Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

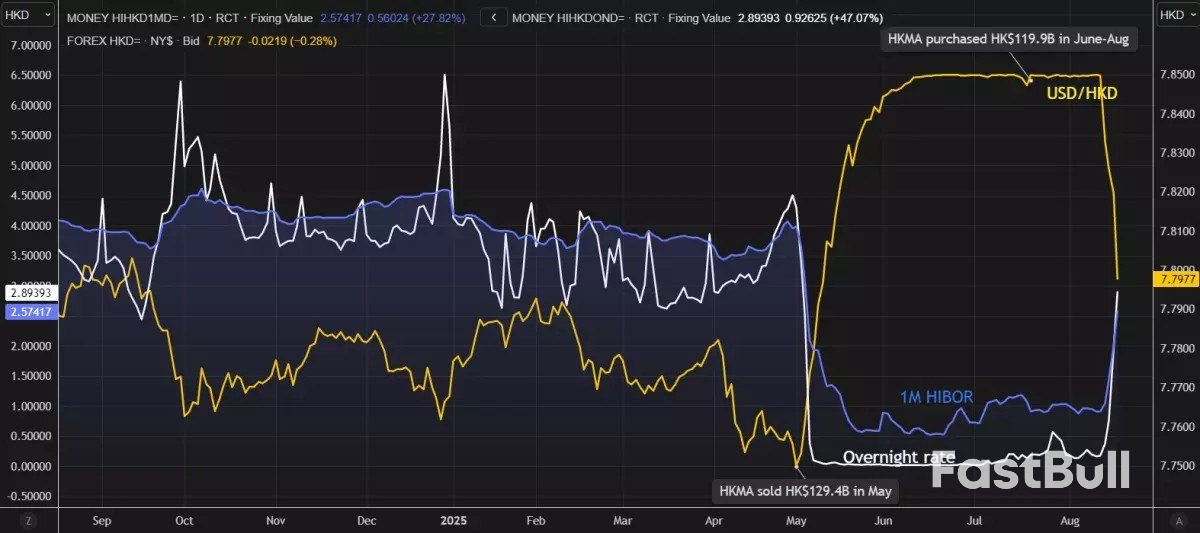

Hong Kong’s HIBOR swung wildly due to HKMA interventions defending the currency peg. While further spikes look limited by Fed cuts and narrowing spreads, tight liquidity and IPO demand should keep rates moderately elevated.

On a quiet corner of Tehran’s mostly residential eastern suburbs, dozens of administrative staff busily file paperwork. Tea is brought in by an assistant, while young men on military service are ordered to fetch lunch.It’s a mundane picture of office life in a city of 10 million people. There’s little to suggest it’s part of an organization that’s had a profound influence on security in the Middle East for almost half a century and has often posed a direct challenge to the US and its allies.

This is the human resources department of Iran’s Islamic Revolutionary Guard Corps., an organization known in the West for its elite forces defending Iran’s theocratic leadership, its proxy militias in the Middle East — and whose tentacles run so deep that efforts to destroy it are likely to make it stronger.Iran’s direct military confrontation with Israel over 12 days in June was the most damaging in the IRGC’s history, killing most of its top echelon and forcing a restructuring of Iran’s strategic decision making. And yet the bombing has left the group more critical to the survival of the Islamic Republic than ever before, according to observers.

The Guard comprises a navy, ground troops, aerospace, an elite unit called the Quds Force and the Basij volunteer paramilitaries. It also has its own intelligence organization that’s known to directly compete with — and sometimes work against — the government’s Ministry of Intelligence.The IRGC also runs hospitals, universities, news agencies and TV stations. It has vast business holdings, including a huge engineering conglomerate involved in building oil pipelines and even Tehran’s metro system. Estimates of the number of direct IRGC personnel range up to almost 200,000.

The announcement of a new National Defense Council this month underscored the Guard’s expanding role and influence on the state in the wake of the attacks by Israel and the US, which were designed to stop Iran producing nuclear weapons. The new body will be headed by President Masoud Pezeshkian and dominated by IRGC veterans and serving generals, according to the state-run Islamic Republic News Agency.“Israel’s attack reinforced the IRGC’s position in the Islamic Republic,” said Abdolrasool Divsallar, an expert on Iran’s military and security strategy and adjunct professor at the Universita Cattolica del Sacro Cuore in Milan. “The war affirmed just how important the IRGC is.”

