Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Turkey Trade Balance

Turkey Trade BalanceA:--

F: --

P: --

Germany Construction PMI (SA) (Nov)

Germany Construction PMI (SA) (Nov)A:--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Senior Ukrainian negotiator Rustem Umerov will hold talks in Brussels on Wednesday with European leaders' national security advisers and then visit the United States, Ukrainian President Volodymyr Zelenskiy said.

Senior Ukrainian negotiator Rustem Umerov will hold talks in Brussels on Wednesday with European leaders' national security advisers and then visit the United States, Ukrainian President Volodymyr Zelenskiy said.

He was speaking after U.S. President Donald Trump's special envoy, Steve Witkoff, and son-in-law Jared Kushner met Russian President Vladimir Putin on Tuesday for talks. The Kremlin said on Wednesday no compromise had been reached on a possible peace deal to end the war in Ukraine.

"Ukrainian representatives will brief their colleagues in Europe on what is known following yesterday's contacts by the American side in Moscow, and they will also discuss the European component of the necessary security architecture," Zelenskiy said on Telegram.

After visiting Brussels, Umerov and Andrii Hnatov, Chief of the General Staff of the Armed Forces of Ukraine, will begin preparations for a meeting with Trump envoys in the U.S., he added.

"This is our ongoing coordination with partners, and we ensure that the negotiation process is fully active," Zelenskiy said.

A leaked set of 28 U.S. draft peace proposals, opens new tab emerged last week, alarming Ukrainian and European officials who said it bowed to Moscow's main demands on NATO, Russian control of a fifth of Ukraine and restrictions on Ukraine's army.

European powers then came up with a counter-proposal, and at talks in Geneva, the United States and Ukraine said they had created an "updated and refined peace framework" to end the war. Details of those talks have not been released made public.

The U.K. now formally recognizes cryptocurrency as property following the passing of a new law this week.

The Property (Digital Assets etc) Act received Royal Assent, the final step of an act becoming law after being passed by Parliament.

The act, approved by King Charles on Tuesday, was designed to modernize property law to take account of digital assets. Previously, property fell into one of two categories: things in possession, such as physical objects, and things in action, such as a debt.

The law establishes a third category that includes digital assets such as cryptocurrencies and non-fungible tokens (NFTs).

Crypto industry associations welcomed the law, hailing it as an important step in the legal recognition of digital assets and therefore instilling greater confidence for users.

"This change provides greater clarity and protection for consumers and investors by ensuring that digital assets can be clearly owned, recovered in cases of theft or fraud, and included within insolvency and estate processes," trade association CryptoUK wrote in a post on X.

"By recognising digital assets in law, the UK is giving consumers clear ownership rights, stronger protections, and the ability to recover assets lost through theft or fraud," Gurinder Singh Josan MP, co-chair of the Crypto and Digital Assets All Party Parliamentary Group (APPG) wrote in an emailed comment.

Cryptocurrency has previously been treated as property in court, but this has been on a case-by-case basis. This act makes the recognition law.

An acute global shortage of memory chips is forcing artificial intelligence and consumer-electronics companies to fight for dwindling supplies, as prices soar for the unglamorous but essential components that allow devices to store data.

Japanese electronics stores have begun limiting how many hard-disk drives shoppers can buy. Chinese smartphone makers are warning of price increases. Tech giants including Microsoft (MSFT.O), opens new tab, Google (GOOGL.O), opens new tab and ByteDance are scrambling to secure supplies from memory-chip makers such as Micron (MU.O), opens new tab, Samsung Electronics (005930.KS), opens new tab and SK Hynix (000660.KS), opens new tab, according to three people familiar with the discussions.

The squeeze spans almost every type of memory, from flash chips used in USB drives and smartphones to advanced high-bandwidth memory (HBM) that feeds AI chips in data centers. Prices in some segments have more than doubled since February, according to market-research firm TrendForce, drawing in traders betting that the rally has further to run.

The fallout could reach beyond tech. Many economists and executives warn the protracted shortage risks slowing AI-based productivity gains and delaying hundreds of billions of dollars in digital infrastructure. It could also add inflationary pressure just as many economies are trying to tame price rises and navigate U.S. tariffs.

