Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

China, Mainland CPI MoM (Nov)

China, Mainland CPI MoM (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

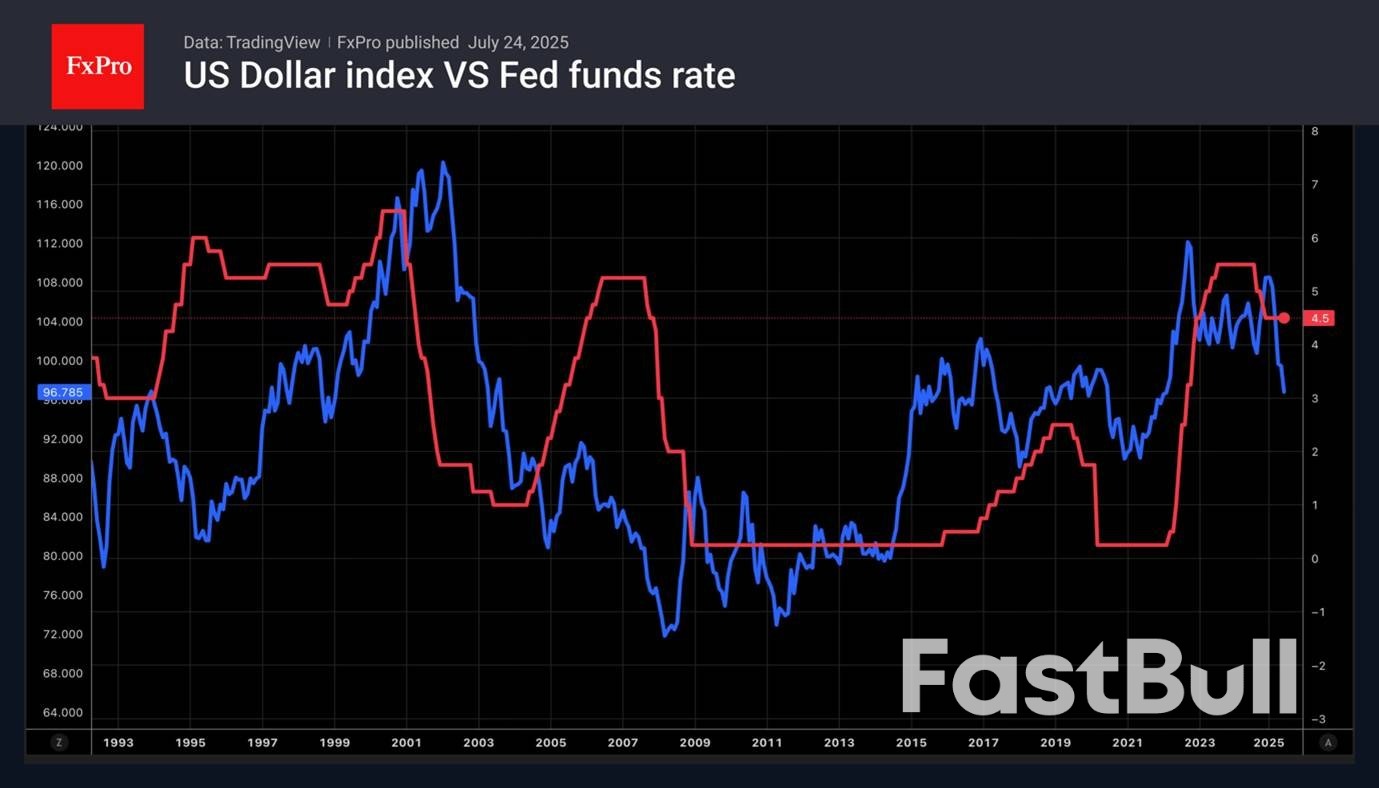

The reduction in trade uncertainty between the US and EU increases risk appetite. The Fed may ease monetary policy sooner, leading to a fall in the USD and positive outlook for stock indices.

The US has signed agreements with Japan, Indonesia and the Philippines. Tariffs range from 15% to 19%. Tokyo has secured a reduction in import duties on cars from Washington from 25% to 15%. Looking at this deal, the European Union also wants to get 15% tariffs. Brussels does not intend to activate the anti-coercion mechanism and respond with reciprocal duties of €100 billion.

