Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Iran's Tasnim News Agency Says Connection With Drone In International Waters Was Lost, Reason For Connection Loss Unknown

Iran's Fars News Agency Says That An Iranian Drone Completed A 'Surveillance Mission In International Waters' After USA Military Said It Shot Down An Iranian Drone

Indian Official Jaishankar: Met With U.S. Treasury Secretary Bessenter In Washington, D.C. On February 3

WTI Crude Oil Futures For March Delivery Closed At $63.21 Per Barrel. Nymex Natural Gas Futures For March Delivery Closed At $3.3110 Per Million British Thermal Units (MMBtu). Nymex Gasoline Futures For March Delivery Closed At $1.8979 Per Gallon, And Nymex Heating Oil Futures For March Delivery Closed At $2.4093 Per Gallon

Chairman Of Spain's Santander Following Acquisition Of Webster In The USA And Tsb In The UK Santander Will Be At Scale In All Its Core Markets

[Bitcoin Sees Rapid 3.23% Rebound In Last 20 Minutes, Ethereum Rebounds 4.14%] February 4Th, According To Htx Market Data, Bitcoin Quickly Rebounded By 3.23% In Nearly 20 Minutes, Briefly Rising Above $7.5; During The Same Period, Ethereum Rebounded By 4.14%, Briefly Peaking At $2200.At The Time Of Writing, Bitcoin Is Currently Trading At $74,560, And Ethereum Is Trading At $2172

Bitcoin Exhibited A V-shaped Pattern, Rebounding Sharply After Falling Below $73,000 And Currently Recovering The $75,000 Mark, With The Current Decline Less Than 4.3%

Goldman Sachs Says Later In 2026, It Expect Supplementary Approvals To Lift Ore Supply Back Toward 300 Mt, Returning The Refined Nickel Market To A 191 Kt Surplus

Bitcoin Fell Below $73,000, With The Decline Widening To Nearly 7%. It Stabilized Around $78,000 Before 00:00 Beijing Time, After Which It Accelerated Its Decline

Goldman Sachs Expects Indonesia To Initially Cut Ore Supply By 11% Y-O-Y To 260 Mt, Tightening Refined Market And Supporting Nickel Prices To $18700/T By Q2 2026

[Bank Of America: Volatility In Gold And Silver To Persist After Price Crash] Bank Of America Stated That The Markets For Both Precious Metals Will Remain Highly Volatile Following The Price Plunge From Record Highs. "We Will Continue To Maintain An Environment Of Above-historic Volatility, But Not As Much As In The Past Few Days, Unless We See Another Speculative Bubble," Said Niklas Westermark, Head Of Commodities Trading For Europe, The Middle East, And Africa At Bank Of America. "The Plunge Over The Past Two Trading Days, I Think, Has Largely Cleared The Market."

Ukraine President Zelenskiy: Ukraine Is Expected To Make Concessions, But Russia Must Also Make Concessions, Mainly Stopping Aggression

Santander: Following The Acquisition Of Webster, In 2027 The Bank Expects Double-Digit Revenue Growth

Turkey Trade Balance (Jan)

Turkey Trade Balance (Jan)A:--

F: --

P: --

Brazil IHS Markit Manufacturing PMI (Jan)

Brazil IHS Markit Manufacturing PMI (Jan)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada Manufacturing PMI (SA) (Jan)

Canada Manufacturing PMI (SA) (Jan)A:--

F: --

P: --

U.S. IHS Markit Manufacturing PMI Final (Jan)

U.S. IHS Markit Manufacturing PMI Final (Jan)A:--

F: --

P: --

U.S. ISM Output Index (Jan)

U.S. ISM Output Index (Jan)A:--

F: --

P: --

U.S. ISM Inventories Index (Jan)

U.S. ISM Inventories Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing Employment Index (Jan)

U.S. ISM Manufacturing Employment Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing New Orders Index (Jan)

U.S. ISM Manufacturing New Orders Index (Jan)A:--

F: --

P: --

U.S. ISM Manufacturing PMI (Jan)

U.S. ISM Manufacturing PMI (Jan)A:--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech South Korea CPI YoY (Jan)

South Korea CPI YoY (Jan)A:--

F: --

P: --

Japan Monetary Base YoY (SA) (Jan)

Japan Monetary Base YoY (SA) (Jan)A:--

F: --

P: --

Australia Building Approval Total YoY (Dec)

Australia Building Approval Total YoY (Dec)A:--

F: --

Australia Building Permits MoM (SA) (Dec)

Australia Building Permits MoM (SA) (Dec)A:--

F: --

Australia Building Permits YoY (SA) (Dec)

Australia Building Permits YoY (SA) (Dec)A:--

F: --

P: --

Australia Private Building Permits MoM (SA) (Dec)

Australia Private Building Permits MoM (SA) (Dec)A:--

F: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key RateA:--

F: --

P: --

RBA Rate Statement

RBA Rate Statement Japan 10-Year Note Auction Yield

Japan 10-Year Note Auction YieldA:--

F: --

P: --

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown.

