Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

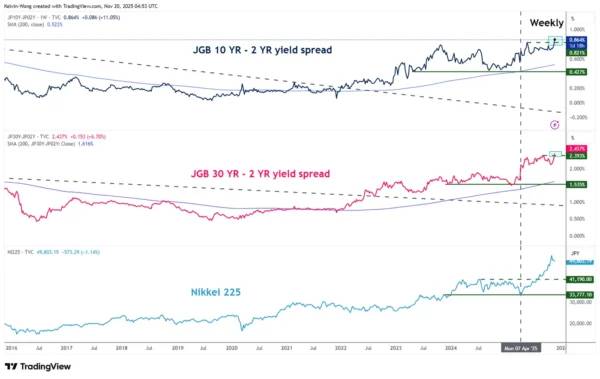

Nikkei 225 remains supported by macro tailwinds, including aggressive fiscal stimulus under PM Takaichi and a renewed steepening in Japan's government bond yield curves, both historically correlated with upside in the index.

Nikkei 225 remains supported by macro tailwinds, including aggressive fiscal stimulus under PM Takaichi and a renewed steepening in Japan's government bond yield curves, both historically correlated with upside in the index.

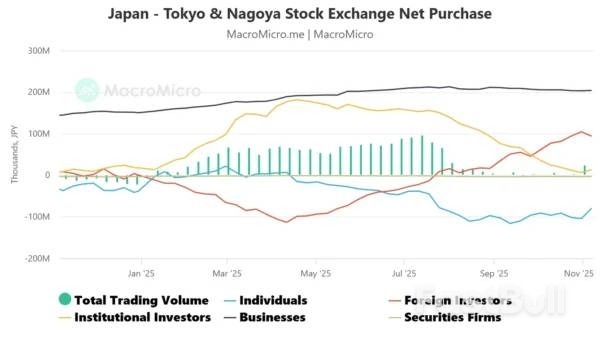

A weakening Japanese yen is attracting stronger foreign inflows, with USD/JPY at a 10-month high and foreign net purchases of Japanese equities trending higher, reinforcing bullish pressure on the Nikkei 225.

Short-term technicals lean positive, with the Japan 225 CFD Index holding above key moving averages and momentum indicators strengthening; a break above 50,730 could unlock the next leg higher towards 51,530 and 52,775/52,830.

The Japan 225 CFD Index (a proxy of the Nikkei 225 futures) has staged the expected minor bullish reversal right at the 49,370/48,450 key inflection support zone as it dropped to an intraday low of 49,099 on 5 November before it rallied by 4.9% to hit an intraday high of 51,514 on 13 November.

Thereafter, it wobbled, erased its earlier gains, and declined by 4.8% to retest the lower limit of the key inflection support at 48,450 on Tuesday, 18 November, on the backdrop of a weaker footing from the US stock market due to fears of overvaluation in Artificial Intelligence (AI)- related stocks.

Interestingly, several localized macro factors remain supportive of the ongoing short- to medium-term bullish trend of the Nikkei 225. Let's examine them in greater detail.

The "Takaichi Trade" is backed in the front seat as market participants turn their attention to focus on the new Japanese Prime Minister Takaichi's push on the implementation of an aggressive fiscal policy and a tilt towards lower interest rates to drive economic growth in Japan.

Takaichi's administration is expected to unveil a new economic package in parliament this week, where the additional supplementary budget for this fiscal year is expected to be at around 20 trillion yen, far bigger than the 13.9 trillion-yen package compiled a year ago by Takaichi's predecessor.

The higher fiscal stimulus is likely to trigger a boost to domestic consumption in Japan as early as the first quarter of 2026, in turn, causing the Japanese Government (JGB) yield curves (both the 10-year and 30-year against 2-year) to steepen further (see Fig. 1).

The 10-year/2-year JGB yield curve has broken above its prior May 2025 high of 0.82% and currently trades at 0.86%, a 13-year high.

In addition, the 30-year/2-year JGB yield curve jumped to a new record high of 2.44% at the time of writing, surpassing the September 2025 peak of 2.39%.

The major bullish breakout (steepening conditions) of the JGB yield curves (both 10-year and 30-year against the 2-year) since June 2022 has a direct correlation with the movements of the Nikkei 225.

Hence, the continuation of a further steepening of the JGB yield curves is likely to trigger another round of a positive feedback loop in the Nikkei 225.

Another "cause and effect" from the "Takaichi Trade" is a weaker JPY, as the Bank of Japan (BoJ) is likely to face an increased risk of jawboning from the new administration in pushing back the gradual interest rate hikes advocated by BoJ's latest monetary policy stance.

The Japanese yen has weakened significantly against the US dollar in the past month, where it shot past 154.00 "easily" to trade at a 10-month low of 157.50 per US dollar at the time of writing.

The USD/JPY has been moving in direct union with the Nikkei 225 since September 2025, where the 20-week rolling correlation coefficient of the USD/JPY with the Nikkei 225 stands at a high value of 0.82 as of 20 November 2025 (see Fig. 2).

In conjunction, the 52-week average of foreign investors' net purchases of Japanese equities listed on the Tokyo and Nagoya stock exchanges has continued to increase from 77.44 billion in the week of 10 October 2025 to 93.98 billion for the week of 7 November 2025 (see Fig. 3).

