Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

The US Dollar Index Rose Approximately 0.7% In Late New York Trading On Monday (February 2nd), Reaching 97.641 Points. The Index Traded Between 97.008 And 97.733 Points During The Day, Maintaining A Slight Upward Trend And Hovering Around 97.100 Points Before Extending Its Gains. The Bloomberg US Dollar Index Rose 0.35% To 1192.42 Points, Trading Between 1187.02 And 1193.19 Points During The Day

US Treasury Says To Borrow $574 Billion In Q1, Sees End Cash Balance Of $850 Billion (Removes Extraneous Word "It")

US Treasury Says It Expects To Borrow $109 Billion In Q2, Sees End Cash Balance Of $900 Billion

[The Carlyle Group Joins Europe's Top Ten Oil Refiners] As Major Oil Companies Streamline Their Portfolios, The Carlyle Group Has Joined The Ranks Of Europe's Top Ten Fuel Manufacturers. The Private Equity Giant Holds A Two-thirds Stake In Varo Energy, Which Completed Its Acquisition Of The Lysekil And Gothenburg Refineries In Sweden In January. According To Data Compiled By Bloomberg, This Move, Combined With Its Existing Holdings, Elevates Carlyle To Ninth Place Among European Fuel Manufacturers

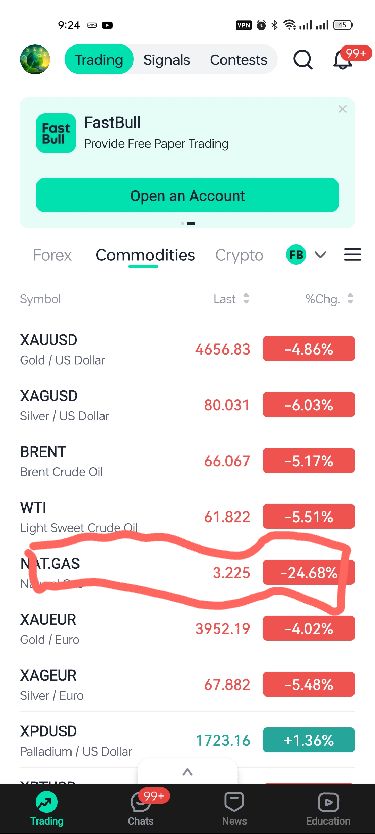

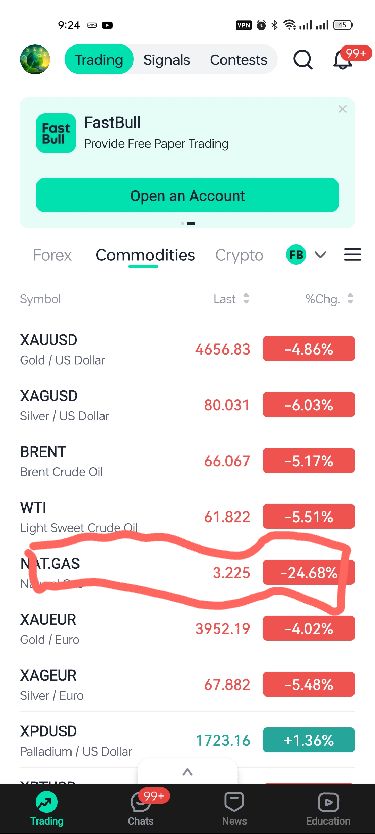

WTI Crude Oil Futures For March Delivery Closed At $62.14 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.2370 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.8514 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.3598 Per Gallon

Ukraine Designates Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization" On February 2nd. Ukrainian President Volodymyr Zelenskyy Announced That Ukraine Has Designated Iran's Islamic Revolutionary Guard Corps As A "terrorist Organization." Iran Has Not Yet Responded

Intercontinental Exchange (ICE), The Owner Of Nasdaq (NYSE), Has Received Approval From The U.S. Securities And Exchange Commission (SEC) To Provide U.S. Treasury Clearing Services

Swiss National Bank Chairman: Expects Swiss Inflation To Rise In Coming Months, Sees Monetary Conditions In Switzerland As Appropriate

Rubio: US Looks Forward To Working Closely With Costa Rica's President-Elect Laura Fernández Delgado's Administration After Electoral Victory

German Chancellor Merz: Transatlantic Relationship Has Changed And No One Regrets It More Than Me

China, Mainland NBS Non-manufacturing PMI (Jan)