The reduced risk of a large-scale trade war between the US and the EU is increasing global risk appetite and putting pressure on the US dollar as a safe-haven asset. At the same time, the reduction in trade uncertainty is giving the Fed a free hand to ease monetary policy. A sharp cut in the federal funds rate may happen sooner than expected, contributing to the dollar’s decline.

The futures market expects an acceleration of easing in 2026 due to Jerome Powell’s departure from the Fed chair. Donald Trump should choose the nominee, and obviously, it will be a very dovish person who aligns with the president’s opinion. Recently, he demanded that the Fed cut rates by 300 basis points.

The US economy is not falling off a cliff since trade deals are reducing uncertainty. The Fed is moving towards easing monetary policy, and corporate earnings are positive. What else do stock indices need for a rally? The S&P 500 continues to break historical highs and eagerly awaits data from the so-called Magnificent Seven. Analysts expect those companies to report 14% profit growth compared to just 3% growth for the other 493 companies in the broad stock index.

So far, actual data for the second quarter has been better for 83% of reporting issuers. The average for the last 5 and 10 years is 78% and 75%, respectively. A weak dollar supports the S&P 500. Due to the enormous size of the US domestic market, only 13% of corporate profits come from abroad. Companies included in the broad stock index are more international. For Goldman Sachs, for example, the figure is 28%.

How long will the euphoria last? If tariffs push the US economy toward stagflation, corporate earnings will fall, and the S&P 500 will slide.

On July 25, the digital asset company declared that it would use some of the funds to pursue business expansion into other regions across the globe. According to a document issued by Macquarie Capital Limited, the firm has entered a placing and subscription agreement that is expected to generate HK$2,355.03 million or approximately $300 million.

OSL intends to use 50% of the funds to support the exchange’s strategic acquisition initiatives, indicating that the firm plans to purchase more companies outside of its own financial Group. Another 20% will be used to support other corporate needs. Meanwhile, 30% of the funds or approximately HK$700.83 million will be allocated for global expansion plans and a new business strategy.

This new business strategy will involve payment and stablecoin initiatives. It comes just a few days before Hong Kong’s first stablecoin act will come into effect on August 1. The region is gearing up to become the next digital-asset hub by offering crypto licenses to firms that plan to issue HKD-pegged stablecoins.

Although it is still unknown whether the firm has plans to register for a stablecoin issuer license, joining a list of regional companies like JD.com and Animoca Group’s joint partnership with Standard Chartered and Telecom, the exchange’s executive has hinted at expansions into stablecoin payment through the global expansion.In an interview with Bloomberg, chief financial officer of the publicly-listed OSL Group, Ivan Wong said that the regulatory environment in Hong Kong has made the firm more certain in its plans to expand its business reach beyond the borders, particularly in terms of stablecoins.

“The funding will accelerate our global buildout — particularly in regulated stablecoin infrastructure and compliant payment rails,” said Wong in his statement.According to OSL’s observations, Wong stated that there is “strong participation from Asian and international financial institutions and investors,” specifically in the growing adoption of digital assets. Some of the joiners even include sovereign wealth funds and large hedge funds.

Bitcoin experienced a sharp decline, dropping below $115,000 for the first time in nearly two weeks after briefly flirting with the $120,000 mark.

Just a day after flirting with the $120,000 mark, bitcoin ( BTC) experienced a swift descent, plummeting below $115,000 — a level not seen in nearly two weeks. Bitstamp data painted a picture of the volatility, showing the flagship cryptocurrency briefly nose-diving to $114,518 at 2:45 a.m. EDT on July 25. While BTC managed to stage a recovery and initially seemed to find a tenuous foothold just above $115,000, it later showed renewed strength, climbing back to $116,000.

However, BTC’s approximately 2% dip in the top cryptocurrency over 24 hours triggered the liquidation of over $140 million in long positions. Coinglass data revealed that liquidated bitcoin ( BTC) long positions alone constituted nearly half of the $382 million in total long positions that were obliterated within a 24-hour window.