The U.S. House of Representatives voted on a short-term spending bill to end the partial government shutdown. Saudi Arabia IHS Markit Composite PMI (Jan)

Saudi Arabia IHS Markit Composite PMI (Jan)A:--

F: --

P: --

RBA Press Conference

RBA Press Conference Turkey PPI YoY (Jan)

Turkey PPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Jan)

Turkey CPI YoY (Jan)A:--

F: --

P: --

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)

Turkey CPI YoY (Excl. Energy, Food, Beverage, Tobacco & Gold) (Jan)A:--

F: --

P: --

U.K. 10-Year Note Auction Yield

U.K. 10-Year Note Auction YieldA:--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoYA:--

F: --

P: --

Mexico Manufacturing PMI (Jan)

Mexico Manufacturing PMI (Jan)A:--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

Japan IHS Markit Services PMI (Jan)

Japan IHS Markit Services PMI (Jan)--

F: --

P: --

Japan IHS Markit Composite PMI (Jan)

Japan IHS Markit Composite PMI (Jan)--

F: --

P: --

China, Mainland Caixin Services PMI (Jan)

China, Mainland Caixin Services PMI (Jan)--

F: --

P: --

China, Mainland Caixin Composite PMI (Jan)

China, Mainland Caixin Composite PMI (Jan)--

F: --

P: --

India HSBC Services PMI Final (Jan)

India HSBC Services PMI Final (Jan)--

F: --

P: --

India IHS Markit Composite PMI (Jan)

India IHS Markit Composite PMI (Jan)--

F: --

P: --

Russia IHS Markit Services PMI (Jan)

Russia IHS Markit Services PMI (Jan)--

F: --

P: --

South Africa IHS Markit Composite PMI (SA) (Jan)

South Africa IHS Markit Composite PMI (SA) (Jan)--

F: --

P: --

Italy Services PMI (SA) (Jan)

Italy Services PMI (SA) (Jan)--

F: --

P: --

Italy Composite PMI (Jan)

Italy Composite PMI (Jan)--

F: --

P: --

Germany Composite PMI Final (SA) (Jan)

Germany Composite PMI Final (SA) (Jan)--

F: --

P: --

Euro Zone Composite PMI Final (Jan)

Euro Zone Composite PMI Final (Jan)--

F: --

P: --

Euro Zone Services PMI Final (Jan)

Euro Zone Services PMI Final (Jan)--

F: --

P: --

U.K. Composite PMI Final (Jan)

U.K. Composite PMI Final (Jan)--

F: --

P: --

U.K. Total Reserve Assets (Jan)

U.K. Total Reserve Assets (Jan)--

F: --

P: --

U.K. Services PMI Final (Jan)

U.K. Services PMI Final (Jan)--

F: --

P: --

U.K. Official Reserves Changes (Jan)

U.K. Official Reserves Changes (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim YoY (Jan)

Euro Zone Core CPI Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim YoY (Jan)

Euro Zone Core HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone PPI MoM (Dec)

Euro Zone PPI MoM (Dec)--

F: --

P: --

Euro Zone HICP Prelim YoY (Jan)

Euro Zone HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core HICP Prelim MoM (Jan)

Euro Zone Core HICP Prelim MoM (Jan)--

F: --

P: --

Italy HICP Prelim YoY (Jan)

Italy HICP Prelim YoY (Jan)--

F: --

P: --

Euro Zone Core CPI Prelim MoM (Jan)

Euro Zone Core CPI Prelim MoM (Jan)--

F: --

P: --

Euro Zone PPI YoY (Dec)

Euro Zone PPI YoY (Dec)--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoW--

F: --

P: --

No matching data

View All

No data

Bitcoin has experienced a sustained decline recently, influenced by market news. It has now reached a critical support level at 75,000 and closed positively, indicating a potential short-term rebound.

