Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

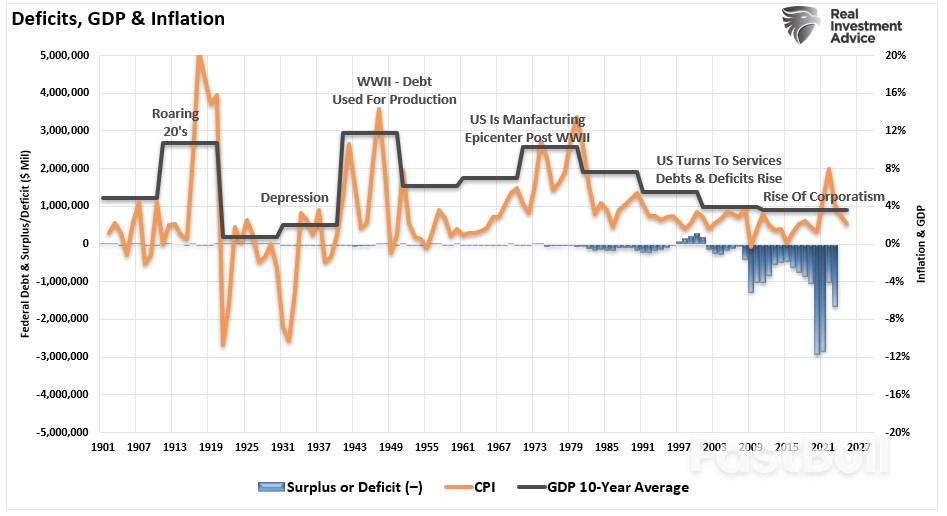

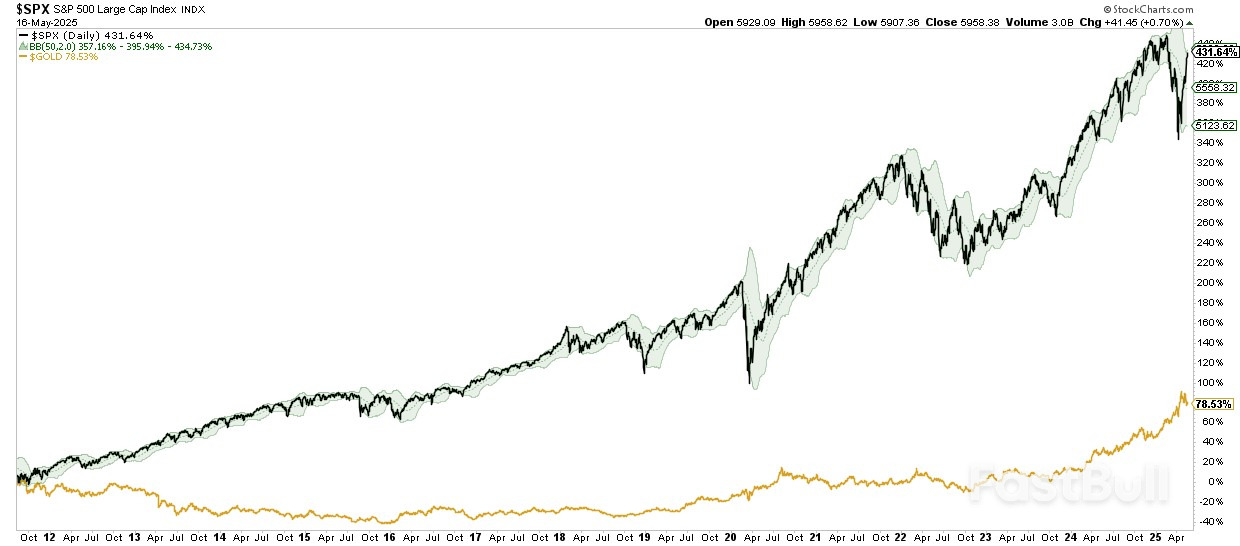

While the Moody’s decision was anticipated given the flood of red ink in Washington, and it trailed moves from the likes of S&P Global Ratings, investors responded by lifting the yield on US 30-year bonds above 5%.

