Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Australia Prime Minister Anthony Albanese said on Tuesday his Israeli counterpart Benjamin Netanyahu was "in denial" about the humanitarian situation in Gaza, a day after announcing Australia would recognise a Palestinian state for the first time.

Key points:

Australia Prime Minister Anthony Albanese said on Tuesday his Israeli counterpart Benjamin Netanyahu was "in denial" about the humanitarian situation in Gaza, a day after announcing Australia would recognise a Palestinian state for the first time.Australia will recognise a Palestinian state at next month's United Nations General Assembly, Albanese said on Monday, a move that adds to international pressure on Israel after similar announcements from France, Britain and Canada.

Albanese said on Tuesday the Netanyahu government's reluctance to listen to its allies contributed to Australia's decision to recognise a Palestinian state."He again reiterated to me what he has said publicly as well, which is to be in denial about the consequences that are occurring for innocent people," Albanese said in an interview with state broadcaster ABC, recounting a Thursday phone call with Netanyahu discussing the issue.Australia's decision to recognise a Palestinian state is conditional on commitments received from the Palestinian Authority, including that Islamist militant group Hamas would have no involvement in any future state.

Right-leaning opposition leader Sussan Ley said the move, which breaks with long-held bipartisan policy over Israel and the Palestinian territories, risked jeopardising Australia's relationship with the United States.

Albanese said as little as two weeks ago he would not be drawn on a timeline for recognition of a Palestinian state.His incumbent centre-left Labor Party, which won an increased majority at a general election in May, has previously been wary of dividing public opinion in Australia, which has significant Jewish and Muslim minorities.But the public mood has shifted sharply after Israel said it planned to take military control of Gaza, amid increasing reports of hunger and malnutrition amongst its people.

Tens of thousands of demonstrators marched across Sydney's Harbour Bridge this month calling for aid deliveries in Gaza as the humanitarian crisis worsened."This decision is driven by popular sentiment in Australia which has shifted in recent months, with a majority of Australians wanting to see an imminent end to the humanitarian crisis in Gaza," said Jessica Genauer, a senior lecturer in international relations at Flinders University.Opposition leader Ley said the decision was "disrespectful" of key ally the United States, which opposes Palestinian statehood.

"We would never have taken this step because this is completely against what our principles are, which is that recognition, the two state solution, comes at the end of the peace process, not before," she said in an interview with radio station 2GB.Neighbouring New Zealand has said it is still considering whether to recognise a Palestinian state, a decision that drew sharp criticism from former prime minister Helen Clark on Tuesday.

"This is a catastrophic situation, and here we are in New Zealand somehow arguing some fine point about whether we should recognise we need to be adding our voice to the need for this catastrophe to stop," she said in an interview with state broadcaster RNZ.

"This is not the New Zealand I've known."

World markets got a minor fillip from the expected 90-day rollover of the U.S.-China trade tariff truce, clearing one of Tuesday's two big hurdles. Now for the July inflation report.

Much rides on the consumer price report - not least markets' assumption of a Federal Reserve interest rate cut next month, but also the impact so far of rising tariffs as well as the reliability data compiled by the embattled Bureau of Labor Statistics. Annual inflation is expected to have ticked up a tenth to 2.8% and 'core' inflation built to 3.0% - the latter involving a 0.3% monthly gain, the biggest since January, and likely lifted by tariff-sensitive goods such as vehicle parts and toys.

* Chinese stocks nudged about half a percent higher after confirmation the recently-negotiated deals between Washington and Beijing officials in Stockholm would indeed see an extension of the existing deal until November. Although largely expected, the new order prevented a snapback to triple-digit tariffs between both sides and it settles for now with a 30% levy on Chinese exports to America and 10% Chinese tariffs on U.S. imports there. Wall Street futures were flat after ebbing slightly on Monday.

* Broader macro markets remained largely frozen ahead of the CPI report - with Treasury yields and the dollar flatlining and bond volatility gauges sinking to their lowest in three years. Aside from the CPI release, investors will keep half an eye on the latest NFIB small business survey for July and Federal budget data for last month too - with growing attention on the revenues being generated by unilateral tariff rises.

* Elsewhere, the Australian dollar eased marginally after the Reserve Bank of Australia delivered another widely expected quarter-point interest rate cut and Japan's Nikkei surged more than 2% on its return from holiday amid a wave of tech enthusiasm. Gold prices nursed Monday's setback after President Donald Trump said bullion would not be subject to tariff rises after all - clearing up confusion on the issue last week. Sterling was firmer after UK wage and retail numbers further dampened Bank of England easing speculation - as did better-than-forecast jobs numbers.