China, Mainland NBS Non-manufacturing PMI (Jan)A:--

F: --

P: --

South Korea Trade Balance Prelim (Jan)

South Korea Trade Balance Prelim (Jan)A:--

F: --

Japan Manufacturing PMI Final (Jan)

Japan Manufacturing PMI Final (Jan)A:--

F: --

P: --

South Korea IHS Markit Manufacturing PMI (SA) (Jan)

South Korea IHS Markit Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia IHS Markit Manufacturing PMI (Jan)

Indonesia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

China, Mainland Caixin Manufacturing PMI (SA) (Jan)

China, Mainland Caixin Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

Indonesia Trade Balance (Dec)

Indonesia Trade Balance (Dec)A:--

F: --

P: --

Indonesia Inflation Rate YoY (Jan)

Indonesia Inflation Rate YoY (Jan)A:--

F: --

P: --

Indonesia Core Inflation YoY (Jan)

Indonesia Core Inflation YoY (Jan)A:--

F: --

P: --

India HSBC Manufacturing PMI Final (Jan)

India HSBC Manufacturing PMI Final (Jan)A:--

F: --

P: --

Australia Commodity Price YoY (Jan)

Australia Commodity Price YoY (Jan)A:--

F: --

P: --

Russia IHS Markit Manufacturing PMI (Jan)

Russia IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Turkey Manufacturing PMI (Jan)

Turkey Manufacturing PMI (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index MoM (Jan)

U.K. Nationwide House Price Index MoM (Jan)A:--

F: --

P: --

U.K. Nationwide House Price Index YoY (Jan)

U.K. Nationwide House Price Index YoY (Jan)A:--

F: --

P: --

Germany Actual Retail Sales MoM (Dec)

Germany Actual Retail Sales MoM (Dec)A:--

F: --

Italy Manufacturing PMI (SA) (Jan)

Italy Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

South Africa Manufacturing PMI (Jan)

South Africa Manufacturing PMI (Jan)A:--

F: --

P: --

Euro Zone Manufacturing PMI Final (Jan)

Euro Zone Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.K. Manufacturing PMI Final (Jan)

U.K. Manufacturing PMI Final (Jan)A:--

F: --

P: --

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)--

F: --

P: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction Yield--

F: --

P: --

Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Dec)

U.S. JOLTS Job Openings (SA) (Dec)--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Bitcoin surged past $124,000 on October 5-6, 2025, reaching an all-time high of $125,559. This increase is driven by institutional inflows, spot Bitcoin ETF growth, and macroeconomic factors, with institutions amassing significant BTC.

Key Points:

Bitcoin surged past $124,000 on October 5-6, 2025, reaching an all-time high of $125,559. This increase is driven by institutional inflows, spot Bitcoin ETF growth, and macroeconomic factors, with institutions amassing significant BTC.

Bitcoin achieved a new high of $125,559 on October 6, 2025, after surpassing $124,000, driven by institutional inflows and ETF growth.

The new Bitcoin high signals significant institutional confidence and potential continued growth in the crypto market.

Bitcoin surpassed $124,000 on October 5-6, 2025, reaching a new record high of $125,559. This milestone was primarily driven by strong institutional inflows and the notable growth of spot Bitcoin ETFs.

Key players such as Bitwise and BlackRock have reported substantial inflows into Bitcoin ETFs, highlighting increased institutional participation. Juan Leon, Senior Investment Strategist at Bitwise, noted:

Institutional inflows have significantly boosted Bitcoin's price, contributing to approximately $124 billion increase in market capitalization this October. The broader market, including ETH and SOL, has correlated positively with Bitcoin's rise.

The financial implications of this rise include enhanced confidence from major institutions like Citigroup, which raised its BTC year-end target to $132,000, reinforcing optimistic future outlooks.

Continued ETF inflows suggest a positive trend for Bitcoin, with large holders collectively amassing over 30,000 BTC in just 48 hours. This marks a significant confidence boost within the market.

The potential for future financial shifts is underscored by trends from past cycles, where similar events prompted broad sector momentum. This current stability at resistance levels hints at reduced volatility and market maturation.

ICE Brent was trading above $65/bbl while NYMEX WTI was seen approaching $62/bbl this morning, amid a modest OPEC+ production increase for November and higher geopolitical risks. Recent reports suggest that Ukraine claims to have attacked one of Russia’s largest oil refineries, Kinef oil refinery, which holds an annual processing capacity of over 20mt. The attack took place over the weekend (the second time in a month), as Ukraine continues to put pressure on Russia’s energy infrastructure.

