Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)A:--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)A:--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)A:--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)A:--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

U.S. Unemployment Rate (SA) (Nov)

U.S. Unemployment Rate (SA) (Nov)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Gas Stations & Vehicle Dealers) (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

First-time buyers are taking out larger mortgages than ever before as rising wages and looser affordability tests allow them to buy properties that were previously beyond their budget.

First-time buyers are taking out larger mortgages than ever before as rising wages and looser affordability tests allow them to buy properties that were previously beyond their budget.

The average first-time buyer borrowed £210,800 in the year to September, a record high, according to analysis by Savills, the property agent.

First-time buyers accounted for 20% of all spending in the UK housing market in the 12-month period, which is the highest level since at least 2007, it added.

This effect is even more pronounced in places such as London, with separate research from the estate agent Hamptons revealing that first-time buyers made more than half of all purchases in the capital this year.

In total, Savills said mortgage lenders loaned a record £82.8bn to 390,000 first-time buyers in the period, a 30% increase on the previous year.

The larger mortgages come as some first-time buyers skip the traditional first rung of the property ladder and buy a house rather than a flat. The average age of a first-time buyer is 34, according to the Mortgage Advice Bureau, while 31% have children by the time they get on the property ladder.

Many first-time buyers also took advantage of the stamp duty holiday, which let them pay no tax on the first £425,000 of a property's value, to buy a larger home. This limit dropped back down to £300,000 in April. They also benefited from a "buyer's market", with prices falling in some parts of the country.

Lucian Cook, the head of residential research at Savills, said a significant driving force behind the record borrowing had also been the "slightly more relaxed approach" of lenders.

"Home ownership is more accessible now than at any point in the last three years, thanks to lower borrowing costs, lower real house prices, and more accessible mortgage debt," he said.

Mortgage lenders typically do not lend more than 4.5 times a borrower's income and also consider whether someone could still afford repayments if interest rates soared, in a check known as "stress tests".

However, in March the Financial Conduct Authority said that the way some lenders were conducting their stress testing "may be unduly restricting access to otherwise affordable mortgages". It reminded lenders that companies have "flexibility to design their test in a way that is appropriate" for their customers.

Since then, most lenders have reduced the interest rate at which they stress test borrowers, with most first-time buyers now able to increase their borrowing by £20,000-£40,000.

The relaxation of lending rules comes at a time when mortgage rates are easing , with an average two-year fix now at 4.91% and a five-year fix at 4.86%, according to Moneyfacts, a financial services provider. These are the lowest rates since before Liz Truss's disastrous mini-budget in September 2022.

A separate analysis found that house hunters could typically snap up a property for about £2,000 less than a year ago and about £6,700 less than the average only a month ago, according to Rightmove.

Across Britain, 2025 is ending with average asking prices at 0.6% (£2,059) less than late 2024. At £358,138, the average asking price in December is also 1.8%, or £6,695, lower than in November, according to the website.

Annual growth in asking prices has been strongest in the north-west of England (2.6%), flat in London (0%) and most negative in the south-west and south-east (both at minus 2.7%). Rightmove said prices usually fall in December but this year's decrease is bigger than usual.

However, a bigger than usual "Boxing Day bounce" is also expected by the website, as people who put their home moving plans on hold because of budget uncertainty start looking again after Christmas.

Measures envisaged in Italy's 2026 budget could have "negative implications" on banks' liquidity because they might prompt lenders to cut interest paid on deposits to lower taxes, reducing liquidity buffers, the European Central Bank said.

In an opinion dated December 12 but published on Monday, the ECB also said higher taxes could persuade domestic banks to cut the already modest credit to families and firms while affecting investors' confidence in Italy.

Measures in the budget affecting banks and insurers, which also include curbs on the way lenders use interest expenses to lower their tax bills, are worth more than 11 billion euros ($12.93 billion) through 2028, according to Treasury estimates.

"The recurring introduction of ad hoc tax provisions unduly increases policy uncertainty regarding the tax framework, damaging investor confidence and potentially also affecting credit institutions' funding costs," the ECB said.

It is unlikely that Italy will radically revise its budget plans following the ECB criticism, given that the contribution from the financial sector funds more than 20% of the tax cuts and spending hikes that benefit households and businesses in the 2026-2028 period.

Both houses of Italy's parliament are due to approve the budget before the end of the year.

Among several measures, the government will oblige banks to spread over a longer period of time provisions on some loan losses which get deducted from income, while hiking by two percentage points the IRAP corporate tax weighing on domestic lenders and insurers.