Presidents Trump and Putin have ended their phone call, which lasted for more than two hours, according to RIA. This suggests some heavy lifting was done regarding peace in Ukraine, and restoring Washington-Moscow relations. Trump had reportedly phoned Zelensky just prior to speaking with Putin. It appears an overall 'positive' development, also given the emerging wire headlines:

But this Putin reference to "certain agreements" or conditions being reached will be the sticking point. Zelensky has repeatedly made clear "this is Ukraine's land" when it comes to the annexed four eastern territories and Crimea.

Very likely, Putin pressed this point with Trump - that Zelensky is refusing any level of compromise (which is precisely what Kiev is currently accusing Moscow of doing).

As we await the call readouts from both sides, Vice President JD Vance's latest remarks upon returning to the US from Rome lay out where things stand:

President Trump is expected to hold a phone call with Russian President Vladimir Putin on Monday, followed by a call with Ukrainian President Volodymyr Zelensky - after they were first announced Saturday.

Writing in all caps, the president posted over the weekend to Truth Social, "The subjects of the call with be, stopping the 'bloodbath' that is killing, on average, more than 5000 Russian and Ukrainian soldiers a week, and trade."

He continued in the statement by saying "hopefully it will be a productive day, a ceasefire will take place, and this very violent war, a war that should have never happened, will end." His highly optimistic note ended with "God bless us all!!!" - again written in all caps.

Trump has further indicated he'll be in contact with "various" NATO leaders related to these ceasefire efforts, coming on heels of the Friday meeting between Russian and Ukrainian delegations - the first such direct engagement since efforts at talks ceased within the opening months of 2022 and the war's start.

The NY Times has previewed:

The call, which Mr. Trump said would take place at 10 a.m. Eastern, would be the third known phone conversation between the two men since the American president’s second term began. The first two, which took place in February and March, were celebrated in Moscow as signs of weakening Western resolve to isolate and punish Russia for its invasion of Ukraine.

And the Kremlin issued the following Monday:

"The conversation is important, taking into account the negotiations held in Istanbul," Peskov said. "As for the talks, we [in the Kremlin] have already said everything we could, we underscored the basic points," he added. "We will now wait for it. We will give the maximum information possible based on the results of the conversation," he stated.

There was little concrete which came out of the meeting, other than a new POW swap - which is to involve 1,000 captives returned on either side - and declarations that each side is open to meeting a gain.

Still, the warring sides are far apart in terms of conditions, with Zelensky having reasserted on Friday, "In all discussions – and I emphasize this – and this is my unwavering position – we do not legally recognize any of our temporarily occupied territories as Russian. This is the Ukrainian land."

Just ahead of the Putin-Zelensky calls at the White House on Monday:

Meanwhile, Secretary of State Marco Rubio revealed the US administration's thinking on how things are really going at this point. He reiterated to CBS News’ ‘Face the Nation’ on Sunday that the White House will not tolerate endless negotiations which simply drag the war and killing on further.

"On the one hand, we’re trying to achieve peace and end a very bloody, costly, and destructive war. So there’s some element of patience that is required," he began by acknowledging.

"On the other hand, we don’t have time to waste. There are a lot of other things happening in the world that we also need to be paying attention to. So we don’t want to be involved in this process of just endless talks. There has to be some progress, some movement forward," he then emphasized.

The US is currently examining competing ceasefire proposals offered by each side. "If those papers have ideas on them that are realistic and rational, then I think we know we’ve made progress," he said.

The following is reportedly among Moscow's top list of demands, which can be described as maximalist (at least from the West's perspective), per a recent Bloomberg report:

But Ukraine has rejected the Kremlin's demand of de-facto recognizing the loss of its territories. Zelensky has time and again vowed to fight on, despite mounting losses and serious manpower issues.

The White House is likely to latch on to anything positive regarding these talks that it can; however, President Trump has clearly been exerting pressure for more speedy resolution, and is growing impatient.

The Europeans are ready to slap more sanctions on Moscow, and Washington has also warned that this would essentially be plan B if Russia doesn't cooperate. But Russia's fresh maximalist demands will be a hard sell.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up