Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

The majority of the main European stock markets slowly moved into positive territory after the opening bell. Investors remain cautious while watching for more news about the Ukraine peace talks and US monetary policy.

The U.S. and European Union granted businesses some desperately sought after clarity as they shared fresh details on their trade agreement on Thursday, but questions remain about whether the deal can really be trusted.

Thursday's update broadly echoed the framework announced by the U.S. and EU in July, which called for 15% tariffs as well as pledges for Brussels to amp up spending and investment in the U.S. New details include a cap of 15% tariffs on pharmaceuticals, lumber and semiconductors. Autos will face the same rate, but only after the EU makes legislation changes to reduce its industrial duties.

However, EU Trade Commissioner Maros Sefcovic on Thursday suggested the framework was just the beginning, leaving the door open for future changes to the deal.

Despite providing some much-needed clarity, there are still various smaller, yet crucial, aspects missing from the current framework.

A muted market reaction from pharmaceuticals on Thursday highlighted investor skepticism and there was no mention of the wine and spirits sector in the deal.

"A lot of the details remain to be worked out," Penny Naas, who leads on the German Marshall Fund's allied strategic competitiveness work, told CNBC, pointing to for example so-called 'rules of origin.'

"These rules determine where value is most added to a product that contains multiple parts from multiple countries, and when it can be labeled 'European' or 'American,'" she explained. Naas noted that these rules come into play when it comes to for example transshipments — a process in which goods might originate from one country, but are then sent to another for final shipment to the U.S.

Carsten Brzeski, ING's global head of macro, meanwhile pointed out uncertainties "stemming from formalities and procedures at customs," which he says are particularly impacting small and medium-sized enterprises.

Some companies are already facing issues in this regard, with firms having to "recruit tariff specialists in order to clarify the new customs requirements," he said.

Another concern is U.S. President Donald Trump's history of fact-paced changes of heart and policy shifts, Antonio Fatás, professor of economics at the European Institute of Business Administration (INSEAD), told CNBC.

The president for example doubled steep steel tariffs overnight, and later quietly expanded their scope.

Elsewhere, Switzerland was victim to the president's erratic decision making, with the country reportedly having been extremely close to a deal, which was then however pulled by Trump as he slapped 39% duties on Swiss exports to the U.S. almost overnight.

"The real issue for business is how to define a long-term strategy with a country that is no longer a reliable partner," Fatás said. "What used to be the most reliable partner for Europe has now become one of the most volatile, if not the worst, when it comes to economic policies," he added.

The German Marshall Fund's Naas also flagged this as a risk for businesses.

"This deal does not include any enforcement provisions, nor will it be codified by Congress, which means it could change at the direction of the U.S. President," she said.

Naas pointed to Section 232 tariffs as an example, with Trump having changed tariff rates on some products "at a moment's notice, and the Administration has expanded the scope to cover other products without warning."

Businesses are therefore left with a key question: to trust or not to trust the deal.

While Thursday's statement adds some clarity, the deal "remains fragile and could quickly dissolve," ING's Brzeski said in a note after the announcement. "The agreement contains numerous elements that could spark future tensions and escalation. Implementation, monitoring and enforcement of many of the intentions is not always clear," he added.

Naas echoed the calls for caution. While the U.S.-EU agreement appears "more likely to be stable" than some of Trump's other tariff policies like sectoral duties, it "will require the EU to remain on "good behavior" or else risk a sudden change," she said.

In addition to the uncertainties about the stability of the U.S.-EU deal, businesses are also contending with questions regarding various global shifts in the market, according to Gregor Hirt, multi-asset chief investment officer at Allianz Global Investors.

He told CNBC businesses are facing several key questions: "Is the US heading toward a recession or even worse, stagflation, and how resilient will companies' margin be in this kind of environment, especially considering the high market valuation in the US? Moreover, what further tools do policymakers have to counter a potential downturn, for example in terms of deregulation or specific sector 'incentives'?"

"And, finally, how will the shift away from global trade liberalisation and institutionalize framework affect long-term investment and supply chain strategies?" Hirt said, adding that these tariff-related issues are also key for companies ability to plan in the current environment.

Natural Gas (NG) Price Chart

Natural Gas (NG) Price Chart WTI Price Chart

WTI Price Chart Brent Price Chart

Brent Price Chart

Dollar is holding broadly firm as markets head into the US session, though intraday momentum has slowed. Traders are reluctant to commit to new positions ahead of Fed Chair Jerome Powell’s highly anticipated Jackson Hole speech.

