Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Forex currencies have been dormant since the beginning of August as Markets haven’t found what they want in the latest key data reports.

Forex currencies have been dormant since the beginning of August as Markets haven’t found what they want in the latest key data reports.

As previously thought, the latest NFP, PPI, and CPI combo reports would have expected to relieve volatility in FX. But volatility there wasn’t.

After receiving all the most influential market data, the next step will be next Wednesday’s FOMC rate decision (September 17).

Prior to the CPI release, expectations for a 50 bps cut were priced at 10% and are now closer to 5%. The 25 bps cut, however, is still priced to be a sure thing.

Indeed, when looking at Market reactions in other assets, it seems that the theme that is developing is one of a less prolonged impact of tariffs.

Despite an as expected 0.3% report, participants bidding on Bonds and Gold point toward a repricing of lower long-run inflationary impact of tariffs (while they are just starting to bite now), which is flattening the US Yield curve.

Until now, pricing has been one of lower short-term inflation expectations versus higher ones in the long run.

Despite the immediate US Dollar selloff, FX currencies are hesitant and hang close to unchanged on the session.

Discover major currency pairs charts and levels, after first peaking at reactions to other asset classes.

An overlook at cross-assets market reactions: Bonds and Gold are loving it, USD corrects.

The most volatile FX pair is enjoying the ongoing selloff in the US Dollar but has yet to break out of its mid-range pivot zone.

Some ongoing selling might be pushing prices out of this region however this move still has to develop.

Wicky action at the extremes prove that participants are still hesitant on the upcoming direction for currencies.

A 25 bps confirming could still provide some strength to the USD which helps to explain why participants are still looking at each other to see who moves first

Levels to watch for USDJPY:

AUDUSD has rebounded significantly since its August 1st lows and by evolving in an intermediate upward channel, heads to retest its yesterday and 2025 highs (0.6535).

Some hesitation at the current levels is forming and will be essential to monitor.

Levels to watch for AUDUSD:

EURUSD still evolves within its August range after a failed upside breakout in yesterday’s session.

Buyers have pushed towards a retest of the resistance but seem to be running out of steam.

Levels to watch for EURUSD:

USDCHF 2H Chart, September 11, 2025, Source: TradingView

The Swiss franc had strengthened immensely in the beginning of the month which pushed USDCHF towards a retest of its 2025 Main support (0.7916 week lows).

However, despite a selling candle from the data, hesitation comes at the 50-period MA which will also be key to upcoming action: A rejection of the MA could provide a boost to the pair, while a breakdown could also lead to further downside.

Levels to watch for USDCHF:

GBPUSD has, like its European neighbor, been stuck in a 2,000 pip range since the middle of August (1.34 to 1.36).

The buying reaction to the CPI report is once again met with some hesitation as prices are meeting the range resistance.

Watch the immediate low-slope downward channel that may shape today’s price action.

Levels to watch for GBPUSD:

USDCAD is virtually unchanged after the report – By attaining the upper bound of its upward channel, mean-reversion selling seems to occur but real momentum has yet to materialize.

Levels to watch for USDCAD:

The Consumer Price Index (CPI) rose 0.4% month-on-month (m/m) in August, a tick ahead of the consensus forecast in Bloomberg and up from the 0.2% m/m gain in July. On a twelve-month basis, CPI was up 2.9% (from 2.7% the month prior).

Excluding food and energy, core inflation rose 0.3% m/m (0.35% m/m unrounded), largely matching last month’s gain and meeting the consensus forecast. The twelve-month change held steady at 3.1%.

Price growth of services continued to come in on the hotter side, rising 0.35% m/m, following a similar gain of 0.36% m/m in July. Primary shelter costs rose at its fastest monthly clip in several months, while price growth of non-housing services (+0.4% m/m) remained firm for a second consecutive month.

Tariff passthrough continued to materialize in core goods prices, which were up 0.3% m/m or its fastest monthly gain since January. Price gains were most notable in apparel (+0.5% m/m), appliances (+0.5% m/m), household furniture and bedding (+0.4% m/m) and new vehicle prices (+0.3% m/m). Used vehicle prices also rose 1.0% m/m, which could in part be driven by consumer switching to used models in an effort avoid paying tariff costs.