Meanwhile, XRP, having already stumbled from its recent all-time high of $3.40, seemingly continued its freefall. The digital asset briefly breached the critical $3.00 psychological barrier before a modest rebound saw it clamber back to trade above $3.12. This decline for XRP triggered a fresh wave of despair for traders, with over $16.45 million in long positions being liquidated within 24 hours. Since July 21, XRP has now shed more than 10% of its value, making it one of the most significant droppers in the past seven days.

The story was similar solana, which declined by 2.8%, while DOGE was down 2.3% during the same window. Ethereum ( ETH), on the other hand, was up nearly 2% while BNB, which recently hit a new all-time high of $808, was up by 0.9% making it one of the few outliers.

At the time of writing, Coinglass data from 5:00 a.m. on July 25 indicated that some 142,437 traders had been liquidated in the past 24 hours, with total liquidations reaching $531.69 million. Liquidated long positions accounted for just over 70% ($382.88 million) of all wiped-out positions.

Russia's central bank lowered its key interest rate for a second straight meeting amid mounting signs of a sharp slowdown in economic activity following two years of rapid expansion driven by government spending on the war in Ukraine.

The Bank of Russia cut its key rate to 18% from 20% on Friday, having lowered borrowing costs in early June for the first time since 2022. That was a larger cut than investors had expected.

"Current inflationary pressures, including underlying ones, are declining faster than previously forecast," the central bank said in a statement. "Domestic demand growth is slowing."

The central bank is moving to ease the restraints it placed on activity at a time when there are mounting signs that Russia's economy has stalled as President Vladimir Putin continues to devote men and materiel to his war in Ukraine, now well into its fourth year.

The economy contracted in the three months through March, the first decline in output since immediately following the full-scale invasion of Ukraine in February 2022. The central bank said recent data point to a further slowdown in the second quarter.

Russia's manufacturing sector has continued to falter, with a June survey of purchasing managers pointing to the third decline in activity in four months, and the sharpest since March 2022.

In new forecasts, the Bank of Russia said it expects the economy to grow by between 1% and 2% this year, having expanded by 4.3% in 2024. It expects to see even slower growth in 2026.

The slowdown has in large part been driven by the central bank, which lifted its key rate to a peak of 21% by late 2024 from 7.5% in mid-2023 as high levels of military spending sent prices surging. In essence, the central bank cooled demand in the rest of the economy to offset the increase in demand related to the war.

The Bank of Russia said it will keep its key interest rate "tight" for "a long period," indicating that it expects to have to continue to restrain activity in order to reach its 4% inflation target. The central bank forecast that will happen in 2027, with prices having risen by 9.4% in the year through June.

Key points:

Iran pushed back on Friday on suggestions of extending a U.N. resolution that ratifies a 2015 nuclear deal as it began the first face-to-face talks with Western powers since Israel and the U.S. bombed it last month.Delegations fromIran,the European Union and the so-called E3 group of France, Britain and Germany, arrived for talks at the Iranian consulate in Istanbul.

The European countries, along with China and Russia, are the remaining parties to a 2015 deal - from which the U.S. withdrew in 2018 - that lifted sanctions on Iran in return for restrictions on its nuclear programme.A deadline of Oct. 18 is fast approaching when the resolution governing that deal expires .

At that point, all U.N. sanctions on Iran will be lifted unless a "snapback" mechanism is triggered at least 30 days before. This would automatically reimpose those sanctions, which target sectors from hydrocarbons to banking and defence.To give time for this to happen, the E3 have set a deadline of the end of August to revive diplomacy. Diplomats say they want Iran to take concrete steps to convince them to extend the deadline by up to six months.

Iran would need to make commitments on key issues including eventual talks with Washington, full cooperation with the International Atomic Energy Agency, and accounting for 400 kg (880 pounds) of near-weapons grade highly enriched uranium, whose whereabouts are unknown since last month's strikes.

Minutes before the talks began, Iranian Foreign Ministry spokesperson Esmaeil Baghaei told the state news agency IRNA that Iran considered talk of extending U.N. Security Council Resolution 2231 to be "meaningless and baseless".The United States held five rounds of talks with Iran prior to its airstrikes in June, which U.S. President Donald Trump, said had "obliterated" a programme that Washington and its ally Israel say is aimed at acquiring a nuclear bomb.

