Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

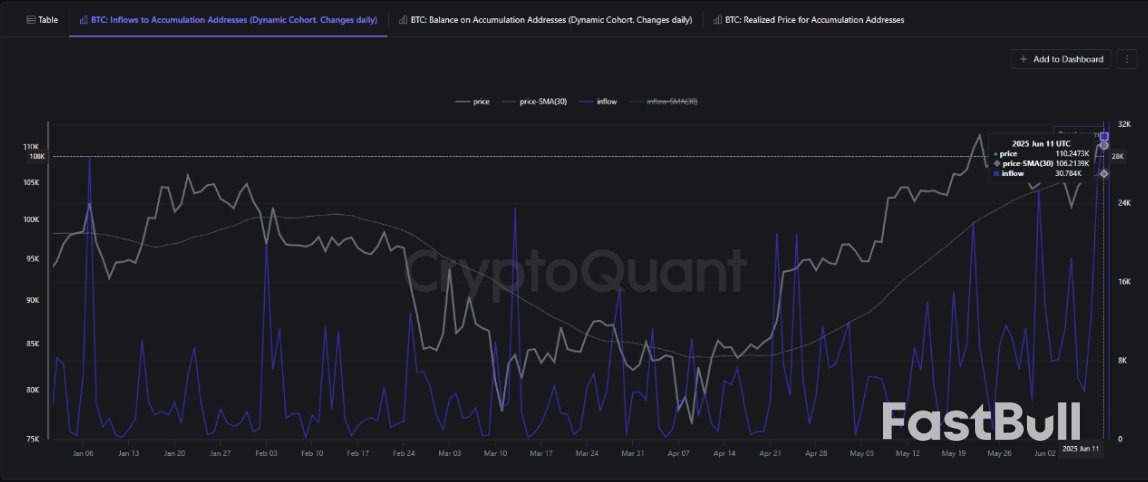

One analyst spots a bullish fractal driven by 2024-like liquidity grabs, hinting that Bitcoin may breakout toward new all-time highs.

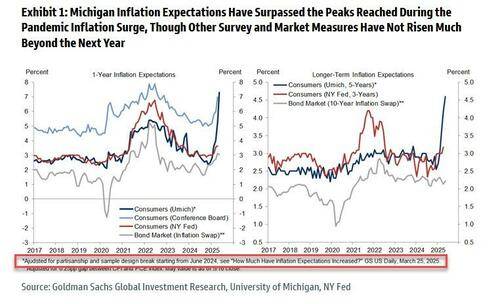

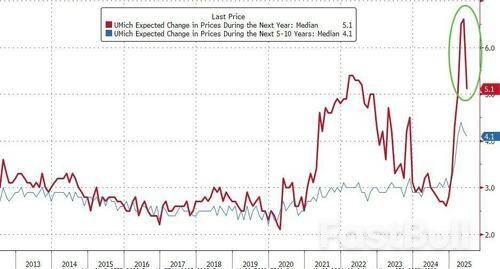

Just days after CPI disappointed the the Trump Tariff infation fear-mongers once again and a month since the UMich survey found that "Women, Democrats, & Low-Income Americans Are Out Of Their TDS-Addled Minds", and one week after Goldman finally called out the idiocy of the UMich survey, slamming its "partisanship" and the "sample design break starting from June 2024"...

not to mention that it has been chronically wrong, warning that "Michigan inflation expectations have already risen even more than in 2022 and this time long-term expectations have risen sharply too, all before tariffs have even meaningfully boosted consumer prices" while "technicalities have exaggerated the increase in the Michigan [inflation] survey, as other survey measures and market-implied inflation compensation have not risen much at horizons beyond the next year", moments ago the preliminary UMich survey for the month of June saw sharp revisions to the prelim prints, to wit:

The headline Sentiment print jumped dramatically from its lowest since May 1980 - to 60.5, well above the median estimate of 53.6

The Current Conditions print also surged from 58.9 to 63.7, well above expectations.

The Expectations print spiked to 58.4 from 47.9 and above the median estimate of 49.7

These trends were unanimous across the distributions of age, income, wealth, political party, and geographic region. Moreover, all five index components rose, with a particularly steep increase for short and long-run expected business conditions, consistent with a perceived easing of pressures from tariffs. Consumers appear to have settled somewhat from the shock of the extremely high tariffs announced in April and the policy volatility seen in the weeks that followed.

Inflation Expectations finally gave way to reality with 1Y expectations falling from 6.6% to 5.1%...

