Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Dallas Fed New Orders Index (Jan)

U.S. Dallas Fed New Orders Index (Jan)A:--

F: --

P: --

U.S. 2-Year Note Auction Avg. Yield

U.S. 2-Year Note Auction Avg. YieldA:--

F: --

P: --

U.K. BRC Shop Price Index YoY (Jan)

U.K. BRC Shop Price Index YoY (Jan)A:--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Dec)

China, Mainland Industrial Profit YoY (YTD) (Dec)A:--

F: --

P: --

Germany 2-Year Schatz Auction Avg. Yield

Germany 2-Year Schatz Auction Avg. YieldA:--

F: --

P: --

Mexico Trade Balance (Dec)

Mexico Trade Balance (Dec)A:--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Nov)A:--

F: --

U.S. FHFA House Price Index MoM (Nov)

U.S. FHFA House Price Index MoM (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index (Nov)

U.S. FHFA House Price Index (Nov)A:--

F: --

P: --

U.S. FHFA House Price Index YoY (Nov)

U.S. FHFA House Price Index YoY (Nov)A:--

F: --

U.S. S&P/CS 10-City Home Price Index YoY (Nov)

U.S. S&P/CS 10-City Home Price Index YoY (Nov)A:--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Nov)A:--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Nov)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Composite Index (Jan)

U.S. Richmond Fed Manufacturing Composite Index (Jan)A:--

F: --

P: --

U.S. Conference Board Present Situation Index (Jan)

U.S. Conference Board Present Situation Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Expectations Index (Jan)

U.S. Conference Board Consumer Expectations Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Manufacturing Shipments Index (Jan)

U.S. Richmond Fed Manufacturing Shipments Index (Jan)A:--

F: --

P: --

U.S. Richmond Fed Services Revenue Index (Jan)

U.S. Richmond Fed Services Revenue Index (Jan)A:--

F: --

P: --

U.S. Conference Board Consumer Confidence Index (Jan)

U.S. Conference Board Consumer Confidence Index (Jan)A:--

F: --

U.S. 5-Year Note Auction Avg. Yield

U.S. 5-Year Note Auction Avg. YieldA:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil StocksA:--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil StocksA:--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline StocksA:--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil StocksA:--

F: --

P: --

Australia RBA Trimmed Mean CPI YoY (Q4)

Australia RBA Trimmed Mean CPI YoY (Q4)A:--

F: --

P: --

Australia CPI YoY (Q4)

Australia CPI YoY (Q4)A:--

F: --

P: --

Australia CPI QoQ (Q4)

Australia CPI QoQ (Q4)A:--

F: --

P: --

Germany GfK Consumer Confidence Index (SA) (Feb)

Germany GfK Consumer Confidence Index (SA) (Feb)--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. Yield--

F: --

P: --

India Industrial Production Index YoY (Dec)

India Industrial Production Index YoY (Dec)--

F: --

P: --

India Manufacturing Output MoM (Dec)

India Manufacturing Output MoM (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

Canada Overnight Target Rate

Canada Overnight Target Rate--

F: --

P: --

BOC Monetary Policy Report

BOC Monetary Policy Report U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports Changes--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock Changes--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

BOC Press Conference

BOC Press Conference Russia PPI MoM (Dec)

Russia PPI MoM (Dec)--

F: --

P: --

Russia PPI YoY (Dec)

Russia PPI YoY (Dec)--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve Balances--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate Target--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest Rate--

F: --

P: --

Australia Import Price Index YoY (Q4)

Australia Import Price Index YoY (Q4)--

F: --

P: --

Japan Household Consumer Confidence Index (Jan)

Japan Household Consumer Confidence Index (Jan)--

F: --

P: --

Turkey Economic Sentiment Indicator (Jan)

Turkey Economic Sentiment Indicator (Jan)--

F: --

P: --

Euro Zone M3 Money Supply (SA) (Dec)

Euro Zone M3 Money Supply (SA) (Dec)--

F: --

P: --

Euro Zone Private Sector Credit YoY (Dec)

Euro Zone Private Sector Credit YoY (Dec)--

F: --

P: --

Adrian Mer

ID: 4465924

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

ECB is expected to trim rates, but the BoC might pause this time.CPI data also in the spotlight; due in UK, Canada, New Zealand and Japan.Retail sales the main release in the United States.China GDP eyed as Beijing not spared by Trump.

