Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy HICP Prelim YoY (Dec)

Italy HICP Prelim YoY (Dec)A:--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Dec)

Euro Zone Core CPI Prelim MoM (Dec)A:--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Dec)

Euro Zone Core CPI Prelim YoY (Dec)A:--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Dec)

Euro Zone Core HICP Prelim MoM (Dec)A:--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Dec)

Euro Zone Core HICP Prelim YoY (Dec)A:--

F: --

P: --

India GDP YoY

India GDP YoYA:--

F: --

P: --

Germany 10-Year Bund Auction Avg. Yield

Germany 10-Year Bund Auction Avg. YieldA:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

U.S. ADP Employment (Dec)

U.S. ADP Employment (Dec)A:--

F: --

Canada Ivey PMI (SA) (Dec)

Canada Ivey PMI (SA) (Dec)A:--

F: --

P: --

U.S. Factory Orders MoM (Oct)

U.S. Factory Orders MoM (Oct)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Dec)

Canada Ivey PMI (Not SA) (Dec)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Oct)

U.S. Factory Orders MoM (Excl. Transport) (Oct)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Oct)

U.S. Factory Orders MoM (Excl. Defense) (Oct)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Oct)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Oct)A:--

F: --

U.S. ISM Non-Manufacturing PMI (Dec)

U.S. ISM Non-Manufacturing PMI (Dec)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Dec)

U.S. ISM Non-Manufacturing Price Index (Dec)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Dec)

U.S. ISM Non-Manufacturing New Orders Index (Dec)A:--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Nov)

U.S. JOLTS Job Openings (SA) (Nov)A:--

F: --

U.S. ISM Non-Manufacturing Employment Index (Dec)

U.S. ISM Non-Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Dec)

U.S. ISM Non-Manufacturing Inventories Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

Japan Wages MoM (Nov)

Japan Wages MoM (Nov)A:--

F: --

P: --

Australia Trade Balance (SA) (Nov)

Australia Trade Balance (SA) (Nov)A:--

F: --

Australia Exports MoM (SA) (Nov)

Australia Exports MoM (SA) (Nov)A:--

F: --

Japan 30-Year JGB Auction Yield

Japan 30-Year JGB Auction Yield--

F: --

P: --

Japan Household Consumer Confidence Index (Dec)

Japan Household Consumer Confidence Index (Dec)--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Dec)

U.K. Halifax House Price Index YoY (SA) (Dec)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Dec)

U.K. Halifax House Price Index MoM (SA) (Dec)--

F: --

P: --

France Trade Balance (SA) (Nov)

France Trade Balance (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Nov)

France Current Account (Not SA) (Nov)--

F: --

P: --

South Africa Manufacturing PMI (Dec)

South Africa Manufacturing PMI (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Nov)

Italy Unemployment Rate (SA) (Nov)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Unemployment Rate (Nov)

Euro Zone Unemployment Rate (Nov)--

F: --

P: --

Euro Zone Consumer Inflation Expectations (Dec)

Euro Zone Consumer Inflation Expectations (Dec)--

F: --

P: --

Euro Zone PPI MoM (Nov)

Euro Zone PPI MoM (Nov)--

F: --

P: --

Euro Zone PPI YoY (Nov)

Euro Zone PPI YoY (Nov)--

F: --

P: --

Euro Zone Selling Price Expectations (Dec)

Euro Zone Selling Price Expectations (Dec)--

F: --

P: --

Euro Zone Industrial Climate Index (Dec)

Euro Zone Industrial Climate Index (Dec)--

F: --

P: --

Euro Zone Economic Sentiment Indicator (Dec)

Euro Zone Economic Sentiment Indicator (Dec)--

F: --

P: --

Euro Zone Services Sentiment Index (Dec)

Euro Zone Services Sentiment Index (Dec)--

F: --

P: --

Euro Zone Consumer Confidence Index Final (Dec)

Euro Zone Consumer Confidence Index Final (Dec)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Dec)

Mexico 12-Month Inflation (CPI) (Dec)--

F: --

P: --

Mexico Core CPI YoY (Dec)

Mexico Core CPI YoY (Dec)--

F: --

P: --

Mexico PPI YoY (Dec)

Mexico PPI YoY (Dec)--

F: --

P: --

Mexico CPI YoY (Dec)

Mexico CPI YoY (Dec)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Dec)

U.S. Challenger Job Cuts MoM (Dec)--

F: --

P: --

U.S. Challenger Job Cuts (Dec)

U.S. Challenger Job Cuts (Dec)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Dec)

U.S. Challenger Job Cuts YoY (Dec)--

F: --

P: --

Canada Imports (SA) (Oct)

Canada Imports (SA) (Oct)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

Canada Exports (SA) (Oct)

Canada Exports (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Year-start capital inflows and bullish sentiment recovery have driven Bitcoin's sustained rally. Now approaching the key resistance level of 95,000, a breakthrough here has become the make-or-break line for bulls.

93409.2

Entry Price

99500.0

TP

89000.0

SL

0.0

Pips

Flat

89000.0

SL

Exit Price

93409.2

Entry Price

99500.0

TP

The bearish reaction observed at this junction suggests that the broader corrective move has not yet concluded.

1.17145

Entry Price

1.16750

TP

1.17400

SL

25.5

Pips

Loss

1.16750

TP

1.17400

Exit Price

1.17145

Entry Price

1.17400

SL

This level is of paramount importance as it converges with a long-term ascending trendline. This confluence zone will be the ultimate "make-or-break" area; a successful defense could trigger a sharp rebound.