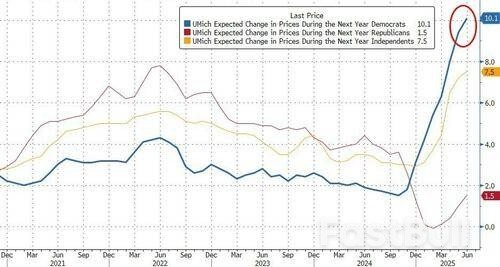

However, 'Tariff Derangement Syndrome', as Treasury Secretary Scott Bessent called it, was very evident as Democrats' inflation expectations surged even higher to a ridiculous 10.1% over the next year!

The longer-term inflation expectation also fell overall but both Independents and Democrats

One more for fun - comparing Democrats view of the inflationary outlook to the 'hard' inflationary data...

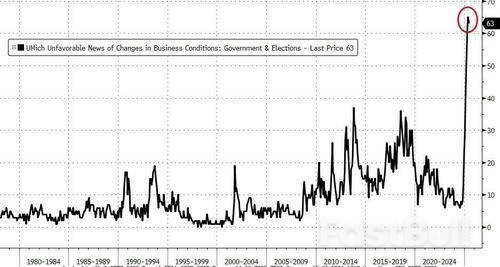

The percentage of UMich respondents making unsolicited negative comments about news they've heard on government economic policy remains just shy of record highs...

But, as we tweeted, this farcical data makes no sense...

We look forward to UMich explaining that... did they change the weighting of Democrats' TDS-addled views? (and not tell anyone?)