Few organizations in the world have drawn as much fascination and condemnation from the West as the IRGC. Its so-called Axis of Resistance abroad includes proxies in Syria, Hezbollah in Lebanon and Hamas in Gaza — all of which have now been critically depleted by Israeli forces.At home, it’s mostly feared by ordinary Iranians who associate it with the hardline ideology of Supreme Leader Ayatollah Ali Khamenei, crackdowns on dissent, corruption and a contempt for an increasingly secular middle class.

The IRGC’s security forces, the Basij and its intelligence agencies have been condemned by rights groups, foreign governments and families of dead protesters, accused of torture and unlawful killing. Economically, the IRGC’s reach is so broad that it’s targeted successful businesses for takeover.But it’s seen by others as the great defender against the US and Israel, directly fighting America’s economic and military grip on the region and the only thing that stands in the way of an invasion.

The “deep entrenchment” of the IRGC in Iran’s politics, economy and society mean it’s well positioned to “dominate the state’s emerging collective leadership and continue its gradual usurpation of state power,” said Ali Alfoneh, a senior fellow at the Arab Gulf States Institute.When a small band of Iranian revolutionaries decided to establish a “people’s army” in 1979 their ambitions were somewhat more modest. Their priority was to protect the nascent political system from a coup and prepare for what they thought was an inevitable military engagement with the US.

At that time, Mohsen Sazegara, a founding member of what would become the IRGC, never imagined that what was essentially a guerilla army would evolve into what he now refers to as an unwieldy “seven-headed serpent.” The initial plan was to have 500 officers and around 50,000 volunteers, he said.“It wasn’t supposed to be a big organization,” Sazegara, who left the Guard shortly after it was established, said in an interview. “Now it’s a monster. It’s got a finger in every part of the country.”

There are no official figures for the IRGC’s reach, but over the years academics and analysts have estimated that its business activities and assets represent anything between 20% to 40% of the Iranian economy.Sazegara reckons it has around 170,000 active personnel, including Basij paramilitaries often used to break up protests and police public behavior, as well as “a few million” people who are more informally employed by the organization and its wider business interests.

The turning point was the war with Iraq in the 1980s. While the direct war with the US that Sazegara and his cohort feared didn’t transpire, Saddam Hussein instead started a full-scale military invasion from Iran’s southwestern border.That gave immediate purpose to the fledgling IRGC at a time when Supreme Leader Ayatollah Ruhollah Khomeini was concerned about the loyalty of Iran’s regular army and the risk of a foreign-backed coup.

The conflict was used to galvanize support for the Islamic Republic and also its ability to suppress dissent. Military deaths were lionized and the conflict burnished the IRGC’s image as the defender of the revolution.In 1989, a year after the war ended, President Ayatollah Hashemi Rafsanjani sought to repair the economy with help from the IRGC and its experience building roads and bridges on the oil-rich wetlands of the Iran-Iraq border.

“They became involved in contracting work, construction projects and trade and factories,” said Sazegara, who became an opponent of the Islamic regime and was imprisoned several times until he eventually went abroad for medical treatment following a hunger strike. “It went on from there and eventually they went into high-profit work.”After the war with Iraq, Iran needed everything — dams, roads, railways, ports and all sorts of infrastructure — and yet didn’t have the resources to get things done, so the IRGC stepped in. With the country battered again by foreign aggression, Iran is now in a similar situation, according to an Iranian official, who spoke on condition of anonymity.

The most prominent example of the IRGC’s economic influence is the conglomerate Khatam al-Anbiya Construction Headquarters that was established in the aftermath of the war by then-commander Mohsen Rezaei. A key figure in Iran’s security apparatus for years, Rezaei is now on the new National Defense Council.

Khatam has been involved in some of Iran’s biggest infrastructure projects including the Persian Gulf Star refinery, some 11,000 kilometers of pipelines, petrochemical companies, housing projects, shopping malls and telecoms.It’s taken over contracts from foreign companies when they’re forced out of Iran because of international sanctions and also profited from oil sales. It did particularly well during the presidency of hardliner Mahmoud Ahmadinejad, who oversaw a period of massive public spending at a time of high oil prices. When President Donald Trump abandoned the US’s nuclear deal with Iran in 2018, a fresh cycle of sanctions triggered another exodus and Khatam announced some $28 billion of new projects for the year ahead.

