Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

Italy Industrial Output YoY (SA) (Oct)

Italy Industrial Output YoY (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

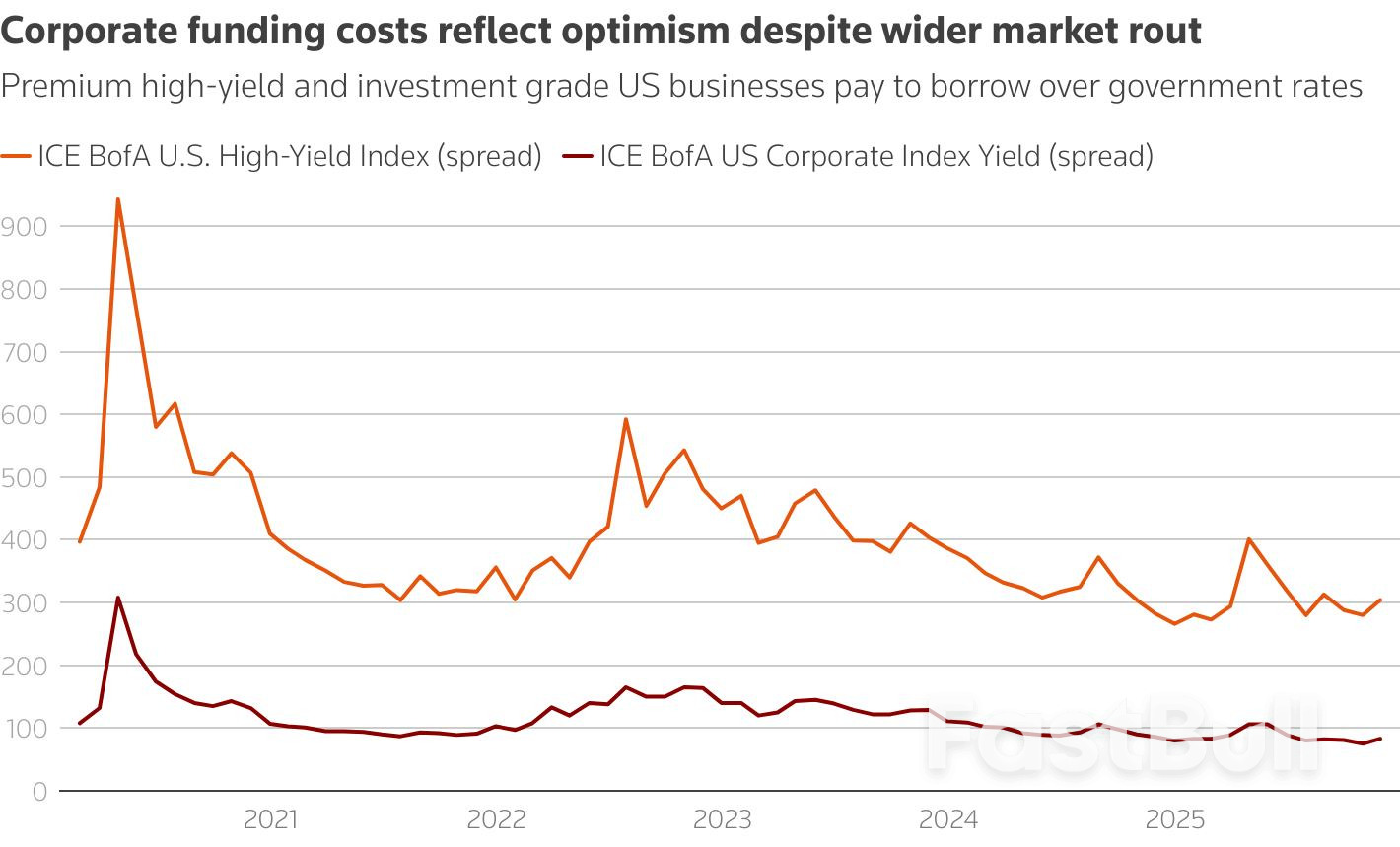

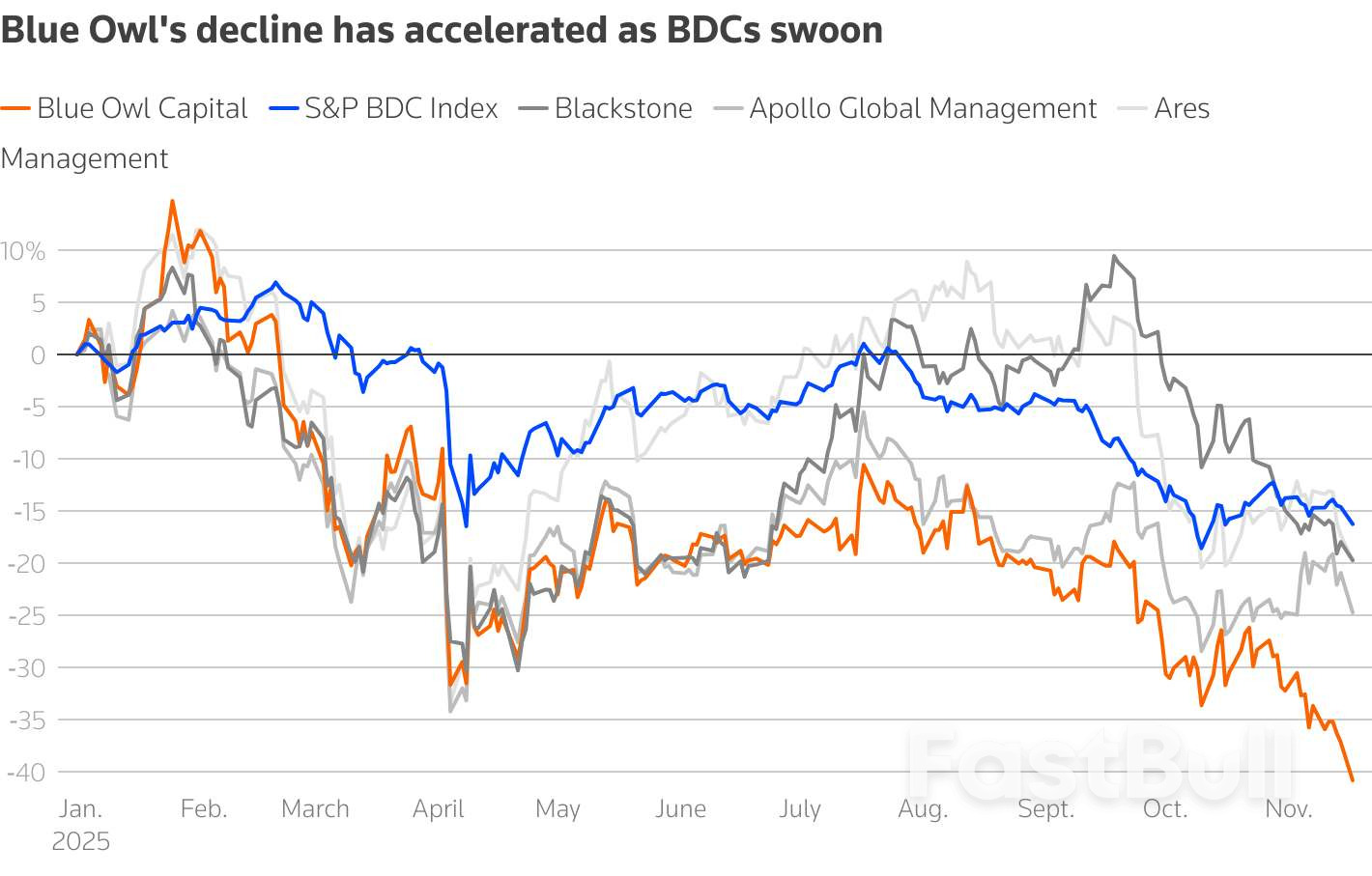

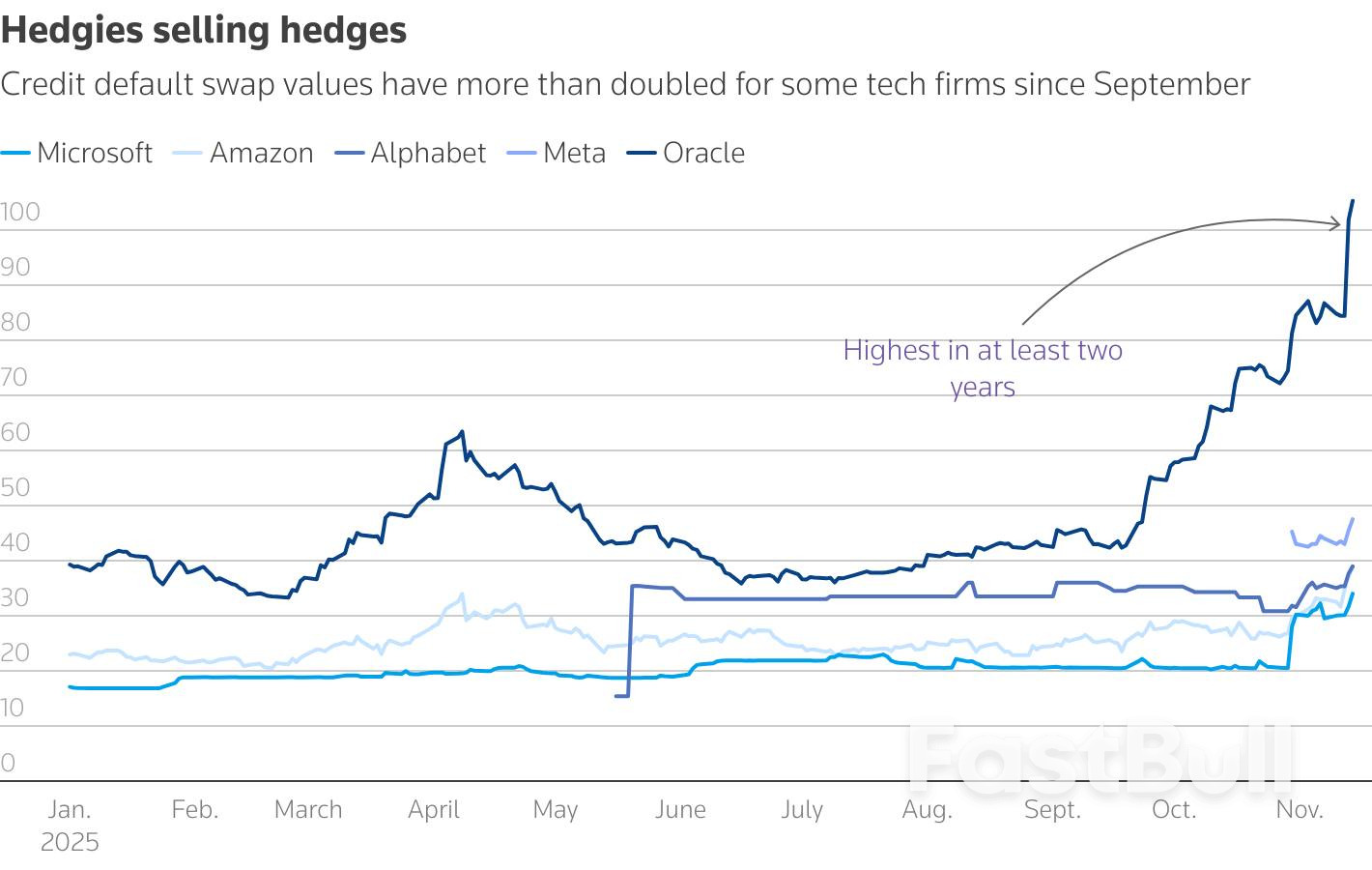