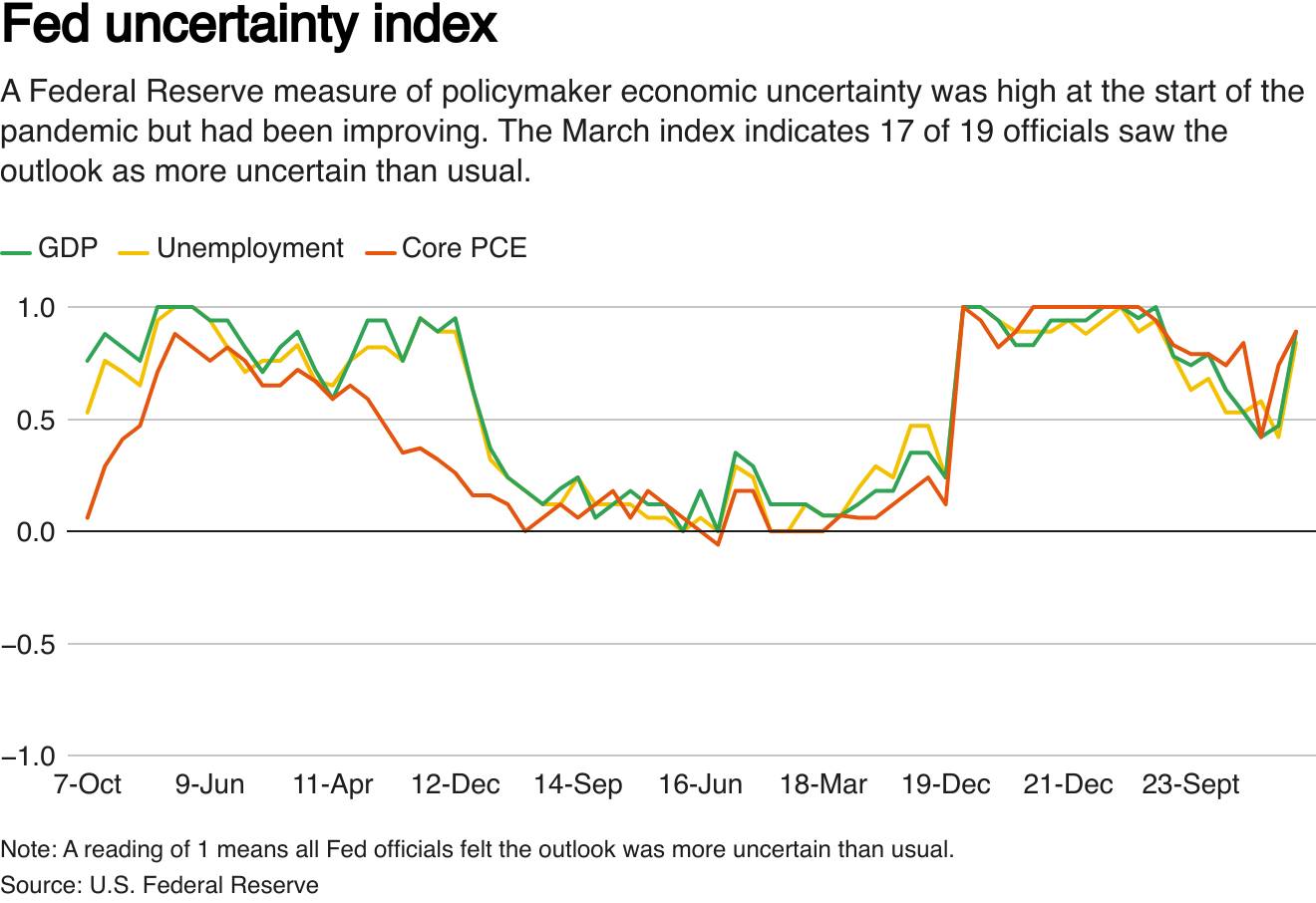

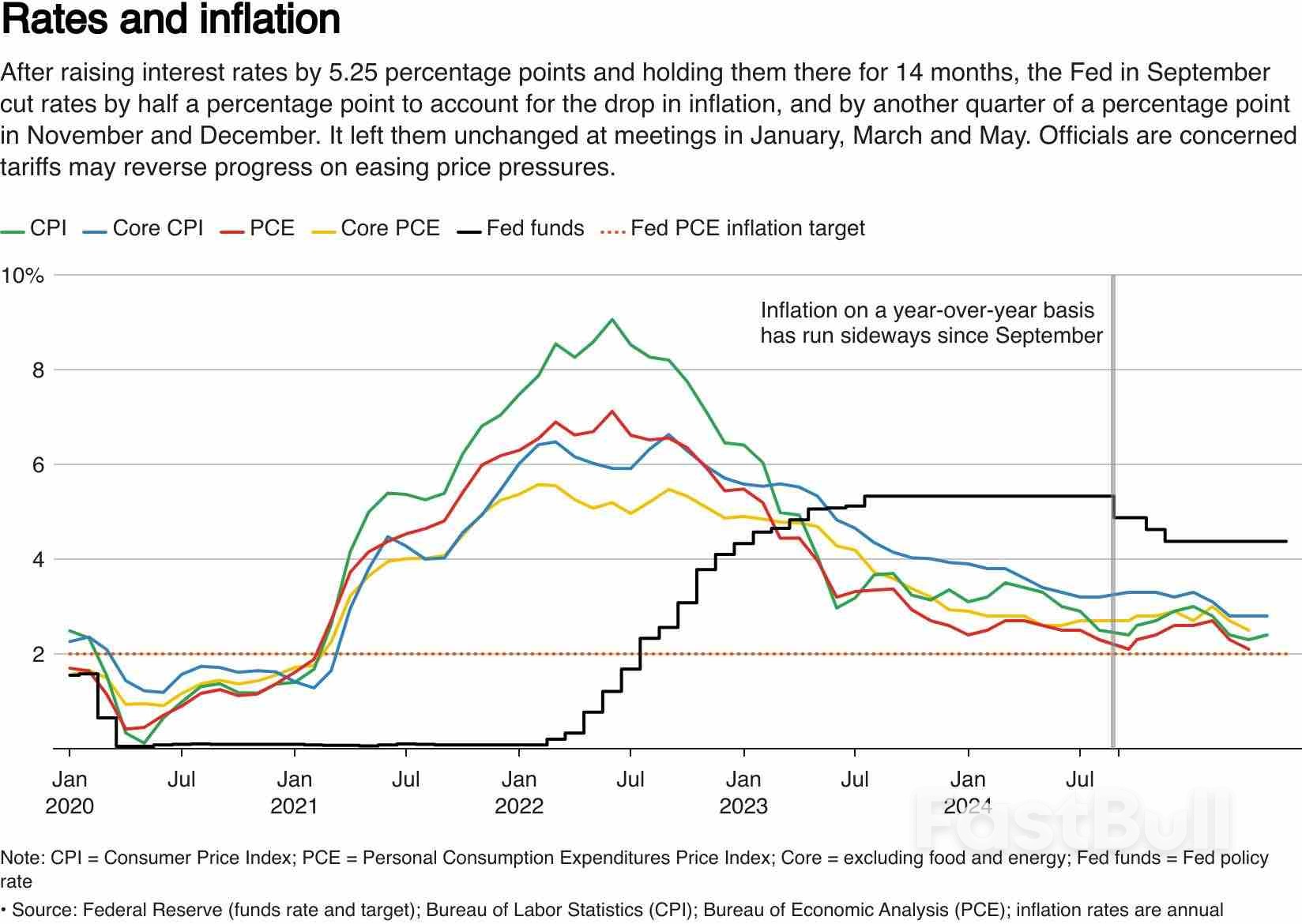

The Federal Reserve is widely expected to hold interest rates steady next week, with investors focused on new central bank projections that will show how much weight policymakers are putting on recent soft data and how much risk they attach to unresolved trade and budget issues and an intensifying conflict in the Middle East.

