Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

[Bitcoin Price Retreats Below $69,000] February 7Th, According To Htx Market Data, Bitcoin Fell Below $69,000, Now Trading At $68,893.Earlier, The "Btc Og Insider Whale" Transferred 5,000 Btc To Binance In The Past Hour

Flightradar24: Airspace In Southeastern Poland Has Once Again Been Closed For The Past Few Hours

[Ethereum Surges Above $2,100, Up 10.9% In 24 Hours] February 7Th, According To Htx Market Data, Ethereum Has Rebounded And Broken Through $2100, Currently Trading At $2114, A 24-Hour Increase Of 10.9%

Booz Allen Hamilton Maintains Its Fiscal Year Guidance After Treasury Cancels Contracts And Trump Sues IRS For $10 Billion. Consulting Giant Booz Allen Hamilton Confirmed Its Fiscal Year Guidance Remains Unchanged, Expecting The Treasury Department's Contract Cancellations By President Trump To Have An Impact Of Less Than 1.0% On Overall Revenue For The Fiscal Year (the 12 Months Ending March 31, 2027). In Late January, The U.S. Treasury Announced The Cancellation Of 31 Contracts With The Company—with Total Annual Expenses Of $4.8 Million

US Plans Initial Payment Towards Billions Owed To UN In A Matter Of Weeks - Washington's UN Envoy Mike Waltz Tells Reuters

[Bitcoin Touched $71,751 This Morning, Rebounding Nearly 20% From The Low.] February 7Th, According To Htx Market Data, Bitcoin Rebounded This Morning To Touch $71,751, A 19.58% Increase From The Intraday Low Of $60,000, Making It The Day With The Highest Single-Day Price Increase During This Bull-Bear Cycle

In The Week Ending February 6, The US Stock Market's "interest Rate Cut Winners" Index Rose 4.41% Cumulatively. The "Trump Tariff Losers" Index Rose 4.03% Cumulatively, And The "Trump Financial Index" Rose 2.46% Cumulatively. The Retail Investor-heavy Stock Index/meme Stock Index Fell 3.35% Cumulatively

US Defense Secretary Hegseth: His Dept Is Formally Ending All Professional Military Education, Fellowships, And Certificate Programs With Harvard University

[Deutsche Bank: Large-Cap Tech Stocks Fall To Bottom Of 10-Year Trend Channel Relative To S&P 500] Deutsche Bank Strategists, Including Parag Thatte, Wrote In A Research Report That On Thursday, Large-cap And Tech Stocks Rebounded From The Bottom Of A 10-year Trend Channel Relative To The Rest Of The S&P 500, And Continued Their Rally On Friday. The Strategists Stated That Historically, This Group Has Typically Seen A Rally After Hitting The Bottom Of The Channel, Especially Against A Backdrop Of Rising Earnings. The Report Noted That This Year's Performance "is Entirely Driven By Changes In Valuation Multiples, Rather Than Adjustments In Earnings Expectations, A Stark Contrast To Last Year When It Was Entirely Driven By Upward Revisions In Earnings Expectations."

India Repo Rate

India Repo RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

Japan Leading Indicators Prelim (Dec)

Japan Leading Indicators Prelim (Dec)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Dec)

Germany Industrial Output MoM (SA) (Dec)A:--

F: --

Germany Exports MoM (SA) (Dec)

Germany Exports MoM (SA) (Dec)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Jan)

U.K. Halifax House Price Index YoY (SA) (Jan)A:--

F: --

U.K. Halifax House Price Index MoM (SA) (Jan)

U.K. Halifax House Price Index MoM (SA) (Jan)A:--

F: --

France Trade Balance (SA) (Dec)

France Trade Balance (SA) (Dec)A:--

F: --

Canada Leading Index MoM (Jan)

Canada Leading Index MoM (Jan)A:--

F: --

Mexico Consumer Confidence Index (Jan)

Mexico Consumer Confidence Index (Jan)A:--

F: --

P: --

Canada Employment (SA) (Jan)

Canada Employment (SA) (Jan)A:--

F: --

Canada Full-time Employment (SA) (Jan)

Canada Full-time Employment (SA) (Jan)A:--

F: --

Canada Part-Time Employment (SA) (Jan)

Canada Part-Time Employment (SA) (Jan)A:--

F: --

Canada Unemployment Rate (SA) (Jan)

Canada Unemployment Rate (SA) (Jan)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Jan)

Canada Labor Force Participation Rate (SA) (Jan)A:--

F: --

P: --

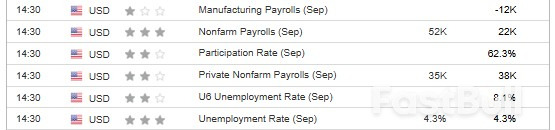

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11.