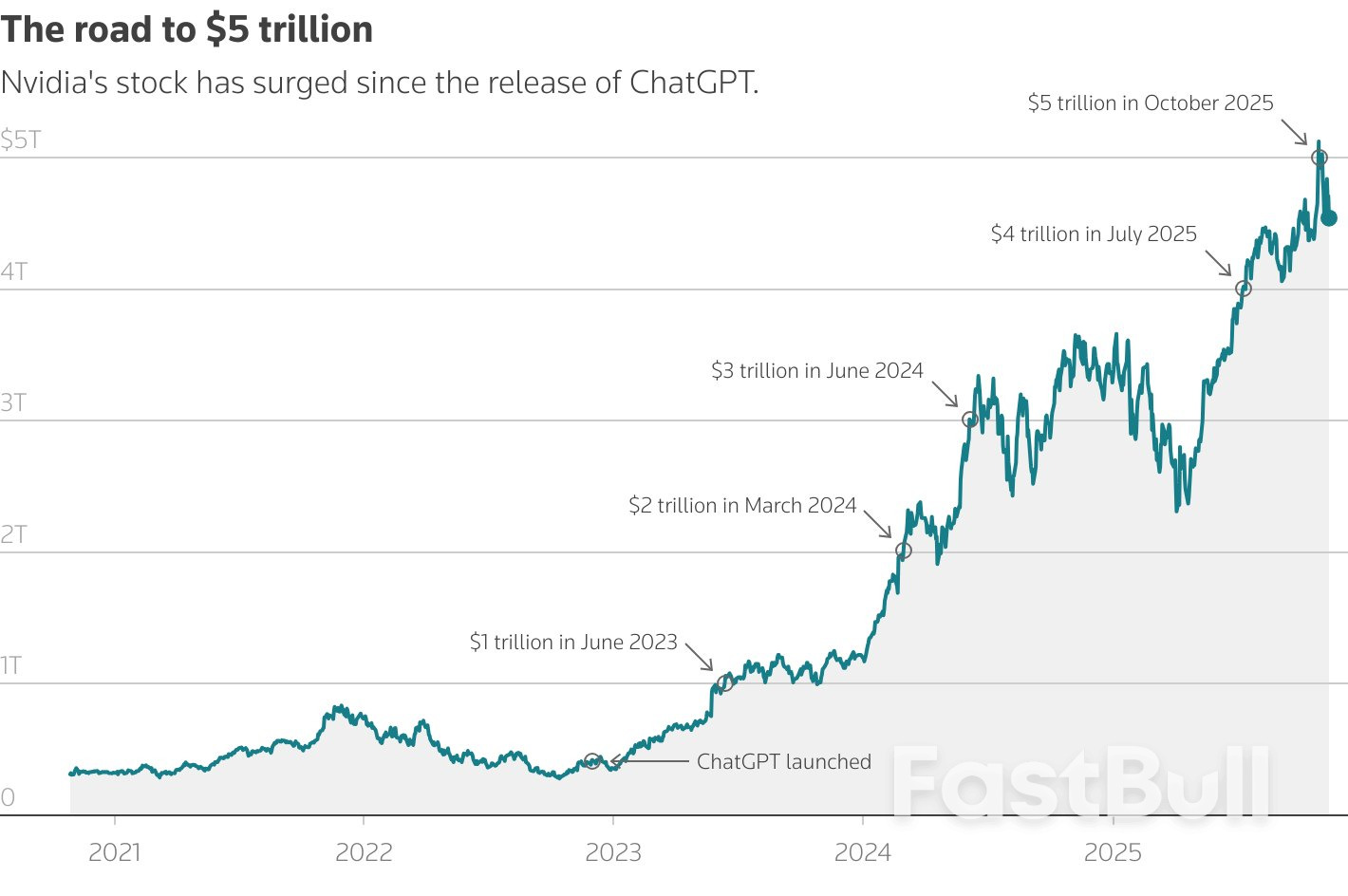

A surge in AI-related corporate borrowing and stress in private credit is making investors pull back from investment-grade bonds, warning spreads are too tight and vulnerable if economic data weakens or funding costs rise.