Meanwhile, OPEC+ agreed to boost crude oil production by 137k b/d in November (similar to last month), in contrast to markets expecting a more aggressive reintroduction of supply. The group remains cautious about increasing its production share in the global oil market on predictions of an upcoming supply surplus in the fourth quarter as well as next year. Last month, the IEA also predicted a record oil surplus for next year, primarily on rising OPEC+ supply.

Baker Hughes data shows that the US oil rig count saw its first weekly decline in six weeks following a weekly drop in crude oil prices. Recent data shows that crude oil rigs declined by two to 422 active rigs last week. While this is a very marginal decline, it does suggest that drilling activity may be stabilising on growing concerns over a supply glut and fears that a prolonged US shutdown would further hurt oil prices.The overall rig count (oil and gas combined) remains unchanged from last week and stood at 549 in the week ending 3 October 2025. However, it is still down 36 from the same time last year.

The latest positioning data shows that speculators sold 11,466 lots of ICE Brent for a second consecutive week over the last reporting week, leaving them with a net long position of 209,113 lots, a move predominantly driven by rising gross shorts positions. Meanwhile, the speculative data for NYMEX WTI is not available yet, as the CFTC weekly report was not released due to the ongoing government shutdown in the US.

Gold prices hit another record high this morning, with spot gold breaking above $3,945/oz for the first time, as the prolonged US shutdown fuelled investors’ demand for safe-haven assets. The US disruption has delayed payroll data expected last Friday, further clouding an already uncertain economic outlook. With official data delayed, traders are depending on private reports for economic insight, while the central bank faces challenges in making monetary policy decisions. Still, markets expect a quarter-point rate cut this month, which could further support gold.

The latest data shows that total known ETF holdings for gold continue to report inflows of 52.5koz for a seventh consecutive session to 97.3moz as of Friday. Net inflows for the last week stand at 655.7koz, taking the total gold ETF holdings to the highest level since September 2022. Gold prices are already up by nearly 50% this year, driven by heightened economic and geopolitical uncertainty under US President Donald Trump. The Federal Reserve’s rate cuts and central bank moves to diversify away from dollar assets have also provided strong support.

In industrial metals, LME copper prices extended the upward rally for a fourth straight session this morning, with prices moving above $10,785/t (the highest since May 2024), amid expectations of US interest rate cuts and ongoing supply disruptions. Recent reports of supply disruptions at major mines – including Freeport-McMoRan Inc. (Grasberg), Codelco (EI Teniente) and Hudbay Minerals Inc. – have led to a sharp downward revision in the output guidance for the year.

Meanwhile, LME data shows that on-warrant inventories for lead fell by 26,525 tonnes (the biggest daily decline since 18 July 2025) after reporting gains for three consecutive sessions to 185,200 tonnes as of 3 October, the lowest since 20 May 2025. Most of the outflows were reported into Singapore warehouses. Total inventories of lead rose by 3,750 tonnes for a fourth straight session to 237,500 tonnes, while cancelled warrants increased by 30,275 tonnes for a second consecutive session to 52,300 tonnes for the period.

Arabica coffee settled more than 3% higher on Friday amid dry weather conditions in Brazil, the world's top producer. Recent weather reports suggest that dry and hot weather will intensify over coffee-growing areas in Brazil by the end of the week, with a likely transition to a La Niña weather pattern adding risks to coffee development.

Turning to inventories, the latest official data shows that total coffee stocks at ICE-monitored warehouses have been declining continuously since 9 September and fell by 8.4k bags to 538.6k bags as of 3 October, the lowest since March 2024. This was primarily due to a sharp decline in Brazilian beans, just 6% as of Friday, compared to 63% at the start of the year. Earlier, CONAB revised down its Brazil arabica coffee production estimates from 37m bags to 35.2m bags for the 2025/26 season. The main flowering for Brazil’s 2026/27 crop is complete. However, October rains are crucial for continued growth.

The General Statistics Office of Vietnam released trade volume estimates for September, showing that coffee shipments are seen at 81kt, up 58.5% compared to 51.4kt reported a year ago. However, the coffee export estimates for September are down 4.7% month-on-month. Cumulative coffee exports rose by 10.9% year-on-year to 1.2mt over the first nine months of the year as overseas sales continue to remain strong.

