Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

After a sharp 5.3% drop last Tuesday, gold found support around $4,000 and entered a consolidation phase. Softening US inflation and market bets on two more rate cuts before year-end have capped further declines, while positive signals from US-China trade talks have weighed on safe-haven demand, limiting gold's upside.

After a sharp 5.3% drop last Tuesday, gold found support around $4,000 and entered a consolidation phase. Softening US inflation and market bets on two more rate cuts before year-end have capped further declines, while positive signals from US-China trade talks have weighed on safe-haven demand, limiting gold's upside.

Looking ahead, the FOMC decision, U.S. Q3 GDP and core PCE data, along with the highly anticipated meeting between Trump and Xi, will be key risk events for gold prices this week.

On the XAUUSD daily chart, gold snapped its nine-week winning streak last week, with heavy profit-taking on Tuesday contributing to a weekly decline of over 3%, though the retreat found support near $4,000.

Since then, bulls and bears have been evenly matched, with long upper and lower wicks reflecting a tug-of-war and no clear directional bias. Near-term upside remains capped by the 5-day EMA, while support comes from the lower boundary of the late-August ascending channel, around the 20-day MA.

If buying pressure strengthens and gold closes back above $4,100, the consolidation high at $4,150 since last Wednesday would be the next resistance level before challenging $4,200.

Conversely, if prices continue to retreat, support at the late-August channel bottom and the $4,000 round number will be key. A breach of these levels could push gold toward the 61.8% Fibonacci retracement of the recent rally, around $3,980.

Despite ongoing US government shutdown risks, elevated fiscal deficits, and persistent geopolitical tensions providing a supportive backdrop, gold's latest boost comes from September US inflation data. Last Friday, core CPI rose 3.0% YoY, below the 3.1% forecast, while core services inflation fell to a cycle low of 3.5%. This cooling trend reinforces market expectations for two more rate cuts this year, supporting non-yielding assets like gold.

At the same time, US-China trade talks in Kuala Lumpur have eased risk sentiment. Bessent confirmed that a "successful framework for leaders" was reached, broadly matching market expectations: China may moderately ease rare earth export controls, while the Trump administration could extend the 90-day tariff pause and withdraw the threat of a 100% additional tariff.

This development lifted sentiment, prompting safe-haven flows to exit gold and shift into risk assets. CME's recent 5.2% increase in gold and silver margins has further restrained short-term buying momentum.

Overall, after dropping from the all-time high of $4,381, gold found temporary support around $4,000 and entered a consolidation phase. While technical profit-taking and easing trade tensions caused short-term volatility, the key drivers for gold's medium- to long-term outlook—Fed rate cut expectations, central bank purchases, and geopolitical safe-haven demand—remain intact.

In my view, near-term upside appears constrained, with gold likely to trade within a neutral to slightly bearish range this week, depending on risk sentiment and key economic developments.

This week features a dense schedule of central bank meetings and key economic data. For gold, the Fed meeting, Powell's speech, Q3 US GDP, and September core PCE data are the main highlights.

With an October rate cut largely priced in, attention will focus on Powell's tone and forward guidance. If he acknowledges the cooling inflation and signals a potential end to balance sheet runoff in the coming months again, expectations for a 25bp cut in December would be reinforced, supporting gold. Conversely, if he emphasizes that tariff effects are still working through the economy and uncertainty remains in policy direction, gold may face pressure.

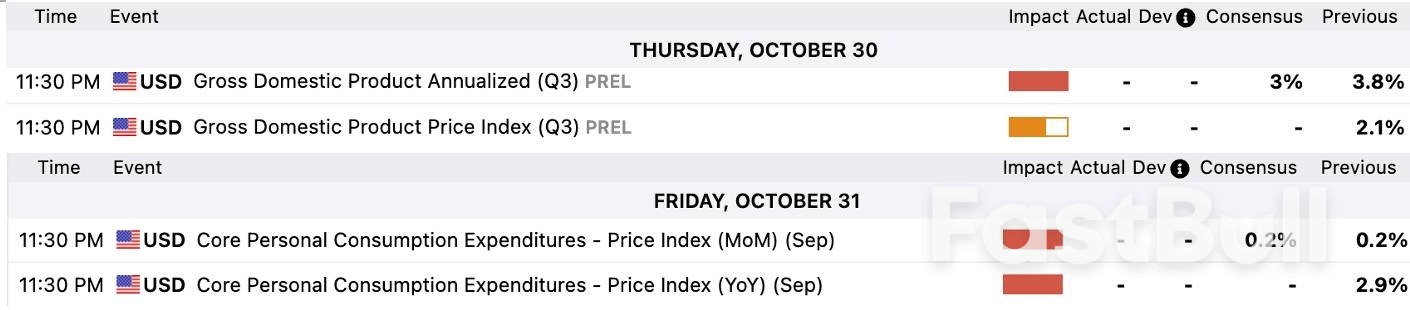

Although GDP and PCE data will be released after the Fed meeting, traders should still watch closely. The consensus is for Q3 US GDP annualized growth to slow to 3.0% (from 3.8%), while September core PCE is expected to remain at 2.9% YoY. Data confirming slowing growth and moderate inflation would further reinforce rate cut expectations, supporting gold.