"This might incentivise credit institutions to postpone or lower the amount of write-offs recognised on stage 1 and stage 2 loans in years affected by the change in taxation as they become more costly compared to the current situation," the ECB said.

Italian banks faced widespread criticism from Prime Minister Giorgia Meloni's right-wing coalition for failing to reward depositors or offer better lending conditions for firms, despite record profits driven by high interest rates and state guarantee schemes adopted in the wake of the COVID-19 pandemic.

The ECB, however, warned Italy that an increased tax burden on banks could lead to "abrupt adjustments" in their lending to the real economy, especially given the already moderate levels of bank lending in Italy.

"The elements of pro-cyclicality entailed in the draft law increase this risk of adverse lending adjustment," the opinion added.

($1 = 0.8507 euros)

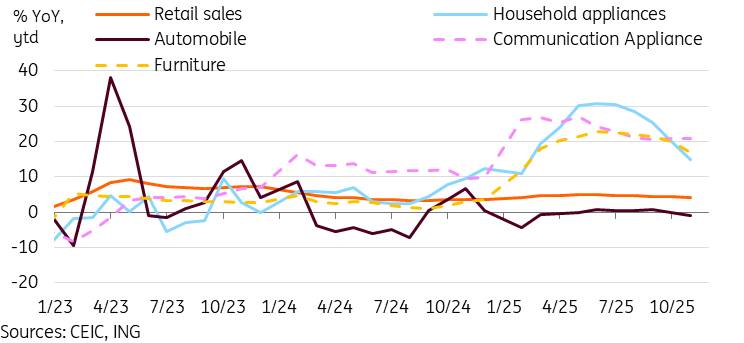

China's retail sales significantly underperformed in November, falling to 1.3% year-on-year from 2.9% in October. This not only fell well short of forecasts but also marked the weakest month of retail sales growth since 2022.

As we have covered in the past few months, the leading cause is the trade-in policy turning from a tailwind to a headwind. The most obvious example is in household appliances, which saw a -19.4% YoY contraction in November, bringing the year-to-date growth down sharply to 14.9%. Recall that the trade-in policy for household appliances ramped up significantly in the fourth quarter of 2024. This resulted in a wave of purchases, something for which the YoY data is now paying the price. The same impact will likely be observed at the start of 2026 for the communication appliance category.

While the trade-in policy has primarily been seen as successful in front-loading consumption, we need to see either an expansion of the policy to new categories next year -- or a new direction in supporting consumption. Otherwise, we will likely continue to see pressure on consumption as the policy is phased out.

China's electric vehicle (EV) transition is influencing soft retail sales data. Reduced petrol demand resulted in a contraction of -8.0% YoY for petrol sales, while the earlier purchases of EVs resulted in a -8.3% YoY drop in auto sales as well. Other categories tended to fare a little better, with catering (3.2%), grains and oils (6.1%), cosmetics (6.1%), and gold and jewellery (8.5%) all outperforming headline growth.

Boosting domestic demand in 2026 looks to be a top priority for policymakers, according to recent communications from the Politburo meeting and the Central Economic Work Conference. One point that has been mentioned several times: "special actions to boost consumption" will be implemented, along with plans to boost household incomes.

Trade-in policy headwinds will likely intensify in coming months

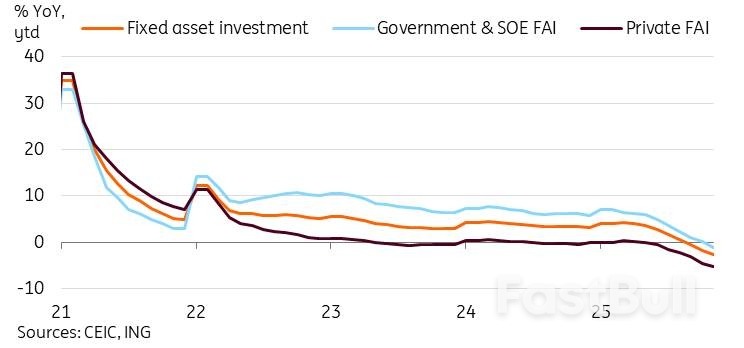

China's fixed asset investment (FAI) growth fell to -2.6% YoY ytd through November, down from -1.7% YoY ytd from a month ago. This once again underperformed market forecasts for -2.3%, though it slightly beat our house forecast of -2.8%.

Despite industrial modernisation being at the core of the next Five-Year Plan, the manufacturing FAI continues to slow down to just 1.9% YoY ytd. The rail, ship, and aeroplane manufacturing sector continued to see investment growth accelerate to 22.4% YoY ytd, but auto sector investment moderated to 15.3% YoY ytd.