"The memory shortage has now graduated from a component-level concern to a macroeconomic risk," said Sanchit Vir Gogia, CEO of Greyhound Research, a technology advisory firm. The AI build-out "is colliding with a supply chain that cannot meet its physical requirements."

This Reuters examination of the spiraling supply crisis is based on interviews with almost 40 people, including 17 executives at chipmakers and distributors. It shows industry efforts to meet voracious appetite for advanced chips — driven by Nvidia (NVDA.O), opens new tab and tech giants like Google, Microsoft and Alibaba (9988.HK), opens new tab — created a dual bind: Chipmakers still can't produce enough high-end semiconductors for the AI race, yet their tilt away from traditional memory products is choking supply to smartphones, PCs and consumer electronics. Some are now hurrying to course-correct.

Details of the global scramble by tech firms and price increases described by electronics retailers and component suppliers in China and Japan are reported here for the first time.

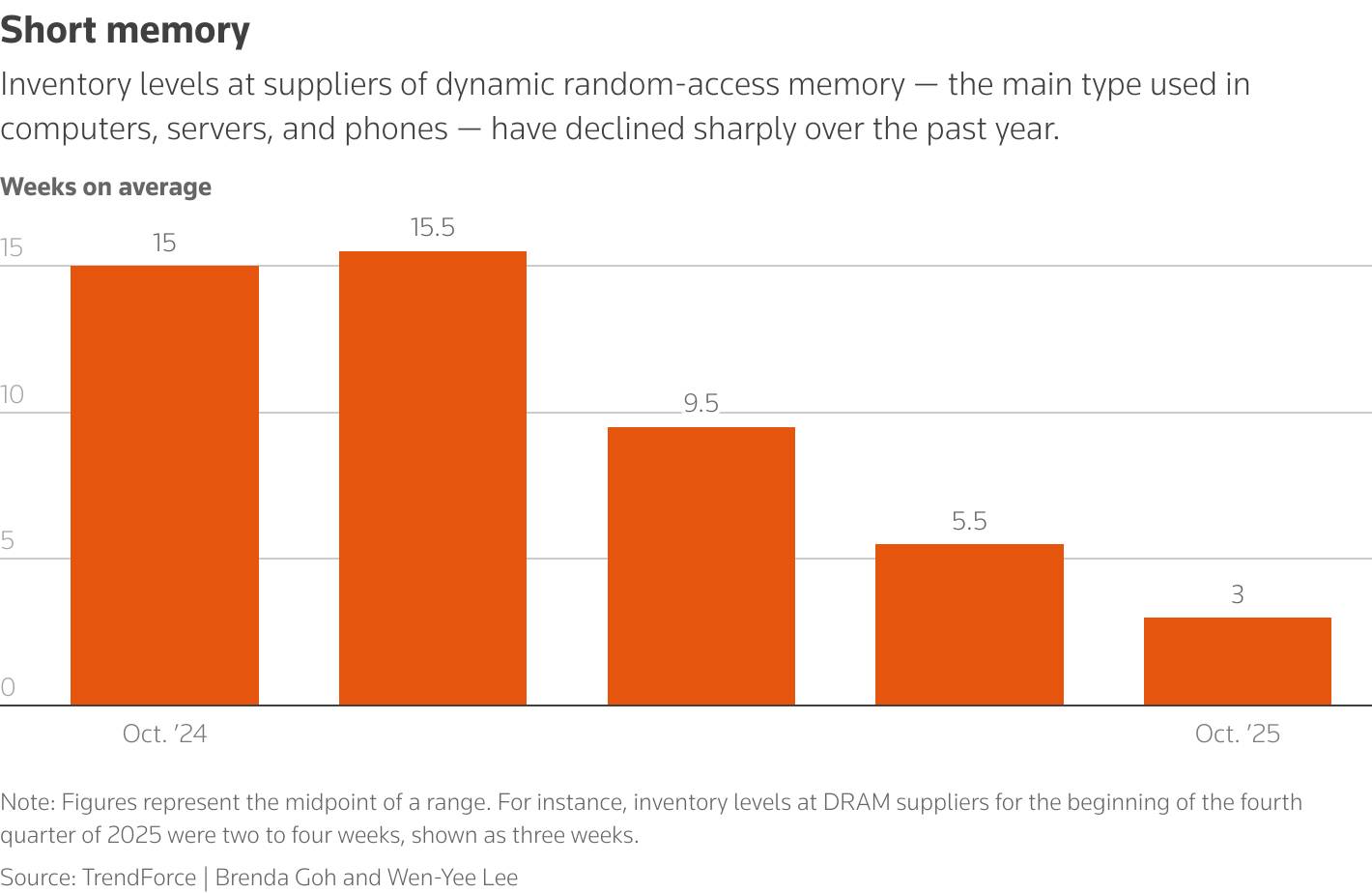

Average inventory levels at suppliers of dynamic random-access memory (DRAM) — the main type used in computers and phones — fell to two to four weeks in October from three to eight weeks in July and 13 to 17 weeks in late 2024, according to TrendForce.

Column chart shows a steep decline in average inventory levels at suppliers of DRAM since October 2024.

Column chart shows a steep decline in average inventory levels at suppliers of DRAM since October 2024.The crunch is unfolding as investors question whether the billions of dollars poured into AI infrastructure have inflated a bubble. Some analysts predict a shakeout, with only the biggest and financially strongest companies able to stomach the price increases.