Due to the previous government shutdown, the release date of the US January non-farm payroll report has been changed to February 11. U.S. UMich Consumer Sentiment Index Prelim (Feb)

U.S. UMich Consumer Sentiment Index Prelim (Feb)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Feb)

U.S. UMich Consumer Expectations Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Jan)

Canada Ivey PMI (Not SA) (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Feb)

U.S. UMich Current Economic Conditions Index Prelim (Feb)A:--

F: --

P: --

Canada Ivey PMI (SA) (Jan)

Canada Ivey PMI (SA) (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Feb)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Feb)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)

U.S. 5-10 Year-Ahead Inflation Expectations (Feb)A:--

F: --

P: --

Russia Retail Sales YoY (Dec)

Russia Retail Sales YoY (Dec)A:--

F: --

P: --

Russia Unemployment Rate (Dec)

Russia Unemployment Rate (Dec)A:--

F: --

P: --

Russia Quarterly GDP Prelim YoY (Q1)

Russia Quarterly GDP Prelim YoY (Q1)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Dec)

U.S. Consumer Credit (SA) (Dec)A:--

F: --

China, Mainland Foreign Exchange Reserves (Jan)

China, Mainland Foreign Exchange Reserves (Jan)A:--

F: --

P: --

Japan Wages MoM (Dec)

Japan Wages MoM (Dec)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Dec)

Japan Trade Balance (Customs Data) (SA) (Dec)--

F: --

P: --

Japan Trade Balance (Dec)

Japan Trade Balance (Dec)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Feb)

Euro Zone Sentix Investor Confidence Index (Feb)--

F: --

P: --

Mexico CPI YoY (Jan)

Mexico CPI YoY (Jan)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Jan)

Mexico 12-Month Inflation (CPI) (Jan)--

F: --

P: --

Mexico PPI YoY (Jan)

Mexico PPI YoY (Jan)--

F: --

P: --

Mexico Core CPI YoY (Jan)

Mexico Core CPI YoY (Jan)--

F: --

P: --

ECB Chief Economist Lane Speaks

ECB Chief Economist Lane Speaks Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

China, Mainland M0 Money Supply YoY (Jan)

China, Mainland M0 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Jan)

China, Mainland M2 Money Supply YoY (Jan)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Jan)

China, Mainland M1 Money Supply YoY (Jan)--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.K. BRC Overall Retail Sales YoY (Jan)

U.K. BRC Overall Retail Sales YoY (Jan)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Jan)

U.K. BRC Like-For-Like Retail Sales YoY (Jan)--

F: --

P: --

Indonesia Retail Sales YoY (Dec)

Indonesia Retail Sales YoY (Dec)--

F: --

P: --

France ILO Unemployment Rate (SA) (Q4)

France ILO Unemployment Rate (SA) (Q4)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Jan)

U.S. NFIB Small Business Optimism Index (SA) (Jan)--

F: --

P: --

Brazil IPCA Inflation Index YoY (Jan)

Brazil IPCA Inflation Index YoY (Jan)--

F: --

P: --

Brazil CPI YoY (Jan)

Brazil CPI YoY (Jan)--

F: --

P: --

U.S. Retail Sales YoY (Dec)

U.S. Retail Sales YoY (Dec)--

F: --

P: --

U.S. Labor Cost Index QoQ (Q4)

U.S. Labor Cost Index QoQ (Q4)--

F: --

P: --

U.S. Import Price Index MoM (Dec)

U.S. Import Price Index MoM (Dec)--

F: --

P: --

U.S. Export Price Index YoY (Dec)

U.S. Export Price Index YoY (Dec)--

F: --

P: --

U.S. Export Price Index MoM (Dec)

U.S. Export Price Index MoM (Dec)--

F: --

P: --

U.S. Import Price Index YoY (Dec)

U.S. Import Price Index YoY (Dec)--

F: --

P: --

U.S. Retail Sales MoM (Dec)

U.S. Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales MoM (Dec)

U.S. Core Retail Sales MoM (Dec)--

F: --

P: --

U.S. Core Retail Sales (Dec)

