Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

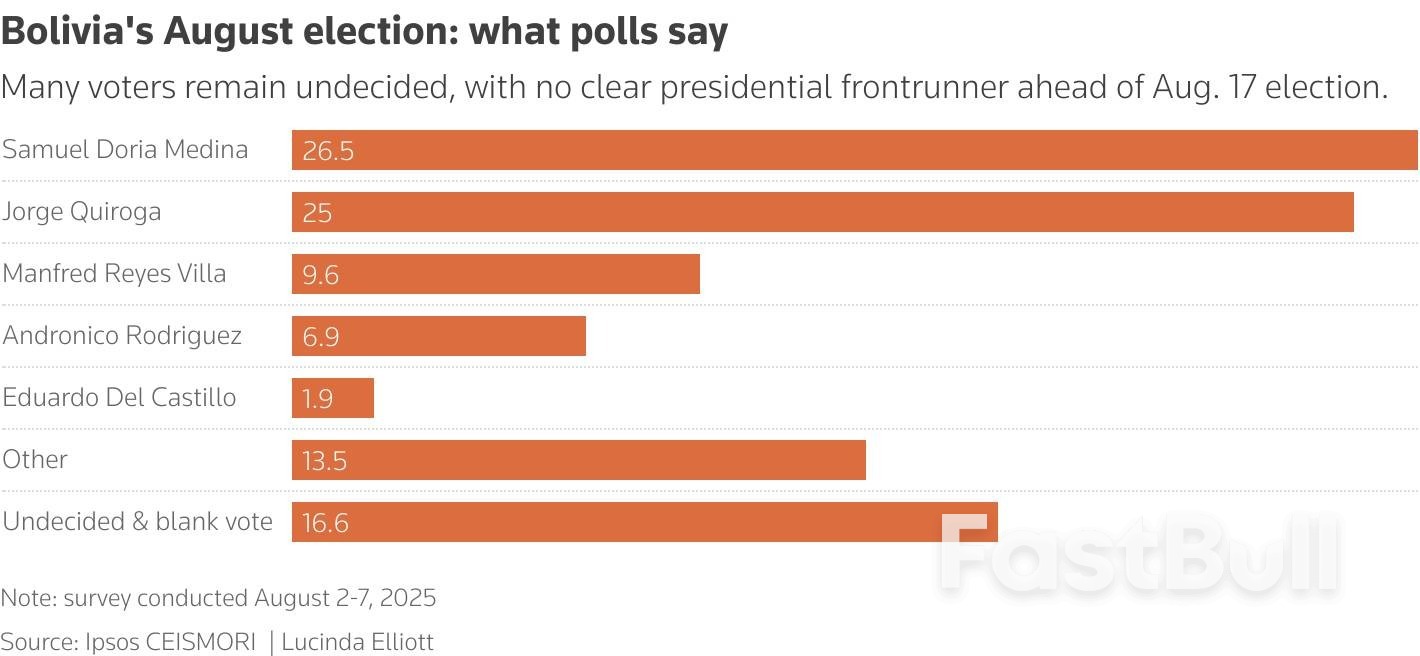

Early exit polls in Bolivia's presidential election on Sunday showed Centrist Senator Rodrigo Paz of the Christian Democratic Party leading, with the ruling Movement for Socialism party on track to suffer its worst electoral defeat in a generation.

Early exit polls in Bolivia's presidential election on Sunday showed Centrist Senator Rodrigo Paz of the Christian Democratic Party leading, with the ruling Movement for Socialism party on track to suffer its worst electoral defeat in a generation.Paz had secured 31.3% of the vote, according to a poll published by Unitel TV, while the ruling Movement for Socialism party candidate Eduardo del Castillo had just 3.2%, with other leftist challengers trailing the opposition.

Conservative former president Jorge "Tuto" Quiroga, of the Alianza Libre coalition, was in second with 27.3%, said Unitel.If no presidential candidate wins more than 40% support with a 10 percentage point lead, the election will head to a runoff on October 19 between the top two candidates.

