Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

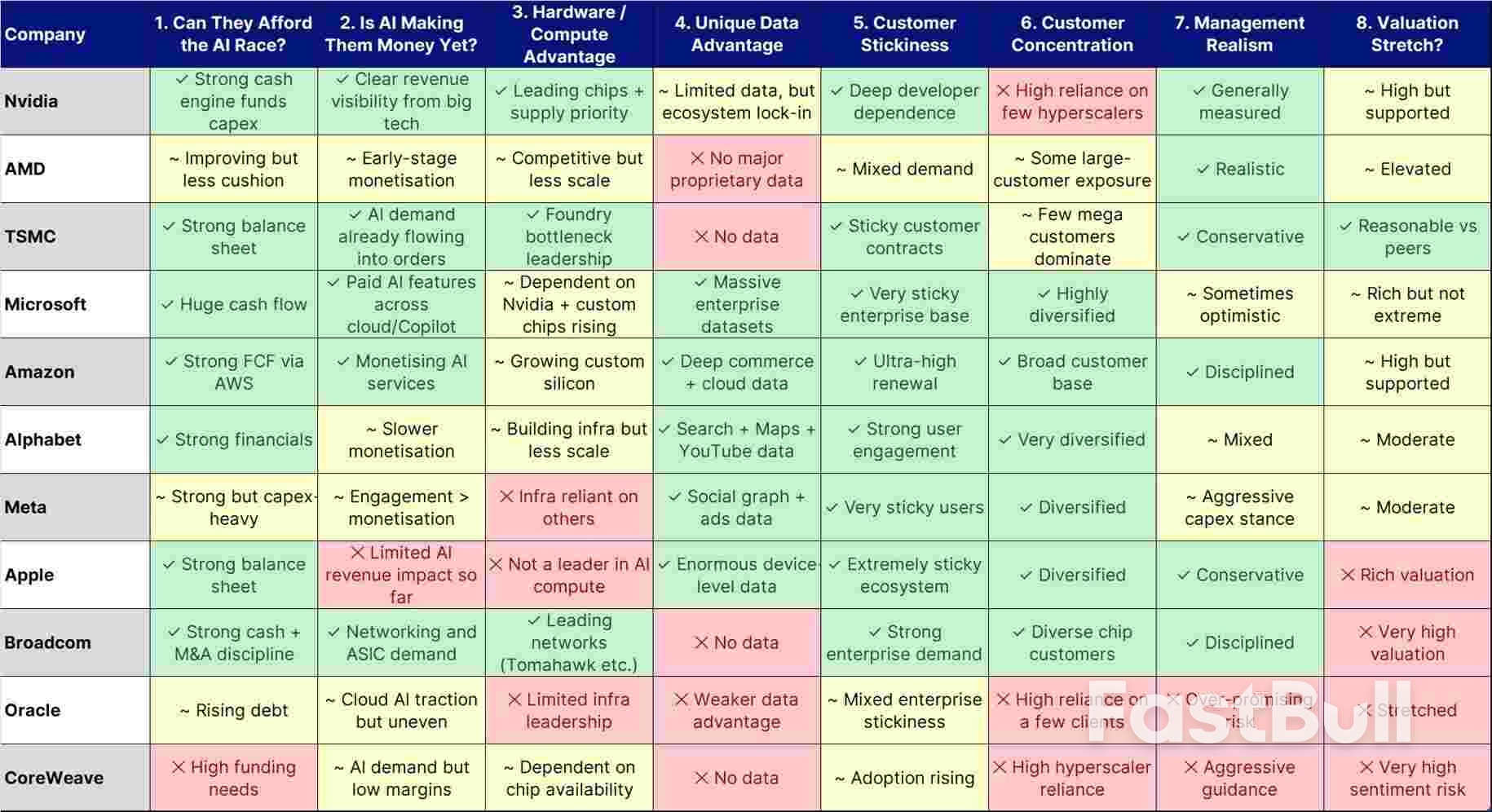

In our view, AI remains one of the most powerful forces reshaping markets, but the tone is changing.

Key points:

In our view, AI remains one of the most powerful forces reshaping markets, but the tone is changing. Strong earnings from leading chipmakers e.g., Nvidia's Q3 FY2026 revenue grew 62% YoY (Source: Nvidia Investor Relations) reassure investors that demand is real, yet the sharp swings in market reaction show that enthusiasm now sits alongside questions around sustainability, profitability, and execution.

The broad "everything goes up" phase of the AI trade is fading. What replaces it is a more nuanced market: one that rewards fundamentals over narratives.

Investors now face a key challenge of understanding which companies have the financial and operational strength to compete through cycles. That will potentially help them to separate the durable players from those caught up in the momentum.

Below is a simplified but strategically meaningful framework that could be used to decode the AI ecosystem.

1. Can the company afford the AI race?

Why it matters: AI is extremely capital-intensive. Companies investing in chips, power, and data centres need financial strength to survive both growth phases and volatility.

What to look for:

Risks: Heavy borrowing or negative cash flow may amplify volatility.

2. Is AI already adding to revenue?

Why it matters: Investors are becoming more selective; they want to see AI adding real business value, not just product demos.

