Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)A:--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)A:--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

Mexico CPI YoY (Nov)

Mexico CPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

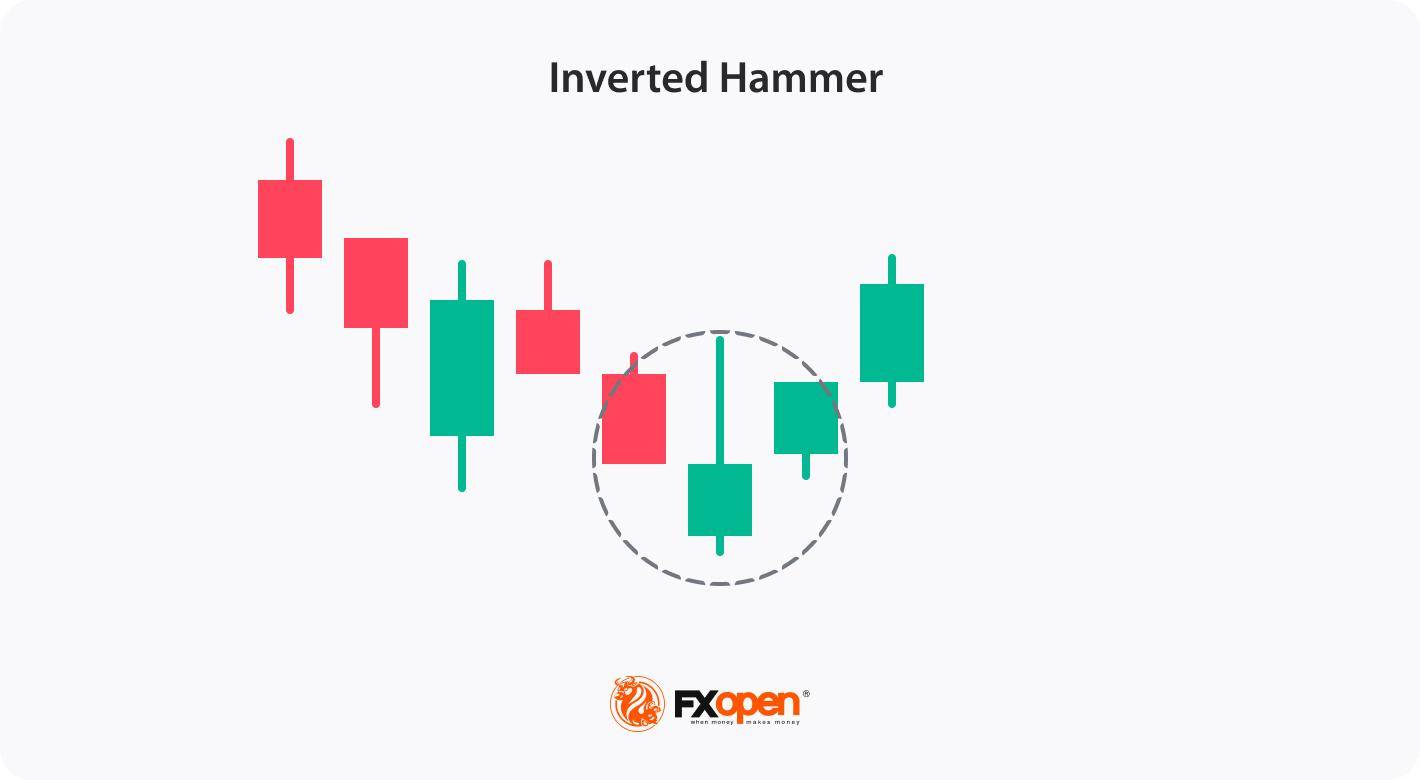

In trading, patterns are powerful tools, allowing traders to anticipate changes in trend direction. One such pattern is the inverted hammer, a formation often seen as a bullish signal following a downtrend.

In trading, patterns are powerful tools, allowing traders to anticipate changes in trend direction. One such pattern is the inverted hammer, a formation often seen as a bullish signal following a downtrend. Recognising this pattern and understanding its implications can be crucial for traders looking to spot reversal opportunities. In this article, we will explore the meaning of inverted hammer candlestick, how to identify it on a price chart, and how traders can incorporate it into their trading strategies.