One memory-chip executive told Reuters the shortage would delay future data-center projects. New capacity takes at least two years to build but memory-chip makers are wary of overbuilding for fear it could end up idle should the demand surge pass, the person said.

Samsung and SK Hynix have announced investments in new capacity but haven't detailed the production split between HBM and conventional memory.

SK Hynix has told analysts that the memory shortfall would last through late 2027, Citi said in November.

"These days, we're receiving requests for memory supplies from so many companies that we're worried about how we'll be able to handle all of them. If we fail to supply them, they could face a situation where they can't do business at all," Chey Tae-won, chairman of SK Hynix parent SK Group, said at an industry forum in Seoul last month.

OpenAI in October signed initial deals with Samsung and SK Hynix to supply chips for its Stargate project, which would require up to 900,000 wafers per month by 2029. That's about double current global monthly HBM production, Chey said.

Samsung told Reuters it is monitoring the market but wouldn't comment on pricing or customer relationships. SK Hynix said it is boosting production capacity to meet increased memory demand.

Microsoft declined to comment and ByteDance didn't address questions about the chip strain. Micron and Google didn't respond to comment requests.

After ChatGPT's release in November 2022 ignited the generative AI boom, a global rush to build AI data centers led memory makers to allocate more production to HBM, used in Nvidia's powerful AI processors.