Today's column looks at how after a turbulent year so far, with multiple potential disturbances to U.S. bond markets, Treasuries appear to be slumbering instead and implied volatility has ebbed to its lowest in three years.

* The United States and China on Monday extended atarifftruce for another 90 days, staving off triple-digit duties on each other's goods as U.S. retailers get ready to ramp up inventories ahead of the critical end-of-year holiday season.

* Trump upended decades of U.S. national security policy, creating an entirely new category of corporate risk, when he made a deal with Nvidia to give the U.S. government a cut of its sales in exchange for resuming exports of banned AI chips to China.

* Australia's central bank cut interest rates on Tuesday for a third time this year and signaled further policy easing might be needed to meet its inflation and employment goals as the economy lost some momentum.

* Western governments are increasingly worried about becoming too reliant on China for rare earths as well as some refined metals. Their challenge is to work out how to secure supply without taxpayers being unduly burdened, explains ROI columnist Clyde Russell.

* It’s becoming increasingly difficult to get any visibility on the U.S. labor market amid all the conflicting economic data. But ROI columnist Jamie McGeever argues that one figure may be worth paying attention to more than the rest.

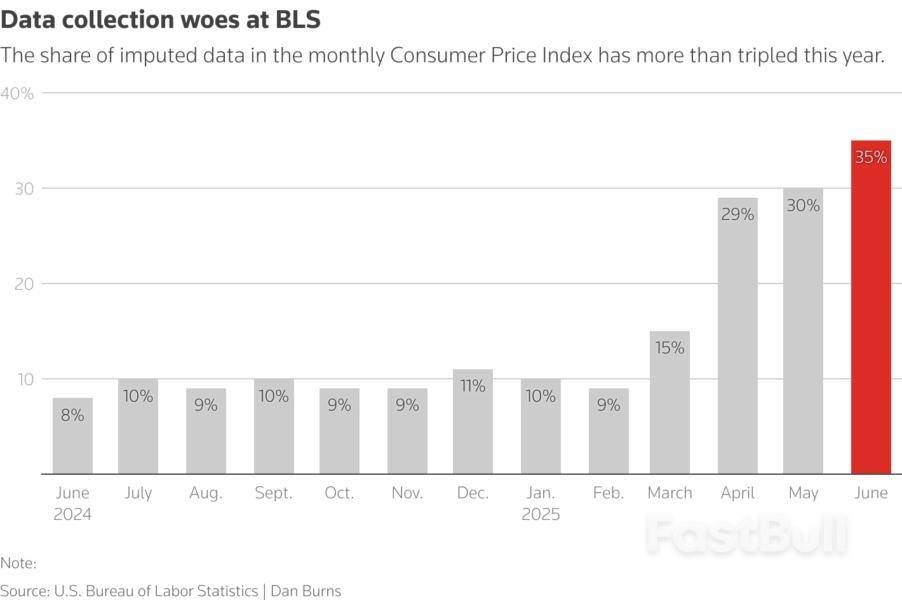

Thomson ReutersData collection woes at BLS

The Consumer Price Index report from the Labor Department's Bureau of Labor Statistics is due Tuesday amid mounting concern over the quality of inflation and employment data. Budget and staffing cuts have led to the suspension of data collection for portions of the CPI basket in some areas across the country - and Trump's firing of BLS boss Erika McEntarfer this month followed big downward revisions to May and June payroll counts.

Data collection suspensions come after years of what many describe as underfunding of the BLS under both Republican and Democratic administrations. Citing a need to "align survey workload with resource levels," the BLS suspended CPI data collection completely in one city in Nebraska, Utah and New York. It has also suspended collection on 15% of the sample in the other 72 areas, on average. The share of different cell imputation in the CPI data - essentially modeled assumptions of where prices might be - jumped to 35% in June from 30% in May. Trump on Monday said he was nominating Heritage Foundation economist E.J. Antoni as the new BLS chief.

* U.S. July consumer price index (8:30 AM EDT) NFIB July small business survey (6:00 AM EDT) July Federal budget (2:00 PM EDT)

* Kansas City Federal Reserve President Jeffrey Schmid and Richmond Fed President Thomas Barkin both speak

* U.S. corporate earnings: Cardinal Health

Elon Musk wrote on his X social media network late Monday that its parent company, xAI, "will take immediate legal action" against Apple (AAPL) for an alleged "antitrust violation" related to App Store rankings.

