Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

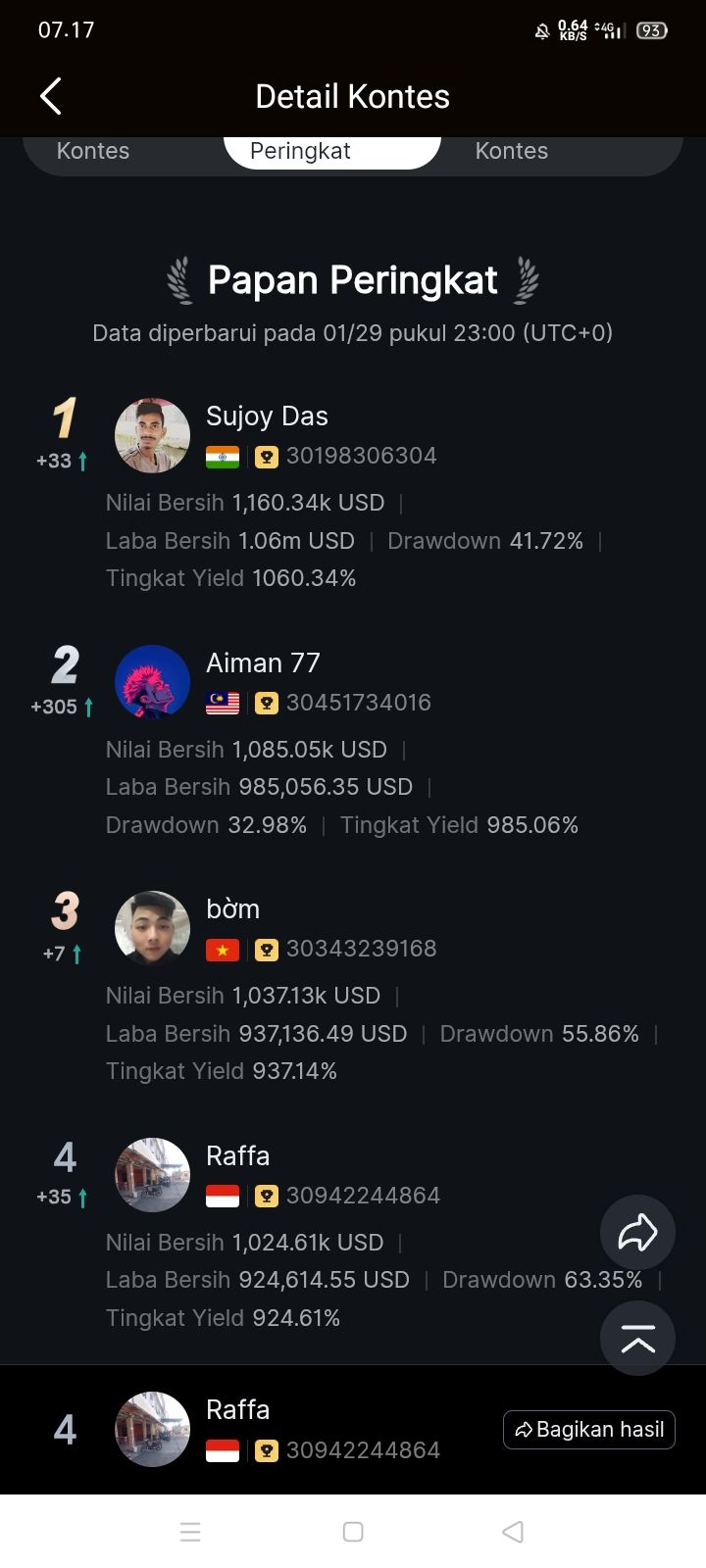

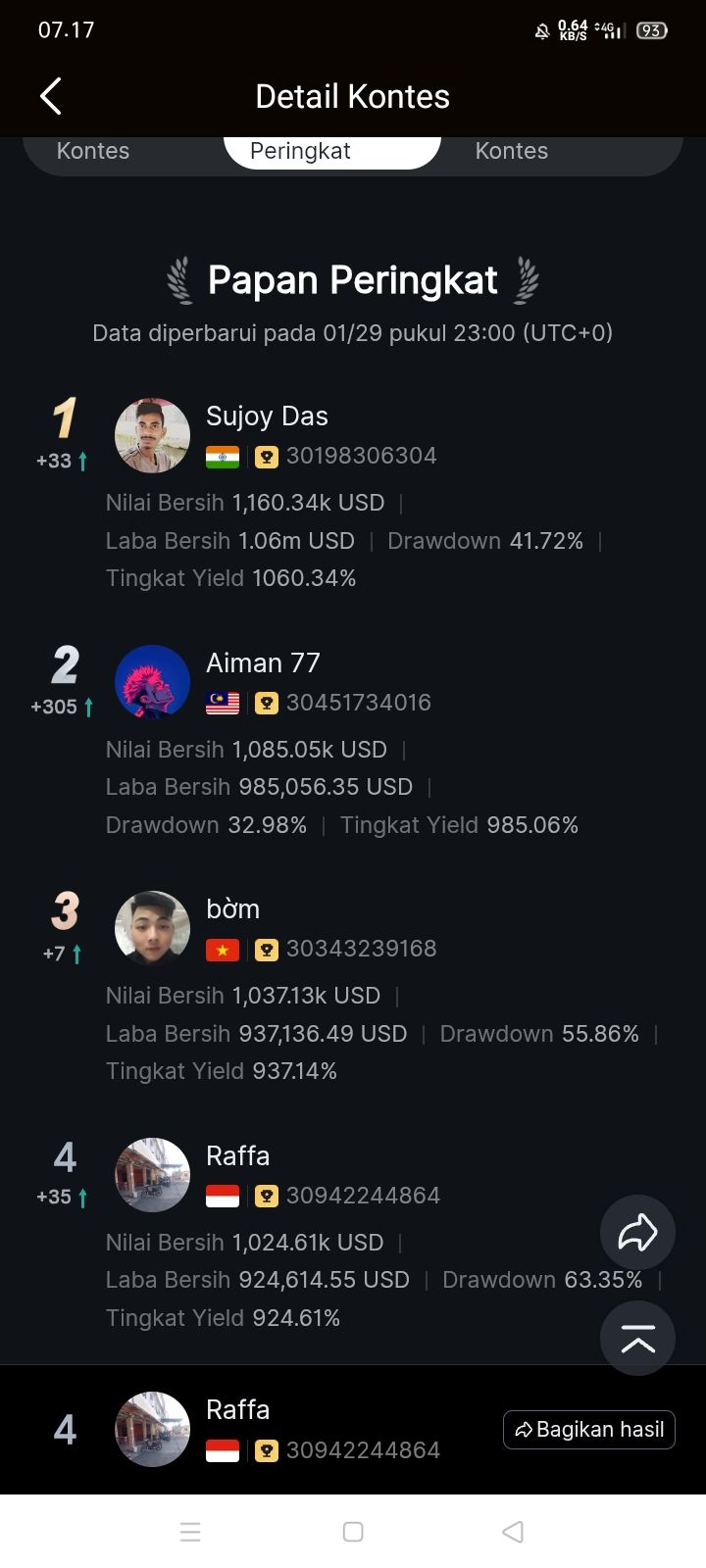

Signal Accounts for Members

All Signal Accounts

All Contests

China Central Bank Injects 477.5 Billion Yuan Via 7-Day Reverse Repos At 1.40% Versus Prior 1.40%

Spot Gold Fell Sharply, Dropping Nearly $50 In The Short Term To A Low Of $5,325.33 Per Ounce, Down 0.80% On The Day

Taiwan Overnight Interbank Rate Opens At 0.805 Percent (Versus 0.805 Percent At Previous Session Open)

Trump: 'Very Dangerous' For UK To Get Into Business With China, More Dangerous For Canada To Get Into Business With China

U.S. Exports (Nov)

U.S. Exports (Nov)A:--

F: --

P: --

Canada Imports (SA) (Nov)

Canada Imports (SA) (Nov)A:--

F: --

Canada Exports (SA) (Nov)

Canada Exports (SA) (Nov)A:--

F: --

U.S. Factory Orders MoM (Excl. Defense) (Nov)

U.S. Factory Orders MoM (Excl. Defense) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Nov)

U.S. Factory Orders MoM (Nov)A:--

F: --

U.S. Wholesale Sales MoM (SA) (Nov)

U.S. Wholesale Sales MoM (SA) (Nov)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Transport) (Nov)

U.S. Factory Orders MoM (Excl. Transport) (Nov)A:--

F: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Nov)A:--

F: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Dec)

Brazil CAGED Net Payroll Jobs (Dec)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Dec)

South Korea Industrial Output MoM (SA) (Dec)A:--

F: --

P: --

South Korea Services Output MoM (Dec)

South Korea Services Output MoM (Dec)A:--

F: --

P: --

South Korea Retail Sales MoM (Dec)