Recent data from France’s Agriculture Ministry show that 24% of the corn has been harvested as of 29 September, up from 14% in the previous week. This pace is faster than previous seasons and is in line with the five-year average. Meanwhile, 62% of the corn crop is rated in good to excellent condition for the period mentioned above, in line with the previous week, but well below the 79% seen at the same period last year.

New French Prime Minister Sébastien Lecornu resigned on Monday, just hours after appointing his new government, after both his allies and rivals threatened to bring down his government. His resignation was unexpected and unprecedented, marking another significant escalation of France's political crisis. French stocks fell sharply, along with the euro, after news of the resignation. After weeks of consultations with political parties across the country, Lecornu, a close ally of President Emmanuel Macron, appointed his ministers on Sunday, and the cabinet was scheduled to hold its first meeting on Monday afternoon.

But the new government lineup has angered opponents and allies alike, who find it either too right-wing or insufficiently so, raising questions about how long it can last at a time when France is already in the grip of a deep political crisis, with no single group holding a majority in a fragmented parliament.

The Elysée Palace press office announced that "Mr. Sébastien Lecornu submitted the resignation of his government to the President of the Republic, who accepted it." French political instability has increased since Macron's re-election in 2022, with no party or bloc commanding a parliamentary majority. Macron's decision to call early parliamentary elections last year deepened the crisis, resulting in an even more divided parliament. Lecornu, appointed only last month, was Macron's fifth prime minister in two years.

Mounting fiscal uncertainty in major economies is accelerating a shift into Bitcoin, gold, and silver, as investors brace for further currency debasement.

Key Takeaways:

● Investors are moving into Bitcoin, gold, and silver as fears of currency debasement rise in major economies.

● Japan’s yen dropped 1.6% after pro-stimulus politician Sanae Takaichi led the PM race, adding pressure to global fiat currencies.

● Bitcoin’s surge past $125K and gold’s fresh highs reflect growing demand for hard assets.

The so-called “debasement trade” has gained traction amid rising national debts and political instability, prompting a broad retreat from fiat assets, according to a Monday report by Bloomberg.

In Japan, the yen dropped 1.6% on Monday after pro-stimulus lawmaker Sanae Takaichi emerged as the frontrunner to become the country’s next prime minister.

Her expected policies dim hopes for near-term monetary tightening, sending the currency to record lows against both Bitcoin and gold.Meanwhile, the dollar continues to weaken under the weight of a prolonged U.S. government shutdown and debt concerns, losing roughly 30% of its value against Bitcoin since the start of the year.Europe offers little reassurance. The euro slipped 0.1% against the dollar as fresh political tension in France clouded the outlook.The region’s high debt burden and fragmented policy responses have further fueled investor unease.

As traditional currencies falter, Bitcoin is hovering near its latest all-time high above $125,000, while gold touched fresh records and silver edged closer to its peak.Chris Weston, head of research at Pepperstone Group, described the surge in demand for these assets as a classic momentum trade, amplified by political chaos and inflation risks. “You’ve got to be in it,” he said.JPMorgan analysts echoed that sentiment in a research note dated Oct. 3, pointing to Washington’s dysfunction and the dollar’s familiar pattern of losing ground to alternative reserves.

They likened the current flight to gold and Bitcoin to investor behavior during the 2008 financial crisis and years of aggressive monetary stimulus.Despite a minor rebound in the Bloomberg Dollar Spot Index on Monday, the greenback remains down about 8% for the year.With global markets gripped by uncertainty, Bitcoin and gold are increasingly seen not just as speculative plays but as defensive havens against fiscal mismanagement and fiat erosion.

As reported, Bitcoin surged to a new all-time high above $125,700 on Sunday morning, breaking past its previous record of $124,500 set in August, according to data from CoinMarketCap.The milestone came as centralized exchanges report the lowest levels of Bitcoin reserves in six years, signaling a tightening supply backdrop amid growing investor demand.

The sharp recovery marks a strong start to October, often dubbed “Uptober” by traders, after Bitcoin slipped to $107,800 in early September.Over the past week, the asset has climbed steadily, buoyed by renewed optimism and tightening exchange liquidity.Notably, Bitcoin’s surge past $124,000 has driven Strategy Inc.’s BTC holdings to a record $77.4 billion, the company revealed Friday.The firm, which began accumulating BTC in 2020 as a corporate treasury asset, has seen its holdings grow exponentially from an initial valuation of $2.1 billion to over 35 times that amount in just five years.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up