The group also had some high-profile financial failures: It spent three years and more than $40 billion developing the giant South Pars gas field without producing any gas, according to the moderate government of Hassan Rouhani, which tried to curtail Khatam’s involvement in the energy sector.

Iran became increasingly isolated after the collapse of the nuclear deal and the US assassination of the IRGC’s most powerful figure at the time, General Qassem Soleimani, in January 2020. That was, within days, followed by a self-inflicted calamity when the IRGC shot down a Ukrainian International Airlines passenger plane, killing 176 people, most of them Iranian nationals.The disaster sparked protests in Tehran and angry crowds were filmed ripping down and burning commemorative posters of Soleimani.

Internally, these events served to marginalize Rouhani and the elected government. The Guard, for all the anger toward it among Iranians, exploited the situation and its hardline political allies gradually clawed back control of the state and its main institutions. Recent years have seen crackdowns on dissent and women’s rights increasing in both scope and violence.Now, the galvanizing impact of Israel’s attacks on nationalist sentiment in Iran may have already helped improve public support for the IRGC, according to Narges Bajoghli, associate professor of Middle East Studies at the School of Advanced International Studies, Johns Hopkins University.

“People are angry at them, but they also realize that there is no other force in the country,” she said. “What they’re committed to today, is about sovereign independence and the idea of resistance to Western and Israeli imperialism.”The question is where it goes from here. For Sazegara, the IRGC’s biggest threat is itself. Management of its myriad divisions and departments is centralized around Khamenei, according to Sazegara, meaning that ultimately its fate is heavily tied to that of the 86-year-old supreme leader.

What’s more, the Axis of Resistance allowed the IRGC to project power over the Middle East for almost two decades, and that pillar of its strategy no longer exists for the time being.That makes it more likely that the organization will look toward a nuclear deterrent, according to Alfoneh at the Arab Gulf States Institute. While Israel and the US hit Iran’s key nuclear facilities in June, its cache of enriched uranium hasn’t been seen since.

Indeed, it would take a US ground invasion or a sustained bombardment by both the US and Israel to change the metrics for the IRGC, Alfoneh said. “The 12-day war exposed the IRGC’s counterintelligence failures,” he said. “However, the IRGC’s loss of prestige is unlikely to lead to its capitulation.”