South Korea Retail Sales MoM (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)

Japan Tokyo CPI YoY (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)

Japan Tokyo CPI MoM (Excl. Food & Energy) (Jan)A:--

F: --

P: --

Japan Unemployment Rate (Dec)

Japan Unemployment Rate (Dec)A:--

F: --

P: --

Japan Tokyo CPI YoY (Jan)

Japan Tokyo CPI YoY (Jan)A:--

F: --

P: --

Japan Jobs to Applicants Ratio (Dec)

Japan Jobs to Applicants Ratio (Dec)A:--

F: --

P: --

Japan Tokyo CPI MoM (Jan)

Japan Tokyo CPI MoM (Jan)A:--

F: --

P: --

Japan Tokyo Core CPI YoY (Jan)

Japan Tokyo Core CPI YoY (Jan)A:--

F: --

P: --

Japan Retail Sales YoY (Dec)

Japan Retail Sales YoY (Dec)A:--

F: --

Japan Industrial Inventory MoM (Dec)

Japan Industrial Inventory MoM (Dec)A:--

F: --

P: --

Japan Retail Sales (Dec)

Japan Retail Sales (Dec)A:--

F: --

P: --

Japan Retail Sales MoM (SA) (Dec)

Japan Retail Sales MoM (SA) (Dec)A:--

F: --

Japan Large-Scale Retail Sales YoY (Dec)

Japan Large-Scale Retail Sales YoY (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim MoM (Dec)

Japan Industrial Output Prelim MoM (Dec)A:--

F: --

P: --

Japan Industrial Output Prelim YoY (Dec)

Japan Industrial Output Prelim YoY (Dec)A:--

F: --

P: --

Australia PPI YoY (Q4)

Australia PPI YoY (Q4)A:--

F: --

P: --

Australia PPI QoQ (Q4)

Australia PPI QoQ (Q4)A:--

F: --

P: --

Japan Construction Orders YoY (Dec)

Japan Construction Orders YoY (Dec)--

F: --

P: --

Japan New Housing Starts YoY (Dec)

Japan New Housing Starts YoY (Dec)--

F: --

P: --

France GDP Prelim YoY (SA) (Q4)

France GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Turkey Trade Balance (Dec)

Turkey Trade Balance (Dec)--

F: --

P: --

France PPI MoM (Dec)

France PPI MoM (Dec)--

F: --

P: --

Germany Unemployment Rate (SA) (Jan)

Germany Unemployment Rate (SA) (Jan)--

F: --

P: --

Germany GDP Prelim YoY (Not SA) (Q4)

Germany GDP Prelim YoY (Not SA) (Q4)--

F: --

P: --

Germany GDP Prelim QoQ (SA) (Q4)

Germany GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)

Germany GDP Prelim YoY (Working-day Adjusted) (Q4)--

F: --

P: --

Italy GDP Prelim YoY (SA) (Q4)

Italy GDP Prelim YoY (SA) (Q4)--

F: --

P: --

U.K. M4 Money Supply (SA) (Dec)

U.K. M4 Money Supply (SA) (Dec)--

F: --

P: --

U.K. M4 Money Supply YoY (Dec)

U.K. M4 Money Supply YoY (Dec)--

F: --

P: --

U.K. M4 Money Supply MoM (Dec)

U.K. M4 Money Supply MoM (Dec)--

F: --

P: --

U.K. Mortgage Lending (Dec)

U.K. Mortgage Lending (Dec)--

F: --

P: --

U.K. Mortgage Approvals (Dec)

U.K. Mortgage Approvals (Dec)--

F: --

P: --

Italy Unemployment Rate (SA) (Dec)

Italy Unemployment Rate (SA) (Dec)--

F: --

P: --

Euro Zone Unemployment Rate (Dec)

Euro Zone Unemployment Rate (Dec)--

F: --

P: --

Euro Zone GDP Prelim QoQ (SA) (Q4)

Euro Zone GDP Prelim QoQ (SA) (Q4)--

F: --

P: --

Euro Zone GDP Prelim YoY (SA) (Q4)

Euro Zone GDP Prelim YoY (SA) (Q4)--

F: --

P: --

Italy PPI YoY (Dec)

Italy PPI YoY (Dec)--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoY--

F: --

P: --

Mexico GDP Prelim YoY (Q4)

Mexico GDP Prelim YoY (Q4)--

F: --

P: --

Brazil Unemployment Rate (Dec)