The European Central Bank meets on Thursday to set monetary policy amidst a turbulent time for financial markets as US President Trump’s trade policies continue to wreak havoc. Having already lowered its deposit rate by 150 basis points to 2.50%, the ECB was contemplating a pause in April to assess the impact of the previous easing. But the economic outlook has deteriorated markedly since the beginning of April when Trump launched his reciprocal tariffs, targeting virtually all of America’s trading partners.

Whilst it is too soon to gauge the immediate hit on businesses, the scale of the market fallout suggests investors are in panic mode. For the ECB, the outlook is complicated by German’s massive fiscal stimulus, as it’s uncertain whether this will be enough to cushion the entire Eurozone from Trump’s trade salvos.

Nevertheless, with inflationary pressures across the euro are subsiding once again, playing it safe and cutting rates further is probably the better option for the ECB. Traders are convinced policymakers will lower rates by 25 bps at the April meeting and have priced in further two cuts before the year end.

The dovish expectations haven’t been a huge drag on the euro, however, as the Eurozone’s large trade surplus with the rest of the world has been providing the currency with some safe-haven attributes during this tumultuous period. And with the US dollar coming under pressure again, the euro has jumped above the $1.13 level.

Unless President Christine Lagarde surprises with a very dovish rhetoric in her press briefing, the euro is unlikely to react much. In fact, a greater risk is if Lagarde disappoints the markets by not sounding dovish enough.

On the data front, Germany’s ZEW economic sentiment index will be watched on Tuesday, along with the Eurozone’s final CPI estimate for March on Wednesday.

A day of before the ECB, the Bank of Canada will announce its decision but it’s doubtful if it will cut rates again. The minutes of the BoC’s March meeting revealed that policymakers would have kept rates unchanged at 3.0%, instead of cutting them, had it not been for Trump’s tariffs. Trade tensions have only intensified since the last meeting, but investors see only a 40% chance of a 25-bps reduction.

Canada has obtained a temporary reprieve from the White House, with the 25% tariffs on pause for the goods that fall under the USMCA agreement. Yet, the high degree of uncertainty about what level of duties Canadian exporters will be facing in the months and years ahead is likely to weigh on the economy.

The problem for the BoC, however, is that it’s already slashed rates by a total of 225 bps, and more importantly, CPI readings have started to pick up again. With Canada imposing its own retaliatory tariffs on some US goods, inflation will probably rise further in the coming months.

Hence, investors will be watching Tuesday’s CPI report very closely, as there’s a reasonable chance the BoC may opt for another rate cut the following day.

If that turns out to be the case, the Canadian dollar might suffer a mild pullback against the US dollar.

The pound initially benefited from the dollar’s weakness but as the stock market selloff accelerated, the bulls ran out of steam and cable took a tumble. Aside from the risk-off sentiment and worries about the impact of tariffs on the UK economy, rising gilt yields have also been weighing on sterling as this would make it more difficult for Keir Starmer’s government to respond to an economic slowdown with looser fiscal policy.

The primary strain on sterling, however, is the expectation that the Bank of England will need to reduce rates more aggressively this year amid the worsening outlook. A 25-bps rate cut is 90% priced in for the May meeting, but those expectations could change next week if the incoming employment and CPI data fuel concerns about persisting inflation.

The headline rate of CPI fell more than forecast in February to 2.8% y/y and may ease further in March before edging up again. The CPI report is out on Wednesday, while ahead of that on Tuesday, the latest employment stats will come to the fore. In particular, wage growth will be key for the BoE decision.

Stronger-than-expected numbers could dampen rate cut bets, potentially giving the pound a leg up.

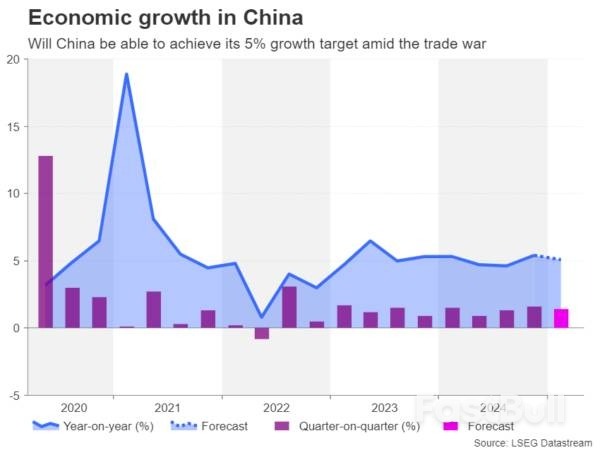

China will publish its latest GDP estimate on Wednesday as it refuses to give in to Trump’s demands for fairer trade treatment, escalating the war. The Chinese economy grew by 5.4% y/y in the fourth quarter of 2024 but is projected to have slowed to 5.1% in Q1.