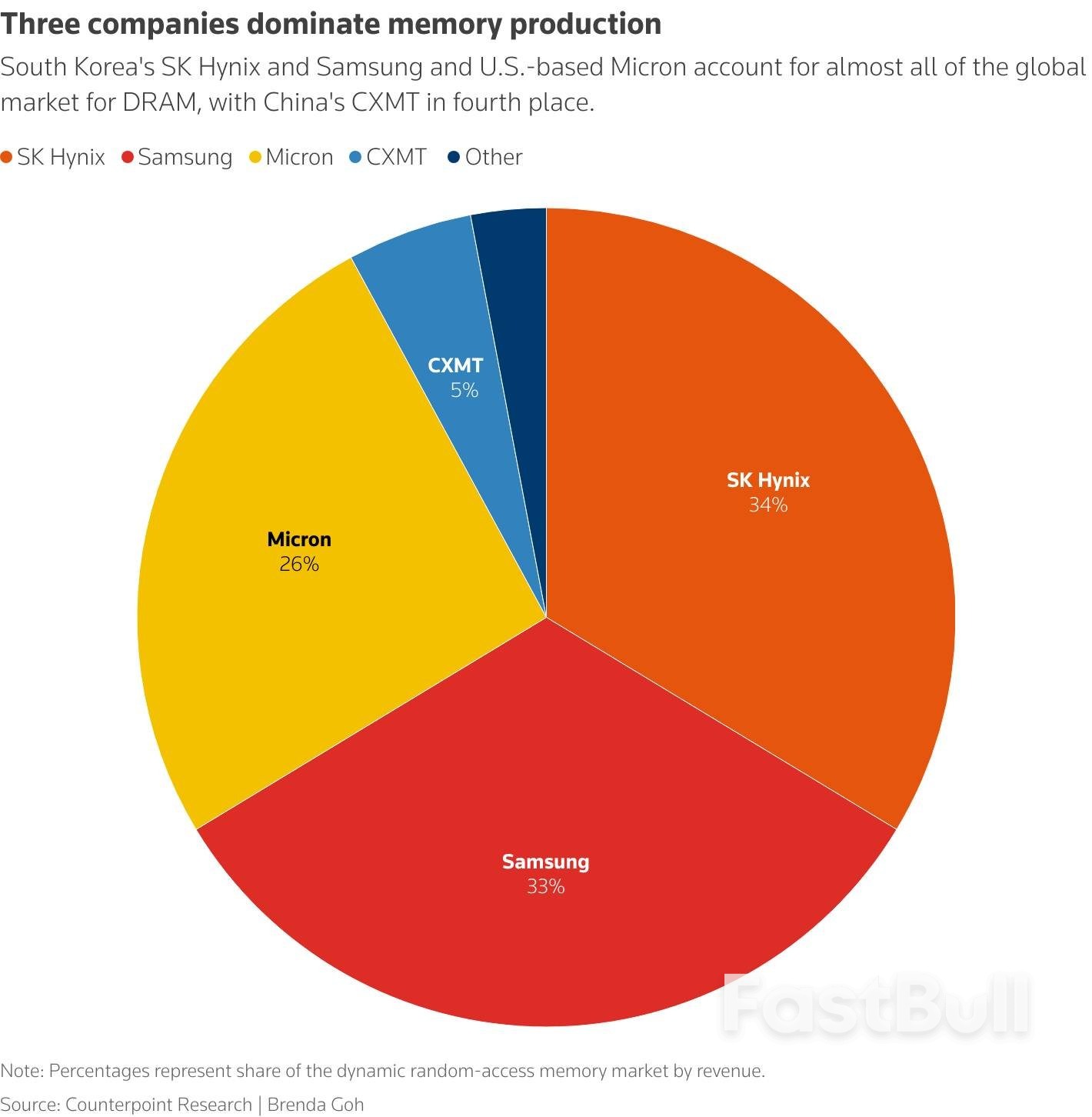

Competition from Chinese rivals making lower-end DRAM, such as ChangXin Memory Technologies, also pushed Samsung and SK Hynix to accelerate their shift to higher-margin products. The South Korean firms account for two-thirds of the DRAM market.

Samsung told customers in May 2024 that it planned to end production of one type of DDR4 chips — an older variety used in PCs and servers — this year, according to a letter seen by Reuters. (The company has since changed course and will extend production, two sources said.) In June, Micron said it had informed customers it would stop shipping DDR4 and its counterpart LPDDR4 - a type used in smartphones - in six to nine months.

Pie chart showing global chipmakers' market share by revenue.

Pie chart showing global chipmakers' market share by revenue.ChangXin followed suit in ending most DDR4 production, one source said. The firm declined to comment.

This shift, however, coincided with a replacement cycle for traditional data centers and PCs, as well as stronger-than-expected sales of smartphones, which rely on conventional chips.

In hindsight, "one could say the industry was caught off-guard," said Dan Hutcheson, senior research fellow at TechInsights.

Samsung raised prices of server memory chips by up to 60% last month, Reuters has reported. Nvidia CEO Jensen Huang, who in October announced deals and shared fried chicken with Samsung Electronics Chairman Jay Y. Lee during a trip to South Korea, acknowledged the price surge as significant but said Nvidia had secured substantial supply.

Google, Amazon, Microsoft and Meta in October asked Micron for open-ended orders, telling the company they will take as much as it can deliver, irrespective of price, according to two people briefed on the talks.

China's Alibaba, ByteDance and Tencent (0700.HK), opens new tab are also leaning on suppliers, dispatching executives to visit Samsung and SK Hynix in October and November to lobby for allocation, the two people and another source told Reuters.