Brazil Unemployment Rate (Dec)--

F: --

P: --

South Africa Trade Balance (Dec)

South Africa Trade Balance (Dec)--

F: --

P: --

Germany CPI Prelim YoY (Jan)

Germany CPI Prelim YoY (Jan)--

F: --

P: --

Germany CPI Prelim MoM (Jan)

Germany CPI Prelim MoM (Jan)--

F: --

P: --

Germany HICP Prelim YoY (Jan)

Germany HICP Prelim YoY (Jan)--

F: --

P: --

Germany HICP Prelim MoM (Jan)

Germany HICP Prelim MoM (Jan)--

F: --

P: --

Canada GDP MoM (SA) (Nov)

Canada GDP MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Zelenskiy awaits a US-brokered Russian attack pause, cautioning it's Moscow's test.

Ukrainian President Volodymyr Zelenskiy said on Thursday that he anticipates Russia will follow through on an agreement for a week-long pause in attacks on Kyiv and other cities, a deal announced by U.S. President Donald Trump in response to winter weather.

Zelenskiy noted, however, that the coming days would serve as the real test of Moscow's commitment to the temporary halt in hostilities.

In a statement on the social media platform X, Zelenskiy confirmed that diplomatic teams had discussed the matter in the United Arab Emirates.

"We expect the agreements to be implemented," he wrote. "De-escalation steps contribute to real progress toward ending the war."

This cautious optimism suggests that while Ukraine welcomes the initiative, it remains wary of Russia's intentions and will be monitoring the situation closely.

In his nightly video address, Zelenskiy specifically thanked Washington for its role in brokering the agreement, which he characterized as an effort to stop Russian strikes on Ukraine's critical energy infrastructure.

"Thanks to the American side for their efforts in ensuring a stop to strikes on energy (targets) at this time and let's hope that America succeeds in ensuring this," he stated.

Despite the diplomatic progress, Zelenskiy adopted a wait-and-see approach, concluding, "We shall see what the real situation is with our energy facilities and cities in the days and nights to come."

Donald Trump has a clear goal for the U.S. housing market: make it more affordable without letting home prices fall. His strategy hinges on lowering borrowing costs, specifically mortgage rates, while actively protecting the wealth of current homeowners.

However, economists question whether this approach can meaningfully tackle the housing affordability crisis, as it avoids addressing the core issue of high property values.

In a speech at the World Economic Forum in Davos, former President Trump laid out his vision. He argued that increasing the housing supply to drive down prices would disrupt the market and erode the wealth homeowners have built, especially since values soared post-pandemic.

"I am very protective of people that already own a house," Trump said. "Because we have had such a good run, the house values have gone up tremendously, and these people have become wealthy."

He framed lower interest rates as a solution that is "good for everybody." This signals a clear preference for one policy lever over another.

"This suggests that the administration sees lower mortgage rates as the preferred channel through which to improve affordability," noted Wells Fargo economists Charlie Dougherty and Ali Hajibeigi.

Yet, some experts argue that addressing high prices is unavoidable. "As a homeowner, I don't want to see the value of my property go down," said Shelton Weeks, an economics professor at Florida Gulf Coast University. "Ultimately, that bit of pain for other homeowners is the pathway to truly alleviating the housing affordability crisis."

Trump's proposals have consistently focused on reducing the cost of borrowing. Key initiatives include:

• Directing government-backed mortgage giants Fannie Mae and Freddie Mac to purchase $200 billion in mortgage bonds to help lower rates.

• Floating the idea of creating 50-year mortgages to provide homebuyers with more financing options.

While lower mortgage rates make monthly payments cheaper, they also risk stimulating demand. Without a corresponding increase in the number of homes for sale, this could backfire.

"Unless new listings pick up substantially, the lack of supply is likely to drive up prices, offsetting much of the affordability gain from lower mortgage rates," wrote Ben Ayers, a senior economist at Nationwide.

Protecting high home values has a direct impact on the broader economy. When homeowners feel wealthier due to rising property values, they tend to spend more—a phenomenon known as the "wealth effect."

"Because a home is often the largest source of family wealth, price swings can materially impact how people spend, save and borrow," the Dallas Federal Reserve explained in a recent report.

This housing wealth has been a key factor supporting strong consumer spending, which accounts for over two-thirds of U.S. economic activity. Data from the Bureau of Economic Analysis showed consumer spending rose 0.3% in both October and November. Trump's policy aims to keep this engine running.

"Affluent consumers continued to buoy spending with an extra boost from wealth effects," said Diane Swonk, chief economist at KPMG.