As we expected in last month's report, public investment tipped into negative territory by November, dropping to -1.1% YoY ytd. Private investment also continued to fall at a faster pace, down to -2.6% YoY ytd.

The recent Central Economic Work Conference stated that investment should be halted from next year. How the government plans to do this, while also cracking down on redundant investments, will be worth monitoring in the coming months. We expect public investment to stage a recovery in 2026, but the private sector is a bigger question mark for China's investment picture. It will likely be seen as a more important gauge of investment appetite and business confidence.

China's value added of industry inched down to 4.8% YoY in November, down from 4.9% in October. This outcome was weaker than market forecasts, but the industrial sector remains a clear outperformer despite soft consumption and investment data.

By sector, we saw outperformance in the usual suspects, with rail, ships, and aerospace, as well as the auto manufacturing sectors, both outperforming at 11.9% YoY in November. We also saw solid production growth of industrial robots (20.6%) and semiconductors (15.6%).

As we saw in the November trade data earlier this month -- China's trade surplus eclipsed USD 1tn on the year -- external demand has been the main bright spot for China's economy this year. This has helped support industrial production for most of the year. Resilient demand from non-US economies has been a key reason China's growth is likely to remain on track this year, but there are signs that this trend faces risks next year. We recently saw Mexico increase tariffs on Chinese products to up to 50% in an attempt to appease the US. The EU has also signalled potential tariff action if trade imbalances were not addressed in short order.

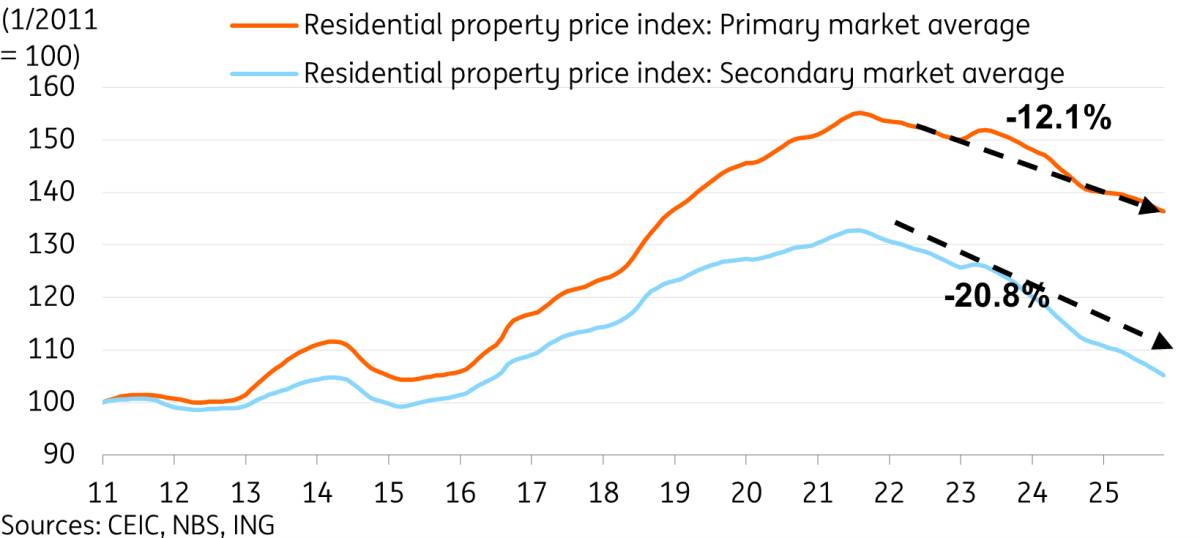

China's 70-city property prices continued to show downward momentum in November, consistent with expectations following another month of limited support. New home prices fell -0.39% month-on-month, a slightly smaller decline compared to October's data. Used-home prices fell by -0.66% MoM, unchanged from October. From the peak, new home prices are now down -12.1%, while used home prices are down -20.8%. Of the 70 cities, 46 have seen secondary-market prices decline by 20%-30% from their peak, while 4 have declined by more than 30%.

In the primary market, 11 of 70 cities saw prices stabilise or increase, which marked a three-month high. In the secondary market, we saw a third consecutive month of price declines across the entire sample. Secondary market prices remain the key to watch; they have the most direct impact on household wealth effects.

As expected, the downturn of property investment continued, now down -15.9% YoY ytd.

