Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Index rebalancing is a routine adjustment that helps keep stock market indices aligned with their intended structure.

Index rebalancing is a routine adjustment that helps keep stock market indices aligned with their intended structure. It affects stock weightings, trading volume, and market movements, creating both potential opportunities and risks for traders. In this article, we will explain index rebalancing, its impact on markets and CFDs, and what traders may consider when these adjustments take place.

So what does rebalance mean in the context of an index? Index rebalancing is the process of adjusting the composition of an index to keep it aligned with its intended structure. Indices like the S&P 500, NASDAQ 100, and FTSE 100 follow specific rules about which companies are included, how they are weighted, and when adjustments take place. Rebalancing ensures an index continues to represent its target market or sector accurately.

The process typically involves adding or removing stocks and adjusting weightings based on factors like market capitalisation, sector representation, or liquidity. For example, if a company in the S&P 500 is acquired or no longer meets the inclusion criteria, it will be removed and replaced with another company. Similarly, if a benchmark is weighted by market cap, stocks that have significantly grown or declined in value may see their weightings adjusted.

Rebalancing occurs on a set schedule—often quarterly or semi-annually—although some indices may rebalance annually. For example, the S&P 500 rebalance dates fall each quarter in March, June, September, and December. In some cases, an index can be rebalanced more frequently if extreme market events necessitate adjustments. These changes have a direct impact on trading activity, as institutional investors and funds tracking the market must buy or sell shares to match the updated composition.

Indices rebalance to stay accurate, relevant, and aligned with their underlying rules. Without rebalancing, an index could drift away from what it’s supposed to represent, making it less useful for investors and traders. The adjustments ensure that changes in stock prices, market conditions, and corporate events don’t distort its structure.

Here are the main reasons indices rebalance:

Index rebalancing isn’t just a routine adjustment—it can create waves across the market. When an index changes its composition, large funds tracking it have to buy and sell stocks to reflect the new weighting. This can contribute to short-term volatility and increased trading volumes. Notably, for CFD traders, rebalancing can affect prices, spreads, and liquidity.

Let’s start by taking a look at how index rebalances may impact markets as a whole.

When an index adds or removes stocks, institutional investors—including ETFs and index funds—adjust their portfolios to match. This results in sharp spikes in trading volume, particularly near the rebalancing date. For example, when the S&P 500 rebalanced in December 2020 to include Tesla, funds tracking the index had to buy billions of dollars worth of Tesla shares, sending prices soaring.Stocks being removed often experience the opposite effect—selling pressure from funds offloading shares can push prices down. These imbalances create volatility, which some traders analyse for their strategies.

Rebalancing-driven buying and selling doesn’t always reflect a company’s fundamentals—it’s often purely mechanical. This can lead to short-term price distortions, where stocks being added to an index see an artificial boost, while those being removed decline, even if their business performance hasn’t changed.These movements are often most pronounced in smaller indices, such as the Russell 2000, where changes in weighting can have a larger impact due to lower liquidity.

If multiple companies from a single sector are added or removed, it can influence broader sector trends. For example, if a rebalancing event shifts weightings toward tech stocks, the sector may see more attention from traders.Additionally, in major indices like the S&P 500, rebalancing can have ripple effects across global markets, as institutional capital moves in response.

Many short-term traders interact with indices through CFDs. Rebalances can have a unique impact on these instruments too.

Since index CFDs track the price movements of underlying indices, rebalancing can create sudden price swings. Traders holding CFD positions may need to consider rebalancing schedules, as components shifting in or out can impact the value of an index CFD.If a high-weighted stock is added, the index price may rise due to greater buying. Conversely, if large components are removed, selling pressure could push prices lower.

During rebalancing, spreads on index CFDs can widen as liquidity providers adjust to increased volatility. This can make trading conditions less favourable, especially around the official rebalancing execution. Some CFD providers may also update their pricing models to reflect the new composition, which could affect contract specifications.

CFD traders who analyse rebalancing effects may find price spikes in newly added stocks or declines in those being removed. However, these moves can be short-lived, as markets often stabilise after the rebalancing is complete.

The Bottom Line

Index rebalancing plays a crucial role in maintaining the accuracy of market-tracking instruments, influencing price movements, volatility, and trading activity. By periodically adjusting the composition of an index to reflect market changes, rebalancing ensures that it continues to serve as an accurate benchmark for investors and traders. Understanding these adjustments can help them navigate market shifts.