Beyond short-term data-driven swings, the US-China leaders' meeting at the APEC summit could be a key catalyst for gold's next move. With positive signals already sent from the Kuala Lumpur talks, markets expect the meeting to focus on confirming concession details. As long as both sides avoid escalating tensions, any level of concession will reduce safe-haven demand, posing a short-term headwind for gold.

Poland's Monetary Policy Council can hold off on further interest rate cuts for now to assess the impact of its monetary policy easing, before returning to cuts at the start of next year, said MPC member Ludwik Kotecki.The key rate has fallen by 125 basis points to 4.5% in 2025 and Poland's central bank chief Adam Glapinski said this month he still sees some room to cut rates, but it remains unclear whether such a move would come in November.Kotecki said next month would be a good time to assess Polish economic conditions and the central bank's actions so far. In November, a new inflation projection prepared by the National Bank of Poland will be published.

"For now, before reviewing the November inflation projection, my baseline scenario is that I would wait a while before making another decision to cut interest rates," he told Reuters in an interview."If nothing extraordinary happens, I believe we should resume discussions about interest rate cuts at the beginning of next year, and in the meantime, calmly monitor changes in prices, wages, and other macroeconomic parameters."The inflation projection will show when and how quickly inflation, according to NBP analysts, will reach the target of 2.5%. Although inflation is no longer a macroeconomic problem, it is still not at the target. It is closer to 3% than 2.5%, he said.

In September, inflation in Poland was 2.9% year-on-year, while the central bank's inflation target is 1.5-3.5%.

Kotecki said that if the November projection indicates a faster decline in inflation towards the middle of the central bank's target of 2.5%, it would be an argument for cutting rates in November."However, this hasn't been evident so far, especially in the case of core inflation. Its level has consistently hovered around 3% or slightly above 3%, including in the last projection. The latter also showed that core inflation is not reaching 2.5%," he said."If we want to achieve inflation at the 2.5% target, we should set these rates a bit higher. And this is another reason why I believe we should proceed with restraint," he said.

Nevertheless, he said it was not a question of "if" but "when" to ease rates further."I don't rule out that the key interest rate could be further reduced next year, to as much as 4%, perhaps even slightly below 4%," Kotecki said.

U.S. President Donald Trump said that Washington and Beijing were poised to "come away with" a trade deal ahead of his expected meeting with Chinese leader Xi Jinping.Speaking aboard Air Force One en route to Japan from Malaysia, Trump added that he could sign a final deal on TikTok as early as Thursday."I have a lot of respect for President Xi, and we are going to come away with the deal," Trump said.He began his whirlwind weeklong Asia trip on Sunday with a flurry of trade deals and a peace agreement aimed at strengthening his position before meeting Xi.

During his first stop in Malaysia, Trump signed separate trade and mineral agreements with his Malaysian and Cambodian counterparts, as well as frameworks for trade pacts with Thailand and Vietnam.The four countries, part of an 11-member regional bloc called the Association of Southeast Asian Nations (ASEAN), pledged to remove trade barriers, provide preferential market access to U.S. goods, and increase purchases of American agricultural, energy products, and aircraft.They also agreed to cooperate with Washington on export controls, sanctions and access to critical minerals — commitments that appear to strengthen Trump's standing in a region where Beijing has a growing clout.

Wendy Cutler, senior vice president at Asia Society Policy Institute, said that the agreements focused on "cooperation rather than hard commitments," with many important points "considerably shorter" than prior U.S. trade agreements."The U.S. can impose tariffs or terminate the agreement if it considers Malaysia in violation of commitments," Cutler added.In Japan, Trump is expected to meet Prime Minister Sanae Takaichi and the emperor before flying to South Korea, capping the trip with a of the Asia-Pacific Economic Cooperation, or APEC, summit.

Chinese Premier Li Qiang, who also flew in to Malaysia for the 28th China-ASEAN Summit, stopped by Singapore, where he witnessed the signing of eight agreements covering trade and the digital economy.

But while the diplomatic momentum appeared strong, few details were released about the scope of the new trade frameworks.Under the agreements, Washington will keep a 19% tariff rate on most exports from Malaysia, Cambodia and Thailand, while some products will face no duties, according to joint statements from the White House.Tariffs on Vietnam will remain at 20% with some goods eligible for duty-free access, according to the joint statement. Vietnam, which recorded a trade surplus of $123 billion with the U.S. last year, also pledged to step up purchases of American products to address the trade imbalance.

