Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Average Hourly Wage MoM (SA) (Dec)

U.S. Average Hourly Wage MoM (SA) (Dec)A:--

F: --

U.S. Average Weekly Working Hours (SA) (Dec)

U.S. Average Weekly Working Hours (SA) (Dec)A:--

F: --

P: --

U.S. New Housing Starts Annualized MoM (SA) (Oct)

U.S. New Housing Starts Annualized MoM (SA) (Oct)A:--

F: --

U.S. Total Building Permits (SA) (Oct)

U.S. Total Building Permits (SA) (Oct)A:--

F: --

P: --

U.S. Building Permits MoM (SA) (Oct)

U.S. Building Permits MoM (SA) (Oct)A:--

F: --

P: --

U.S. Annual New Housing Starts (SA) (Oct)

U.S. Annual New Housing Starts (SA) (Oct)A:--

F: --

U.S. U6 Unemployment Rate (SA) (Dec)

U.S. U6 Unemployment Rate (SA) (Dec)A:--

F: --

P: --

U.S. Manufacturing Employment (SA) (Dec)

U.S. Manufacturing Employment (SA) (Dec)A:--

F: --

U.S. Labor Force Participation Rate (SA) (Dec)

U.S. Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Private Nonfarm Payrolls (SA) (Dec)

U.S. Private Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Unemployment Rate (SA) (Dec)

U.S. Unemployment Rate (SA) (Dec)A:--

F: --

U.S. Nonfarm Payrolls (SA) (Dec)

U.S. Nonfarm Payrolls (SA) (Dec)A:--

F: --

U.S. Average Hourly Wage YoY (Dec)

U.S. Average Hourly Wage YoY (Dec)A:--

F: --

Canada Unemployment Rate (SA) (Dec)

Canada Unemployment Rate (SA) (Dec)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Dec)

Canada Labor Force Participation Rate (SA) (Dec)A:--

F: --

P: --

U.S. Government Employment (Dec)

U.S. Government Employment (Dec)A:--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Jan)

U.S. UMich Consumer Expectations Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Jan)

U.S. UMich Consumer Sentiment Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Jan)

U.S. UMich Current Economic Conditions Index Prelim (Jan)A:--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Jan)A:--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Jan)A:--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)

U.S. 5-10 Year-Ahead Inflation Expectations (Jan)A:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Dec)

China, Mainland M0 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Dec)

China, Mainland M1 Money Supply YoY (Dec)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Dec)

China, Mainland M2 Money Supply YoY (Dec)--

F: --

P: --

Indonesia Retail Sales YoY (Nov)

Indonesia Retail Sales YoY (Nov)A:--

F: --

P: --

Euro Zone Sentix Investor Confidence Index (Jan)

Euro Zone Sentix Investor Confidence Index (Jan)A:--

F: --

P: --

India CPI YoY (Dec)

India CPI YoY (Dec)A:--

F: --

P: --

Germany Current Account (Not SA) (Nov)

Germany Current Account (Not SA) (Nov)--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.S. Conference Board Employment Trends Index (SA) (Dec)

U.S. Conference Board Employment Trends Index (SA) (Dec)--

F: --

P: --

Russia CPI YoY (Dec)

Russia CPI YoY (Dec)--

F: --

P: --

Richmond Federal Reserve President Barkin delivered a speech.

Richmond Federal Reserve President Barkin delivered a speech. U.S. 3-Year Note Auction Yield

U.S. 3-Year Note Auction Yield--

F: --

P: --

U.S. 10-Year Note Auction Avg. Yield

U.S. 10-Year Note Auction Avg. Yield--

F: --

P: --

New York Federal Reserve President Williams delivered a speech.

New York Federal Reserve President Williams delivered a speech. Japan Trade Balance (Customs Data) (SA) (Nov)

Japan Trade Balance (Customs Data) (SA) (Nov)--

F: --

P: --

Japan Trade Balance (Nov)

Japan Trade Balance (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Dec)

U.K. BRC Overall Retail Sales YoY (Dec)--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Dec)

U.K. BRC Like-For-Like Retail Sales YoY (Dec)--

F: --

P: --

Turkey Retail Sales YoY (Nov)

Turkey Retail Sales YoY (Nov)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Dec)

U.S. NFIB Small Business Optimism Index (SA) (Dec)--

F: --

P: --

Brazil Services Growth YoY (Nov)

Brazil Services Growth YoY (Nov)--

F: --

P: --

Canada Building Permits MoM (SA) (Nov)