NZDUSD Daily

NZDUSD Daily NZDUSD 4 hour

NZDUSD 4 hour NZDUSD 1 hour

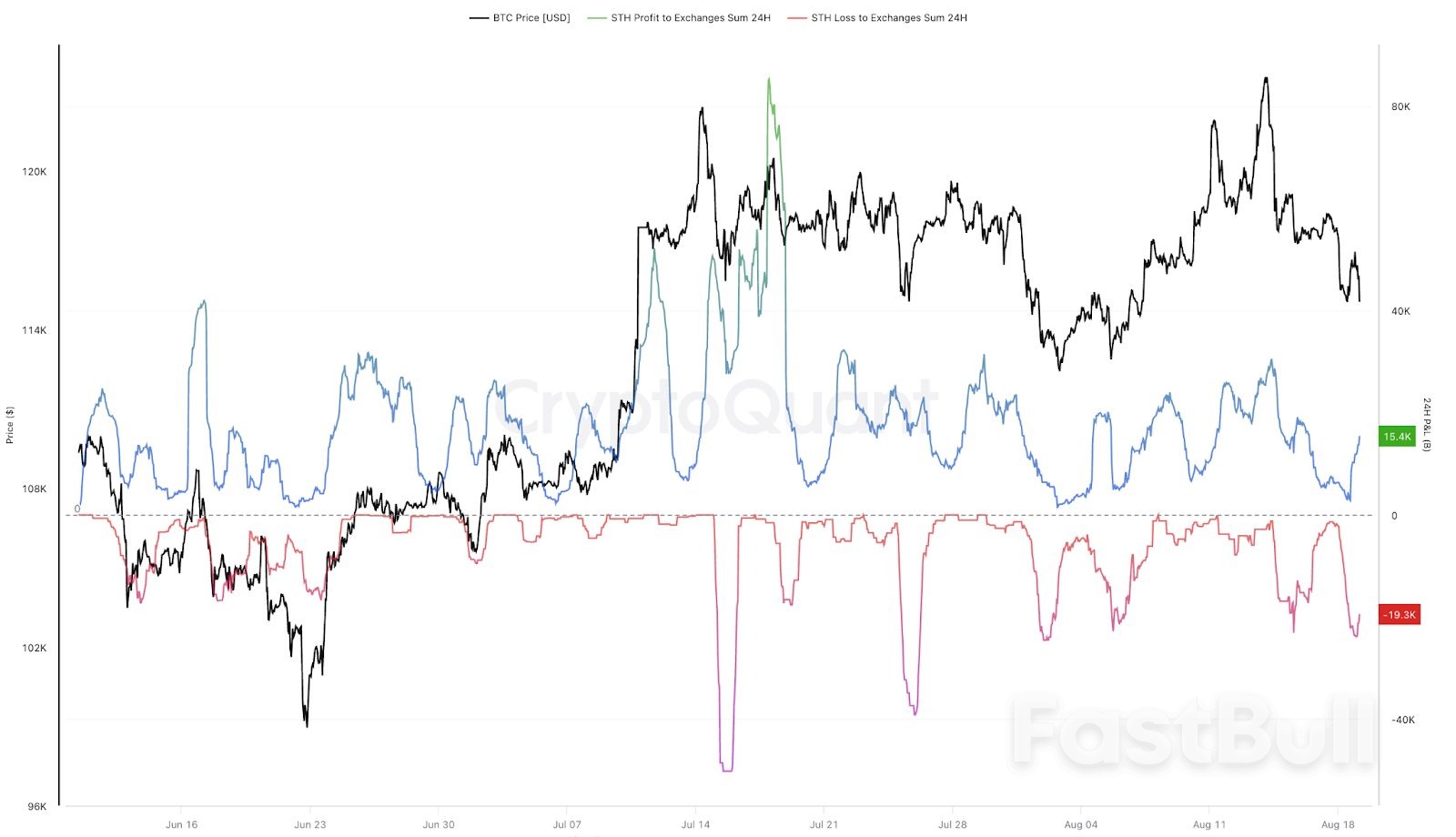

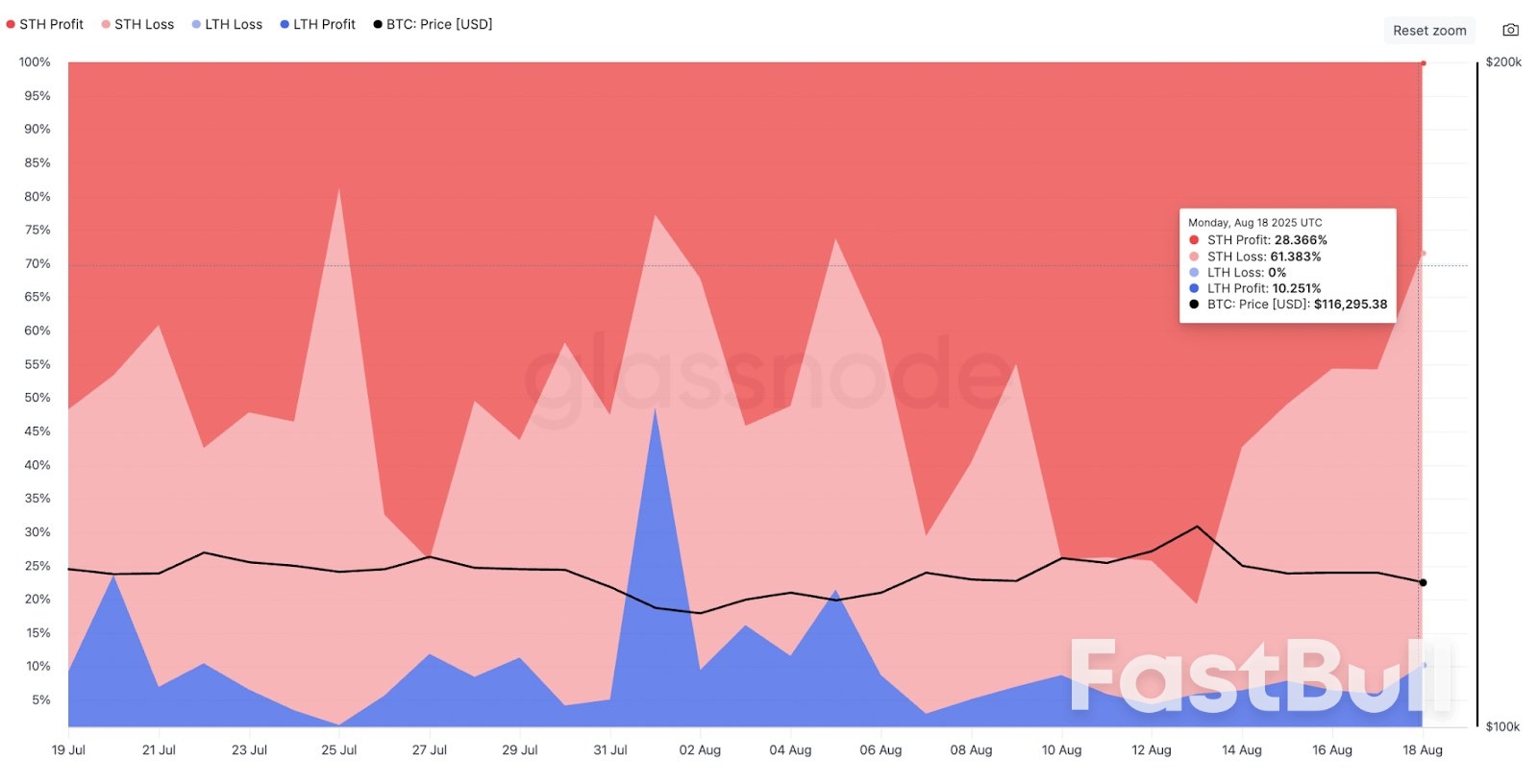

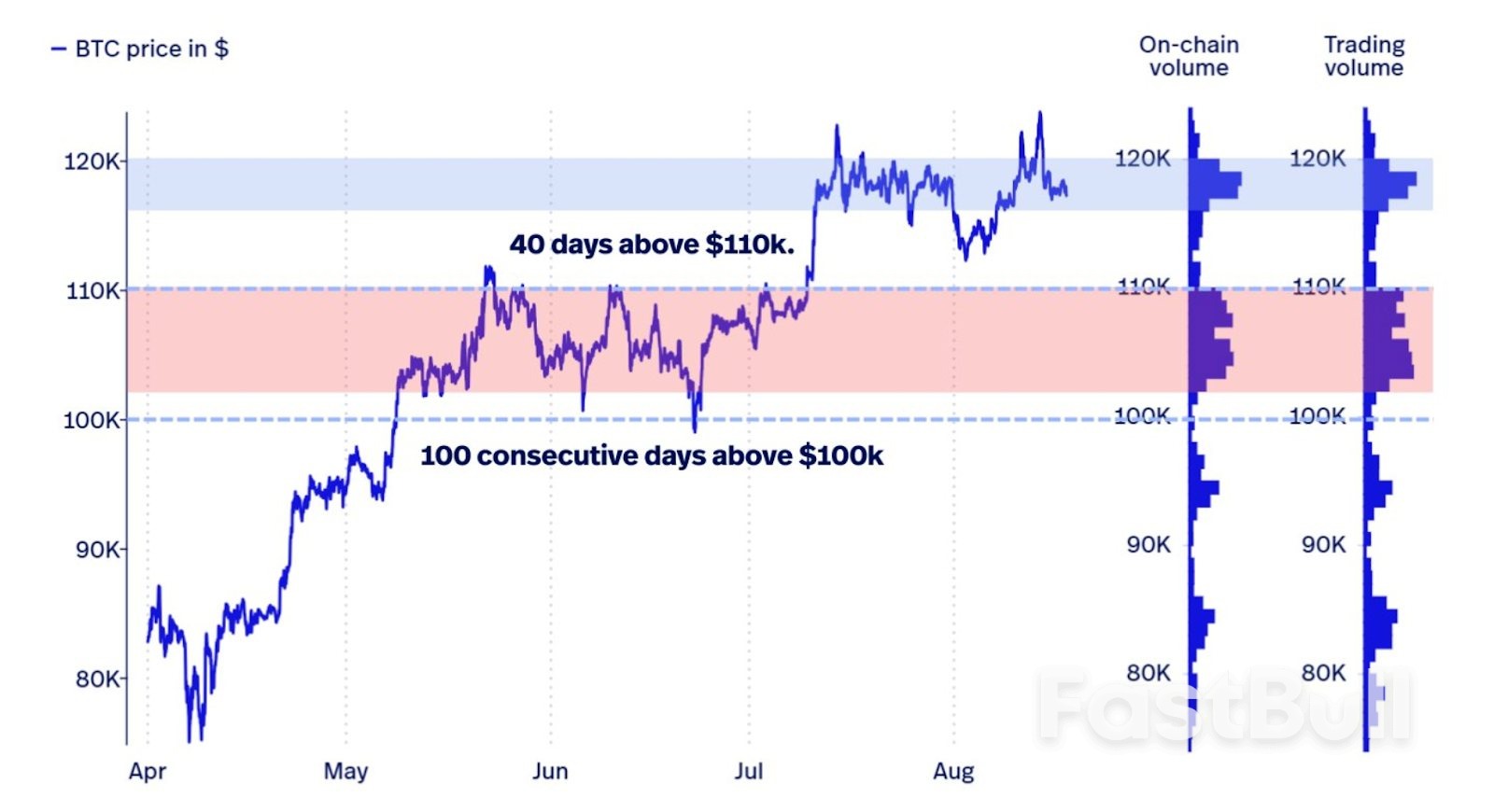

NZDUSD 1 hourAs Bitcoin plunges to a daily low of $114,000, a loss of $3,000 within 24 hours has left investors deeply worried. Continuous tests around the $112,000 mark heighten these concerns. Our weekly report underscored expectations of a horizontal and downward trend in Bitcoin’s value, explaining the underlying reasons. This aligns perfectly with recent market movements, clarifying why cryptocurrencies are experiencing a downturn.

Recent U.S. producer inflation figures released five days ago surpassed expectations, showing a rise of 3.3% against the anticipated 2.5%. Combined with a cooling labor market, these numbers paint a bleak picture. The Federal Reserve is in a bind: while a rate cut might support employment, it risks accelerating inflation. Recent