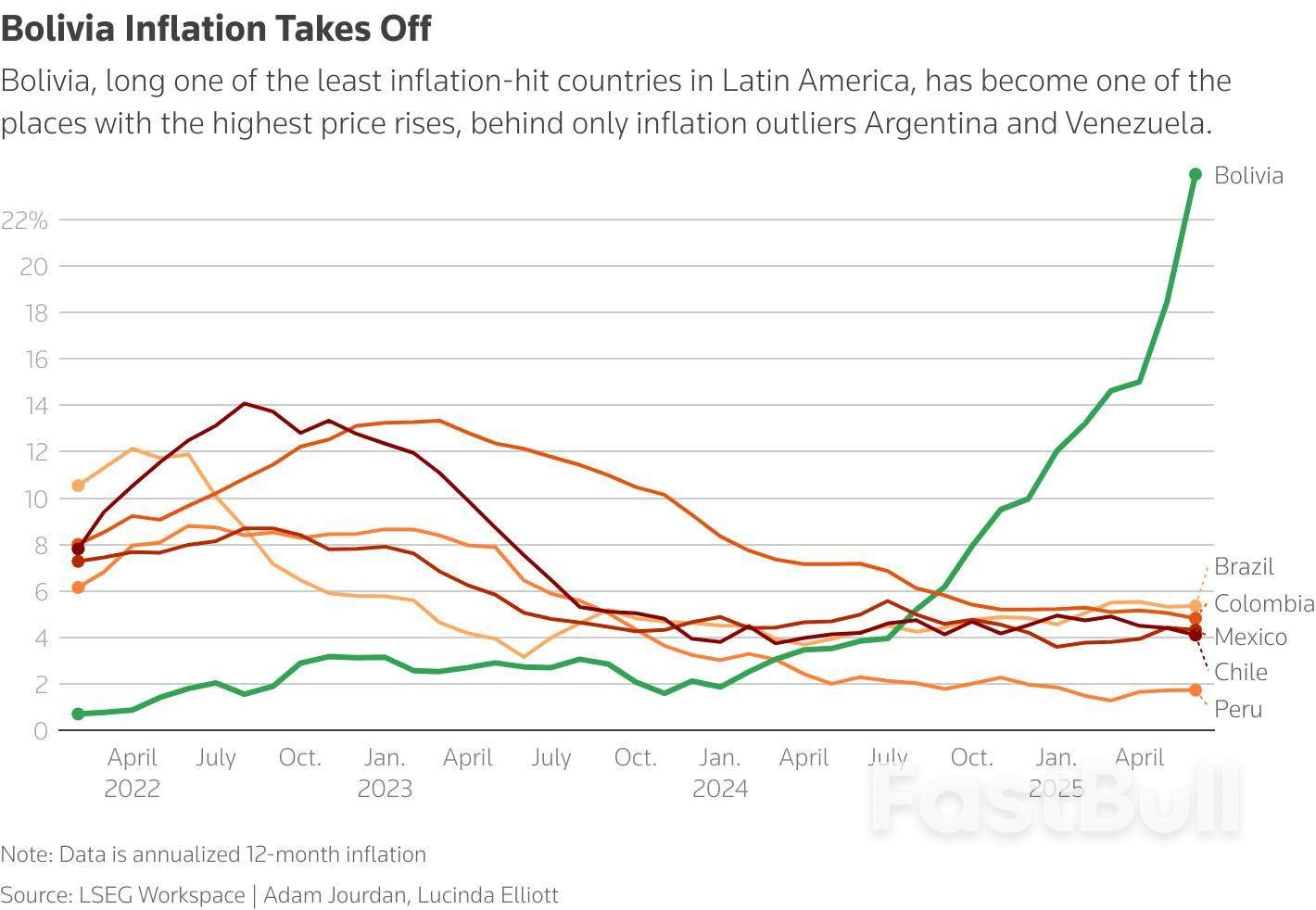

Sunday's general election has been overshadowed by inflation at a four-decade high and the absence of former leftist president Evo Morales, who is barred from running.Voter turnout on Sunday was steady, authorities said. Despite earlier concerns that the electoral process in Bolivia could be obstructed by supporters of Morales, who had called on the public to boycott the race, international observers said the vote took place without major disruptions.

Head of the electoral mission of the Organization of American States (OAS) in Bolivia, Juan Fernando Cristo, said the elections proceeded "normally" in a post on X.Earlier on Sunday, several minor incidents took place at polling stations in the central region of Cochabamba, Morales' political stronghold.