Canada Building Permits MoM (SA) (Nov)--

F: --

P: --

U.S. CPI MoM (SA) (Dec)

U.S. CPI MoM (SA) (Dec)--

F: --

P: --

U.S. CPI YoY (Not SA) (Dec)

U.S. CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Real Income MoM (SA) (Dec)

U.S. Real Income MoM (SA) (Dec)--

F: --

P: --

U.S. CPI MoM (Not SA) (Dec)

U.S. CPI MoM (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI (SA) (Dec)

U.S. Core CPI (SA) (Dec)--

F: --

P: --

U.S. Core CPI YoY (Not SA) (Dec)

U.S. Core CPI YoY (Not SA) (Dec)--

F: --

P: --

U.S. Core CPI MoM (SA) (Dec)

U.S. Core CPI MoM (SA) (Dec)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. New Home Sales Annualized MoM (Oct)

U.S. New Home Sales Annualized MoM (Oct)--

F: --

P: --

U.S. Annual Total New Home Sales (Oct)

U.S. Annual Total New Home Sales (Oct)--

F: --

P: --

U.S. Cleveland Fed CPI MoM (SA) (Dec)

U.S. Cleveland Fed CPI MoM (SA) (Dec)--

F: --

P: --

China, Mainland Exports (Dec)

China, Mainland Exports (Dec)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Dec)

China, Mainland Imports YoY (CNH) (Dec)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Dec)

China, Mainland Trade Balance (CNH) (Dec)--

F: --

P: --

@Kung Fu

@Kung Fu

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Explore the XRP price prediction 10000 token outlook for 2025 and 2030 with realistic ROI tables, expert forecasts, and key factors affecting value.

As investors evaluate long-term opportunities, the xrp price prediction 10000 token stands out as a benchmark for understanding potential returns. This guide analyzes XRP’s fundamentals, historical trends, and expert forecasts for 2025 and 2030 to reveal how much 10,000 tokens might be worth in different market conditions.

XRP is the native cryptocurrency of the Ripple network, a blockchain-based payment system designed to enable instant, low-cost cross-border transactions. Unlike Bitcoin or Ethereum, which rely on mining, XRP operates on a consensus ledger verified by trusted validators, allowing transaction finality in seconds. Its real-world use cases in remittances and liquidity management have made it one of the most adopted digital assets among banks and fintechs.

Many investors consider XRP a utility-driven token rather than a speculative meme coin. This distinction often shapes long-term price prediction for XRP analyses, particularly those focusing on its role in institutional payment systems. In recent market discussions—including AI-driven models and data forecasts such as xrp price prediction 2025 chat gpt—XRP’s unique fundamentals remain a core argument for its value potential.

XRP has experienced multiple boom-and-bust cycles since its debut in 2012. The token reached an all-time high near $3.84 in January 2018, driven by speculative hype and Ripple’s rapid partnership expansion. However, the subsequent crypto winter and ongoing SEC lawsuit heavily pressured prices, leading to years of underperformance.

Between 2020 and 2023, volatility remained high, but the market began to reprice XRP as regulatory clarity improved. The xrp price prediction after lawsuit phase showed renewed optimism, with several analysts forecasting moderate recovery once Ripple secures full compliance for institutional use. Some forecasts even reference a potential xrp price prediction $50 target in extreme bullish cases, though most experts consider such outcomes possible only under large-scale banking integration.

| Year | Average XRP Price (USD) | Market Sentiment |

|---|---|---|

| 2017–2018 | $2.80–$3.84 | Speculative boom and Ripple hype |

| 2019–2021 | $0.25–$1.20 | Litigation pressure and crypto correction |

| 2022–2024 | $0.45–$0.80 | Rebuilding phase with clearer regulation |

| 2025–2026 (forecast) | $1.50–$5.00 | Adoption-driven recovery, per xrp price prediction 2026 |

Retail and long-term holders often benchmark their projections around 10,000 XRP because it offers a clear, scalable view of potential portfolio growth. For example:

This calculation format underpins the core of the xrp price prediction 10000 token model, helping traders visualize future ROI across different targets. As AI-assisted forecasts such as xrp price prediction claver and xrp price prediction ai emerge, more investors rely on data-driven insights to estimate realistic outcomes rather than pure speculation.

Whether considering a modest 2025 recovery or a longer-term rally through 2030, the “10,000-token” framework remains a practical lens for understanding risk and reward. It connects personal investment scale with macro-level projections—bridging individual expectations with institutional market dynamics.