PPI data reflects concerns over tariffs driving inflation upwards. The troubling aspect is the new effective tariff rates enforced in August, increasing for almost all countries.

The base tariff, previously at 10%, has surged to a minimum of 15% for many countries. Consequently, the impact of tariffs is expected to be more pronounced this month, likely leading to September’s figures also exceeding estimates. As the Federal Reserve anticipates August data, crypto investors are already feeling the heat, fearing the consequences.

Moreover, this week brings crucial developments that could further unsettle the crypto space. The Jackson Hole meeting is happening, followed by the release of Fed minutes tomorrow evening and a speech by Powell on Friday. These consecutive events are set to significantly impact cryptocurrencies, further dampening risk appetite.

Investors’ anxiety is compounded by these successive challenges, casting uncertainties over market stability. The anticipation of pivotal economic data and Federal Reserve decisions looms large, contributing to the prevailing negative sentiment among crypto enthusiasts.

Furthermore, the potential for heightened tariffs in the coming months adds an additional layer of complexity to the volatile crypto market. Stakeholders find themselves navigating through increasingly unstable financial tides.

As the global economic landscape responds to these shifts, the repercussions on the cryptocurrency domain could be profound. Close monitoring of these economic indicators is essential for stakeholders aiming to refine their investment strategies amidst heightened market volatility.

In the face of these challenges, the cryptocurrency market remains on edge, poised for potential fluctuations influenced by broader economic pressures and policy-related developments. The path ahead is fraught with challenges, urging careful attention and strategic navigation.