FAQ

What Is Rebalancing of an Index?

Index rebalancing is the process of adjusting the assets within a market index to maintain its intended composition. This involves adding or removing assets and updating weightings based on factors like market capitalisation, liquidity, or sector representation. Rebalancing occurs on a set schedule, such as quarterly or semi-annually.

How Is the S&P 500 Rebalanced?

S&P 500 rebalancing occurs quarterly in March, June, September, and December. The index committee reviews companies based on market cap, liquidity, financial performance, and sector balance. If a company no longer meets the criteria, it is removed and replaced with a more suitable stock. These changes can influence stock prices due to large-scale institutional adjustments.

What Is the Index Rebalancing Strategy?

An index rebalance strategy involves analysing upcoming adjustments to anticipate potential price movements. Traders and investors track changes to identify stocks that may experience increased buying or selling pressure. Some strategies focus on stocks being added or removed, while others assess the broader market impact.

How Often Do ETFs Rebalance?

ETFs rebalance based on their underlying index, typically quarterly or semi-annually. More frequent ETF rebalancing is common in actively managed ETFs, necessary to adjust weightings, manage risk, or align with specific investment strategies.

Institutional investors continue to accumulate Bitcoin at an unprecedented pace. This demand has come through the treasury companies, which are on the rise, and through the Bitcoin ETFs, which are again on a daily net inflow streak.

Bitcoin for Corporations data shows that treasury companies again bought Bitcoin between last week and this week. Strategy, the largest BTC treasury company, added 155 BTC to its treasury at an average price of $116,401 per BTC. This brings their total holdings to 628,946 BTC. Metaplanet, which was the first to replicate Strategy’s Bitcoin model, also bought more BTC.

The Japanese company announced that it bought 518 BTC for $61.4 million at an average price of $118,519 per Bitcoin. The company now holds 18,113 BTC, which it acquired for $1.85 billion at an average price of $101,911 per bitcoin. Furthermore, smaller treasury companies also added to their Bitcoin stack.

Canadian company Matador added 5 BTC to its treasury at an average price of $116,619 per Bitcoin. The company now holds 77.4 BTC and plans to hold 1,000 BTC by next year. The Smarter Web Company added 295 BTC to their treasury at an average price of $119,412. It now holds 2,395 BTC.

Bitcoin company FOLD announced that it holds 1,492 BTC as part of its Q2 results. The company has also secured $250 million equity purchase facility. Meanwhile, these companies continue to raise more capital, which they intend to use to buy BTC.

Michael Saylor’s Strategy had filed a $4.2 billion STRC offering at the beginning of the month. The company plans to use the net proceeds to buy more BTC. Metaplanet had also earlier announced a $5.4 billion raise, which it intends to use to expand its treasury. The company’s goal is to own 1% of the total Bitcoin supply.

SoSo Value data shows that the Bitcoin ETFs are also actively accumulating more BTC. These funds are on a five-day net inflow streak. During this period, they have bought just over $1 billion in BTC. Their best outing during this period was on August 8, when they took in $403.88 million.

Notably, these Bitcoin ETFs hold $155.02 billion in net assets, which represents 6.48% of Bitcoin’s total market cap. They have also recorded a net inflow of $54.67 billion since they launched last year. The inflows into these funds have continued to act as one of the catalysts for higher BTC prices and are expected to remain that way as the flagship crypto eyes new highs.

At the time of writing, the Bitcoin price is trading at around $119,300, up in the last 24 hours, according to data from CoinMarketCap.

BTC trading at $119,980 on the 1D chart | Source: BTCUSDT on Tradingview.com

BTC trading at $119,980 on the 1D chart | Source: BTCUSDT on Tradingview.comOil prices continued to edge lower this morning following a triangle breakout which could lead to a potential $12 move to the downside.

The International Energy Agency (IEA) announced on Wednesday that it expects oil supply to grow more this year but has reduced its forecast for demand because of weak fuel usage in major economies.

This comes a day after OPEC + released their monthly report yesterday. The OPEC + report saw the group raise its global oil demand forecast in a move that contradicts the IEA forecast today. Thesis is not a surprise as we have seen this diverging outlooks between the two organizations over the last few years.

The International Energy Agency (IEA) has updated its oil market forecasts with several key highlights. Global oil supply is now expected to increase by 2.5 million barrels per day (bpd) in 2025, higher than the previous forecast of a 2.1 million bpd rise, following the latest production hike by OPEC+. In August, global crude oil refining is projected to reach nearly a record high of 85.6 million bpd.