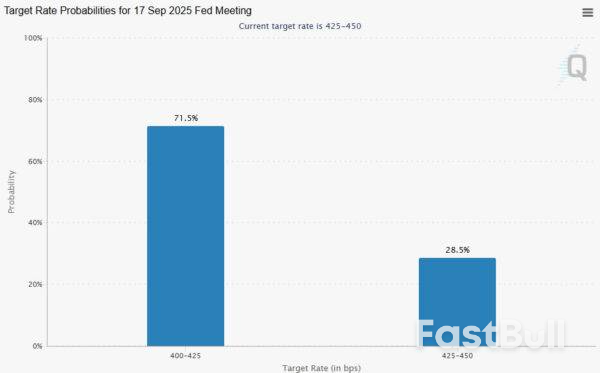

Expectations for a September rate cut have already been pared back sharply, with Fed fund futures now pricing around a 71% chance, down from over 90% just a week ago. Powell’s remarks will be closely scrutinized for any hint on whether he sees scope for a near-term move, or whether inflation risks still outweigh concerns about labor market cooling.

Market participants are also mindful that Powell’s tone will not be the only driver today. Comments from other Fed officials are expected to hit the wires, helping investors gauge the balance of views across the committee. By the end of the day, markets should have a clearer sense of the prevailing hawkish or dovish leanings inside the Fed.

Still, it must be stressed that today’s speeches are not the final word. Both the August nonfarm payrolls and CPI reports will be released before the next FOMC meeting, and those could easily shift expectations again. Market pricing will therefore remain highly data-dependent over the coming weeks.

For now, the Dollar sits as the strongest performer of the week, trailed by Swiss Franc and Loonie. Kiwi remains the weakest, followed by Aussie and Sterling, while Euro and Yen are trading in the middle of the pack.

In Europe, at the time of writing, FTSE is up 0.08%. DAX is down -0.03%. CAC is up 0.11%. UK 10-year yield is up 0.007 at 4.74. Germany 10-year yield is down -0.013 at 2.746. Earlier in Asia, Nikkei rose 0.05%. Hong Kong HSI rose 0.93%. China Shanghai SSE rose 1.45%. Singapore Strait Times rose 0.52%. Japan 10-year JGB yield rose 0.008 to 1.619.

Canada’s retail sales climbed 1.5% mom to CAD 70.2B in June, though the gain fell just short of expectations of 1.6% mom. The increase was broad-based, with all nine subsectors contributing, led by food and beverage retailers.

Excluding autos, sales rose an even stronger 1.9% mom, more than doubling forecasts of 0.9% mom, suggesting underlying consumer spending remains resilient.

In volume terms, retail sales advanced 1.5% mom in June, reinforcing that the pick-up was not purely price-driven. On a quarterly basis, sales grew 0.4% qoq, with volumes up 0.7% qoq, pointing to a modest but positive contribution from consumption to Q2 GDP.

However, early signals from Statistics Canada suggest the momentum could be fading. The agency’s advance estimate shows sales likely slipped -0.8% in July mom, raising the risk that strong second-quarter consumption may not carry through into the third.

Eurozone negotiated wages accelerated to 3.95% in Q2, up sharply from 2.46% in Q1, the ECB reported on Friday. Though well below the 2024 peak of 5.4%, the acceleration suggests cost pressures remain sticky.

Some analysts noted that much of the gain reflected one-off payments, raising the possibility that the rise is short-lived. Still, with services inflation remaining elevated, policymakers have little scope to accelerate easing after already cutting the deposit rate to 2.00%.

Whether wage growth cools in the coming quarters will be central to determining if the ECB can continue on its path toward looser policy.

Japan’s inflation slowed again in July, with core CPI (ex-fresh food) easing to 3.1% yoy from 3.3% yoy, slightly above expectations of 3.0% yoy. Headline CPI also dipped to 3.1% yoy. The moderation was driven in part by cooling rice prices, which rose 90.7% yoy after surging 100.2% yoy in June, alongside the reintroduction of energy subsidies. Together, these helped bring core inflation down from May’s 3.7% peak.

However, price pressures remain entrenched. Food inflation excluding fresh items actually quickened to 8.3% yoy from 8.2% yoy. Core-core CPI (ex-food and energy) stayed unchanged, elevated at 3.4%. Energy prices provided some relief with a -0.3% yoy annual decline, the first drop since March 2024, but this was not enough to counter stubborn underlying strength.

For policymakers at BoJ, the data paints a mixed picture: rice and energy are finally easing their grip on consumer prices, but persistently high core inflation highlights why interest rate hikes remain on the table. While inflation is clearly off its May peak, the road back toward the 2% target looks slow and uneven.