Industrial production and retail sales numbers for March will also be released on the same day. The data is unlikely to spur much reaction even if there’s a significant surprise either to the downside or upside as investors will be more concerned about how China navigates itself through Trump’s trade storm.

With Chinese exports now being charged 125% levies and US goods facing similar tariffs, trade between the world’s two largest economies could shrink drastically in the coming months. The government may therefore choose to accompany the GDP press conference with a fresh stimulus announcement as it tries to boost domestic consumption to counter Trump’s tariffs.

The Australian dollar would be the biggest beneficiary from any significant stimulus update out of Beijing, as speculation grows about whether or not the Reserve Bank of Australia will cut rates at its next meeting on May 20. A 25-bps rate cut has become fully priced in following the spike in trade frictions and next week’s employment report, due on Thursday, may not necessarily change those bets much.

The New Zealand dollar has also endured quite a bit of volatility since Trump’s reciprocal tariffs were unveiled, as risk-sensitive currencies have been caught between the swings in equity markets, hopes of more stimulus by China, and expectations of steeper domestic rate cuts.

However, the focus for the kiwi on Thursday will be the quarterly CPI prints. The Reserve Bank of New Zealand just trimmed its cash rate to 3.5% and another 25-bps cut is almost fully baked in for the May meeting.

A hotter-than-expected CPI figure could dent those expectations slightly but probably not too significantly.

Staying in the region, Japan will also be publishing CPI numbers. Prior to the market turmoil, the Bank of Japan was expected to deliver nearly two rate increases in 2025. But the odds have now fallen to less than one hike. If the March CPI readings out on Friday show that inflation in Japan is not going to dissipate quickly, the yen could stretch its latest advance against the greenback.

Finally, retail sales figures will be the highlight in the United States where it’s going to be a relatively lighter agenda. Tariff headlines are bound to dominate, however, as the uncertainty sparked by Trump’s erratic decisions is making markets nervous even as he rows back on some of the measures.

Trump’s position on China is in particular focus as neither side appear to be easing up on their defiant stance.

Still, an upbeat retail sales report on Wednesday could lift sentiment on Wall Street and provide support to the US dollar by lessening the risk of a recession.

Retail sales are forecast to have risen by 1.3% m/m in March, compared to a 0.2% increase in the prior month.

Industrial production figures are also due on Wednesday. Other data will include the Empire State manufacturing index on Tuesday, as well as building permits, housing starts and the Philly Fed index on Thursday.

Most Western markets will be shut on Friday for the Easter celebrations.

Fed member Williams has notably addressed tariffs directly, marking a shift in focus. Contrary to expectations, recent Producer Price Index (PPI) figures reflect a decline in investor sentiment. Additionally, the Michigan inflation expectation statistic has surged from 5% to 6.7%, signaling growing concerns among economists.

Williams pointed out that inflation levels are set to rise considerably, with tariffs posing a significant threat to annual economic growth. He stated, “Tariffs will raise inflation this year by 3.5% to 4%. The economy is enveloped in uncertainty, with tariffs and trade playing critical roles in this dynamic.”

Despite the market’s reaction, expectations for interest rate reductions have diminished. Reports indicate that a meeting between the leaders of China and the U.S. is on the horizon. Should they fail to reach an agreement, the resulting uncertainty may lead to a scenario where recession fears overshadow concerns about a depression.

The ramifications of these developments are complex, with experts cautioning against overlooking the interplay of inflation, trade, and interest rates. As the economic landscape continues to evolve, stakeholders must remain vigilant and adaptable to these shifting conditions.

Bitcoin ($BTC) is showing technical signals of an imminent bullish reversal since its momentum indicators are diverging from its current price action. The setup indicates decreasing downward momentum with declining prices, a signal typically monitored to track the changes in market cycles.

As noted in a tweet by Javon Marks, this divergence on the chart of Bitcoin may have the price making a strong move up if supported by any further technical signals. The MACD lines are converging right now, which suggests there could be an impending bullish crossover. Such a crossover would terminate the existing downtrend if confirmed with rising volume and a close above the local high.

The current chart on the BTC/USD depicts a classic divergence condition in which the prices make lower lows but the MACD indicator makes higher lows. Such divergence indicates a weakening in the momentum to the downside, which is usually the precursor to a reversal or a bounce.

On the weekly graph, Bitcoin is still above an enduring ascending trendline that has experienced consistent buying pressure since late 2022. Every price drop to this trendline has witnessed an upside reaction, maintaining the general bullish setup in place.