However, NBC News has cited current and former U.S. officials as saying a subsequent U.S. assessment found the strikes destroyed most of one of three targeted Iranian nuclear sites, but that the other two were not as badly damaged.Iran denies seeking a nuclear weapon.European and Iranian diplomats say there is no prospect of Iran re-engaging with the U.S. at the negotiating table for now.

At the end of May, we noted that the German stock index DAX 40 (Germany 40 mini on FXOpen) was exhibiting significantly stronger performance compared to other global equity indices. However, we also highlighted the 24,100 level as a strong resistance zone.

Two months have passed, and the chart now suggests that bearish signals are intensifying.

From a technical analysis perspective, the DAX 40 (Germany 40 mini on FXOpen) formed an ascending channel in July (outlined in blue). However, each time the bulls attempted to push the price above the 24,460 level (which corresponds to the May high), they encountered resistance.

It is worth noting the nature of the bearish reversals (indicated by arrows) – the price declined sharply, often without intermediate recoveries, signalling strong selling pressure. It is likely that major market participants used the proximity to the all-time high to reduce their long positions.

From a fundamental standpoint, several factors are weighing on the DAX 40 (Germany 40 mini on FXOpen):→ Ongoing uncertainty surrounding the US–EU trade agreement, which has yet to be finalised (with the deadline approaching next week);→ Corporate news, including disappointing earnings reports from Puma, Volkswagen, and several other German companies.

Given the above, it is reasonable to assume that bearish activity could result in an attempt to break below the lower boundary of the ascending blue channel.

The armed military conflict between Thailand and Cambodia presents limited risks to most business sectors for now while tourism industry experts are taking a wait-and-see stance to assess the impact.

Thailand is warning of an all-out war with its neighbouring country as the US has called for a ceasefire. The clashes, though, are limited to border areas far removed from popular tourist destinations, such as Bangkok and Phuket.

“We’ve been monitoring the situation and have yet to see significant changes in travel searches to these destinations,” booking site Expedia said in an emailed statement.

The border clashes aren’t expected to affect Thailand’s tourism sector under the current circumstances, Chai Arunanondchai, president of the Tourism Council of Thailand, said at a Thursday briefing.

Nonetheless, the conflict is already adversely affecting overall economic confidence and disrupting trade and investment between the two countries, the Thai Chamber of Commerce said in a Thursday statement.

Exports from Thailand to Cambodia, including jewellery, oil and sugar, totalled US$5.1 billion (RM21.52 billion) in the first half of 2025, according to the Thai Commerce Ministry. Thailand imported US$732 million of Cambodian goods, mostly fruits and vegetables.

The flareup, which included Thai airstrikes on Cambodian military bases, wasn’t initially expected to have a significant effect on food, media, cement and retail sectors in Thailand, UOB Kay Hian analysts said in a June 17 note to investors.

Thai convenience store CP All and conglomerate Berli Jucker have limited exposure in Cambodia, they said in a research note.

Thailand’s Carabao Group beverage maker, though, has relatively high sales in Cambodia, Citi Research said in a Friday note to investors. The clash could increase freight costs because of shifting trade routes due to the conflict, it said.

“A prolonged dispute could weaken consumption sentiment in provinces close to border region,” according to Citi.

Carabao is estimated to derive 28% of its energy drink revenue this year from Cambodia, CGS International said.

Thailand’s Bumrungrad Hospital, as well as herbal supplement maker Mega Lifesciences, is estimated to receive about 6% of their fiscal-year revenue from Cambodia and could face limited risks, CGS added.

Cambodia’s economic growth was already expected to slow, according to a July 17 report by Maybank Securities Pte.

The country has more than half a million workers in Thailand, according to official estimates, though Maybank said undocumented migrants could push that number closer to 1.2 million people. Officials in Thailand’s Chanthaburi and Trat provinces said some 2,000 Cambodian migrant workers have gathered at a checkpoint to return home.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up