What to look for:

Risks: Companies that invest ahead of monetisation may face margin pressure.

3. Does the company have infrastructure advantage?

Why it matters: AI needs chips, land, power, cooling, and network bandwidth. Access to scarce infrastructure is becoming a major competitive edge.

What to look for:

Risks: Delays due to power shortages or supply constraints.

4. Does the company control unique data?

Why it matters: As models get more similar, proprietary data becomes the true differentiator.

What to look for:

Risks: Companies relying on public data face weaker defensibility.

5. Are customers staying and using more?

Why it matters: Sticky customers create recurring revenue and lower the risk of AI investments not paying off.What to look for:

Risks: Churn or weak engagement can quickly erode the AI narrative.

6. How dependent is the company on a few large customers?

Why it matters: Many AI suppliers — especially in chips, cloud infrastructure, and data-centre services — rely heavily on a small number of hyperscalers. When 20–50% of revenue comes from one or two clients, even a slight pause in spending can create sudden earnings volatility.

What to look for:

Risks: Revenue may fall sharply if a major customer delays capex, shifts to an in-house solution, renegotiates pricing, or reduces reliance on the company's AI infrastructure.

7. Is management realistic about AI timelines?

Why it matters: Markets are punishing over-promising and rewarding measured execution.

What to look for:

Risks: Missed timelines or shifting goalposts raise credibility concerns.

8. Is the valuation pricing in too much perfection?

Why it matters: Elevated expectations increase volatility, especially in an environment where interest rates may stay higher for longer.

What to look for:

Risks: Stocks with perfection priced in can fall sharply on small disappointments.

Illustrative only. Not investment advice.Reasoning is simplified to help investors understand strengths and risks.

Source: Saxo

Source: SaxoWhile AI is clearly transforming industries and driving a multi-year investment cycle, in our opinion the next stage of this cycle may reward companies that balance ambition with financial strength, operational execution and diversified demand.

This 8-factor checklist gives investors a simple, structured framework to evaluate AI stocks, acknowledging both the potential upside and the meaningful risks.

Singapore's inflation rate climbed for a second straight month, year on year, with price growth in October hitting a near 1-year high and topping analysts' expectations.

After hitting a four-year low in August, consumer prices rose 1.2% — highest since August 2024 — compared with the average 0.9% estimated by economists polled by Reuters and the 0.7% rise in September.

Core inflation in the city-state — which strips out prices of accommodation and private transport — also rose to 1.2%, up from 0.4% and compared with the 0.7% expected in the Reuters poll.

On a month-on-month basis, the consumer price index was flat, with core inflation coming at 0.5% compared to the prior month.

Inflation data comes as Singapore on Friday sharply upgraded its economic growth forecast to 4% from 1.5%-2.5%, as it posted robust third-quarter GDP numbers.

The economy grew 4.2% in the third quarter from a year earlier, beating estimates and extending the second quarter's 4.7% expansion. Singapore's Ministry of Trade and Industry said that global economic conditions had turned out more resilient than expected, but warned that growth would likely cool in 2026 as U.S. tariffs weigh on global demand.

Singapore's exports to the U.S. are subject to a 10% baseline tariff, despite the country having a trade deficit with the U.S. and also a free trade agreement going back to 2004.

The country's economy is hugely dependent on trade, with World Bank data showing that Singapore has a trade-to-GDP ratio of over 320% in 2024.

In the third quarter, Singapore recorded a 3.3% fall in non-oil domestic exports, or NODX, year on year, dragged by weaker pharmaceutical and petrochemical exports.

In October though, NODX surged 22.2% compared to a year earlier, driven by exports of non-monetary gold and electronic products.

The Monetary Authority of Singapore has forecast inflation around 0.5% to 1% for 2025.

The MAS held monetary policy unchanged in its October meeting, saying that Singapore's economic growth had been stronger than expected.

South African police on Sunday confirmed they are investigating claims that Duduzile Zuma-Sambudla, daughter of former President Jacob Zuma, and two others conned 17 men into fighting for Russia in Ukraine.

Another of Zuma's daughters, Nkosazana Bongamini Zuma-Mncube, accused her stepsister of sending the men to Russia before they were ordered to the front lines.

"These men were lured to Russia under false pretenses and handed to a Russian mercenary group to fight in the Ukraine war without their knowledge or consent. Among these 17 men are eight of my family members," Zuma-Mncube said in a public statement.

Earlier this month, President Cyril Ramaphosa's office said it "received distress calls for assistance to return home from 17 South African men, ages 20 to 39, who are trapped in the war-torn Donbas."

Zuma-Sambudla, who is also a member of parliament for her father's uMkhonto weSizwe party (MK), did not immediately respond to the accusations.

She reportedly told the men they would train as bodyguards to work for the party.

On November 6, the South African Presidency said in a statement that the men were promised "lucrative employment contracts." Ramaphosa ordered an inquiry into how the men were recruited.

South African law prohibits citizens from fighting for foreign armies without government authorization.

Zuma-Mncube urged the government "to expedite all diplomatic efforts to secure the immediate and safe return of our citizens."