The short-term price prediction for XRP in 2025 depends largely on regulatory clarity and renewed institutional interest following Ripple’s partial legal victory. Analysts expect a gradual revaluation phase rather than an explosive rally. Most AI-assisted models, including xrp price prediction 2025 chat gpt and xrp price prediction ai algorithms, point to a price range between $1.50 and $5.00 by the end of 2025.

Several catalysts could drive this outcome:

In a realistic recovery scenario, XRP’s ROI outlook based on the xrp price prediction 10000 token model is compelling. If the token trades at $3 in 2025, a 10,000-token holding would be worth $30,000. If a strong institutional push lifts prices toward $5, the total value reaches $50,000, confirming moderate upside without requiring speculative extremes like a xrp price prediction $50 target.

| Scenario (2025) | XRP Price | Value of 10,000 Tokens | Expected ROI |

|---|---|---|---|

| Base Case | $1.50 | $15,000 | +150% |

| Bullish Case | $5.00 | $50,000 | +809% |

| Extreme Case | $10.00 | $100,000 | +1,718% |

While some algorithmic forecasts such as xrp price prediction claver estimate a possible breakout above $10, most experts caution that speculative price targets rely on sustained liquidity inflows and improved macro stability. The broader consensus positions XRP as a steady, utility-backed performer rather than a high-volatility moonshot.

The long-term xrp price prediction after lawsuit narrative centers on adoption. By 2030, Ripple’s infrastructure could become a critical layer for global cross-border settlements. Analysts foresee a market structure where XRP’s price reflects genuine transaction utility rather than speculation. The range most often projected by institutional forecasters lies between $10 and $25, while the most optimistic cases push toward $50.

Key long-term drivers include:

Based on the xrp price prediction 2026 trendline and subsequent compounding growth, a realistic ROI projection for a 10,000-token portfolio is as follows:

| Scenario (2030) | XRP Price | 10,000 Token Value | Approximate ROI |

|---|---|---|---|

| Conservative | $10 | $100,000 | +1,718% |

| Moderate Growth | $25 | $250,000 | +4,436% |

| Optimistic Scenario | $50 | $500,000 | +8,991% |

These forecasts illustrate how compounding adoption and institutional trust could elevate XRP’s valuation. Whether or not XRP reaches a xrp price prediction $50 target depends on macroeconomic stability and sustained network expansion. For investors applying the xrp price prediction 10000 token framework, the long-term outlook suggests meaningful growth potential even under conservative assumptions.

The ongoing Ripple vs. SEC lawsuit remains the single biggest variable for XRP’s market valuation. A favorable ruling or regulatory clarity could unlock significant institutional adoption and improve liquidity across exchanges. Most xrp price prediction after lawsuit analyses highlight that a positive outcome would strengthen investor confidence, potentially driving the next revaluation cycle. Conversely, prolonged uncertainty could suppress new capital inflows despite Ripple’s technological strength.

Analysts using data-driven tools such as xrp price prediction ai emphasize that regulatory outcomes directly affect model accuracy. The clearer the legal landscape, the more reliable long-term forecasts become—especially when considering scenarios like the xrp price prediction 2026 and beyond.

Ripple’s strategic partnerships with global banks and payment providers form the cornerstone of XRP’s fundamental value. The more institutions adopt RippleNet and its On-Demand Liquidity (ODL) service, the greater the transactional demand for XRP. In turn, this drives long-term sustainability for the token’s market price. The price prediction for XRP increasingly ties to real-world payment volume, not speculation alone.

As AI-driven research like xrp price prediction claver becomes more sophisticated, models are beginning to quantify adoption impact more precisely. Higher transaction velocity and liquidity depth correlate strongly with bullish xrp price prediction 10000 token scenarios extending to 2030 and beyond.

XRP’s performance does not exist in isolation—it reflects the sentiment of the broader crypto market. In bullish cycles led by Bitcoin, altcoins with strong fundamentals often outperform. However, during macro tightening or liquidity crunches, even robust projects like Ripple face headwinds. Analysts note that maintaining diversification and timing entries remain key for maximizing returns under any xrp price prediction 2025 chat gpt model.

The interplay between inflation trends, monetary policy, and digital asset regulation could shape XRP’s price floor. In a favorable macro backdrop, even conservative forecasts such as the xrp price prediction $50 target could appear achievable if global liquidity expands and institutional trust deepens.

