Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

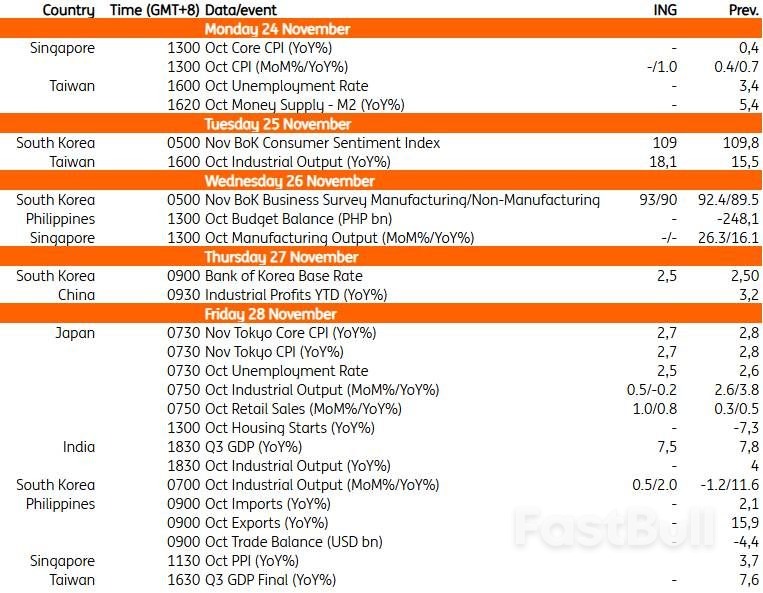

South Korea: BOK to stand pat, while industrial production continues growing The Bank of Korea will likely keep the policy rate

The Bank of Korea will likely keep the policy rate at 2.50% on Thursday for another month, with a minor dissent vote expected. The Bank of Korea is likely to prioritise concerns about financial instability over inflation. Given no clear signs that housing prices have settled and the FX market remains volatile, the BoK has reason to keep rates unchanged. Also Thursday, the BoK releases its outlook report. Amid easing trade tensions and a stronger-than-anticipated semiconductor cycle, we believe the BoK will revise up its 2025 GDP forecast to 1.1% from 0.8% and its 2026 forecast to 1.9% from 1.6%. A GDP outlook below 2% is likely to support the BoK's continued easing policy stance. The recent hike in KTB yields reflected Governor Rhee's hawkish remarks - signalling a possible change of policy direction - during an earlier media interview. We think his remarks at press conference should be more balanced and highlight that policy decisions are data-dependent.

Industrial production is forecasted to increase for a second consecutive month, driven by strong chip output. The longer-than-expected Chuseok holiday, combined with the 2nd cash payout program, should boost service activity.

China's industrial profits data, out Thursday, will round out the month's data releases. The data has been showing signs of improvement in the past few months, with profits so far up 3.2% YoY, year-to-date, through September, thanks to two straight months of YoY profit growth above 20% in August and September. This was boosted by a supportive base effect. Support from this effect should gradually wane in the 4Q data, but be enough to keep profit growth solidly positive in October. The industries that have been seeing strong export demand such as rail, ships, and aerospace, computers, communication, other electronic equipment manufacturing, and electrical machinery & equipment manufacturing have generally been outperformers so far this year. This trend should continue.

Tokyo's consumer price index inflation is expected to rise 2.7% YoY in November, supported by solid wage gains. The weaker JPY probably added upward pressure. Industrial production will likely remain positive following Japan's trade agreement with the US. Despite a contraction in the third quarter, recent data suggest an economic recovery, supporting the Bank of Japan's continued policy normalisation. Market expectations for a December rate hike have fallen sharply over the week. We believe that recent BoJ comments indicate at least three board members support a more hawkish stance. However, it remains unclear if others will agree. We continue to forecast a rate hike in December, though the likelihood of a delay to January is rising.

We expect Taiwan's industrial production data, out Tuesday, to continue its streak of strong growth, accelerating slightly to 18.1% YoY. Strength has been quite heavily concentrated in the Information & Electronic Industries and remains vulnerable to a downturn if demand in this sector slows. While market debate on this possibility has increased recently, we do not yet see it affecting the October data.

We expect India's GDP growth in the third quarter to slow down modestly to 7.5% YoY. Export growth began to slow in 3Q due to the impact of 50% tariffs on US exports. But private consumption growth remained relatively strong, driven by GST rate cuts and the consequent boost in consumer goods purchases.

Transport operator ComfortDelGro on Nov 20 announced senior leadership changes, which included the creation of a new "point-to-point mobility officer" role.

Derek Koh will step down from his role as chief financial officer (CFO) in 2026, and retire at the end of March. He will also give up his two other senior roles – as deputy chief executive officer and chief corporate services officer.

Having spent seven years in his roles, he will next assume an advisory role, to aid in the transition and ensure "continuity of strategic initiatives", said the company in a bourse filing.

Stepping into Mr Koh's CFO role would be the current group deputy CFO, Christopher David White.

Mr White, who has more than two decades of experience in finance, has been with ComfortDelGro since 2019, overseeing group-level financial governance, performance management and integration of international finance operations. He is concurrently the group head of investor relations.

The newly created role of group chief point-to-point mobility officer will be filled by Liam Griffin, who has been the group's current head of point-to-point mobility in the UK. Mr Griffin is also chief executive officer of ComfortDelgro's London subsidiary, Addison Lee.

ComfortDelGro chairman Mark Greaves said: "The board views these forward-looking appointments as essential to the ongoing evolution of the group as a leading global multi-modal mobility operator."

He added that these internal appointments enable "continuity" and provide the necessary structure to advance the group's future growth plans.

Shares of ComfortDelGro fell 1.4 per cent or two cents to $1.45 as at 10.57am on Nov 21, after the announcement. The Straits Times Index was down 0.9 per cent.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up