Tesla (TSLA) CEO Musk, whose xAI firm developed the Grok artificial intelligence chatbot, wrote, "Hey @Apple App Store, why do you refuse to put either 𝕏 or Grok in your 'Must Have' section when 𝕏 is the #1 news app in the world and Grok is #5 among all apps?"

In a later post, Musk—who co-founded ChatGPT maker OpenAI—wrote, "Apple is behaving in a manner that makes it impossible for any AI company besides OpenAI to reach #1 in the App Store, which is an unequivocal antitrust violation," and that "xAI will take immediate legal action."

Apple did not immediately respond to an Investopedia request for comment. Shares were down less than 1% in premarket trading.

Late last month, Apple CEO Tim Cook said on the iPhone maker's earnings call that the tech giant is "significantly growing" its investments and reallocating employees to focus on AI. Cook added that Apple would consider buying other companies to raise its AI capabilities.

China has eased curbs on urea shipments to India, in the latest indication of a thaw in tensions between Beijing and New Delhi as US President Donald Trump’s trade policies target the two Asian nations.India, the world’s top importer of the crop nutrient, could take as much as 300,000 tonnes, according to people familiar with the matter. They asked not to be identified as they were not authorised to talk to the media. China is typically a major exporter of the nitrogen-based fertiliser, although it has restricted sales in recent years.

The move from Beijing comes in the wake of Trump’s latest salvo of trade levies — doubling tariffs on Indian goods to 50% as a penalty for its purchases of Russian oil — which has helped warm ties between China and India.Relations between the two Asian neighbours hit a low point in 2020, when border clashes left 20 Indian fighters and an unknown number of Chinese soldiers dead. India recently allowed tourist visas for Chinese nationals after years of curbs, and Prime Minister Narendra Modi may meet Chinese President Xi Jinping on the sidelines of a summit in Tianjin starting on Aug 31.

The Ministry of Commerce in Beijing didn’t immediately reply to a fax seeking comment. India’s Ministry of Chemicals and Fertilizers didn’t immediately reply to a request for comment.In 2023, almost half of China’s exports headed to India. But it halted sales to all destinations last year. Beijing relaxed the ban in June, while keeping its restrictions on India until now.While the volume is small, it could grow into a significant trade flow, and help ease tight global supplies and cool high prices.

India imported about 5.7 million tonnes of urea in the fiscal year ended March 31, down almost 20% from a year earlier, according to the Fertiliser Association of India. Purchases from China fell to almost 100,000 tonnes in 2024-25, compared with 1.87 million tonnes a year ago, it said.Given India’s large, farm-dependent economy and the fact that domestic production falls short of demand, the country relies heavily on imports to bridge the gap and make supplies stable for farmers. Urea is heavily subsidised in the country, with the soil nutrient playing a critical role in boosting yields of key crops.

Investor confidence in Germany’s economic prospects slumped in August after the risk of a costly European Union-US trade deal became a reality.

An expectations index by the ZEW institute dropped to 34.7 from 52.7 the previous month, less than the 39.5 that analysts in a Bloomberg survey had estimated. A measure of current conditions also retreated.

Europe’s largest economy is struggling after hopes for a quick recovery from two years of contraction were quashed when President Donald Trump slapped tariffs of 15% on nearly all of Germany’s exports to the US. The friction over trade is adding to a fragile political backdrop at home, where support for Chancellor Friedrich Merz is falling.

“Financial market experts are disappointed with the announced EU–US trade deal,” ZEW President Achim Wambach said in a statement, adding that “the poor performance of the German economy in the second quarter” also contributed.

He said that the outlook had especially worsened for the chemical and pharmaceutical industries, with mechanical engineering, metals and automotive “also severely affected.”

Merz, who’s viewed by most Germans as incapable of guiding the nation through a crisis, faces a daunting list of challenges. The likelihood of output shrinking for another year has risen after major industrial firms trimmed their outlooks. Carmakers in particular are downbeat as they grapple with tepid demand for electric models, collapsing sales in China and Trump’s tariffs.

In addition, wars in Ukraine and Gaza are testing long-held political convictions, while there are doubts over the viability of Germany’s social-security system and disagreements over migration.

While hundreds of billions of euros of spending should bolster the economy down the line, the Bundesbank anticipates no growth at all this year. Underscoring the malaise, factory orders unexpectedly dropped for a second month in July, with industrial production suffering its biggest decline in almost a year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up