With a crowded field and no dominant MAS party candidate, the election marks a "crossroads moment" for Bolivia, said Southern Andes analyst Glaeldys Gonzalez Calanche of the International Crisis Group.Bolivia's fragile economy has been top-of-mind for voters. Price rises have surged past other Latin American countries this year, and fuel and dollars have run scarce.Annual inflation doubled to 23% in June, up from 12% in January, with some Bolivians turning to cryptocurrencies as a hedge.

Bolivia's inflation is soaring past others in the region who were far more affected in recent years, including during the Covid-19 pandemic.Many Bolivians, especially those who work in the informal economy, were now struggling to make ends meet, said economist Roger Lopez."Prices of the basic food basket are going up fast," said Lopez. "Suddenly the math doesn't add up anymore."

Exit polls indicated they chose to punish MAS on Sunday, creating a window of opportunity for centrists, the right, or a leftist faction led by Senate President Andronico Rodriguez."Every year the situation has got worse under this government," said Silvia Morales, 30, from La Paz, who works in retail. A former MAS voter, she said this time she would cast her vote for the center-right.Carlos Blanco Casas, 60, a teacher in La Paz, said he intended to vote for change. "This election feels hopeful. We need a change of direction," he said.

Quiroga has promised "radical change" to reverse what he calls "20 lost years" under MAS rule. He supports deep public spending cuts and a shift away from alliances with Venezuela, Cuba and Nicaragua. Quiroga was president for a year in 2001-2002 after the then-leader resigned.Paz meanwhile plans to decentralize government by introducing a "50-50 economic model" in which the central government would manage only half of public funds. The remainder would be designated to regional governments.

Silvia Morales, 30, a former MAS voter from La Paz, said she had cast her ballot for Paz on Sunday."He's a new face with experience," she said, "I think we should make space for new opportunites."On the left, the vote is split between the official MAS party candidate Eduardo del Castillo, who is backed by outgoing President Luis Arce, and Senate President Andronico Rodriguez, who has distanced himself from the party and is running on his own ticket.

Morales, 69, has called for a boycott of the election, but analysts said his influence is waning."There is widespread support for these elections," said Calanche. "Most Bolivians see them as key to leading the country towards economic recovery."

Daily Bitcoin (BTCUSD)

Daily Bitcoin (BTCUSD) Daily E-mini Nasdaq 100 Index Futures

Daily E-mini Nasdaq 100 Index FuturesPresident Volodymyr Zelenskiy accused Russia of unleashing "cynical" attacks on Ukrainian civilians that he said were designed to undermine his talks with U.S. President Donald Trump in Washington later on Monday.

Officials in Ukraine said a drone attack on a residential complex in the northern city of Kharkiv killed at least seven people, including a 1-year-old girl. Strikes also hit the southeastern city of Zaporizhzhia, killing three people, they said.

"This was a demonstrative and cynical Russian strike," Zelenskiy wrote on X.

"The Russian war machine continues to destroy lives despite everything," he added. "Putin will commit demonstrative killings to maintain pressure on Ukraine and Europe, as well as to humiliate diplomatic efforts."

After rolling out the red carpet for Russian President Vladimir Putin at a summit in Alaska on Friday, Trump is leaning on Ukraine to accept a peace deal to end Europe's deadliest war in 80 years.

The war has killed or wounded more than a million people from both sides, including thousands of mostly Ukrainian civilians, according to analysts. Kyiv and its allies worry that Trump could force an agreement more favourable to Moscow.

The Russian defence ministry's daily report said its forces had attacked Ukrainian units in the Kharkiv region but did not refer to any strike on the city of Kharkiv. Russia says it does not deliberately target civilians.

Trump will meet Zelenskiy first and then the leaders of Britain, Germany, France, Italy, Finland, the European Union and NATO, the White House said. The European leaders are flying to Washington to show solidarity with Ukraine and to press for strong security guarantees in any post-war settlement.

Trump's team stressed on Sunday that there had to be compromises on both sides. But Trump put the burden on Zelenskiy to end the war that Russia began with its full-scale invasion in February 2022.

Ahead of the meeting, he said in a social media post Ukraine should give up hopes of getting back Crimea, annexed by Russia in 2014 during Barack Obama's presidency, or of joining the NATO military alliance.