It is highly unlikely under current market dynamics. A $1000 price would imply a multi-trillion-dollar market capitalization—larger than the global banking sector combined. While the xrp price prediction ai models explore such hypothetical cases, realistic forecasts under xrp price prediction 10000 token frameworks place XRP’s long-term range closer to $10–$50 given existing liquidity and adoption potential.

Most experts consider this level unattainable by 2025 unless unprecedented institutional usage occurs. Even optimistic projections from xrp price prediction 2026 and xrp price prediction after lawsuit studies place XRP’s value around $5–$25 during the next cycle. A xrp price prediction $50 target remains the upper boundary for ultra-bullish long-term models based on AI and adoption analytics.

The majority of AI and data-based forecasts, including xrp price prediction 2025 chat gpt simulations, estimate XRP trading between $10 and $25 by 2030. This projection assumes continued RippleNet expansion, regulatory normalization, and sustained global adoption. If those drivers persist, price prediction for XRP by 2030 implies solid ROI potential for holders of 10,000 tokens.

The xrp price prediction 10000 token highlights XRP’s balanced potential between risk and long-term opportunity. With regulatory clarity improving and institutional adoption expanding, XRP remains a solid utility-driven asset. Whether it meets moderate or bullish forecasts, consistent network growth suggests sustainable value appreciation over time.

Rio Tinto is exploring a potential asset-for-equity swap with Chinalco that would trim the Chinese investor’s 11% stake, freeing up Rio to resume buybacks and pursue new strategic deals, three people familiar with the matter told Reuters.State-owned mining giant Aluminium Corporation of China Limited (Chinalco) would exchange part of its holding for partnerships in some of Rio’s mining assets, ending governance constraints that have hamstrung the Anglo-Australian company’s flexibility for over 15 years, the sources said.

The swap could allow Rio to allocate capital and pursue mergers and acquisitions more decisively, putting it in line with broader industry trends, as global miners use consolidation and new projects to attract investors focused on long-term supply prospects.

As Western governments scramble to catch up with China’s dominance in critical mineral supply chains, Beijing’s push to expand into copper is drawing growing scrutiny.For that reason, Rio assets that would be of interest to the Chinese state-owned enterprise are the Simandou iron ore project in Guinea, which is already 75% Chinese-owned and a target of Chinalco’s failed 2016 buyout attempt, and the Oyu Tolgoi copper mine in Mongolia, a fourth source said.

Another possible swap could include Rio’s titanium business, another said, which is under strategic review as part of a broader restructuring by new chief executive Simon Trott.China, the world’s top producer and consumer of titanium dioxide, used in paints, cosmetics and military hardware, has expanded output to dominate over half the global market in the past decade.

The swap would cut Chinalco’s stake by up to 2 to 3 percentage points, the fourth source said, freeing Rio to execute buybacks, pursue large M&A deals, and restructure its capital without diluting its largest shareholder.

Chinalco bought a near 15% stake in Rio Tinto Plc, the London-listed arm of the dual-listed company, in 2008 under conditions imposed by Canberra, including no stake increase without approval and no board seat. Its stake in the overall company is around 11%.A year later, Chinalco proposed a $19.5 billion investment to help reduce Rio’s $39 billion debt, giving it minority stakes across the miner’s global portfolio in exchange. That was blocked by other shareholders and regulators over concerns about Chinese control of strategic assets.

Today, activist investors are pressing Rio to scrap its dual Anglo-Australian listing structure, arguing that it creates governance conflicts between UK and Australian shareholders, and complicates mergers with companies in states that have restrictions on strategic holdings by Chinese firms.

The discussions come as Trott pushes for tighter cost control across the group.Three days after taking the top job on August 25, he said Rio would streamline its structure to three core business units from four, to focus on profitable assets.A further update on the reorganisation could come within the next two weeks, two of the sources said, ahead of Rio’s investor day scheduled for December 4.

As well as reviewing Rio’s borates, iron and titanium businesses, Trott is considering further divestments, including pausing early work at the Jadar lithium project in Serbia, two of the sources said. The project has faced years of opposition from environmental groups despite being identified as strategic by the European Union.

No further cuts to Rio’s leadership team are expected, the sources said, after Trott reduced the executive committee to nine members from 11. The number of managing directors is also likely to fall, with each asked to outline cost cuts in their departments rather than meet a fixed company-wide target, one of the sources said.