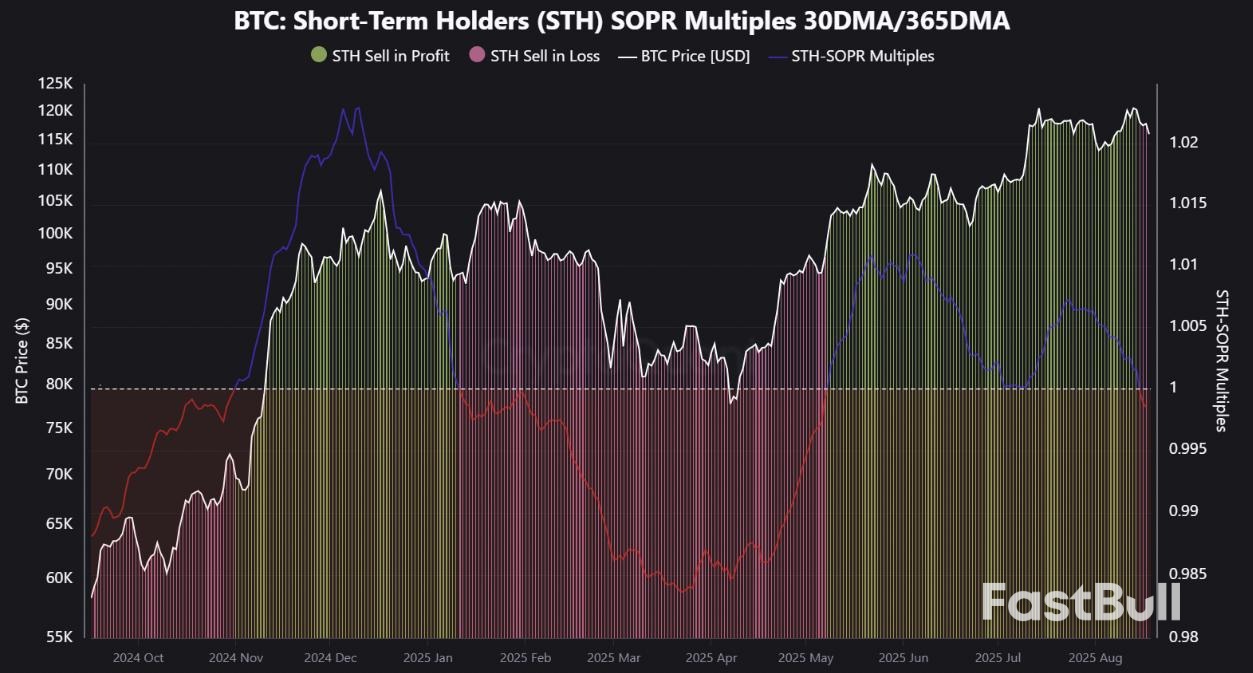

Bitcoin STH SOPR Multiples 30DMA/365DMA. Source: CryptoQuant

Bitcoin STH SOPR Multiples 30DMA/365DMA. Source: CryptoQuant

President Trump has made it clear that he will not send American troops to enforce a possible peace agreement in Ukraine centered on 'security guarantees' - despite having appeared possibly open to the idea just a day earlier.

In a phone interview on Fox News Tuesday morning, Trump was asked what assurances he could offer that American forces wouldn't end up defending Ukraine's borders, and beyond his time in office. The question was based on his campaign and opening months in office - when he repeatedly vowed no more boots on the ground in entangling conflicts abroad.

"You have my assurance, and I’m president," Trump responded. European leaders are pressing for the strongest possible security guarantees for Ukraine, to ensure it can never be attacked in the future, once a peace settlement is reached.

A White House official additionally confirmed on Tuesday that Trump has definitively ruled out deploying US ground forces to Ukraine, according to CNN.

Security guarantees for Ukraine were a central focus between Trump, Ukrainian President Volodymyr Zelensky, and seven EU leaders - among them NATO Secretary General Mark Rutte.

The Europeans want clarity on what level of American military support Trump is willing to offer to prevent Russia from regrouping and pursuing further territorial advances after a potential peace deal.

British Prime Minister Keir Starmer, who was in the White House yesterday alongside France's Macron, is still vowing to press for the most robust guarantees possible.

"Turning to next steps, the Prime Minister outlined that Coalition of the Willing planning teams would meet with their US counterparts in the coming days to further strengthen plans to deliver robust security guarantees and prepare for the deployment of a reassurance force if the hostilities ended," a Downing Street spokesperson said in a statement.

"The leaders also discussed how further pressure – including through sanctions – could be placed on Putin until he showed he was ready to take serious action to end his illegal invasion," Starmer's office added. In some ways, this can easily be read as the Europeans saying they are actively trying to sabotage peace, as the fear is that it will be settled on Moscow's terms.

Additionally, Bloomberg is reporting that "Security guarantees for Ukraine will be formalized in the coming days and as soon as this week, European Council President Antonio Costa tells reporters in Lisbon following virtual meetings of 'Coalition of the Willing' and EU leaders.

President Putin has repeatedly emphasized that Russia will never allow Western boots on the ground in Ukraine as part of some peacekeeping force or entity patrolling frozen front lines. At least Trump is saying he's on the same page, and fully understands this, at least for now.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up