Stochastic RSI on the weekly chart is in the zone of overselling. The %D and %K lines are both beneath 20 and are set to cross above it soon. This is usually considered a buying signal. The Relative Strength Index (RSI) is steady at 45.89 and indicates neutral momentum with a tendency to recover.

Source : TradingView

Source : TradingViewThe A/D line is rising, which points to ongoing buying pressure even on the recent corrections. The rising A/D line is evidence to support the argument that larger participants are still on the buy side on declines.

Bitcoin is trading at $82,542.35 and is up 2.02% in the past 24 hours. If the price breaks above the recent swing high, an upside move to the upper $80,000s becomes technically achievable. Sustained momentum can put Bitcoin in the position to revisit levels above $90,000 based on market affirmation.

Current technical configurations, ranging from the bullish divergence on MACD to oversold Stoch RSI conditions and price stability against trendline support, put BTC into a pivotal technical position.

The post Bitcoin MACD Divergence Could Trigger Bullish Reversal, Says Analyst appears on Crypto Front News. Visit our website to read more interesting articles about cryptocurrency, blockchain technology, and digital assets.

The milestone serves as a reminder of Bitcoin's sustained relevance and impact on the global financial landscape, provoking diverse reactions from market stakeholders as substantial price fluctuations continue.

Bitcoin, the pioneering cryptocurrency, reached its 15-year milestone, marking a profound influence on the digital finance sector. Introduced by Satoshi Nakamoto, it has consistently demonstrated resilience amidst market volatility.

The cryptocurrency community globally celebrated this milestone, emphasizing the enduring innovation Bitcoin represents. This event reinforces digital currency's role in transforming traditional financial systems worldwide.

Investors expressed mixed outlooks on Bitcoin's future, balancing optimism with caution due to its inherent price spikes. The anniversary serves as a focal point for evaluating blockchain technology's influence on investment strategies.

Bitcoin's maturation points towards increased regulatory scrutiny and financial sector integration.

However, historical trends suggest cyclical market adjustments are commonplace, providing seasoned analysts with ample data to gauge Bitcoin's enduring value.

Comparable to past anniversaries, Bitcoin's 15th year highlighted its speculative nature among investors. Its fluctuating valuation cycles mirror familiar patterns, providing both challenges and opportunities to market participants.

Expert commentary from Kanalcoin indicates that Bitcoin's evolution may signal new investment opportunities. Comprehensive analysis of market trends underscores its capacity for adaptation and sustained influence within the digital currency domain.

Valentin Fournier from BRN noted in a Friday report that the recent drop in inflation could increase the chances of a rate cut at the upcoming Fed meeting in May. This potential shift is seen as a critical factor that could influence both traditional markets and the cryptocurrency sector. Following the inflation report, Bitcoin has been trading well, maintaining levels above $80,000 and recently hovering around $82,300.

However, there are signs of weakness in institutional investments, with a notable capital outflow from spot Bitcoin ETFs over the past six days, suggesting that a robust upward trend has not yet been established. Fournier points to ongoing tariff disputes between the U.S. and China as a contributing factor. Nonetheless, some cryptocurrency funds on Wall Street might still see significant capital inflows soon.

Despite the increased optimism surrounding the cryptocurrency market, experts caution that March’s inflation figures may not significantly alter the Fed’s policy decisions. Ongoing tariff negotiations and global trade tensions are exacerbating economic uncertainty, resulting in a more cautious approach from the Fed. U.S. stock markets and government bonds have faced challenges since week’s beginning, compounded by President Trump’s remarks regarding the bond market’s complexities.

The latest data shows that the yield on U.S. 10-year Treasury bonds has exceeded 4.5%, indicating declining investor confidence. Mike Cahill, CEO of Douro Labs, argues that the prevailing low inflation, alongside a weakening bond market and a temporary tariff freeze, suggests structural instability rather than a clear path to recovery. Amberdata Research President Mike Marshall emphasized that turmoil in the traditional financial sector will continue to exert pressure on the cryptocurrency market over time, particularly with escalating tariffs between the U.S. and China.

Shifts in capital dynamics could mean that cryptocurrencies might soon see renewed interest as investors look for stability amidst turmoil in traditional markets. The coming weeks will be critical in determining how these economic indicators influence both investor sentiment and market strategies in the cryptocurrency space.

“There will be a kerfuffle in the Treasury markets because of all the rules and regulations,” Dimon said Friday on an earnings call. When that happens, the Fed will step in — but not until “they start to panic a little bit,” he added.

