Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q3)

U.S. Unit Labor Cost Prelim (SA) (Q3)--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)--

F: --

P: --

Japan Trade Balance (Customs Data) (SA) (Oct)

Japan Trade Balance (Customs Data) (SA) (Oct)--

F: --

P: --

Japan GDP Annualized QoQ Revised (Q3)

Japan GDP Annualized QoQ Revised (Q3)--

F: --

China, Mainland Exports YoY (CNH) (Nov)

China, Mainland Exports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (USD) (Nov)

China, Mainland Trade Balance (USD) (Nov)--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)--

F: --

P: --

Canada Leading Index MoM (Nov)

Canada Leading Index MoM (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Elliott Wave Theory is a technical analysis method that uses recurring wave patterns to identify market trends. It suggests investor psychology creates these waves, with optimism and pessimism driving prices. The theory can be complex, but it can potentially help traders spot turning points in the market. However, it's not foolproof and should be used with other analysis methods.

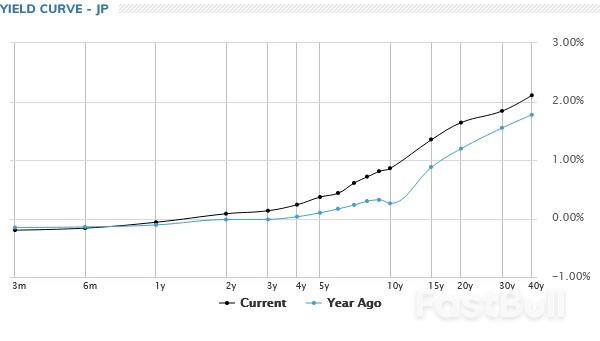

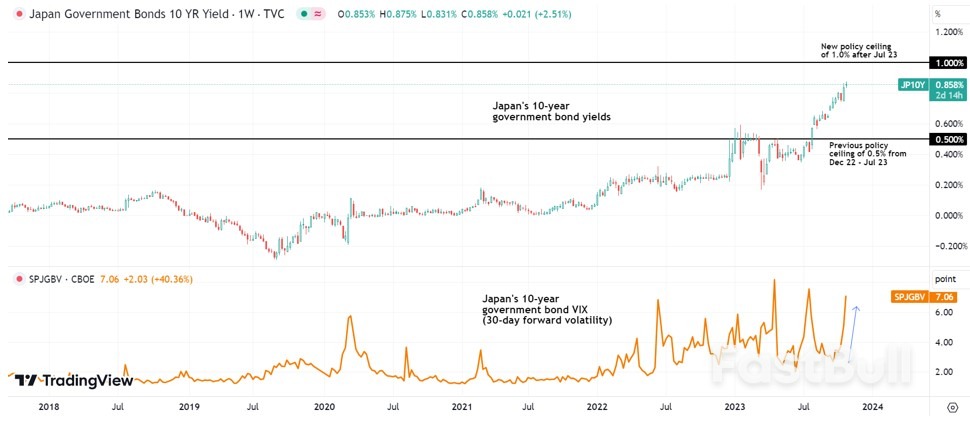

In Asia, at the time of writing, Nikkei is down -2.16%. Hong Kong HSI is down -0.82%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is up 0.0251 at 0.886. Overnight, DOW dropped -0.32%. S&P 500 dropped -1.43%. NASDAQ dropped sharply by -2.43%. 10-year yield rose 0.113 to 4.953.