0.86350

Entry Price

0.87550

TP

0.85700

SL

--

Pips

PENDING

0.85700

SL

Exit Price

0.86350

Entry Price

0.87550

TP

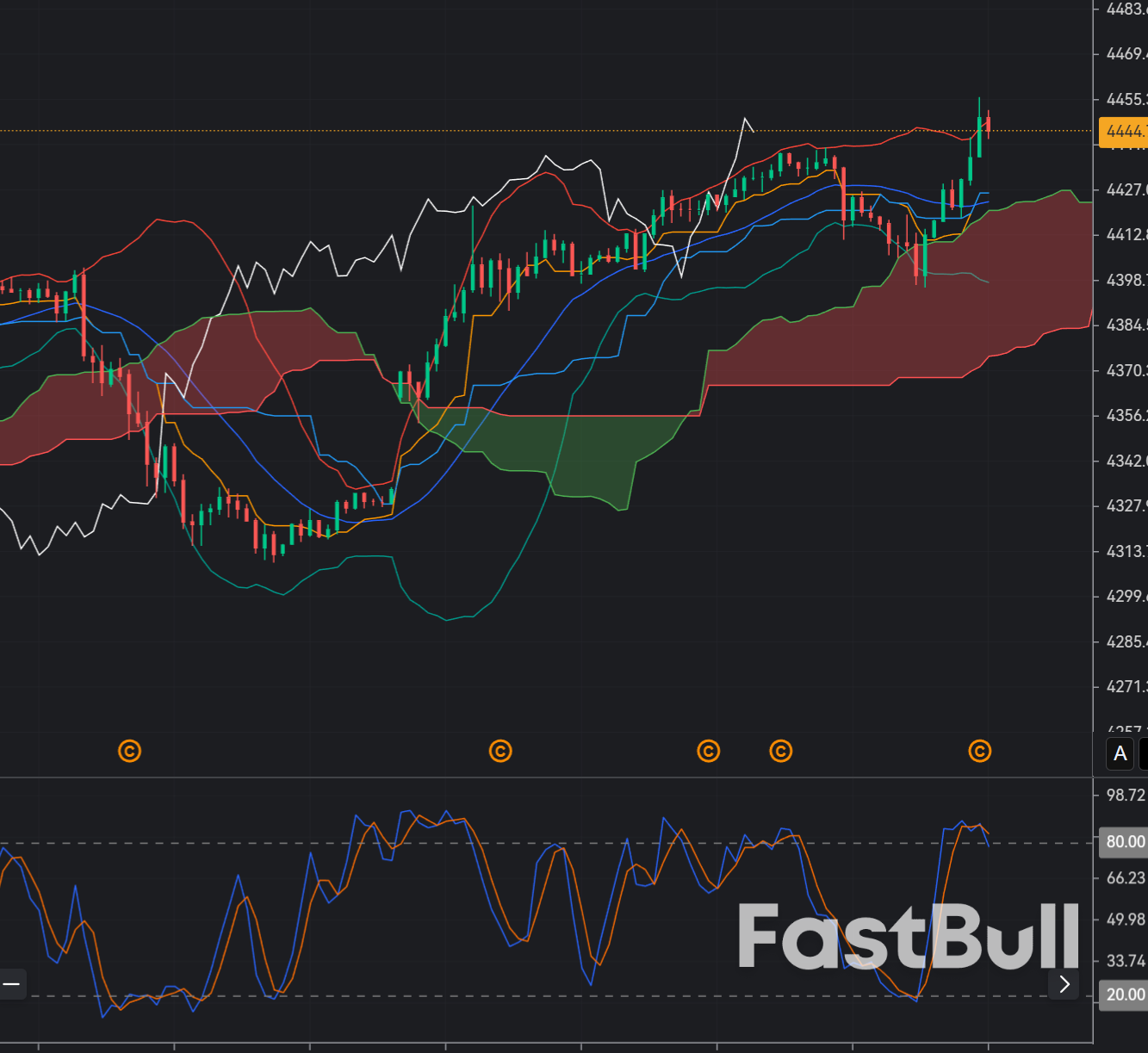

Geopolitical developments have reignited bullish sentiment in the precious metals market. Gold is expected to rise toward a target of 5000 in 2026.

4470.00

Entry Price

4300.00

TP

4532.00

SL

0.0

Pips

Flat

4300.00

TP

Exit Price

4470.00

Entry Price

4532.00

SL

Gold prices rose sharply to around ~$4,424/oz as geopolitical risk surged following the U.S. capture of Venezuelan President Maduro, boosting safe-haven demand and lifting spot gold and futures higher....

4435.00

Entry Price

4370.00

TP

4460.00

SL

250.0

Pips

Loss

4370.00

TP

4460.03

Exit Price

4435.00

Entry Price

4460.00

SL

EUR/USD is trading near 1.168–1.1725 after modest dip earlier in the session but showing early signs of support and potential rebound from lows as European fundamentals hold ground against a broad US dollar rally...

1.17000

Entry Price

1.17500

TP

1.16500

SL

12.2

Pips

Loss

1.16500

SL

1.16878

Exit Price

1.17000

Entry Price

1.17500

TP

EUR/USD trades near four-week lows around 1.1690 as US dollar strength persists, with markets focused on key US data and largely brushing off escalating Venezuela-related geopolitical tensions.

1.16600

Entry Price

1.15000

TP

1.18000

SL

--

Pips

PENDING

1.15000

TP

Exit Price

1.16600

Entry Price

1.18000

SL

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up