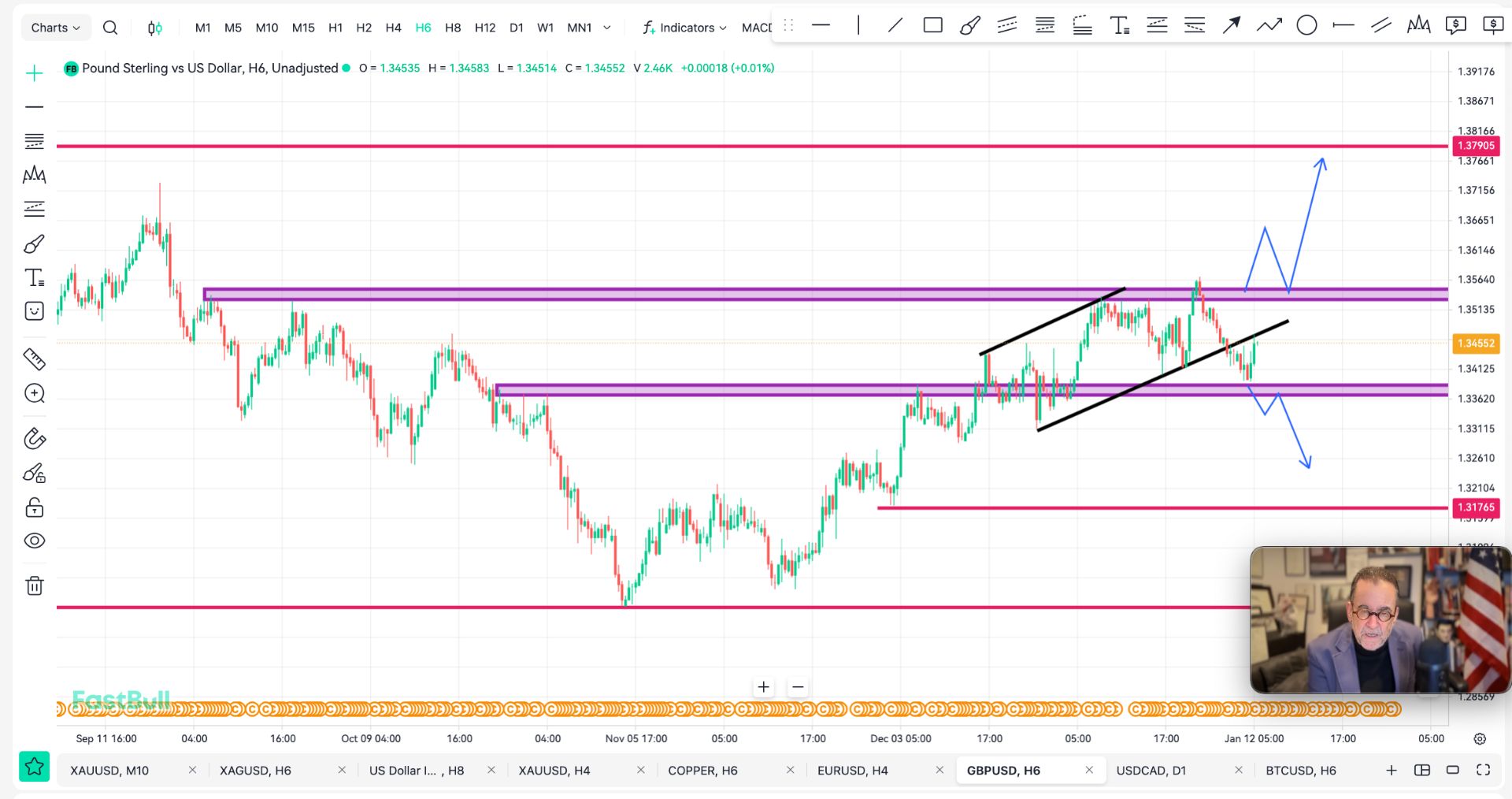

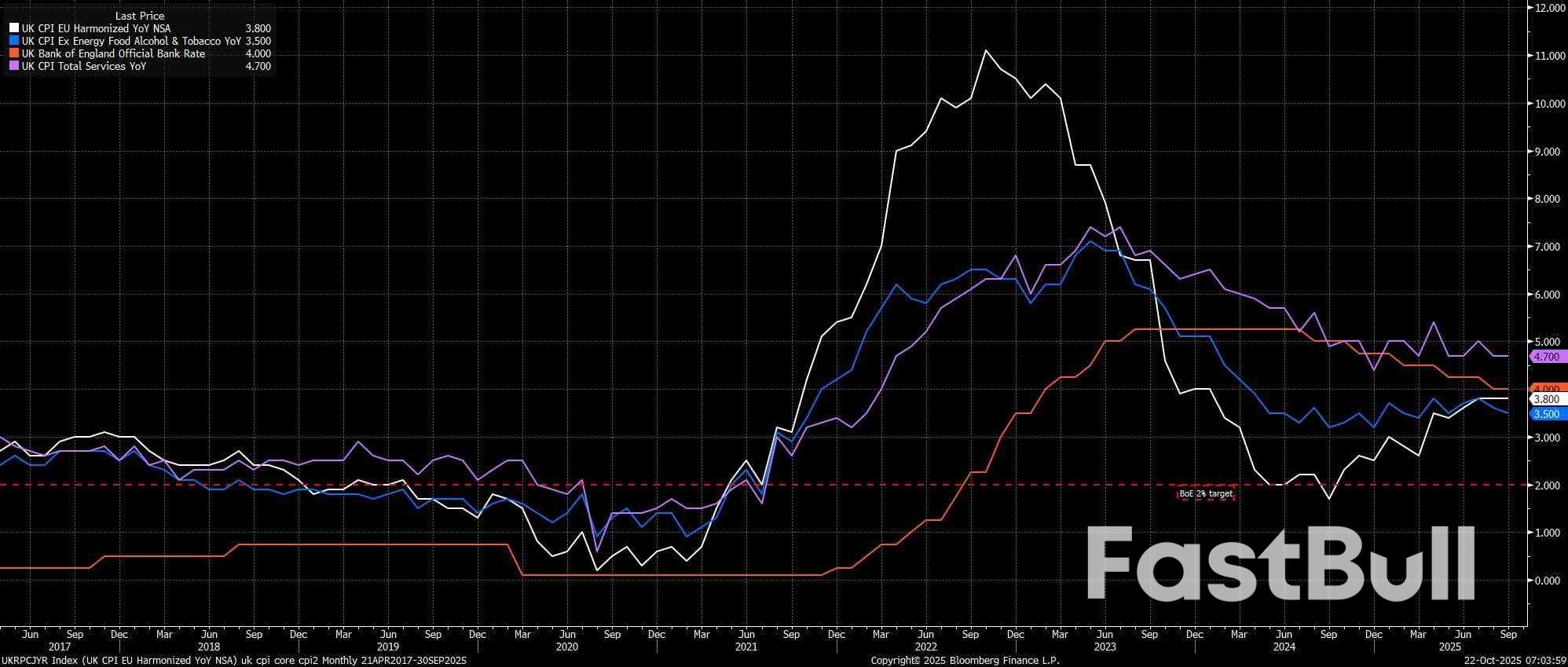

Headline CPI rose 3.8% YoY in September, well below both market expectations, and the BoE's forecast for a 4.0% YoY rise, and unchanged from the pace seen in August. Meanwhile, metrics of underlying price pressures also printed cooler than expected, as core CPI rose 3.5% YoY, and as services CPI rose 4.7% YoY, also unchanged from last time out, and considerably below the Bank's 5.0% YoY expectation.

The details of the report were also surprisingly optimistic, most notable as food prices fell 0.2% MoM, and rose by 4.5% YoY, mirroring declines seen elsewhere in Europe in recent months, and likely giving the MPC some cause for optimism, given how this component remains a key driver of consumer inflation expectations.

On the whole, however, it seems highly unlikely that this morning's figures will materially move the needle in terms of the BoE policy outlook, despite the figures being considerably better than expected.

While the 'Old Lady' expect September to mark the peak in terms of inflation this cycle, policymakers on the MPC will want to be sure that peak has indeed passed before taking further steps to remove restriction, something that is impossible to gleam from just one print.

Furthermore, the huge degree of pre-Budget uncertainty, chiefly in terms of where upcoming tax hikes are likely to fall, and whether those tax increases again prove to be inflationary.

Hence, while there remain significant splits among MPC members over the degree of slack emerging in the labour market, and the speed at which said slack is making itself known, it seems unlikely that a majority of policymakers will favour a rate reduction before the year comes to an end. As such, my base case remains that the MPC are now on hold until next February, at which point a 25bp cut is likely to be delivered, providing that greater certainty of inflation having peaked has been obtained. From then on, a resumption of the quarterly pace of 25bp cuts is likely, before Bank Rate gets to a terminal 3.25% this time next year.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up