78944.0

Entry Price

88000.0

TP

74000.0

SL

4944.0

Pips

Loss

74000.0

SL

74000.0

Exit Price

78944.0

Entry Price

88000.0

TP

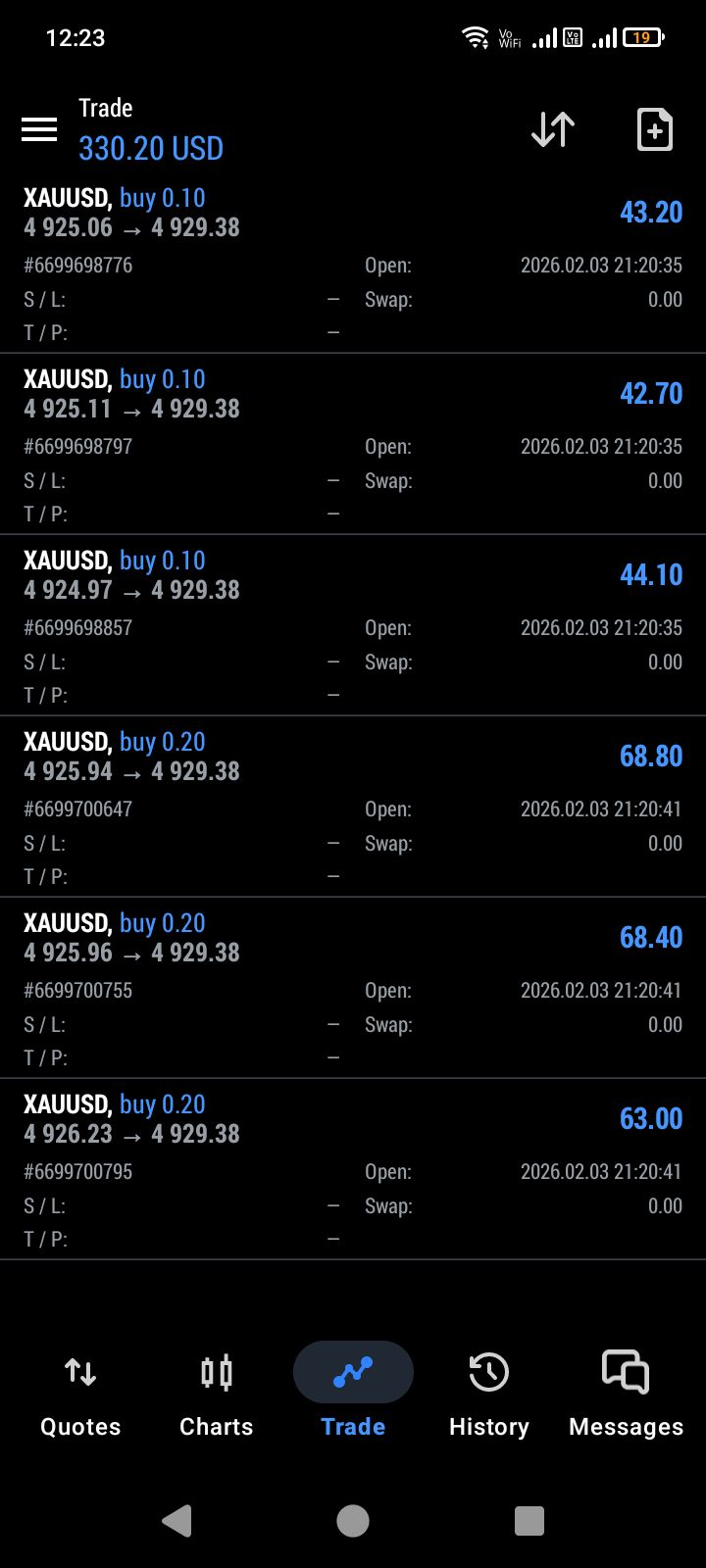

Gold prices have recovered some lost ground, approaching $4,880 per ounce. Previously, gold experienced a historic plunge and has now edged slightly higher. However, with U.S. President Trump nominating Kevin Warsh as the next Federal Reserve Chair, the upside potential for gold in the short term may be limited.

5050.00

Entry Price

4300.00

TP

5200.00

SL

--

Pips

PENDING

4300.00

TP

Exit Price

5050.00

Entry Price

5200.00

SL

Trading Recommendations:

Trading Recommendations:This failure to sustain lower prices indicates that buyers are stepping in aggressively at these value levels.

0.95203

Entry Price

0.96400

TP

0.94400

SL

46.9

Pips

Profit

0.94400

SL

0.95672

Exit Price

0.95203

Entry Price

0.96400

TP

If this support level continues to show resilience and the bullish histogram gains depth, we expect the primary trend to recapture its momentum.

