event is growing increasingly stale.

The dearth of official data helps explain recent comments by a number of Fed policymakers that they should hold the line on interest rates when they meet next month. The central bank on Wednesday will issue minutes of its October meeting. Traders have trimmed bets that the Fed will cut rates at its December meeting as Fed speakers have raised concerns about inflation.

Fed Vice Chair Philip Jefferson on Monday said he sees increased downside risks to employment, though repeated his view that policymakers need to proceed slowly as interest rates approach neutral.

Among upcoming private-sector data, figures from the National Association of Realtors on Thursday are projected to show little change in October sales of previously owned homes. The report is expected to illustrate a housing market still challenged by limited affordability.

Budget speculation has depressed the UK property market, figures from a leading property website have suggested, with asking prices slipping in the run-up to Rachel Reeves's much anticipated fiscal set piece on 26 November.

The average new seller asking price fell by 1.8%, or £6,589, month on month in November, the figures collated by the property website Rightmove set out, taking the average price tag on a British home put up for sale to £364,833.

The data has emerged as the chancellor has come under pressure to reform property taxes, with housing market experts including the TV presenter Kirstie Allsopp saying "people are in a panic" about potential stamp duty changes, and "sitting tight" before the budget.

It is fairly common for prices to fall month on month in November, when the average monthly price drop has been 1.1% over the past decade, Rightmove says.

However, the current fall is the biggest for this time of year since 2012, with 34% of homes on the market reducing their asking prices and then implementing an average price cut of 7%. Both numbers are the highest since February 2024, the website says.

The gloom in the market is thought to have been partly fuelled by speculation about the contents of the budget, particularly for more expensive properties.

Colleen Babcock, a property expert at Rightmove, said: "The decade-high number of homes available on the market continues to restrict price growth, with many new sellers keen to avoid standing out by overpricing compared with their competition.

"The budget is a big distraction, and is later in the year than usual, with many would-be buyers waiting to see how their finances will be impacted. It appears that the usual lull we'd see around Christmas time has arrived early this year, and sellers who are keen to move are having to work especially hard to entice buyers with competitive pricing."

Homes priced at under £500,000 had been less affected by potential policy change rumours, the survey said.

The figures were released as a separate report predicted that UK mortgage lending growth will weaken in 2026.

After expected net growth of 3.2% this year, UK mortgage lending is forecast to slow to 2.8% next year, as stretched affordability and a squeeze on real incomes drive a dip in housing demand, according to the EY Item Club outlook for financial services.

A challenged global economy and reduced real income growth were set to affect the banking sector in 2026, the study said.

Martina Keane, the EY UK and Ireland financial services leader, said: "The UK economy made a strong start to 2025, but momentum is slowing and we are facing a challenging market. Ongoing global uncertainty and the prospect of further domestic tax rises in the upcoming budget are likely to impact the financial services sector next year. However, our industry is resilient and adaptable, and our fundamentals remain solid."

It said the anticipated dip in 2026 was "likely to be temporary" and followed by improvement in growth levels across most UK financial services in 2027 and 2028.

New York state factory activity in November expanded at the fastest pace in a year as new orders and shipments picked up.

The Federal Reserve Bank of New York's general business conditions index increased 8 points to 18.7, figures issued Monday showed. Readings above zero indicate expansion, and the number exceeded all estimates in a Bloomberg survey of economists.

Gauges of new orders and shipments also advanced to the highest in a year. The overall outlook over the next six months moderated but has been positive for most of the year.

A measure of factory employment edged up and a gauge of hours worked climbed to the highest since May 2022 against the backdrop of steadier demand. The outlook for employment in the next six months climbed to the highest since the start of the year.

While the report is largely positive for a sector that's struggled for momentum in recent months, the overall index has been prone to wide swings amid rising prices for inputs, inconsistent demand and uncertainty from President Donald Trump's erratic tariff announcements.

The Fed's report showed gauges of prices paid for materials as well as a measure of prices received both eased. Forward-looking metrics for both also cooled.

The survey responses were collected between Nov. 3 and 10.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up