U.S. Core Retail Sales (Dec)--

F: --

P: --

No matching data

View All

No data

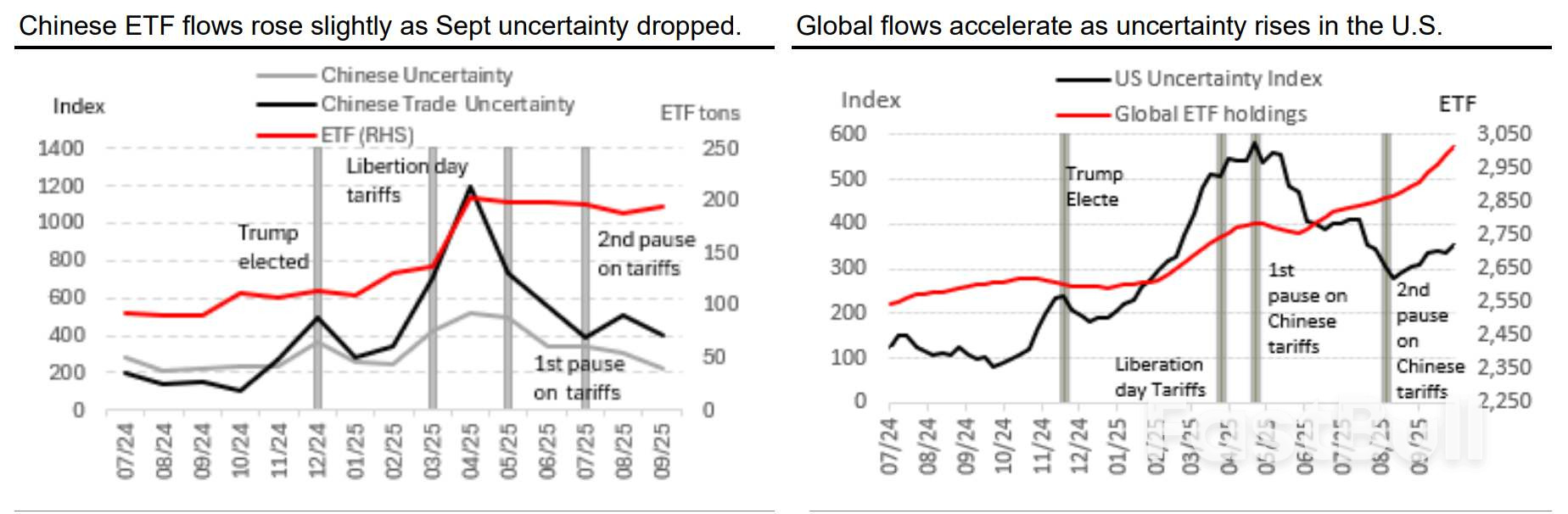

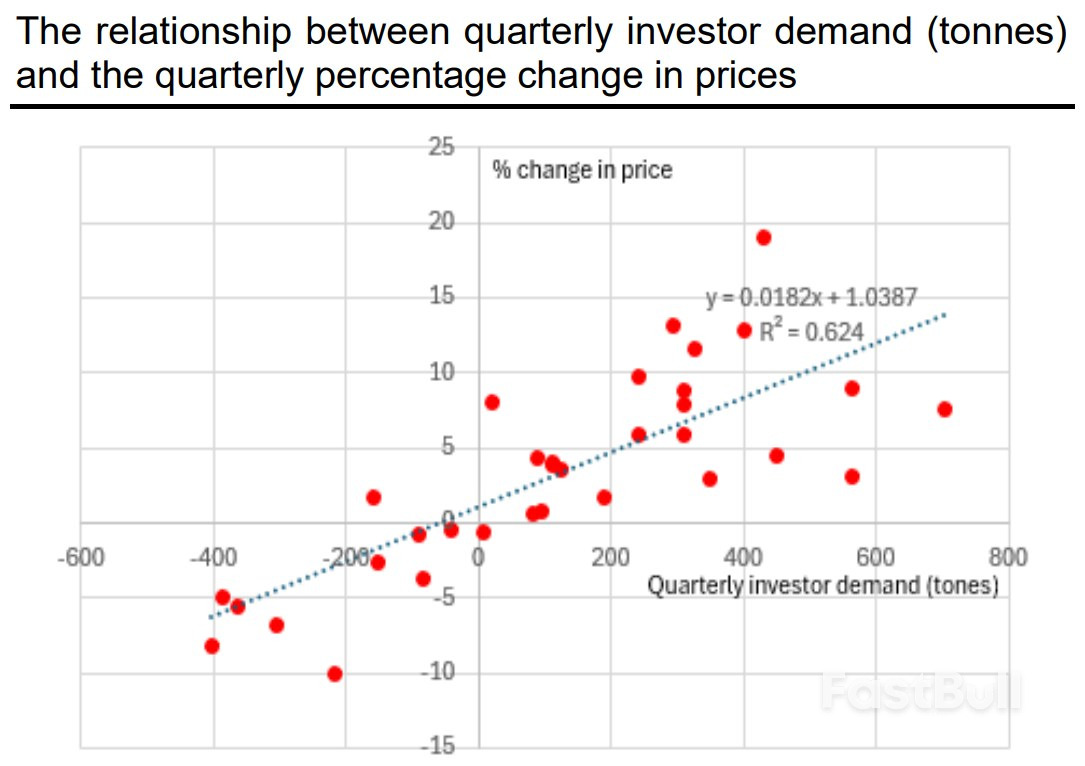

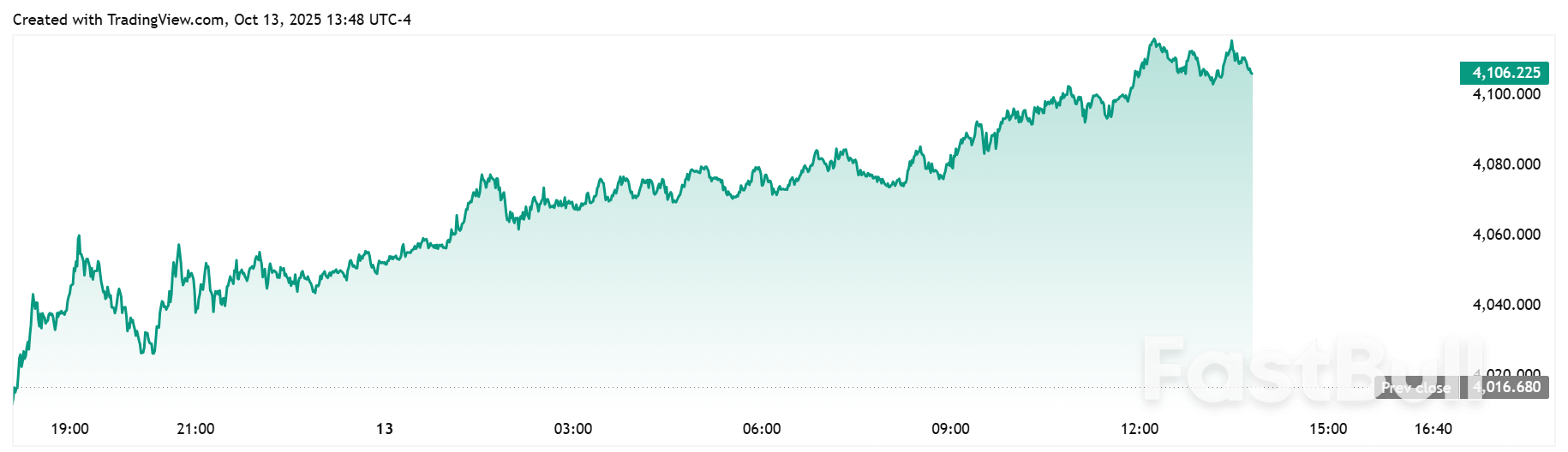

Societe Generale said $5,000 gold is “increasingly inevitable,” citing surging ETF inflows, central-bank demand, and rising global uncertainty. The bank now targets $4,217 by end-2025 and $5,000 by 2026.

Israeli Defense Minister Israel Katz said on Sunday that the Israeli military would destroy tunnels in Gaza after the remaining Israeli captives are released by Hamas, which has happened on Monday."Israel’s great challenge after the phase of returning the hostages will be the destruction of all of Hamas’s terror tunnels in Gaza, directly by the IDF and through the international mechanism to be established under the leadership and supervision of the United States," Katz wrote on X.

“This is the primary significance of implementing the agreed-upon principle of demilitarizing Gaza and neutralizing Hamas of its weapons. I have instructed the IDF to prepare for carrying out the mission,” he added.

According to the outline of the Gaza ceasefire proposal released by the White House, all “military, terror, and offensive infrastructure, including tunnels and weapon production facilities, will be destroyed and not rebuilt,” and there will be a “process of demilitarization of Gaza under the supervision of independent monitors.” But the details of how those steps will be taken, including who will be doing it, are unclear. A senior Hamas official has also said that Hamas won’t disarm unless it can hand its weapons to a Palestinian state.