0.69585

Entry Price

0.70500

TP

0.68800

SL

42.0

Pips

Profit

0.68800

SL

0.70005

Exit Price

0.69585

Entry Price

0.70500

TP

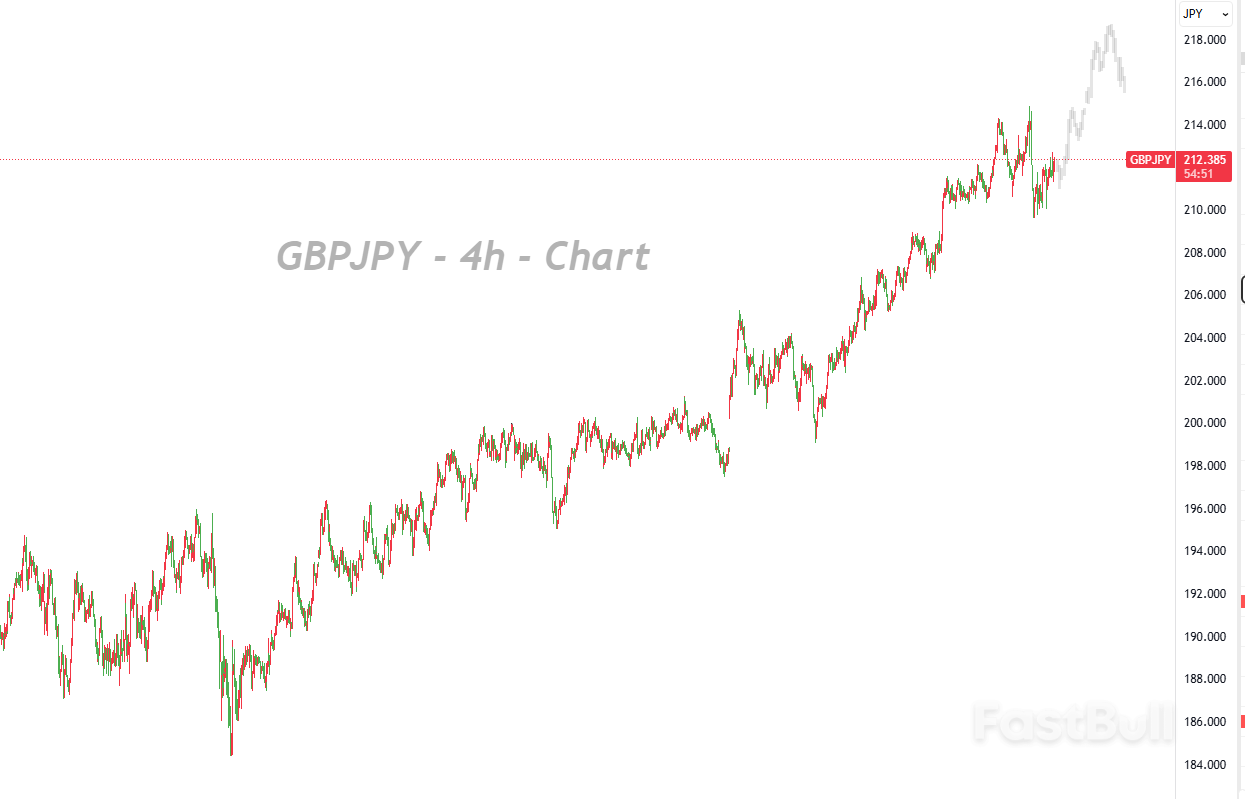

The final UK Manufacturing Purchasing Managers' Index (PMI) hit a 17-month high, reigniting inflation risks. Japan’s final Manufacturing PMI came in at 51.5, with economic growth picking up, yet inflation risks persist.

212.000

Entry Price

218.690

TP

209.500

SL

--

Pips

PENDING

209.500

SL

Exit Price

212.000

Entry Price

218.690

TP

EUR/USD has broken its rising trendline and is consolidating below 1.1870 resistance, keeping downside risk toward 1.1750 in focus unless bulls reclaim lost structure.

1.18500

Entry Price

1.17500

TP

1.19150

SL

61.8

Pips

Profit

1.17500

TP

1.17882

Exit Price

1.18500

Entry Price

1.19150

SL

Gold’s recent drop appears overdone, as structural demand, steady investor positioning, and rising Chinese buying interest suggest the long-term bullish case for precious metals remains intact.

4759.64

Entry Price

5800.00

TP

4600.00

SL

1596.4

Pips

Loss

4600.00

SL

4599.97

Exit Price

4759.64

Entry Price

5800.00

TP

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up