Hence, a further weakening of the JPY may see a continuation of more foreign inflows to support the bullish trend of the Nikkei 225.

Let's now shift to Nikkei 225's potential share price trajectory from a short-term technical perspective, focusing on the next one to three days.

Bullish bias with 49,085 as key short-term pivotal support for the Japan 225 CFD Index (a proxy of the Nikkei 225 futures).

A clearance above 50,730 (also the 20-day moving average) reinforces the potential bullish impulsive up move sequence to see the next intermediate resistances coming in at 51,530 and 52,775/52,830 next (see Fig. 4).

Failure to hold at the 49,085 key short-term support negates the bullish tone on the Japan 225 CFD Index for a slide to retest the 48,450 key medium-term pivotal support.

NuEnergy Gas Ltd said it had completed drilling for the fourth and final well in its "Early Gas Sales" project under the initial development plan for the Tanjung Enim coalbed methane (CBM) production sharing contract (PSC) in Indonesia.

"Gas shows were observed at surface via surface logging equipment, confirming the presence of methane across multiple seams", the Australian company said in a stock filing.

The TE-B01-003 well, drilled 451 meters (1,479.66 feet) deep, intersected five coal seams at depths ranging between 299 and 419 meters, according to NuEnergy.

"NuEnergy has installed a progressive cavity pump system for the TE-B01-003 well and preparations are now underway to commence dewatering - a key step toward establishing stable gas flow and optimizing well performance", the company said.

"Gas will be gathered at the surface facility and delivered to the gas processing facility upon reaching target production levels".

It added, "Pursuant to the signed heads of agreement with PT Perusahaan Gas Negara Tbk (PGN), gas produced from the drilled wells, TE-B06-001, TE-B06-002, TE-B06-003 well and the TE-B01-003 well, will be delivered via an infield pipeline to PGN's processing and distribution facility".

The Early Gas Sales project will sell one million standard cubic feet a day (MMscfd) to Indonesian state-owned gas distributor PGN, toward the 25-MMscfd initial plan for the Tanjung Enim license, according to NuEnergy. On September 8, it announced approval from the Energy and Mineral Resources Ministry for the one-MMscfd sale through its subsidiary Dart Energy (Tanjung Enim) Pte Ltd (DETE).

"With the gas allocation approval now secured, DETE will proceed with finalizing the Gas Sale and Purchase Agreement with PGN", NuEnergy said then.

Meanwhile the bigger Tanjung Enim Plan of Development (POD) 1 was approved June 2021 "under a gross split scheme which will allow the PSC to proceed field development, surface facility construction and selling of the gas", NuEnergy says on its website. "The approval also represents the first coalbed methane POD in Indonesia".

The 30-year PSC, awarded August 2009, has proven and probable reserves of 215 billion cubic feet (Bcf) and gas in place of 484 Bcf and spans 249.1 square kilometers (96.18 square miles), according to NuEnergy.

The contract area sits about 50 kilometers (31.07 miles) and 130 km from the cities of Prabumulih and Palembang respectively and approximately 35 km from major gas trunk lines, according to NuEnergy.

It operates the license with a 45 percent stake. Indonesia's state-owned oil and gas company PT Pertamina and state-owned coal mining company PT Bukit Asam each own 27.5 percent.

The Federal Reserve Open Market Committee (FOMC) lowered the federal funds rate to a target range of 4.00% to 3.75% in October, despite the government shutdown leaving them with little additional official data since their September decision.

The minutes showed that the committee is still concerned about the impact of tariffs on inflation. Many participants also noted expectations of core goods inflation to pick up over the coming quarters, as tariffs pass through to firms' prices. On the other hand, a few participants did note that productivity gains from AI and automation may help tamp down cost increases. Still, participants seemed to agree that inflation expectations remained well anchored.

On the labor market, participants did comment on the lack of a jobs report for September and reported relying on private-sector estimates and limited government data. Pointing to the available data, including surveys, participants generally viewed the data as consistent with layoffs and hiring both having remained low, and the job market having softened through September and October, but not sharply.

Participants generally judged that "uncertainty about the economic outlook remained elevated", while still noting that inflation had moved up from earlier in the year and remained elevated. Many participants who voted in favor of lowering rates this meeting "could have also supported maintaining the level of the target range".

Critically, participants expressed strongly differing views about what would be appropriate at their December meeting. While most participants seem to favor reducing the policy rate over time, several of those with that view are unconvinced that would be appropriate in December. Many participants suggested that it would likely be appropriate to keep the target range unchanged for the rest of the year given their economic outlook.

The key takeaway from this meeting, and the real surprise, is how strongly FOMC members disagree about what is likely in their December meeting. The recent upticks in inflation and the signs that tariffs are going to start passing through to inflation are eroding some members confidence in the balance of risks, and may be pushing out rate cuts further.

The release of the missing jobs data tomorrow will be critical for the FOMC. The potential for the committee to favor holding rates constant in December rests in part on the assessment of the labor market as softening but not sharply deteriorating. This potentially puts the rate outlook in a "bad news is good news" situation – jobs reports for September and October that confirm the labor market is only softening and not severely weakening will strengthen the case made by some FOMC members in September that a pause in December may be appropriate.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up