"Everyone is begging for supply," one said.

The Chinese firms didn't address questions about the chip crunch. Nvidia, Meta (META.O), opens new tab, Amazon (AMZN.O), opens new tab and OpenAI didn't respond to requests for comment.

In October, SK Hynix said all its chips are sold out for 2026, while Samsung said it had secured customers for its HBM chips to be produced next year. Both firms are expanding capacity to meet AI demand, but new factories for conventional chips won't come online until 2027 or 2028.

Shares in Micron, Samsung and SK Hynix have rallied this year on chip demand. In September, Micron forecast first-quarter revenue above market estimates while Samsung in October reported its biggest quarterly profit in more than three years.

Consultancy Counterpoint Research expects prices of advanced and legacy memory to rise by 30% through the fourth quarter and possibly another 20% in early 2026.

Chinese smartphone makers Xiaomi (1810.HK), and Realme have warned they may have to raise prices.

Francis Wong, Realme India's chief marketing officer, told Reuters the steep increases in memory costs were "unprecedented since the advent of smartphones" and could force the company to lift handset prices by 20% to 30% by June.

"Some manufacturers might save costs on imaging cameras, some on processors, and some on batteries," he said. "But the cost of storage is something all manufacturers must completely absorb; there's no way to transfer it."

Xiaomi told Reuters it would offset higher memory costs by raising prices and selling more premium phones, adding that its other businesses would help cushion the impact.

In November, Taiwanese laptop maker ASUS said it had about four months of inventory, including memory components, and would adjust pricing as needed.

Winbond (2344.TW), a Taiwanese chipmaker with around 1% of the DRAM market, was among the first to announce a capacity expansion to meet demand. Shareholders approved a plan in October to sharply boost capital expenditure to $1.1 billion.

"Many customers have been coming to us saying, 'I really need your help,' and one even asked for a six-year long-term agreement," Winbond's President Pei-Ming Chen said.

TRADERS RUSH IN

In Tokyo's electronics hub of Akihabara, stores are restricting purchases of memory products to curb hoarding. A sign outside PC shop Ark says that since November 1 customers have been limited to buying a total of eight products across hard-disk drives, solid-state drives and system memory.

Clerks at five shops said shortages had pushed prices sharply higher in recent weeks. At some stores, one-third of products were sold out.

Products such as 32-gigabyte DDR5 memory – popular with gamers – were over 47,000 yen, up from around 17,000 yen in mid-October. Higher-end 128-gigabyte kits had more than doubled to around 180,000 yen.

The hikes are driving customers to the secondhand market — benefiting people like Roman Yamashita, owner of iCON in Akihabara, who said his business selling used PC parts is booming.

Eva Wu, a sales manager at component trader Polaris Mobility in Shenzhen, said prices are changing so rapidly that distributors issue broker-style quotes that expire daily – and in some cases hourly – versus monthly before the crunch.

In Beijing, a DDR4 seller said she had hoarded 20,000 units in anticipation of further increases.

Some 6,000 miles away in California, Paul Coronado said monthly sales at his company, Caramon, which sells recycled low-end memory chips pulled from decommissioned data-center servers, have surged since September. Almost all its products are now bought by Hong Kong-based intermediaries who resell them to Chinese clients, he said.

"We were doing about $500,000 a month," he said. "Now it's $800,000 to $900,000."

The dollar headed for its ninth straight decline on Wednesday as traders ramped up bets on Federal Reserve rate cuts following U.S. economic data and growing expectations of a more dovish central bank.

Fed Governor Christopher Waller said last week the labour market is weak enough to justify another quarter-point rate cut in December, while White House economic adviser Kevin Hassett emerged as the frontrunner to become the next Fed chair.

U.S. President Donald Trump said he would be announcing his pick as Fed chair early in 2026.

"Such an announcement, if it occurs this early, will create a 'shadow Fed chair' since current Fed Chair Powell's term does not end until May," said Kristina Hooper, chief market strategist at Man Group.

"This could complicate the Fed's ability to communicate monetary policy and could create some confusion for markets at a time when they need clarity," she added.