That suggested he would press Zelenskiy hard.

Zelenskiy "can end the war with Russia almost immediately, if he wants to, or he can continue to fight," Trump said on Truth Social.

Trump will meet Zelenskiy at 1:15 p.m. EDT (1715 GMT) in the Oval Office and then with all the European leaders in the White House's East Room at 3 p.m. EDT (1900 GMT), the White House said.

Ukrainian President Volodymyr Zelenskiy walks to meet British Prime Minister Keir Starmer at Downing Street, in London, Britain, August 14, 2025. REUTERS/Isabel Infantes/File Photo Purchase Licensing Rights, opens new tab

The Ukrainian president, seeking to avoid a repeat of the bad-tempered Oval Office meeting he had with Trump in February, said after arriving in Washington late on Sunday he was grateful to the president for the invitation.

Ukraine and its allies have taken heart from some developments, including Trump's apparent willingness to provide post-settlement security guarantees for Ukraine. A German government spokesperson said on Monday that European leaders would seek more details on that in the talks in Washington.

Zelenskiy has already all but rejected the outline of Putin's proposals from the Alaska meeting, including for Ukraine to give up the rest of its eastern Donetsk region, of which it currently controls a quarter.

Zelenskiy is also seeking an immediate ceasefire to conduct deeper peace talks. Trump previously backed that but reversed course after the summit with Putin and indicated support for Russia's favoured approach of negotiating a comprehensive deal while fighting rumbles on.

Russia launched missiles and drones in overnight attacks that included strikes on Kharkiv.

"They hit an ordinary apartment block, many flats, many families were living here, small children, children's playground, residential compound, there are no offices here or anything else, we lived here peacefully in our homes," said Olena Yakusheva, a local resident.

Firefighters battled a blaze in the building and rescue workers dug in the rubble.

On the battlefield, Russia has been slowly grinding forward, pressing home its advantages in men and firepower. Putin says he is ready to continue fighting until his military objectives are achieved.

The outline of Putin's proposals, reported by Reuters earlier, appears impossible for Zelenskiy to accept. Ukrainian forces are deeply dug into the Donetsk region, whose towns and hills serve as a crucial defensive zone to stymie Russian attacks.

"D-Day at the White House" said Britain's Daily Mail, while the Daily Mirror said "Europe takes a stand" in its front page headline. Germany's Die Welt called it the "moment of truth" for the U.S. president.

Meanwhile, Russian crude oil flows to Hungary and Slovakia via the Druzhba pipeline were halted on Monday. Hungary blamed Ukraine for an attack on a transformer station. Ukrainian Foreign Minister Andrii Sybiha neither confirmed nor denied the account of the attack, but wrote on X that Hungary "can now send complaints" to Moscow, not Kyiv.

Unlike most other EU countries, Hungary has kept up its reliance on Russian energy since Moscow's invasion of Ukraine. It imports most of its crude via the Druzhba pipeline, which runs through Belarus and Ukraine to Hungary and also Slovakia.

Goldman Sachs predicts the Federal Reserve will cut interest rates three times in 2025, starting September, due to weaker tariff impacts and a softening labor market.

This forecast could enhance risk sentiment and potentially buoy cryptocurrency markets, affecting assets like Bitcoin and Ethereum with anticipation of Federal Reserve policy easing.

Goldman Sachs has revised its forecast, anticipating the Federal Reserve will cut interest rates three times in 2025. The decision comes as part of an accelerated timeline due to weaker-than-expected impacts of tariffs on inflation.

Goldman Sachs has revised its forecast, anticipating the Federal Reserve will cut interest rates three times in 2025 due to weaker-than-expected impacts of tariffs on inflation. Led by chief economist Jan Hatzius, the Goldman Sachs research team projects rate cuts of 25 basis points, scheduled for September, October, and December. The revised forecast highlights softening labor market indicators.

Market impacts of these rate cuts could be substantial, notably for cryptocurrency markets. Historically, such monetary actions improve risk sentiment, leading to increased demand for assets like Bitcoin and Ethereum. The broader financial implications include anticipated shifts in asset allocation. Lower interest rates generally foster increased investment in riskier assets as investors seek higher returns. This has been seen in previous easing cycles.