An inverted hammer is a candlestick pattern that appears at the end of a downtrend, typically signalling a potential bullish reversal. It has a distinct shape, with a small body at the lower end of the candle and a long upper wick that is at least twice the size of the body. This structure suggests that although sellers initially dominated, buyers stepped in, pushing prices higher before closing near the opening level. While the inverted hammer alone does not confirm a reversal, it’s often considered a sign of a possible trend change when followed by a bullish move on subsequent candles.

The pattern can have any colour so that you can find a red inverted hammer candlestick or upside down green hammer. Although both will signal a bullish reversal, an inverted green hammer candle is believed to provide a stronger signal, reflecting the strength of bulls.

One of the unique features of this pattern is that traders can apply it to various financial instruments, such as stocks, cryptocurrencies*, ETFs, indices, and forex, across different timeframes.

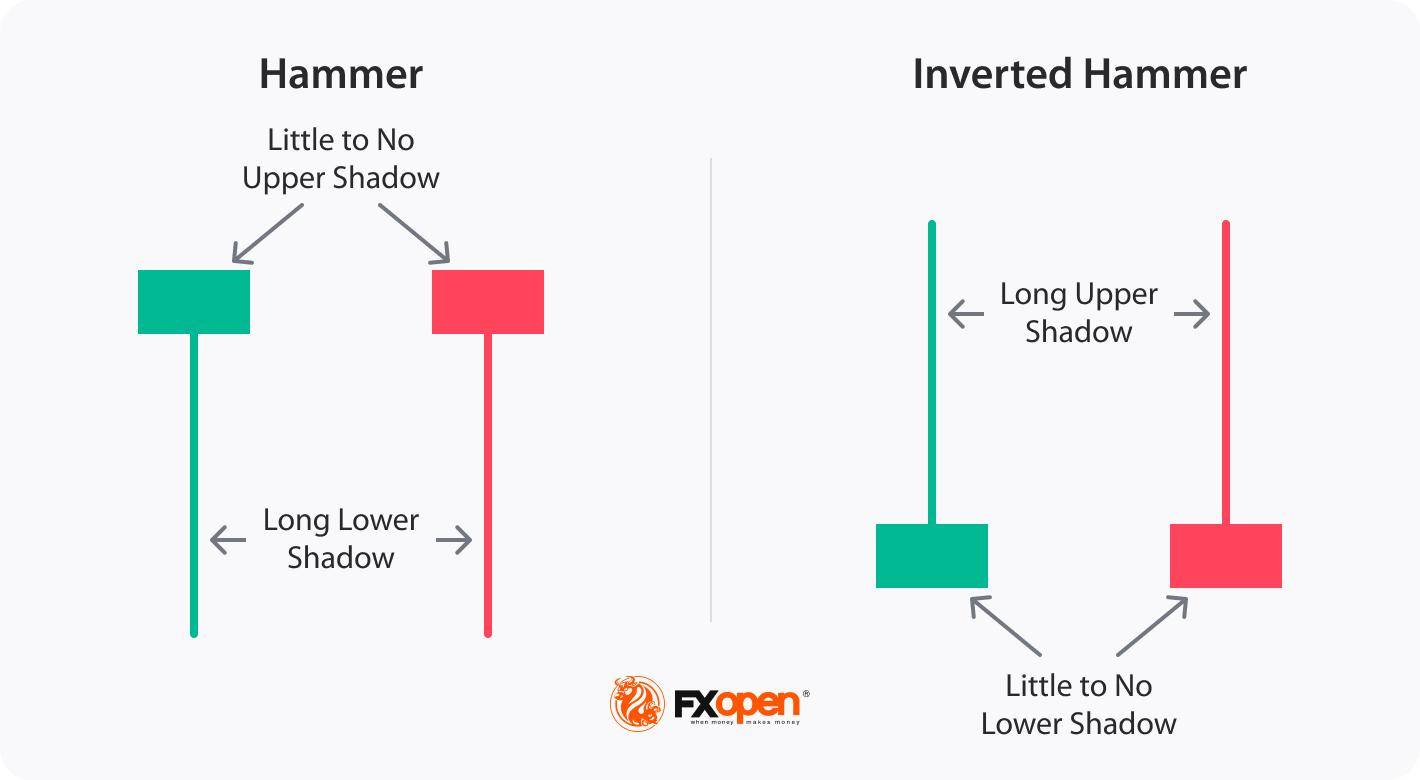

The hammer and inverted hammer are both single-candle patterns that appear in downtrends and signal potential bullish reversals, but they have distinct formations and implications:

Both patterns signal possible bullish sentiment, but while the green or red hammer candlestick focuses on buyer strength after selling, the inverted hammer suggests buyer interest in an overall bearish context, needing further confirmation for a trend shift.

Although the inverted hammer is easy to recognise, there are some rules traders follow to increase the reliability of the reversal signal it provides.

Step 1: Identify the Pattern in a Downtrend

Step 2: Choose Appropriate Timeframes

Step 3: Use Indicators to Strengthen Identification

Step 4: Look for Confirmation Signals

By following these steps and waiting for confirmation signals, traders can increase the reliability of the inverted hammer’s signals.

Trading the inverted hammer involves implementing a systematic approach to capitalise on potential bullish reversals. Here are some steps traders may consider when trading:

The trader looks for a bullish inverted hammer on the USDJPY chart. After a subsequent downtrend, the inverted hammer provides a buying opportunity that aligns with the support level. They enter the market at the close of the inverted hammer candle and place a stop loss below the support level. Their take-profit target is at the next resistance level.A trader could implement a more conservative approach and wait for at least a few candles to form in the uptrend direction. However, as the pattern was formed at the 5-minute chart, a trader could lose a trading opportunity or enter the market with a poor risk-reward ratio.

The inverted hammer has its strengths and limitations. Here’s a closer look:

Advantages

Limitations

While the inverted hammer can provide valuable insights into potential trend reversals, it should not be the sole basis for trading decisions. It is important to supplement analysis with other technical indicators and tools to strengthen the overall trading strategy. Furthermore, effective risk management strategies are crucial while trading the setup. Setting appropriate stop-loss orders to limit potential losses and implementing proper position sizing techniques can help potentially mitigate risks and protect trading capital.

FAQ

Is an Inverted Hammer Bullish?

Yes, it is considered a bullish reversal pattern. It indicates a potential shift from a downtrend to an uptrend in the market. While it may seem counterintuitive due to its name, the setup suggests that buying pressure has overcome selling pressure and that bulls are gaining strength.

How Do You Trade an Inverted Hammer?

To trade an inverted hammer, traders wait for confirmation in the next session, such as a gap-up or strong bullish candle. They usually enter a buy position with a stop-loss below the low of the pattern to potentially manage risk and a take-profit level at the closest resistance level.

Is the Inverted Hammer a Trend Reversal Signal?

It is generally considered a potential trend reversal signal. An inverted hammer in a downtrend suggests a shift in market sentiment from bearish to bullish. An inverted hammer in an uptrend does not signify anything.

What Happens After a Reverse Hammer Candlestick?

After a reverse (or inverted) hammer candle, there may be a potential bullish reversal if confirmed by a strong bullish candle in the next session. However, without confirmation, the pattern alone does not guarantee a trend change.

How Do You Trade an Inverted Hammer Candlestick in an Uptrend?

In an uptrend, an inverted hammer isn’t generally considered significant because it’s primarily a reversal signal in a downtrend.

Are Inverted Hammer and Shooting Star the Same?

No, the inverted hammer and shooting star look similar but occur in opposite trends; the former appears in a downtrend as a bullish reversal signal, while the latter appears in an uptrend as a bearish reversal signal.

What Is the Difference Between a Hanging Man and an Inverted Hammer?

The hanging man and inverted hammer differ in both appearance and context. The former appears at the end of an uptrend as a bearish signal and has a small body and a long lower shadow, while the latter appears at the end of a downtrend as a bullish signal and has a small body and a long upper shadow.

What Is the Difference Between a Red and Green Inverted Hammer?