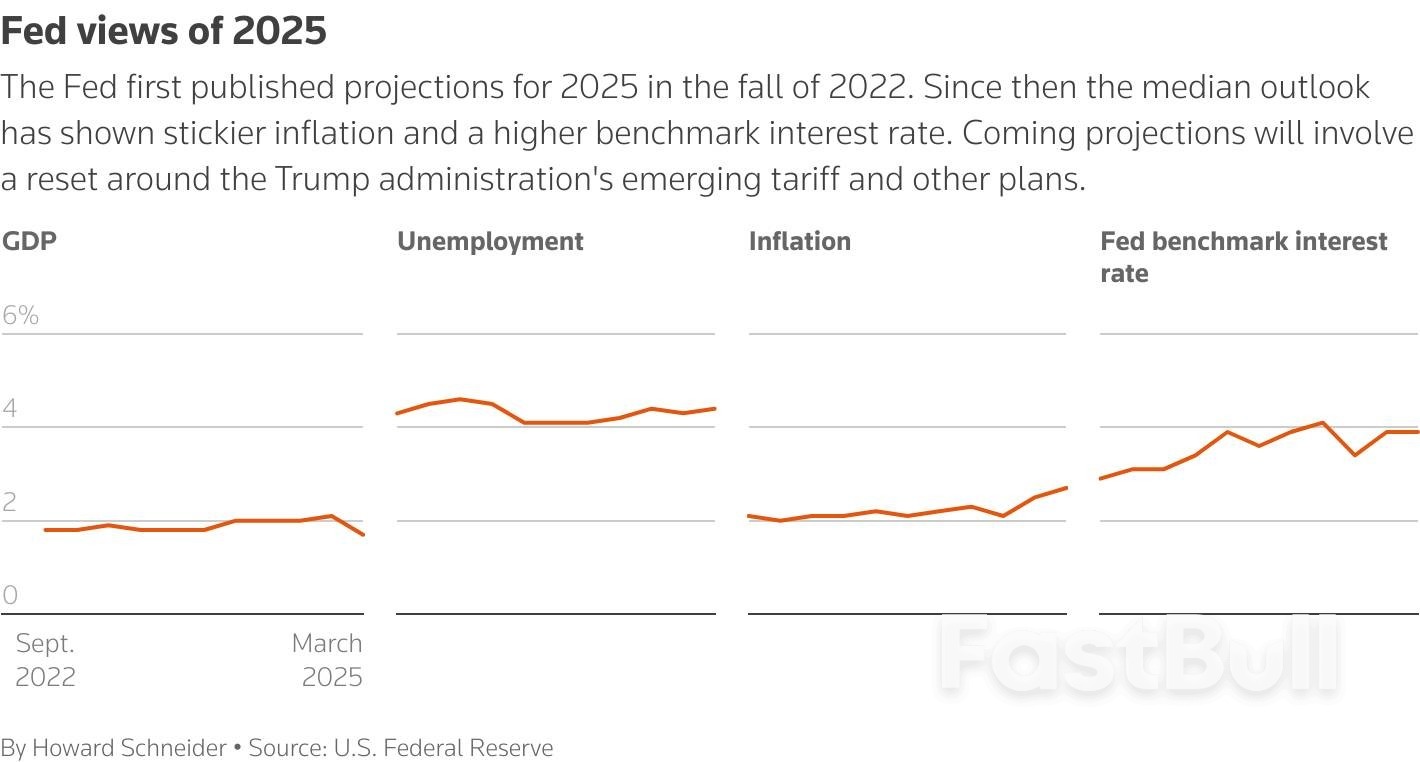

Recent inflation data had eased concern that the tariffs imposed by President Donald Trump would translate quickly into higher prices, while the latest monthly employment report showed slowing job growth - a combination that, all things equal, would put the Fed closer to resuming its rate cuts.

Trump has demanded the U.S. central bank lower its benchmark overnight interest rate immediately by a full percentage point, a dramatic step that would amount to an all-in bet by the Fed that inflation will fall to its 2% target and stay there regardless of what the administration does and even with dramatically looser financial conditions.