Mexican President Claudia Sheinbaum has again sought to stand up to President Donald Trump, on Tuesday repeating her rejection of any possibility of US military intervention against cartels on sovereign Mexican soil.

Trump has recently floated openness toward the possibility, and also Colombia, in exchanges with reporters related to the military build-up off Venezuela. "It's not going to happen," Sheinbaum said, according to The Associated Press. "He (Trump) has suggested it on various occasions, or he has said, 'we offer you a United States military intervention in Mexico, whatever you need to fight the criminal groups.'"

Trump had been asked asked on Monday if he would seek the Mexican government's permission before launching any potential strikes and responded that he "wouldn't answer that question." He added that he has been "speaking" with Mexico and that they "know how I stand."

That exchange had started as follows:

Speaking to reporters in the Oval Office, Trump answered a question about potentially striking Mexico or sending American troops or other personnel into the country by saying it would be "OK with me."

"Would I launch strikes in Mexico to stop drugs? OK with me, whatever we have to do to stop drugs. Mexico is — look, I looked at Mexico City over the weekend. There's some big problems over there," Trump said after he was asked whether he was considering such action.

The military campaign ongoing in the southern Caribbean and off Latin America is called "Operation Southern Spear," per a prior announcement from Pentagon chief Pete Hegseth.

"We've stopped the waterways, but we know every route. We know every route, we know the addresses of every drug lord," Trump had additionally explained.

"We know their address, we know their front door. We know everything about every one of them. They're killing our people. That's like a war. Would I do it? I'd be proud to."

The question of US military action south of the border is not a completely 'new' one; however, Operation Southern Spear marks the first time in history that the Pentagon has parked this many US naval assets, including a carrier group, just off Latin America. It's making leaders in the region very nervous, to say the least.

The Trump administration's mammoth fiscal legislation will boost economic growth next year, but the impact will be partially undercut by Federal Reserve interest rates kept higher than they would be otherwise, a former top Fed researcher concluded in a new analysis.

The federal deficit, meanwhile, will be even larger than the gain in gross domestic product.

John Roberts, former deputy associate director of the Fed's research division and now a special advisor to Evercore ISI, wrote in an analysis of the Trump legislation known as the "One Big Beautiful Bill" that the arrival of perhaps $100 billion in extra refunds early next year will help lift economic growth by about four-tenths of a percentage point in the first half of the year.

The legislation exempted some overtime and tipped income from taxes and included other tax breaks.

The GDP impact will fade fast, however, and for the full year growth will be about 0.32 percentage points higher than it would have been otherwise, Roberts found using the Fed's internally developed and publicly available FRB/US model of the economy. Next year's deficit, meanwhile, will grow by eight-tenths of a percentage point as a result of the tax cuts and higher spending on defense and border protection.

The slowing impact on growth is partly due to the nature of consumer behavior - the extra money is likely to be spent quickly by the households who intend to spend it at all - and partly due to the Federal Reserve reducing its benchmark policy rate less than it would otherwise due to faster economic growth that leads to slightly higher inflation and a slightly lower unemployment rate.

"The model suggests that rates should be roughly a quarter point higher at the end of 2026 than would have been appropriate in the absence of One BBB stimulus – so for instance, one cut if two would otherwise have been warranted," Roberts wrote. "In response to the stronger economy, interest rates are higher and those higher interest ratesdampen the increase in GDP" by about half.

Roberts' findings illustrate the type of considerations the Fed will be debating at the December 9-10 meeting, with the implications of changed tax policy factoring into the outlook for next year. Officials already are divided over whether further rate cuts are needed now, while President Donald Trump continued to demand lower rates.