A green (bullish) inverted hammer candlestick closes higher than its opening price, indicating a stronger bullish sentiment. A red (bearish) inverted hammer candlestick closes lower than its opening, which might indicate less buying strength, but both colours can signal a reversal if followed by confirmation.

U.S. President Donald Trump hopes to finalize a Gaza peace plan proposal in a meeting on Monday with Israel's Prime Minister, Trump told Reuters on Sunday, as Israeli tanks pushed deeper into Gaza City and the military wing of Hamas said it had lost contact with two hostages held there.

The fate of the two hostages, which has strong domestic resonance in Israel, could cast a shadow over a meeting between Israeli Prime Minister Benjamin Netanyahu and Trump on Monday.

The Hamas military wing, Al-Qassam Brigades, called on Israel on Sunday to pull troops back and suspend air strikes on Gaza City for 24 hours so fighters could retrieve the captives.

Trump told Reuters in a phone interview he had received a "very good response" from Israel and Arab leaders to the Gaza peace plan proposal and that "everybody wants to make a deal."

Hamas said the group had not yet received any proposal from Trump nor from mediators.

Israel has launched a massive ground assault on Gaza City, flattening whole districts and ordering hundreds of thousands of Palestinians to flee to tented camps, in what Netanyahu says is a bid to destroy Hamas.

Nevertheless, the past few days have seen increasing talk of a diplomatic resolution to the nearly two-year-old Gaza war.

Trump's 21-point Middle East peace plan to end the Gaza war calls for the return of all Israeli hostages, living and dead, no further Israeli attacks on Qatar and a new dialogue between Israel and Palestinians for “peaceful coexistence.”

Netanyahu has repeatedly said Hamas must lay down its arms or be defeated. He told Fox News earlier on Sunday it is possible to have amnesty for Hamas leaders under a ceasefire agreement that would include them being escorted out of Gaza.

Hamas has so far said it will never give up its weapons as long as Palestinians are struggling for a state. It refuses any expulsion of its leaders from Gaza.

Al-Qassam Brigades called on the Israeli military to pull troops back from the Sabra and Tel Al-Hawa districts southeast of Gaza City's centre, and suspend flights over the area for 24 hours from 1500 GMT so it could reach the two trapped hostages.

The Israeli military did not directly comment on the request but made clear it had no plans to halt its advances, issuing a statement ordering all residents of parts of Gaza City including the Sabra district to leave. It said it was about to attack Hamas targets and raze buildings in the area.

Gaza residents and medics said Israeli tanks pushed deeper into Sabra, Tel Al-Hawa and nearby Sheikh Radwan and Al-Naser neighbourhoods, closing in on the heart of the city and western areas where hundreds of thousands of people are sheltering.

The Gaza health ministry said in a statement that at least 77 people had been killed by Israeli fire in the past 24 hours.

Local health authorities said they had been unable to respond to dozens of desperate calls from trapped residents.

Gaza's Civil Emergency Service said late on Saturday that Israel had denied 73 requests, sent via international organisations, to let it rescue injured Palestinians in Gaza City. The Israeli military had no immediate comment.

The families of the two hostages identified by Hamas have requested that their names not be published by the media.

The war began after Hamas-led militants attacked Israeli territory in October 2023, killing around 1,200 people and capturing 251 hostages, according to Israeli tallies. Forty-eight hostages are still in Gaza, 20 of whom Netanyahu says are still alive.

Israel's assault has killed more than 66,000 Palestinians, according to medical authorities in the territory. Most homes have been damaged or destroyed and 2.3 million residents are living under a severe humanitarian crisis.

The Israeli military says Hamas, which ruled Gaza for nearly two decades, no longer has governing capacity and that its military force has been reduced to a guerrilla movement.

The military launched its long-threatened ground offensive on Gaza City on September 16 after weeks of intensifying strikes on the urban centre.

Over the past 24 hours, the air force had struck 140 military targets across Gaza, including militants and what it described as military infrastructure, the military said.

The World Food Programme estimates that between 350,000 and 400,000 Palestinians have fled Gaza City since last month, although hundreds of thousands remain. The Israeli military estimates that around a million Palestinians were in Gaza City in August.