The latest police investigation comes as Zuma-Sambudla is already on trial for allegedly inciting violence during riots in 2021 that left more than 300 people dead.

The unrest broke out in July 2021 after her father was arrested for disobeying a court order to testify at a corruption inquiry, and it morphed into widespread looting.

Zuma-Sambudla has consistently voiced strong support for her father, former president Jacob Zuma [FILE: December 16, 2023]Image: Themba Hadebe/AP Photo/picture alliance

Zuma-Sambudla has consistently voiced strong support for her father, former president Jacob Zuma [FILE: December 16, 2023]Image: Themba Hadebe/AP Photo/picture allianceShe pleaded not guilty to the charge during a hearing in early November attended by Zuma.

He was South Africa's president from 2009 to 2018.

MK was a major disruptor in last year's national election, contributing to a sharp drop in support for the African National Congress, which Zuma once led.

The World Bank lifted Kenya's economic growth forecast for this year to almost 5% on Monday, citing a pick up in the construction sector in East Africa's largest economy.

Some of Kenya's main industries like construction suffered last year, partly as concerns mounted about the government's finances, but the trend has begun to reverse, the development lender said.

"Signs of recovery are emerging," a new report on Kenya's economy said, adding that the rebound in construction in the first half of 2025 had offset a slowdown in manufacturing.

The result is that the economy is now projected to grow by 4.9% this year, up from the World Bank's May forecast of 4.5%, and maintain that rate of growth over the next two years.

Risks to the outlook stem from international trade uncertainty, including the expiry of a U.S. trade deal with the region, and ongoing fiscal consolidation that could curb government spending, the report said.

Government officials say Kenya's economic expansion has also been negatively affected by a heavy public debt burden characterised by high annual repayments that have absorbed much of its revenue.

The government has turned to measures like loans securitised on a motorists' road maintenance levy on petrol prices to raise funds to pay road contractors who had abandoned sites last year due to lack of payment.

It is also in talks with the International Monetary Fund to secure a new financial support programme. Differences remain, however, including over whether the securitised borrowing should be classified as government debt or not.

Monday's World Bank report laid out a set of reforms the government should carry out to boost competition and support investment and economic growth.

Barriers to competition include the presence of more than 200 state owned firms that benefit from undue advantages, distorting competition, and restrictions on foreign investments, it said.

"There is significant room to make Kenya's regulatory framework less restrictive to competition," the lender said.

The United States and Ukraine were set to continue work on Monday on a plan to end the war with Russia after agreeing to modify an earlier proposal that was widely seen as too favorable to Moscow.

The two sides said in a joint statement they had drafted a "refined peace framework" after talks in Geneva on Sunday, although they did not provide specifics.

The White House separately said the Ukrainian delegation had told them it "reflects their national interests" and "addresses their core strategic requirements," although Kyiv did not issue a statement of its own.

It was not clear how the updated plan would handle a host of issues, including how to guarantee Ukraine's security against ongoing threats from Russia. The United States and Ukraine said they would continue "intensive work" ahead of a Thursday deadline, although U.S. Secretary of State Marco Rubio, who led the American delegation during the talks, was flying back to Washington late on Sunday.

U.S. President Donald Trump has kept up the pressure on Ukraine to reach a deal. On Sunday, he said Ukraine had shown "zero gratitude" for American efforts over the war, prompting Ukrainian officials to emphasize their thanks for Trump's support.

Trump previously set a Thursday deadline for Ukrainian President Volodymyr Zelenskiy to accept a peace plan, but Rubio said on Sunday that deadline might not be set in stone.

Zelenskiy could travel to the United States as soon as this week to discuss the most sensitive aspects of the plan with Trump, according to sources familiar with the matter.

The initial 28-point proposal put forth by the United States last week called on Ukraine to cede territory, accept limits on its military and abandon its ambitions to join NATO. Those terms would amount to capitulation for many Ukrainians after nearly four years of fighting in Europe's deadliest conflict since World War II.

The original plan came as a surprise to U.S. officials across the administration, and two sources said it was crafted at an October meeting in Miami that included special envoy Steve Witkoff, Trump's son-in-law Jared Kushner, and Kirill Dmitriev, a Russian envoy who is under U.S. sanctions.

Democratic lawmakers have criticized it as essentially a Russian wish list, but Rubio has insisted that Washington authored the plan with input from both sides in the war.

European allies said they were not involved in crafting the original plan, and they released a counter-proposal on Sunday that would ease some of the proposed territorial concessions and include a NATO-style security guarantee from the United States for Ukraine if it is attacked.

The talks come as Russia has slowly gained ground in some regions, while Ukraine's power and gas facilities have been pummeled by drone and missile attacks, leaving millions of people without water, heating and power for hours each day.

Zelenskiy has also been under pressure at home, as a major corruption scandal has ensnared some of his ministers, stirring fresh anger at pervasive graft. That has complicated the country's efforts to secure funding to keep its economy afloat.

Kyiv had taken heart in recent weeks after the United States tightened on Russia's oil sector, the main source of funding for the war, while its own long-range drone and missile strikes have caused considerable damage to the industry.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up