So far, Israel and Hamas have just entered the first phase of the ceasefire deal, which involves the release of the Israeli hostages in exchange for thousands of Palestinians held in Israeli jails, the IDF pulling back to an agreed-upon line, and Israel allowing more aid to enter Gaza. Details on implementing the rest of the agreement still need to be worked out in negotiations between Israel and Hamas.Katz’s comments come as many are concerned Israel will restart its brutal war once Hamas releases the Israeli captives. Also on Sunday, Israeli Prime Minister Benjamin Netanyahu said the military “campaign is not over,” though he could be referring to other areas where Israel is at war or potential escalations elsewhere in the region.

“And I want to say: Everywhere we fought – we won. But in the same breath, I must tell you: The campaign is not over. There are still very great security challenges ahead of us,” Netanyahu said, according to a statement from his office. “Some of our enemies are trying to rebuild themselves to attack us again. And as we say – ‘We’re on it.'”According to a report from Israel Hayom, the US has given Israel a guarantee that it would back Israeli military action if it determined Hamas violated the deal in a way that “poses a security threat.” The report said the understanding “constitutes a side agreement” between the US and Israel.The US gave Israel a similar side deal for the November 2024 Lebanon ceasefire agreement, which Israel continues to violate on a near-daily basis.

The British economy faces a growing risk of a hard-landing, Bank of England policymaker Alan Taylor said on Tuesday, reaffirming his calls to speed the pace of interest rate cuts.

Taylor, an external member of the BOE’s Monetary Policy Committee, made the remarks as part of a broader speech about the impact of tariffs on the British economy. The economist and Columbia University professor said downside risks in the UK were fueling concerns that the British central bank “may have braked too hard” while raising interest rates to combat inflation in the wake of the pandemic and Russia’s invasion of Ukraine.

While Taylor said he believed that a “bumpy landing” had eclipsed a soft landing has the most likely outcome for the UK, he warned that the risk of a hard landing was growing. In that scenario, weak domestic demand can prompt a more forceful downturn, whereby recession dynamics kick in a way that’s difficult to contain or reverse, he said.

“This was a remote and low probability event a year ago, but the risk is rising,” Taylor said at King’s College, Cambridge. “The probability of this outcome is now not trivial.”

Data released earlier on Tuesday showed that UK unemployment unexpectedly rose and wage growth slowed more than forecast, prompting traders to add to bets on further interest-rate cuts from the BOE. The jobless rate climbed to 4.8% in the three months through August, the highest since May 2021 when Covid restrictions were in place, the Office for National Statistics said.

There was further bad news for Chancellor of the Exchequer Rachel Reeves ahead of what’s shaping up to be a challenging budget on Nov. 26. In its latest forecasts, the International Monetary Fund said Britain will suffer the highest inflation of any Group of Seven country next year and the weakest growth in living standards.

Taylor has emerged as one of the MPC’s most dovish members since joining the panel a year ago, having voted to cut rates at almost every meeting. He’s worried about a rapidly deteriorating economy, while colleagues such as Megan Greene have argued for keeping borrowing costs on hold until at least March due to worries about lingering price pressures.

Traders fully priced two quarter-point interest-rate cuts through next year earlier Tuesday, with the first point cut expected in by March.

“By maintaining what I think is a too restrictive path of interest rates, we may have braked too hard, such that inflation cannot smoothly return to target with the economy close to potential,” Taylor said.

Taylor said he saw more evidence that China was rerouting cheap goods destined for the US to the UK. He said that underestimating the impact of trade diversion may cause inflation to come in below the 2% target.

Taylor’s comments contrast with views held by fellow external rate-setter Catherine Mann, one of his most hawkish colleagues. In a recent interview with Bloomberg TV, Mann dismissed the effects of trade diversion on inflation, arguing that domestic factors will prevent firms from passing on lower prices to consumers.

An imported good “coming in on the dock there, still has to make it to the shelf in the UK, and that gets us back to the domestic foundations for the inflation pressures in the UK... whatever is happening with tariffs abroad,” Mann said. “The domestic component is the more important issue that I need to face.”

But Taylor argued that those domestic inflationary forces are receding. He said that wage settlements are set to end the year around 3.5% and are likely to decline to 3%, close to the BOE’s preferred rate, as soon as next year.

“As I see it, in an economy with rising unemployment and weak demand, wage settlements will be pushed down, and wage-led domestic inflation will not re-kindle an upward spiral,” Taylor said.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up