Inflationary pressures continued to heat up in August, with broad strength in goods and services inflation. Goods prices are likely to continue to drift higher over the coming months as businesses increasingly pass-on more of the tariff costs. However, further upward pressure on services inflation looks limited against the backdrop of a cooling labor market which is likely to limit upward pressure on wage growth and keep a lid on discretionary services spending.

But nothing is a guarantee, and policymakers will need to balance the risks of reducing the policy rate by enough to breathe some life back into the labor market, but not by so much that they risk unnecessarily stoking inflation. We see the Fed delivering on three quarter-point cuts by year-end, with the first coming at next week’s meeting. We’ve long held this view, and following this morning’s release, Fed futures are pricing in a similar rate-cut path by year-end.

A few weeks ago, President Trump attempted to fire Federal Reserve Governor Lisa Cook for "cause". The identified "cause" was the alleged falsification of mortgage documents prior to her taking up the role of governor. There has been a court hearing on the matter, and we’ve just had the outcome, which is a positive one for Cook. Essentially, the court ruled that "cause" should reflect something done while actually in office, followed by the assertion that a firing based on "unsubstantiated and vague allegations" would "endanger the stability of our financial system". Cook keeps her job and gets to vote at the upcoming FOMC meeting.

But this is not over. The Justice Department is likely to appeal on the theory that even if Cooks' alleged falsification of documents is viewed as minor under some interpretations, it may still be sufficient grounds for removal. In the extreme, this could go all the way to the Supreme Court. And if it did, that court has tended to swing right. Either way, this whole affair does smack of a political agenda to make changes at the Fed by the Trump administration.

A burning question is why the markets have not reacted more negatively? After all, this does smack of political interference. Part of the explanation could lie in the perception that the allegations - while unproven - retain a degree of plausibility in the eyes of investors, at least until definitively dismissed. Some investors may also trust the courts to uphold due process, reinforcing faith in institutional safeguards.However, if Chair Jerome Powell were to get involved as an obstacle, say, for attempting to protect Cook, and were fired on that basis, that would be a whole different story. Take us there, and the market would react more dramatically. In the end, any extreme action taken to undermine Fed independence would be viewed with much suspicion by longer-dated bonds.

The front end does not care about longer-term risks, as it is slavish to where the funds rate goes. By definition, it cannot think beyond two years. But the back end is a deeper thinker, and can worry about second- and third-round effects, and especially on medium-term risks potentially being taken on inflation should the interference with the Fed be seen to be swinging policy too dovish.

This has the potential to get very messy, and could finally tip the back end over the edge – an edge it has thus far resisted crossing, even under significant fiscal pressure. How messy? It's tough to say, but we'd more than likely comfortably take out the previous 10yr and 30yr yield highs seen in this cycle.

In the wake of the latest round of weak jobs data and a downbeat assessment on the economy from the Federal Reserve’s own Beige Book report, the market is now convinced the Fed will soon resume cutting interest rates. While this is mostly aside from the Lisa Cook saga, the market’s hunger for cuts has been further fuelled by the prospect that the Fed is set to lean more dovishly in the months ahead as Donald Trump seeks to appoint new members who are more aligned with his thinking that interest rates need to be much lower than they are currently.

The anticipated changes in personnel at the Fed mean there is a perception in the market that the “new” Fed could be seen to be more willing to put the political goals of the president ahead of economic stability, similar to when Richard Nixon pressured Arthur Burns into cutting interest rates ahead of the 1972 election. In combination with a lifting of wage and price controls, this contributed to a spiralling of inflation in subsequent years.

Nonetheless, it is important to point out that no potential Fed candidate has endorsed the president’s call for 200-300bp of immediate interest rate cuts.Stephen Miran is set to be in position for the 17 September FOMC meeting, temporarily filling the governor role vacated by Adriana Kugler after she decided to step down early. Miran has somewhat controversially refused to resign from his current role as chair of the President’s Council of Economic Advisors. Instead, he is taking a temporary period of unpaid leave, raising questions about how independent he can be, given that he will be returning to work for the president in early 2026.

It will then be up to President Trump to name a permanent successor to Kugler, and with the future of Lisa Cook in doubt, plus Jerome Powell’s term as Fed Chair ending in May 2026, the composition of the FOMC will soon look very different to how it started 2025. Nonetheless, we must remember the FOMC is a committee made up of 12 voting members, and while any new members joining in the coming months may be in favour of lower interest rates right now, given the current economic conditions, there is no guarantee that will be the case if the economic situation changes.