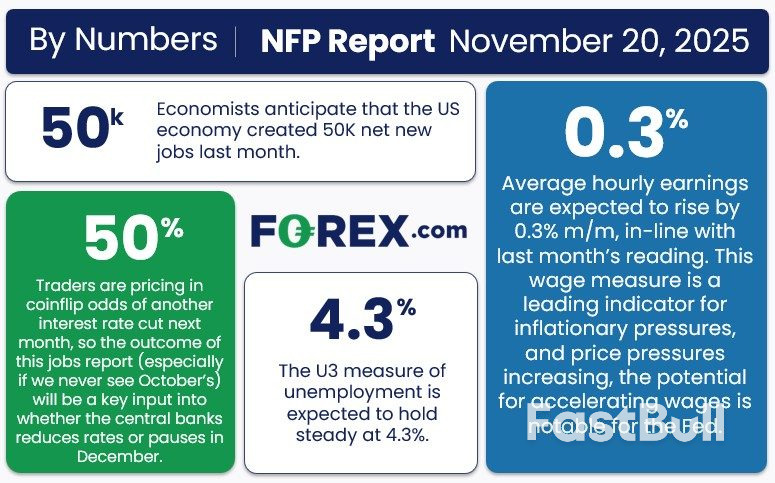

Odds of a December rate cut remained low following the release of delayed jobs data.

Markets were last pricing about a 35% chance of a quarter-point cut from the Federal Reserve next month, according to the CME FedWatch Tool. That is higher than the 30% likelihood priced in during the prior session, but remains weak. The tool used fed funds futures trading to calculate the odds.

The target rate is currently at 3.75% to 4.00%.

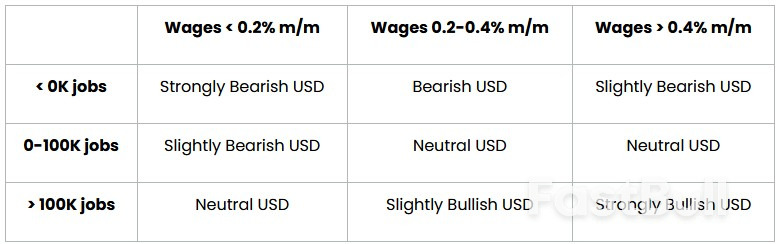

Those expectations held steady after the release of the September jobs data, the first nonfarm payrolls report investors have seen since the government shutdown. The report gave an uneven picture of the U.S. labor market. The U.S. economy added 119,000 jobs in September, a headline number that blew away expectations for 50,000 jobs added, according to economists polled by Dow Jones.

However, the unemployment rate showed unexpected weakness, rising to 4.4% from 4.3%. The new level is the highest level it's been since October 2021.

"All those numbers suggest an economy that's still hanging in there. Not a dramatic move one way or the other," Former Federal Reserve Vice Chairman Roger Ferguson told CNBC's "Squawk Box" on Thursday. "People should take note of the slight uptick in the unemployment rate, but labor force participation still looks pretty strong, average hourly earnings certainly looks strong, or strong enough. And so, I don't think this sort of tilts the cut decision much one way or the other."

To be sure, some investors are hopeful that weakness in the unemployment rate means a December rate cut remains on the table. The level is closely watched by Fed policymakers, more so than the headline number, and is additionally troubling given that a shrinking labor pool, given the rise in immigration crackdowns, theoretically would keep the job market tight.

"A December cut remains possible given continued labor market softness as expressed by the unemployment rate," wrote Kay Haigh, global co-head of fixed income and liquidity solutions at Goldman Sachs Asset Management. "Weak hard data and close-to-target inflation look set to drive policy going forward, despite recent hawkish noises."

"The setup is in place for Powell to continue his risk-management approach to the labor market before his term as Chair expires in May," Haigh continued.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up