Reporting by Nidal al-Mughrabi in Cairo; Additional reporting by Steven Scheer, Alexander Cornwell and May Angel in Jerusalem and Ahmed Tolba in Cairo; Writing by Nia Williams; Editing by David Holmes, Peter Graff and Diane Craft

Chancellor of the Exchequer Rachel Reeves can be sure the bond markets have her back. But on Monday she faces down her own party, and she may find them tougher to win over.

At the annual Labour Party conference in Liverpool she needs to assure her restive colleagues that she can put the economy in the service of beating the populist right without undermining her reputation for fiscal prudence.

The British finance minister, who has seen her personal popularity ratings crater since Labour won a landslide election victory last year, will offer a mix of pro-growth initiatives, back-to-work support and pledges of fiscal restraint in her speech, which comes against the backdrop of angst in Labour ranks about how to confront the threat from Nigel Farage’s poll-topping Reform UK party.

The question is whether that will be enough for colleagues, some of whom have been urging her to loosen the purse strings to serve party’s progressive values — and to curtail the rise of Reform.

“Keir and Rachel go into this conference with their backs against the wall,” said Nick Williams, a former special adviser to Starmer in 10 Downing Street, speaking on Bloomberg Radio.

“The idea that we can just borrow our way out of issues, borrow our way out of a tight spot is fanciful, and so I think that’s going to be the reality check,” he added.

The speech is one of the most important yet for Britain’s first female finance minister, who alongside Prime Minister Keir Starmer has come under pressure after policy missteps. She launched an unpopular and eventually aborted move to strip many pensioners of winter fuel payments, and a failed bid to curb welfare to disabled people — plus an inaugural tax-raising budget which soured relations with the business community.

Her task is particularly difficult now because she’s facing a black hole in the public finances of at least £20 billion ($26.8 billion), largely driven by a downgrade in productivity estimates from the Office for Budget Responsibility, but also due to the welfare policy reversal and the impact of US President Donald Trump’s global tariff war. That’s left her needing to draw up plans for tax rises again at her autumn budget on Nov. 26, despite previously saying she wouldn’t need to do so.

Starmer began this Labour conference by amping up his attacks on Farage, saying his party is in a battle with Reform for the nation’s ‘soul’. A YouGov survey on the eve of Labour’s annual gathering in Liverpool showed Farage’s party would win a general election if one were held now, a sign of the threat posed by his populist outfit.

For Reeves, the challenge is how to respond to the economic offer being made by Reform, which includes tax cuts and more welfare spending for UK citizens, though Farage has been vague about how those policies will costed. Reeves’ focus to date has been to stress a tight grip on Britain’s public finances, which she describes as “pretty precarious,” and to warn that any loosening would risk a self-defeating backlash from bond investors.

“We are exposed,” Reeves said at a summit in London on Friday. “We have to explain how we’re going to make those sums add up.”

Reeves’ repeated pledge of fealty to the UK’s fiscal rules — which require her to balance day-to-day spending with tax revenues — is unpopular among some parts of the left, with her critics urging her to relax her stance. Potential Labour leadership contender Andy Burnham said this week that the government should try not to be so “in hock” to the bond markets, a comment that Reeves rebuffed.

“Those fiscal rules need to be changed,” said Sharon Graham, general secretary of the Unite trade union. “If that budget is essentially nothing, it’s insipid, I think we’ve got a real problem on our hands, because without the money to make the change, then nothing is going to change.”

The backdrop to Reeves’ conference speech is a far cry from the optimism and hope that prevailed when she took to the stage two years ago, receiving a rock-star reception as the chancellor-in-waiting after more than a decade of Conservative rule. This year, a key plank of her keynote will be a pledge to eliminate long-term youth unemployment by offering paid work to any young person who’s been out of work for 18 months or more, a measure aimed at appeasing the Labour base and boosting the economy.

As Labour conference kicked off on Sunday, Starmer brought Australia’s prime minister Anthony Albanese on stage, and Albanese shared a message that appeared to endorse Starmer and Reeves’ framing of how to respond to the Reform threat.

“Being a party of government means grappling with uncertainty and complexity,” he said. “It means dealing with the gritty realities of the world as it is, and it means making, and yes, owning tough decisions in the national interest.”

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up