However, the IEA has slightly lowered its demand growth forecasts. The average oil demand growth for 2026 has been revised down to 700,000 bpd from the earlier estimate of 720,000 bpd. Similarly, the 2025 oil demand growth forecast has been trimmed to 680,000 bpd, compared to the previous projection of 700,000 bpd.

The White House said Tuesday that Friday’s Alaska meeting between US President Donald Trump and Russian President Vladimir Putin is meant to be a “listening session” for the president, lowering hopes for a quick Russia-Ukraine ceasefire agreement.

Market participants are already eyeing positive developments from the meeting but either way the meeting could be a catalyst for Oil prices.

Key challenges remain before the talks. Trump has suggested that both sides may need to give up land to end the three-and-a-half-year conflict. A resolution could ease some of the sanction concerns affecting the market. Meanwhile, oil prices have fallen, even though US inflation data yesterday strengthened expectations that the Federal Reserve will cut interest rates in September.

Oil prices are edging lower ahead of the Trump-Putin meeting which could dominate Oil price moves the rest of this week.

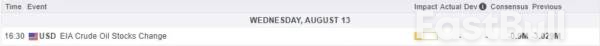

Risk-On sentiment has returned and yet Oil prices continue to struggle. Later in the day we will get another look at inventories data after API numbers were released yesterday.

For all market-moving economic releases and events, see the MarketPulse Economic Calendar. (click to enlarge)

From a technical analysis standpoint, Oil has broken below the triangle pattern and the 200-day MA resting around the 64.73 handle.

The breakout could lead to a long term drop toward the $52 a barrel mark based on the technical setup in play.

The RSI period-14 has yet to enter oversold territory, which hints that further downside could materialize in the days ahead.

Immediate support rests at 60.77 before the psychological 60.00 handle comes into focus.

Looking at the upside, resistance rests at 64.00 before the confluence level around the 64.73 handle comes into focus. Acceptance above this level, a move beyond the 65.00 handle could come into play.

WTI Oil Daily Chart, August 13, 2025

Key points:

Emerging market equities jumped on Wednesday, lifting a key stocks gauge to its highest in nearly four years on hopes the Federal Reserve will trim rates next month.The MSCI global EM equity gaugeCBOE:EFSjumped 1.7%, hitting its highest since Nov. 2021, helped by strong gains in Asian stocks. A similar gauge for currencies edged up 0.3%.

Hong Kong's Hang Seng Indexjumped 2.6%, logging its strongest intraday performance in over three months. South Koreanrose 1.1%, while Indonesian equitiesrose to their highest in nearly 11 months.Thai stocksjumped 1.6% after the central bank cut interest rates by 25 basis points, as expected. The bahtgained marginally.Emerging market currencies rose at the expense of the dollaras Tuesday's tame U.S. inflation data and a recent dismal jobs report cemented expectations of a U.S. interest rate cut next month.

CME FedWatch now pegs the probability of a September cut at 97%, up from about 86% a day earlier and just 57% a month ago."Markets were reassured because the tariff impact on inflation didn't look so obvious this time," Deutsche Bank analysts said in a note.Momentum in central and eastern European stocks and currencies was subdued compared to Asia. Equities in Polandslipped 0.3%, while Romania's stocksinched up 0.4%.

Markets tracked Wednesday's virtual sit‑down between European and Ukrainian leaders and U.S. President Donald Trump before the latter's summit with Russian President Vladimir Putin in Alaska on Friday.The unpredictability of how the summit will play out has fanned European jitters that the two leaders could cut sweeping deals, or strong‑arm Ukraine into accepting a deal that forces it to surrender a significant amount of land.Ukraine's international dollar bonds slipped for the second day."The market seems to be lowering its expectations for the outcome of Friday's talks," said Frantisek Taborsky

"It seems that the market has slightly overestimated the outcome, and the risk is becoming more symmetrical again, but still biased towards losses in case of a collapse in negotiations."Meanwhile, South African equitiesjumped 1.1% to a record high, while the randgained 0.3% JPMorgan said on Tuesday the recently imposed 30% U.S. tariffs on South African exports are expected to have a limited effect on the country's assets, as markets have "largely priced in the reality of higher tariff headwinds".The country's business confidence and retail sales figures are due later in the day.Elsewhere, stocks in Israeljumped 1.8%, recovering from a steep fall in the previous session.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up