The risks of that approach were highlighted overnight when an Israeli attack on Iran sent spot oil prices up nearly 9%, potentially upending a four-month run of falling energy prices that have helped keep overall inflation more moderate than expected. Iran is a major oil producer, and a broader conflict in the region could disrupt both production and shipping.

Though the price of oil figures less prominently in U.S. inflation than it did during the oil shocks of the 1970s, big swings in commodity prices or developing geopolitical risks can make Fed officials more cautious in their decisions - as Russia's invasion of Ukraine did in early 2022 when it prompted the U.S. central bank to start a cycle of interest rate hikes with a quarter-percentage-point increase, smaller than many officials had favored before the war began.

Trump's push to rewrite the rules of global trade also remains a work in progress, with potentially inflationary results. Since the Fed's last policy meeting in May, the administration delayed until next month a threatened round of global tariffs that central bank officials worry could lead to both higher prices and slower growth if implemented; trade tensions between the U.S. and China have eased but not been resolved; and the terms of a massive budget and tax bill under consideration in Congress are far from settled.

When Fed officials issued their last set of quarterly projections in March, anticipating two quarter-percentage-point rate cuts this year, Fed Chair Jerome Powell noted the role that inertia can play in moments when the outlook is so unclear that "you just say 'maybe I'll stay where I am,'" a sentiment that may last as long as the tariff debate remains unresolved.

"Recent Fed commentary has reinforced a wait-and-see approach, with officials signaling little urgency to adjust policy amid increased uncertainty around the economic outlook," Gregory Daco, chief economist at EY-Parthenon, wrote in the run-up to the Fed's June 17-18 meeting. Daco said he anticipates the median rate projection among the Fed's 19 policymakers to still show two rate cuts in 2025, with an overall tone of "cautious patience" and "little in the way of forward guidance" given the uncertainty weighing on households and businesses.

That view aligns roughly with what investors in contracts tied to the Fed's policy rate currently expect, though pricing shifted towards a possible third rate cut this week after data showed consumer and producer prices both increased less than expected in May. While year-over-year inflation measured by the Fed's preferred Personal Consumption Expenditures Price Index is around half a percentage point above the central bank's target, recent data show it running close to 2% for the past three months once the more volatile food and energy components are excluded.

The unemployment rate, meanwhile, has remained at 4.2% for the past three months.

The Fed's policy rate was set in the current 4.25%-4.50% range in December when the U.S. central bank cut it by a quarter of a percentage point in what officials at the time expected would be a steady series of reductions in borrowing costs spurred by slowing inflation. The trade policy Trump pursued after he returned to office on January 20, however, raised the risk of higher inflation and slower growth, an outcome that would put the Fed in the uncomfortable position of having to choose whether to focus on keeping inflation at its 2% target or supporting the economy and sustaining low unemployment.

The risk of that worst-of-both-worlds outcome has eased since the early spring, when Trump's "Liberation Day" slate of global tariffs caused a market backlash and led to widespread forecasts of a U.S. recession before the president backed down.

In its most recent analysis, Goldman Sachs analysts lowered the odds of a recession to around 30% and said they now see a bit less inflation and slightly higher growth this year.

Yet that analysis did not prompt a shift in the investment bank's Fed rate outlook, which currently expects higher inflation numbers over the summer to sideline the central bank until December.

The Fed itself may see its median rate projection fall to a single quarter-percentage-point cut this year if only due to the passage of time, noted Tim Duy, chief U.S. economist at SGH Macro Advisors.

With three fewer months in the year to make changes in policy and so many major issues outstanding, "if the Fed retained two cuts ... it would have more confidence in those two cuts than in March," Duy wrote. "But ... participants have less confidence in rate cuts since 'Liberation Day,' and that should be reflected" in the new projections.

It would only take two officials to change their outlooks for the Fed's projected rate reductions to shift more toward next year.

There's another scenario, one in which the weak pass-through from tariffs to inflation is due to weakening demand as consumers pay more for imported goods by cutting back on services, a dynamic that may already be developing.

The retail sales report for May, which is due to be released next week ahead of the Fed meeting, may provide insight into that issue. But Citi economists say they think weakening demand will keep inflation down, lead to rising unemployment, and prompt the central bank to cut rates faster than expected, beginning in September and continuing at each meeting from there into 2026.

"Tariffs may eventually boost some goods prices, but the broad-based slowing in core services inflation will make this a one-time price increase," the Citi analysts wrote. "Markets have yet to internalize that softer demand will lead to cooler inflation but also to rising unemployment ... The path to Fed rate cuts is becoming increasingly clear."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up