The continued slide in the property market remains one of the most significant issues that could hinder China's efforts to shift to a domestically demand-driven growth model. Comments from the Central Economic Work Conference on actively and prudently resolving key risks focused on the property market, and suggest that property market support could be on the way. The directions in the readout included encouraging the acquisition of existing housing, focusing on affordable housing, and city-specific policies to reduce inventories and optimise supply. Market discussions have also centred on measures to improve housing affordability, such as tax breaks for first-time buyers and potential reduction of mortgage burdens. The wave of support in 2024 showed some promise, with prices stabilising toward the start of 2025. However, this may require continued and concerted efforts, as the downturn resumed after a few months of policy inertia. There remains no easy answer for ending the downturn.

Policymakers make clear that domestic demand-led growth is the priority moving forward. November's data showd that a lot of work remains for this scenario to play out successfully, with all key domestic activity data continuing to weaken. This year's growth targets should still be on track, though a weak set of November data further pushes risks to the downside from our 5.0% YoY forecast.

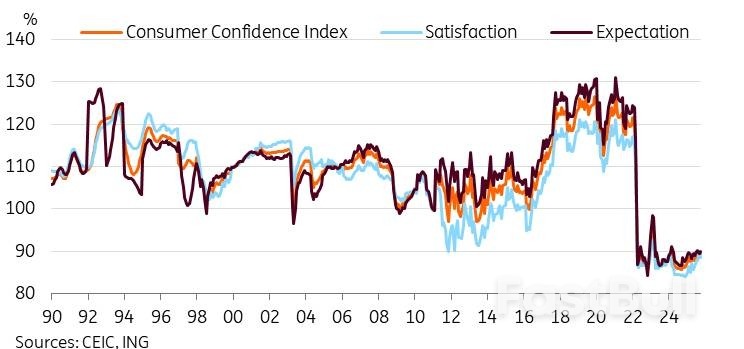

A bigger question mark lies ahead for next year, and the years ahead. In our view, the biggest issue suppressing China's economy is downbeat confidence, which risks becoming entrenched. While official confidence indicators have been inching higher over the past year, they remain well below historical averages.

We believe the negative wealth effect from falling property prices remains a major drag on confidence. Falling property prices have thus far overshadowed a solid equity market recovery, which is unsurprising given the greater weight of property prices in household balance sheets.

The other key area is the widespread cost-cutting environment, which has led to sluggish wage growth and layoffs. This decreased labour market dynamism is also resulting in less hiring and labour mobility. This increases challenges for youth unemployment as well, where the unemployment rate for ages 16 to 24 reached 17.3% in October. It has generally been in the mid-high teens since the pandemic, versus an average of around 11% between 2018-19. A generation of underemployed and unemployed youth will likely constrain their purchasing power in the future.

These factors translate to an overall deflationary environment, which also acts as a key drag on both consumption and investment. We see some improvement in inflation next year, though food prices will likely drive the recovery. The trajectory of core inflation, which has also shown some positive signs in recent months, will likely be more important.

It's certainly easier said than done to restore confidence, but it will be key to domestic demand becoming the main driver of growth. To unlock China's savings and transition China's economy into the next phase of domestic demand-led growth, households need to feel confident that tomorrow will be better than today.

Doctors in England voted to reject the government's latest offer on working conditions, the British Medical Association union said on Monday, confirming that a five-day strike planned for this week would go ahead.

The doctors' union - which represents the so-called resident doctors who make up nearly half of the medical workforce - will stage a walkout from Wednesday as part of a series of strikes that have taken place this year over pay and working conditions.

"Tens of thousands of frontline doctors have come together to say 'no' to what is clearly too little, too late," BMA chair Jack Fletcher said in a statement.

He said the union was still willing to work to find a solution.

The strike will add pressure to an already stretched healthcare service after NHS England warned last week that hospitals were facing a "worst-case scenario" from a wave of a super flu.

Health minister Wes Streeting appealed to the doctors to go to work.

"There is no need for these strikes to go ahead this week, and it reveals the BMA's shocking disregard for patient safety," he said, adding that the strikes are "self-indulgent, irresponsible and dangerous".

The BMA said 83% of resident doctors rejected the government's offer in an online survey with a 65% turnout of its more than 50,000 members.

The offer made by the government last Wednesday did not include new pay terms, something the BMA has been campaigning for even before the Labour Party won last year's election.

At the time, Streeting struck a deal with the doctors, offering them a 22% pay rise - 7 percentage points below the 29% sought by the BMA.

The union has also been pushing for a better pay offer from the 5.4% pay increase announced earlier this year, saying resident doctors were still suffering from years of pay erosion.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up