Markets priced in an 87% chance of a rate cut this month on Wednesday, according to the CME Group's FedWatch tool. The probability was at 30% on November 19.

Now that a December move is almost fully priced in, investors will shift their focus to the Fed following decisions, with markets indicating cuts for 88 basis points by December 2026.

The dollar index, which measures the U.S. currency against six other units, was 0.15% lower at 99.10, set for a nearly 9% decline in the year.

The eurorose 0.11% to $1.1639 as investors monitored progress in Ukraine peace talks, which could bolster energy security and lower costs, supporting the single currency.

However, Russia and the U.S. did not reach a compromise on a possible peace deal to end the war in Ukraine after a five-hour Kremlin meeting between President Vladimir Putin and Trump's top envoys, the Kremlin said on Wednesday.

Analysts said the euro could rally further if a ceasefire or full peace agreement is reached, particularly if elevated defense spending, which is expected to support the economy in coming years, remains in place.

Euro zone inflation data came in slightly above expectations on Tuesday, but bets on the policy rate path were unchanged, with the European Central Bank expected to stay on hold through early 2027.

The Japanese yen dropped 0.13% to 155.69 against the dollar (JPY=EGB) on Wednesday after rising 0.25% to 155.89 the day before as Bank of Japan Governor Kazuo Ueda provided the strongest signal yet of a rate hike later this month.

"The initial price action casts some doubt on whether an earlier BoJ rate hike will be sufficient on its own to reverse the yen weakening trend that has been in place since Sanae Takaichi won the Liberal Democratic Party (LDP) leadership election in early October," said Lee Hardman senior currency economist at MUFG.

Prime Minister Takaichi is expected to favour an expansionary fiscal policy and lower rates.

"It may still require intervention if the yen continues to weaken," he added.

Analysts said Washington is likely to push back against any yen slide to or beyond 160.00 making intervention likely around that level, while noting U.S. Treasury Secretary Scott Bessent has repeatedly blamed BoJ policy for keeping the currency undervalued.

In Asia, the Australian dollarhit its highest level since October 30 at $0.6584 after gross domestic product data was slightly below expectations. The Reserve Bank of Australia is due to meet next week and is expected to hold rates steady.

The other main action in Asia was in India where the rupee breached the closely watched 90 per U.S. dollar threshold, pressured by weak trade and portfolio flows despite strong economic growth in the world's fifth-largest economy.

A sharp rebound for bitcoinhelped investors get somewhat in the mood for taking on a bit more risk. The biggest cryptocurrency by market value rose 2% on Wednesday to a two-week high of $93,633.70 after a 6% rise in the previous session.

Bitcoin had slumped at the start of December after a woeful November when it fell more than $18,000 as a record amount of money rushed out of the market, its largest dollar loss since May 2021, when a number of cryptocurrencies collapsed.

The Crypto Fear and Greed Index, a popular tool to measure market sentiment, has risen from 23 to 28 within a day. While both numbers fall under the "Fear" category, the jump from "Extreme Fear" to "Fear" reflects a modest but notable shift in how investors are currently feeling about the crypto market.

This change suggests that some confidence may be returning after a period of high uncertainty and selling pressure. However, with the index still below 30, market participants remain cautious, and the overall mood is far from bullish.

The Fear and Greed Index analyzes various factors—such as volatility, trading volume, social media trends, and surveys—to quantify the emotional state of the market. A score closer to 0 represents extreme fear, while 100 signals extreme greed.

Today's move to 28 still suggests investors are wary, but they're not in panic mode like they were yesterday. This small shift could indicate stabilization after a rough patch, or it might be a short-lived reaction to a minor positive development—such as slight price recoveries or encouraging news.

Understanding market sentiment is essential for crypto traders and investors. When fear dominates, opportunities may arise for long-term believers to enter at lower prices. On the other hand, excessive greed can signal that the market is overheated and due for a correction.

Even a small rise in the Crypto Fear and Greed Index can help gauge market direction. As of now, the index is showing early signs of a possible trend reversal, but fear still lingers. Investors should stay informed and watch for further sentiment shifts that might affect price movements.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up