Financial markets will also provide a stiff test for new officials. In the UK, the reason that the then newly elected Labour government gave the Bank of England independence in 1997 was to give the new political administration more economic credibility. It was believed that an independent central bank gives financial markets greater confidence that inflation would be more stable at lower levels, and this reduced term premium, which helped deliver lower market interest rates and stronger economic growth than would have been otherwise achieved. If global markets started to question the credibility of US economic policy, this could risk higher borrowing costs and slower growth, which would not be in the president’s best interests as we head towards the mid-term elections.

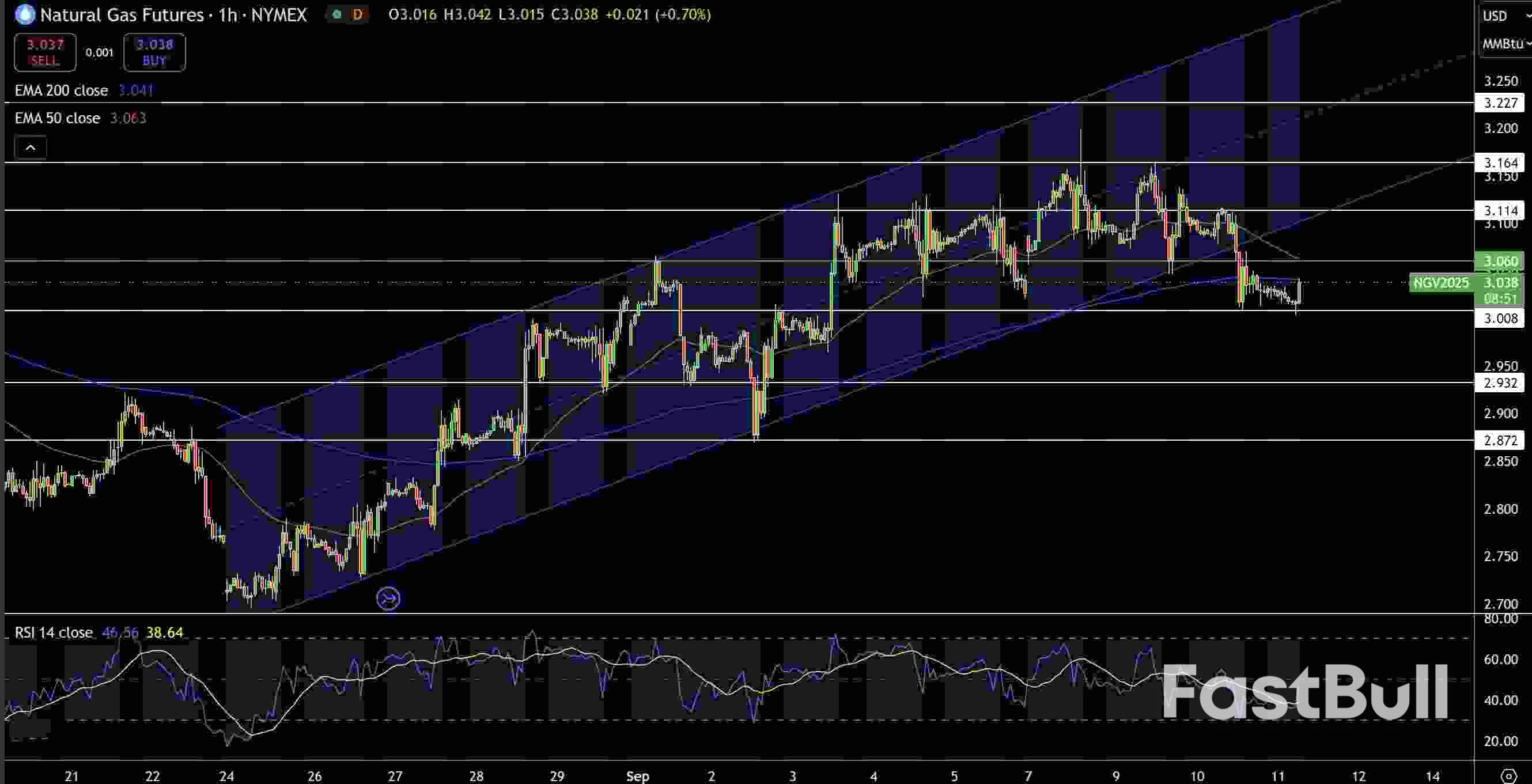

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

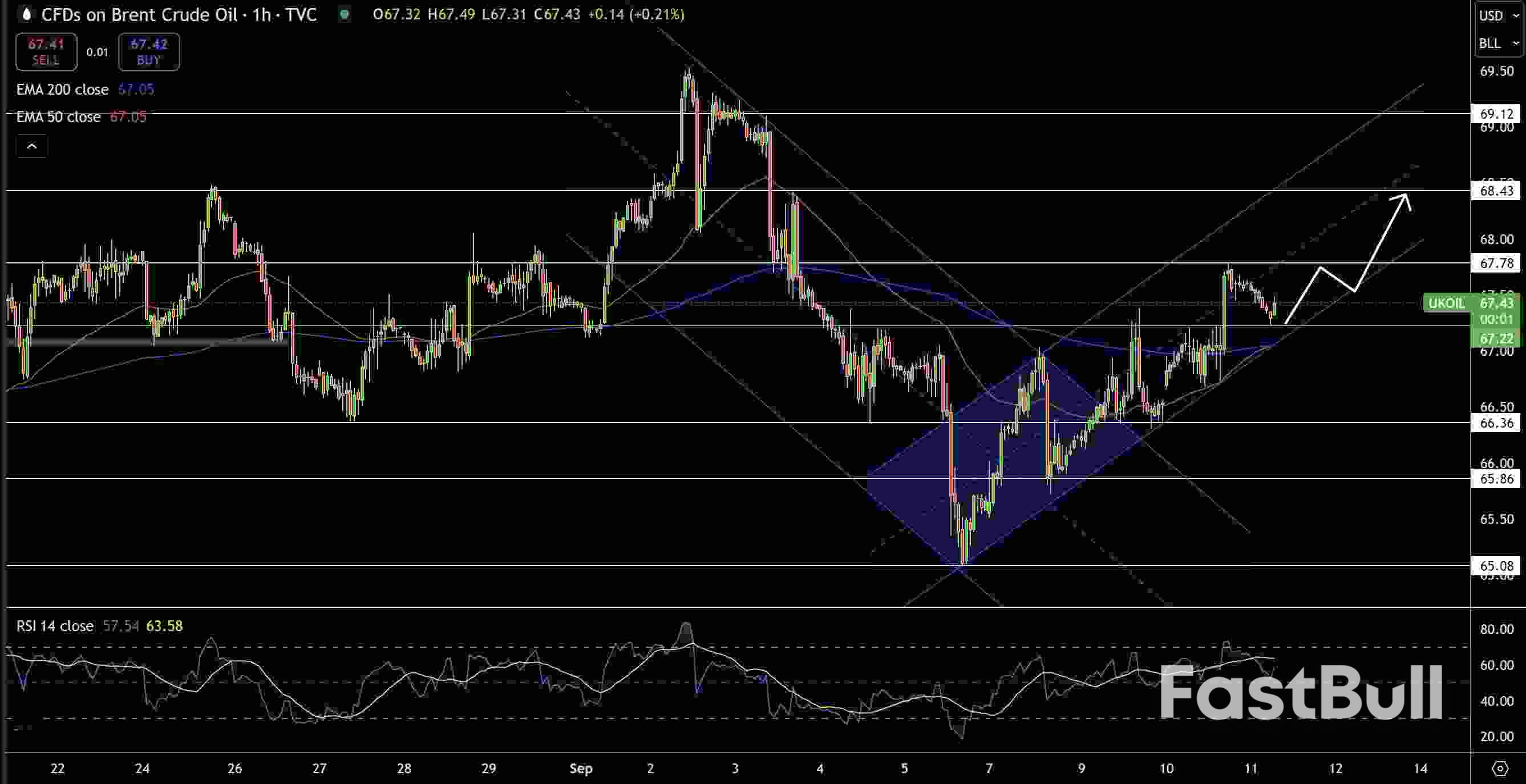

WTI Price Chart Brent Price Chart

Brent Price ChartWhite Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up