In Asia, at the time of writing, Nikkei is down -2.16%. Hong Kong HSI is down -0.82%. China Shanghai SSE is down -0.20%. Singapore Strait Times is down -0.41%. Japan 10-year JGB yield is up 0.0251 at 0.886. Overnight, DOW dropped -0.32%. S&P 500 dropped -1.43%. NASDAQ dropped sharply by -2.43%. 10-year yield rose 0.113 to 4.953. ECB to finally pause, EUR/USD looking soft

ECB to finally pause, EUR/USD looking soft

Source: ActionForex

Source: ActionForex

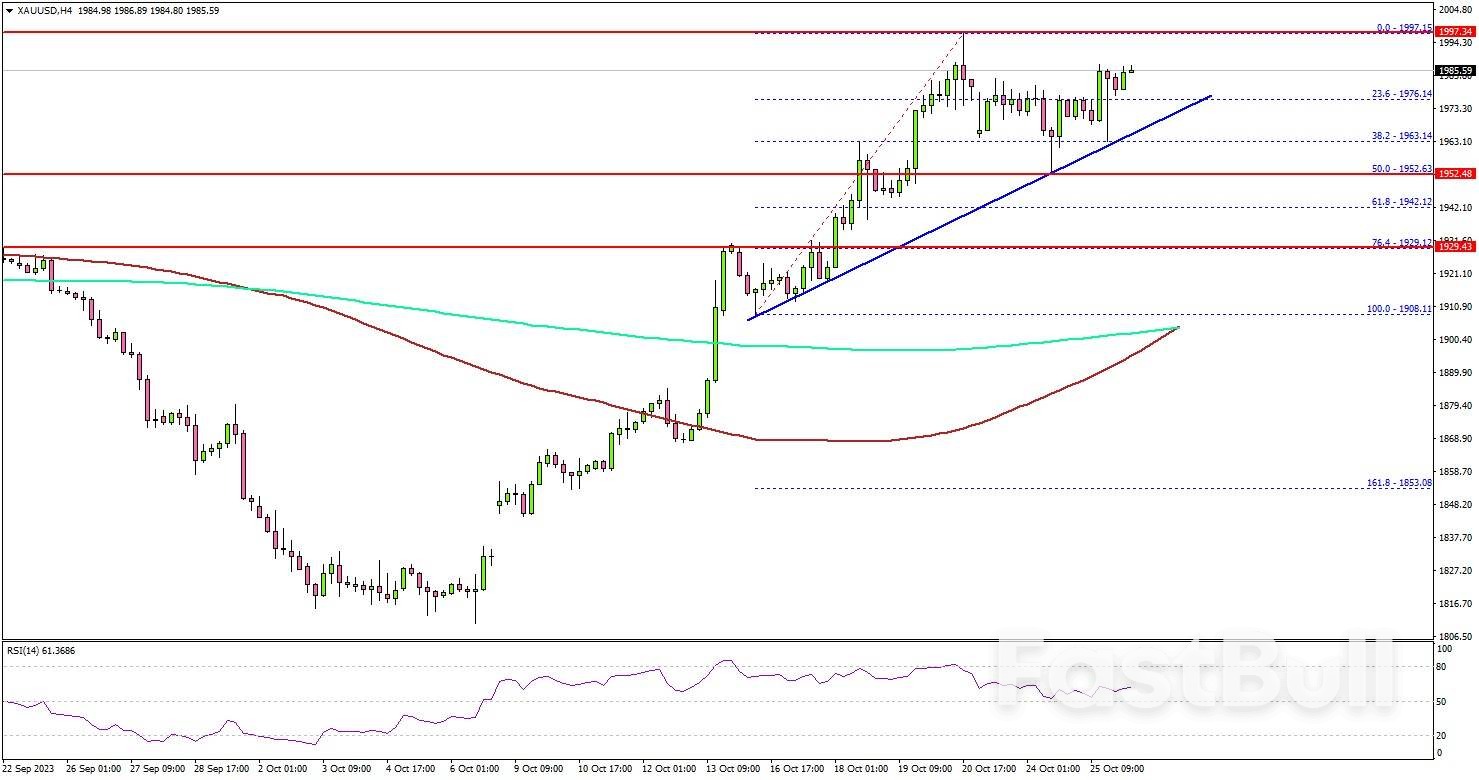

Source: Refinitiv, as of 25 October 2023.