While prioritizing rate reduction, Trump has proposed some measures to increase the housing supply available to typical buyers. An executive order aims to ban large institutional investors from purchasing homes, targeting Wall Street's growing stake in the residential market.

However, analysts believe this move may have a limited impact. According to Wells Fargo, institutional investors account for a relatively small 2.5% share of the market. Furthermore, the policy's wording suggests it may not be an absolute prohibition.

"The order only appears to erect hurdles for additional home sales to investors and does not look to be an outright ban," Wells Fargo economists wrote. "There is no mention of completely stopping new sales, or mandating the liquidation of existing portfolios."

Trump himself acknowledged the tension between affordability and property values. "Every time you make it more and more and more affordable for somebody to buy a house cheaply, you're actually hurting the value of those houses," he said. "And I don't want to do anything that's going to hurt the value of people that own a house."

A critical government funding package failed to advance in the Senate on Thursday, significantly raising the chances of a government shutdown set to begin Saturday at 12:01 a.m. ET.

The procedural vote on the six-bill package fell short, with a final tally of 45-55. The measure needed 60 votes to overcome a filibuster and move forward.

The outcome was widely anticipated as the legislative standoff intensifies. The failure will likely force Senate Republicans back into negotiations with Democrats to find a path to keep the government open.

The core of the dispute is funding for the Department of Homeland Security (DHS). Democrats are demanding that funding for the agency be stripped from the package, insisting on new restrictions for federal immigration enforcement. This follows an incident where agents shot and killed two U.S. citizens in Minneapolis this month.

Seven Republican senators joined Democrats in blocking the bill. Majority Leader John Thune, a Republican from South Dakota, voted "no" as a procedural move to reserve the right to reconsider the vote later.

"Democrats are ready to pass five bipartisan funding bills in the Senate," Minority Leader Chuck Schumer, a New York Democrat, stated on the Senate floor. "We're ready to fund 96% of the federal government today, but the DHS bill still needs a lot of work."

Beyond the controversial Homeland Security allocation, the failed package also included funding for several other essential federal departments:

• Defense

• Treasury

• State

• Health and Human Services

• Labor

• Housing and Urban Development

• Transportation

• Education

With the deadline approaching, Republicans began signaling a potential compromise on Wednesday. Some expressed a willingness to separate the DHS funding bill from the main package, allowing the other departments to be funded while negotiations continue.

However, altering the bill presents its own procedural challenge, as it would require another vote in the House of Representatives, which is currently on recess.

Thune confirmed that Democrats are negotiating with the White House to find a solution. "Let's hope it lands," he told reporters.

He acknowledged that a resolution on the contentious issues would require a broader agreement. "There's a path to consider some of those things and negotiate that out between Republicans, Democrats, House, Senate, White House, but that's not going to happen in this bill," Thune said.

The United States is once again on the brink of a partial government shutdown after a critical funding bill failed to pass the Senate. With the deadline fast approaching, divisions in Congress are intensifying, raising the likelihood of significant disruptions to federal operations.

A pivotal vote on spending bill H.R. 7148 was defeated in the Senate with a 45-55 result, falling short of the 60 votes required for passage. The outcome threatens to halt operations for parts of the federal government as early as Friday night.

The opposition was notably bipartisan, with seven Republicans joining Democrats in voting against the measure. Despite clearing the House of Representatives, the bill stalled in the Senate as Republicans could not secure the necessary Democratic support, revealing deepening ideological divides.

The central sticking point is the Democratic push for substantial reforms within federal agencies, prompted by recent controversial incidents. Senators in opposition are demanding new restrictions on federal agents, including:

• A ban on the use of masks

• Mandatory body cameras

• Independent oversight on the application of force

Senate Minority Leader Chuck Schumer underscored his party's firm stance, stating, "No ICE funding bill will progress without restructuring." While another vote could potentially occur by Saturday morning, the prospects for a breakthrough appear dim.

While a previous funding agreement has already secured the budgets for the Justice Department, FBI, and Veterans Affairs until 2026, a partial shutdown would still have widespread consequences.

Key economic data releases could be delayed, and agencies like the IRS are anticipating operational disruptions. A prolonged shutdown, similar to the record 43-day stoppage seen previously, could have serious effects across various sectors, including cryptocurrencies.

Reflecting the high stakes and political uncertainty, gambling markets are signaling a strong expectation of a shutdown. Polymarket currently indicates a 75% probability that the government will experience a stoppage by Saturday.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up