Malaysia agreed not to impose bans or quotas on U.S.-bound exports of critical minerals and to speed up development of its rare-earth projects needed by American companies.The country, which sits on an estimated 16.1 million tonnes of rare earth deposits, has enforced a nationwide moratorium on the export of unprocessed rare earth materials since last year to develop its downstream industries and prevent resource exploitation.

Thailand will ease tariff barriers on U.S. goods by accepting some American-made vehicles, medical devices and pharmaceuticals, and by importing ethanol for fuel. It also pledged to relax foreign ownership restrictions for U.S. investors in the telecommunications sector.The agreements left open the possibility of additional product exemptions to be decided later, said Michael Wan, economist at MUFG Bank. He noted that sectoral tariffs on pharmaceuticals and electronics would remain key, as would questions over the legality of Trump's use of an emergency powers law to impose them.

Aside from trade agreements, Trump announced the formalization of an extended truce between Thailand and Cambodia, building on a ceasefire that he brokered in July following their violent border clashes this summer.Trump, who has cast himself as a global peace broker, said the deal showed his administration has done "something that a lot of people said couldn't be done, and we saved maybe millions of lives.""My administration immediately began working to prevent the conflict from escalating," Trump said. "Everybody was sort of amazed that we got it done so quickly."

As Trump mingled with other leaders, U.S. and Chinese negotiators met on the sidelines of the ASEAN summit, where the bilateral talks yielded a framework ahead of an expected meeting between Trump and Xi in South Korea on Thursday."Markets are increasingly getting used to a 'punch-first, negotiate-second' tariffs overture," said John Woods, chief investment officer at Lombard Odier.Chinese top trade negotiator Li Chenggang said Sunday that a preliminary consensus had been reached after "very intense discussions" on a range of issues, including export controls, fentanyl and shipping fees.

The next step, he said, was for both sides to complete their domestic approval procedures.In an interview with CBS on Sunday, U.S. Treasury Secretary Scott Bessent said that Trump's threat of 100% tariffs is "effectively off the table" after a "very good two-day meeting" with Chinese officials.Speaking separately to ABC News' "This Week," Bessent said the negotiations produced a "substantial framework" that could ease concerns among American soybean farmers over China's boycott.

China bought more than half of U.S. soybeans in 2023 and 2024, accounting for nearly $12.8 billion in 2024. But Beijing halted purchases earlier this year after Trump ignited a trade war.Bessent also told ABC News that he expected China to delay its rare earth export controls, set to take effect in the coming weeks, by one year. Trump and Xi could "consummate" a deal to allow TikTok to continue to operate in the U.S., Bessent added.

"We believe both sides, after testing the other's boundaries, will likely make concessions again," said Ting Lu, China economist at Nomura, who expects the additional 100% tariffs on Chinese goods will "surely not be implemented" with both sides likely to extend the existing tariff truce.In return, Lu added, Beijing may resume purchases of U.S. soybeans and ease the enforcement of its rare earth export controls.

Key Takeaways:

Gold prices have stalled, while Bitcoin's momentum increases as the BTC/gold ratio surges ahead of anticipated U.S. Federal Reserve announcements, reflecting renewed risk appetite in financial markets.

This event highlights a shift towards Bitcoin at risk-on points, affecting capital allocations and potentially influencing crypto and gold markets as investors anticipate Federal policy changes.

Gold's recent price pause coincides with renewed momentum in Bitcoin, as the BTC/gold ratio surges. This occurs amidst revived risk appetite ahead of expected U.S. Federal Reserve announcements. The Federal Reserve's policies often influence market dynamics.

Bitcoin currently trades at $111,641.73, while gold stands at $4,113.45 per ounce. This marks a record high in the BTC/gold ratio, approaching 27:1. Increased institutional allocations to Bitcoin ETFs reflect a shift in investment strategies.

The market impact is significant, with Bitcoin outperforming gold dramatically over the past five years by 756.7% compared to gold's 116.2% return. Risk-on capital has shifted away from gold in favor of BTC, influencing market trends.

Institutional investments lean towards Bitcoin amid dovish Federal Reserve expectations, reducing demand for gold-backed products. Official ETF flows corroborate this trend, showcasing a financial shift towards more volatile assets.

The BTC/gold ratio has not prompted direct comments from major industry figures like Michael Saylor or Cathie Wood. Historically, Bitcoin exhibits speculative tendencies, while gold maintains its position as a safe haven asset. "The recent uptick in the BTC/gold ratio illustrates not just a change in asset preference but also an evolving market strategy leading into Fed Week," said Alice Brown, Cryptocurrency Analyst, Market Trends Inc.

Potential outcomes include continued Bitcoin dominance in the face of speculative inflows contrasted with gold's stable conservative demand. Historical precedents highlight moments where both assets diverged significantly in market behavior during crisis and risk-on phases.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up