Yields, especially on longer-term debt, have jumped this week amid broader market turmoil tied to President Donald Trump’s evolving tariff policy. The moves have raised questions about the debt’s safe haven appeal and stoked fears that hedge funds may be unwinding a pair of popular leveraged trades — one on the price difference between cash Treasuries and futures, and another on the spread between Treasury yields and swap rates.

In March 2020 with Covid engulfing the world, the Treasury market seized up as investors rapidly unwound their positions. The Fed was forced to intervene, pledging to buy trillions of dollars of bonds and providing emergency funding to the repo markets. Dimon said bank rule changes are needed to avoid that happening again.

“When you have a lot of volatile markets and very wide spreads and low liquidity in Treasuries, it affects all other capital markets,” Dimon said. “That’s the reason to do it, not as a favour to the banks.”

One of the speculated changes that Trump administration regulators may pursue is exempting Treasuries from the US banks’ supplementary leverage ratio, allowing firms to buy up more of the debt without a hit to their key capital ratios.

Dimon said the issue is not just with the SLR, and listed a slew of regulations with “deep flaws” that he said required reforms so banks could become more active intermediaries in markets.

“If they do, spreads will come in, there’ll be more active traders,” he said. “If they don’t, the Fed will have to intermediate, which I think is just a bad policy idea.”

The comments build on ones Dimon made this week in his annual shareholder letter. Certain rules treat Treasuries as “far riskier” than they are, he wrote, adding that restrictions on market-making by primary dealers, together with quantitative tightening, will likely lead to much higher volatility in Treasuries.

“These rules effectively discourage banks from acting as intermediaries in the financial markets — and this would be particularly painful at precisely the wrong time: when markets get volatile,” Dimon wrote.

The euro has emerged as a surprising victor in recent market fluctuations, reaching a three-year high against the US dollar as global investors grow increasingly nervous about holding American assets. This remarkable turnaround comes in the wake of President Donald Trump’s new tariff policies, which have triggered significant market turbulence and caused a substantial shift in global investment flows. The euro’s strength has confounded earlier market consensus, which had predicted the currency would weaken below $1 if tariffs were imposed. Instead, the single currency has gained more than 5% against the dollar since April 1, the day before Trump introduced new 10% baseline tariffs on all economies and additional 20% duties specifically targeting the European Union. The currency’s rally has accelerated following Trump’s decision to pause the higher levies for 90 days, fueling the biggest single-day jump in the euro since 2015.

As of 11:13 AM EST on April 11, 2025, the EUR/USD exchange rate stood at 1.1380, representing a daily gain of 1.08%. This follows an even more impressive 2.80% surge on April 10, when the rate closed at 1.1258. The currency pair reached as high as 1.1473 during April 11 trading, marking a substantial rise from its recent low of 1.0732 recorded on March 27, 2025. Over this period, the euro has experienced a remarkable 5.06% jump, with the most dramatic movement occurring between April 9-10 when the euro decisively broke above the psychologically important 1.10 level. This upward momentum builds on gains that started weeks earlier following Germany’s announcement of a massive spending plan, creating a perfect storm of factors supporting the single currency.

The primary driver behind the euro’s unexpected strength is a significant shift in global capital flows. European investors are selling their US assets and bringing money home, with the euro area accounting for the largest share of foreign ownership of US assets by currency. This repatriation pattern is particularly potent given that foreign holdings of US assets had ballooned to $62 trillion in 2024 from just $13 trillion a decade earlier. Unlike traditional safe havens such as the Japanese yen and Swiss franc, the euro typically weakens against the dollar during periods of market stress, making its current performance all the more remarkable. The gap between German and US 10-year bond yields has widened substantially, suggesting growing investor nervousness about US debt. According to ECB policymaker Francois Villeroy de Galhau, Trump’s policies have eroded confidence in the dollar, while some analysts now project the euro could potentially rally to $1.25 if current trends continue.

The euro’s appreciation carries mixed implications for the European economy. On the positive side, increased demand for euro-denominated debt could make it easier for European governments to fund spending initiatives. The stronger euro also provides the European Central Bank with more flexibility to maintain lower interest rates even if tariffs cause inflation to rise. However, analysts warn that becoming a currency of choice could ultimately hurt European exporters who have traditionally benefited from a weaker euro during global economic slowdowns. This concern is particularly relevant as the euro’s strength has been broad-based, hitting a 17-month high versus Britain’s pound and trading around 11-year highs against China’s yuan, pushing it to a record level on a trade-weighted basis. As markets continue to adjust to the new tariff landscape, European policymakers will need to carefully balance these competing economic forces.

The post Euro Surges Against the Dollar Amid Tariff Turbulence appeared first on Tokenist.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up