Daily Pivots: (S1) 1.3384; (P) 1.3434; (R1) 1.3462;

Intraday bias in GBP/USD remains mildly on the downside for the moment. Fall from 1.3594 is in progress for 61.8% retracement of 1.3140 to 1.3594 at 1.3313. Firm break there will bring retest of 1.3140 low. On the upside, above 1.3481 minor resistance will bring retest of 1.3594 first. Overall, corrective pattern from 1.3787 is extending.

In the bigger picture, up trend from 1.3051 (2022 low) is in progress. Next medium term target is 61.8% projection of 1.0351 to 1.3433 from 1.2099 at 1.4004. Outlook will now stay bullish as long as 55 W EMA (now at 1.3090) holds, even in case of deep pullback.

For American farmers travelling through the Heartland scouting corn and soybean fields, it feels like 2019 all over again.President Donald Trump is back in power, a trade war with top soybean buyer China is raging, and growers are coping with prices that are near the lowest levels in years. Huge crops ahead are only going to make matters worse.It’s a familiar picture for the more than 40 growers, analysts and journalists taking part in the annual Pro Farmer Crop Tour that started on Monday and will cross seven states before ending in Minnesota on Thursday. In 2019, they were facing exactly the same conditions.

Back then, tensions were so high that a staffer from the US Department of Agriculture (USDA) was threatened, forcing the agency to pull their people out of the tour as a precaution. Things are much calmer this year, but anxiety is slowly building up — after all, the US has yet to sell a single cargo of soybeans to China from the harvest that starts next month.“I just wish they’d start buying again,” said Bill Timblin, a Nebraska farmer on the tour. He hopes the Chinese market isn’t gone for good.

American farmers, a key voting bloc for Trump, are growing increasingly worried as harvest approaches. In a letter to the president this week, Caleb Ragland, who heads the American Soybean Association, warned growers are near a “trade and financial precipice” and cannot survive a prolonged trade war with China.“Soybean farmers are under extreme financial stress,” he said, urging the administration to reach a deal with China to remove duties. “Prices continue to drop and at the same time our farmers are paying significantly more for inputs and equipment.”

A gauge of grain prices tracked by Bloomberg fell earlier this month to the lowest since the pandemic in 2020.The USDA is already forecasting a record corn crop for the season starting in September. While the soy harvest will be smaller than last year as farmers planted less, yields are on track to hit a record.Partial results from the crop tour indicate bigger corn crops than last year in all states but Illinois. Indiana is currently the only state where soybean counts were lower than in 2024. Scouts crossed Ohio, South Dakota, Indiana, Nebraska, Illinois, Iowa and Minnesota. The combined result is expected on Friday.

In typical years, China buys on average 14% of its estimated soybean purchases before the US begins gathering its crop on Sept 1, according to an analysis by the American Soybean Association provided to the administration. The impact is being felt from Chicago to the Pacific Northwest, which is home to several export elevators dedicated to shipping American crops to Asia.

Steve Swanhorst, a South Dakota farmer on the tour, said he isn’t surprised. Trump was transparent about his plans on a variety of issues including tariffs and immigration, he said in an interview.“We had to know it was going to get rough,” he said. “You’ve got to give Trump some credit because he isn’t scared to get out of the box.”Chip Flory, who has taken part in all but one tour since 1988 and is now one of the hosts, is still positive.

“China has the need for soybeans,” he said. “There is going to come a time when they have to book beans.”Thousands of miles away from the crop tour, in Washington DC, the head of the US Soybean Export Council (USSEC) echoed that idea.“We are optimistic that some sort of a trade deal will be made soon,” Jim Sutter, USSEC’s chief executive officer, said in an interview at an event hosted by the group. “We don’t know exactly how soon.”

Luke Lindberg, the USDA’s undersecretary for trade and foreign agricultural affairs, said the government has created “very real” opportunities to get American products into new markets and that sales to destinations other than China are growing as a result.“The combines are firing up, and we need to get that soy crop sold around the world, we’re very aware of that,” he said at the USSEC event. “There are deals on the horizon that will make a significant impact for the American farmer.”

Still, concerns about China’s absence from the market at a time when growers are expected to harvest big crops are generating anxiety beyond the crop tour.

At the Iowa State Fair last week, Aaron Lehman, president of the centrist Iowa Farmers Union, said trade is top of mind after the US lost foreign markets during Trump’s first trade war with China. The Asian nation turned to South America for supplies instead.“Last time we went through this we lost lots of customers overseas and they have not come back to us,” said Lehman, who grows corn, soybeans and hay in Polk County. “We know there are things we need to do to get to fair trade for farmers, but we are not getting any closer to that with this approach.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up