The financial community may perceive these cuts as a response to macroeconomic conditions. They could stimulate investment and lending activity. Similar policy moves in past cycles led to increased crypto valuations, highlighting potential benefits. Insights from past cycles suggest that rate cuts often lead to improved liquidity conditions. Cryptocurrency markets, including Bitcoin and Ethereum, might experience price increases and heightened trading activity as investors react to market conditions.

Political pressure, changing personnel and a complex mix of macroeconomic data in recent weeks have renewed the focus on the Federal Reserve and its policy direction. Compared to the bond markets, equity markets seem to be taking these developments in stride.The past few weeks have been captivating for Federal Reserve watchers. The resignation of board governor Adriana Kugler and temporary replacement by President Trump appointee Stephen Miran has coincided with the emergence of an expanding list of possible successors to chair Jay Powell and the release of a swath of policy-influencing macroeconomic data.

Taken together, this has renewed the focus on the Fed and future policy direction, which the market still currently expects to head lower even though the path is being made more complex by a mix of positive and negative employment and inflation prints.The hot Producer Price Index data—showing wholesale inflation rising 0.9% from a month earlier and 3.3% from a year ago—provided a fresh example last week, overshadowing the earlier broadly benign Consumer Price Index data and unsettling the U.S. equity and bond markets.

After equities had rallied to fresh highs earlier in the week on the CPI data (core CPI year-over-year was in line with expectations at 3.1% in July) and expectations the Fed would cut rates in September, the PPI print halted the march higher and in parallel pushed up Treasury yields, especially at the short end.As a result of last week’s data—including broadly resilient July retail sales reported on Friday—the market is still pricing in a rate cut next month. It’s just no longer fully pricing in a quarter-point cut, as it did at the start of the week.

Such a reaction to the PPI data broadly reflects two views: equity investors see the threat inflation poses to their bet of a soft landing and a more accommodative policy environment, while bond investors see a longer period of above-target inflation, higher economic growth prospects and continued deficit concerns.

A more accurate reading of what the equity and bond markets are signalling is complicated. Combined with multiple exogenous factors influencing the shape of the yield curve, bond investors are clearly preoccupied by the impact of sticky inflation and any weakening in the labor market on monetary easing.Yet many equity investors are instead more focused on the Fed and continued easing, which would accelerate business and consumer investment, and, through lower financing costs, support smaller companies, especially those in more interest-rate sensitive cyclical industries.

The move higher in the Russell 2000 small cap index in recent weeks—extending a stronger performance overall and especially lower-quality parts of the market over the past few months—gives some support to this, indicating investors are beginning to price in a more accommodative monetary environment as the U.S. economy potentially begins to accelerate out of the current slowdown.When that may happen is uncertain, but we believe that muted economic growth in the next few quarters is unlikely to approach recessionary levels, and that the economy will continue to demonstrate resilience, particularly to the impact of tariffs and the extent they are being absorbed by companies and consumers.

Further fortifying this resilience and boosting the prospects for growth over the medium term is the administration’s deregulation drive and the passing of the U.S. tax and spending bill. As well as helping to bolster disposable income and sustaining consumer demand, the bill will more significantly benefit small and medium-sized companies by introducing several pro-growth measures aimed at stimulating innovation, investment and domestic production.

Looking ahead, the focus now turns to three more major data releases—July Personal Consumption Expenditures, August CPI and August non-farm payrolls—in the coming days as well as the Jackson Hole symposium.

Much of the focus will likely fall on the August jobs report, but the relative strength or weakness of the overall economy will also be a driving factor in the Fed’s messaging coming into and out of Jackson Hole and the September meeting.In our view, there is likely little to disrupt the near-term path to lower rates, but any evidence showing that services prices are reversing their downward trend could jeopardize rate cuts slated for 2026 and keep the Fed above the 3.5% mark moving into middle of next year.

In addition, evidence of continued political pressure on the Fed could also push yields higher and disrupt efforts to effect more accommodative policy.History tells us that August and September can bring market volatility, and to some extent we are already seeing this. However, looking through these periods, our medium-term outlook remains constructive.What’s more, we believe the combination of lower rates to come, deregulation and the pro-growth measures of the tax and spending bill continue to create an attractive case for small and mid-caps, which is why the Asset Allocation Committee is overweight the sector.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up