Source: Refinitiv, as of 25 October 2023. Source: TradingView

Source: TradingView Source: TradingView

Source: TradingView Source: Refinitiv

Source: Refinitiv Source: IG charts

Source: IG charts Source: IG charts

Source: IG charts

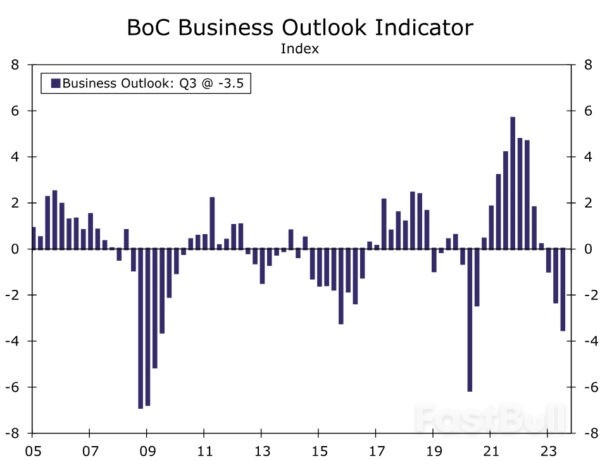

Moreover, economic fundamentals and forward-looking indicators do not point to an improvement in Canada's growth prospects any time soon. From a consumer perspective, the outlook is mixed. Growth in real household disposable income has returned to positive territory and the household saving rate of 5.1% remains slightly above pre-pandemic levels. However, the Bank of Canada's monetary tightening has led to a rising interest and debt servicing burden for Canadian households. In Q2, interest costs were 9.0% of disposable income, while total debt servicing costs (that is, principal and interest) were 14.8% of disposable income. Those metrics are elevated by historical standards, and suggest continued consumer restraint going forward. The outlook for businesses is similarly subdued. Declining corporate profit growth has led to a drop in business fixed investment through mid-2023, and the central bank's Q3 Business Outlook Survey suggests the outlook may have worsened further since. The Bank of Canada's (BoC) Business Outlook Indicator fell further to -3.5, the weakest reading since the depths of the pandemic. In addition, the Indicators of Future Sales balance, which takes into account factors such as order books, advance bookings, sales inquiries and so on, fell to zero in Q3, also the weakest reading since Q3-2020. Finally, more than half of firms surveyed by the BoC believe that the effects of past monetary tightening on their businesses are far from over. To the extent that more cautious businesses scale back hiring plans, that could add to headwinds for Canadian households and consumers. Against this backdrop we have pared our growth forecast for Canada, and now anticipate GDP growth of 1.1% in 2023 (previously 1.2%) and 0.7% in 2024 (previously 1.0%).

Moreover, economic fundamentals and forward-looking indicators do not point to an improvement in Canada's growth prospects any time soon. From a consumer perspective, the outlook is mixed. Growth in real household disposable income has returned to positive territory and the household saving rate of 5.1% remains slightly above pre-pandemic levels. However, the Bank of Canada's monetary tightening has led to a rising interest and debt servicing burden for Canadian households. In Q2, interest costs were 9.0% of disposable income, while total debt servicing costs (that is, principal and interest) were 14.8% of disposable income. Those metrics are elevated by historical standards, and suggest continued consumer restraint going forward. The outlook for businesses is similarly subdued. Declining corporate profit growth has led to a drop in business fixed investment through mid-2023, and the central bank's Q3 Business Outlook Survey suggests the outlook may have worsened further since. The Bank of Canada's (BoC) Business Outlook Indicator fell further to -3.5, the weakest reading since the depths of the pandemic. In addition, the Indicators of Future Sales balance, which takes into account factors such as order books, advance bookings, sales inquiries and so on, fell to zero in Q3, also the weakest reading since Q3-2020. Finally, more than half of firms surveyed by the BoC believe that the effects of past monetary tightening on their businesses are far from over. To the extent that more cautious businesses scale back hiring plans, that could add to headwinds for Canadian households and consumers. Against this backdrop we have pared our growth forecast for Canada, and now anticipate GDP growth of 1.1% in 2023 (previously 1.2%) and 0.7% in 2024 (previously 1.0%).

Canadian Inflation: High, But Heading In The Right Direction

Canadian Inflation: High, But Heading In The Right Direction Survey data also point to elevated inflation trends that are nonetheless moving in a more favorable direction. The BoC's Business Outlook Survey showed more firms expecting slower input and output price inflation over the next 12 months. For example, the net balance for input price inflation fell to -63 in Q3 from -53 in Q2 (that is, more respondents seeing slower input price inflation), while the net balance for output price inflation fell to -43 in Q3 from -33 in Q2 (more seeing slower output price inflation). In terms of firms' CPI inflation expectations over the next two years, 53% saw inflation above 3% during that period, still high but less than the 64% in Q2 and 79% in Q1. Finally, in a separate survey of consumers during Q3, one-year ahead and two-year ahead inflation expectations were still elevated at 5.03% and 4.04% respectively. Nonetheless, that same survey said consumers who expect more adverse effects from rate hikes are less likely to plan major purchases such as cars or appliances, and more likely to spend on discretionary items like vacations and concerts—a hint perhaps that higher interest rates are having some impact on consumer expectations.

Survey data also point to elevated inflation trends that are nonetheless moving in a more favorable direction. The BoC's Business Outlook Survey showed more firms expecting slower input and output price inflation over the next 12 months. For example, the net balance for input price inflation fell to -63 in Q3 from -53 in Q2 (that is, more respondents seeing slower input price inflation), while the net balance for output price inflation fell to -43 in Q3 from -33 in Q2 (more seeing slower output price inflation). In terms of firms' CPI inflation expectations over the next two years, 53% saw inflation above 3% during that period, still high but less than the 64% in Q2 and 79% in Q1. Finally, in a separate survey of consumers during Q3, one-year ahead and two-year ahead inflation expectations were still elevated at 5.03% and 4.04% respectively. Nonetheless, that same survey said consumers who expect more adverse effects from rate hikes are less likely to plan major purchases such as cars or appliances, and more likely to spend on discretionary items like vacations and concerts—a hint perhaps that higher interest rates are having some impact on consumer expectations. Although BoC maintained a moderate rate hike bias, we continue to believe that further tightening remains a possibility rather than a probability. We expect Canadian economic growth to slow more quickly than the central bank's forecast, and as a result, we see slightly slower CPI inflation next year than does the central bank. We believe the Bank of Canada will hold its policy rate steady at 5.00% for an extended period. That said, as growth remains subdued and underlying inflation measures move a bit closer to the central bank's 2% target, we still forecast Bank of Canada rate cuts beginning in Q2-2024, and a cumulative 150 bps of easing to 3.50% by the end of next year. As Canadian growth remains subdued and in the absence of further BoC tightening, we also see potential for further Canadian dollar weakness. The USD/CAD exchange rate has already reached our medium-term target of CAD1.3700, but a further move closer to CAD1.4000 over the next several months cannot be ruled out. We will provide a full assessment and updated currency forecasts in our International Economic Outlook, due for publication later this week.

Although BoC maintained a moderate rate hike bias, we continue to believe that further tightening remains a possibility rather than a probability. We expect Canadian economic growth to slow more quickly than the central bank's forecast, and as a result, we see slightly slower CPI inflation next year than does the central bank. We believe the Bank of Canada will hold its policy rate steady at 5.00% for an extended period. That said, as growth remains subdued and underlying inflation measures move a bit closer to the central bank's 2% target, we still forecast Bank of Canada rate cuts beginning in Q2-2024, and a cumulative 150 bps of easing to 3.50% by the end of next year. As Canadian growth remains subdued and in the absence of further BoC tightening, we also see potential for further Canadian dollar weakness. The USD/CAD exchange rate has already reached our medium-term target of CAD1.3700, but a further move closer to CAD1.4000 over the next several months cannot be ruled out. We will provide a full assessment and updated currency forecasts in our International Economic Outlook, due for publication later this week.White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up