Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Defying expectations, on May 12 the United States and China announced an important agreement to de-escalate bilateral trade tensions after talks in Geneva, Switzerland.

Defying expectations, on May 12 the United States and China announced an important agreement to de-escalate bilateral trade tensions after talks in Geneva, Switzerland.

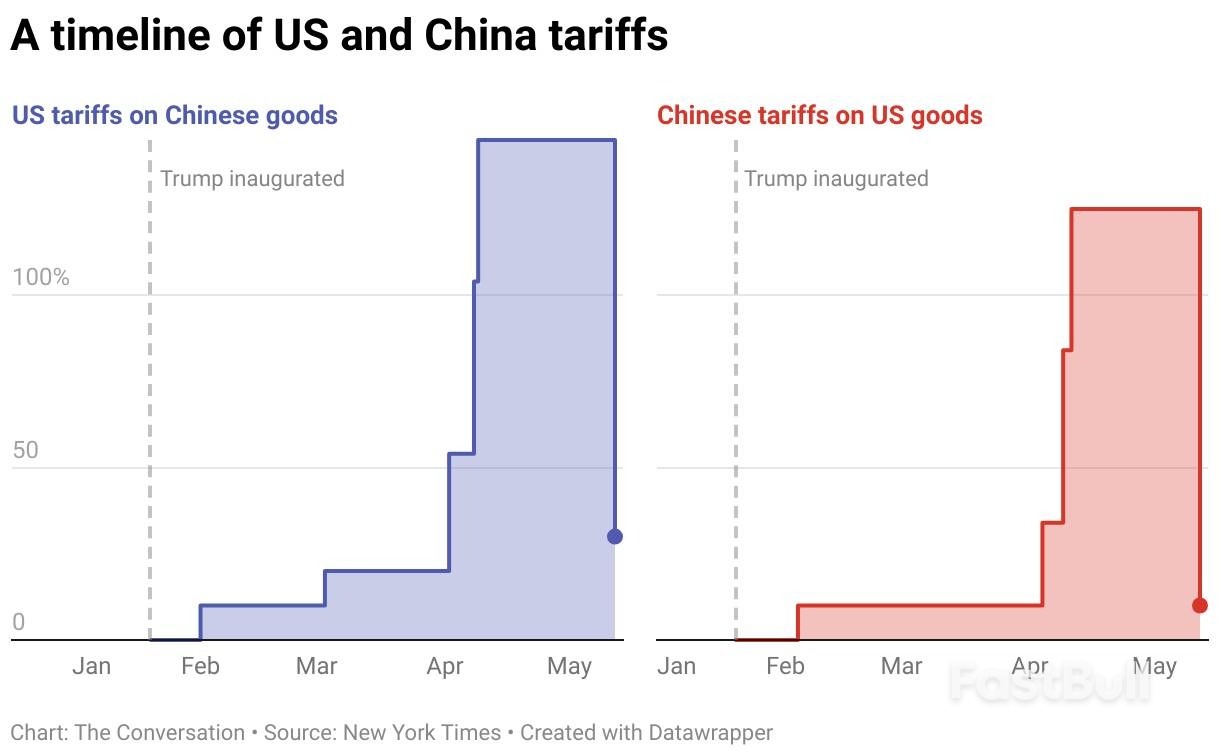

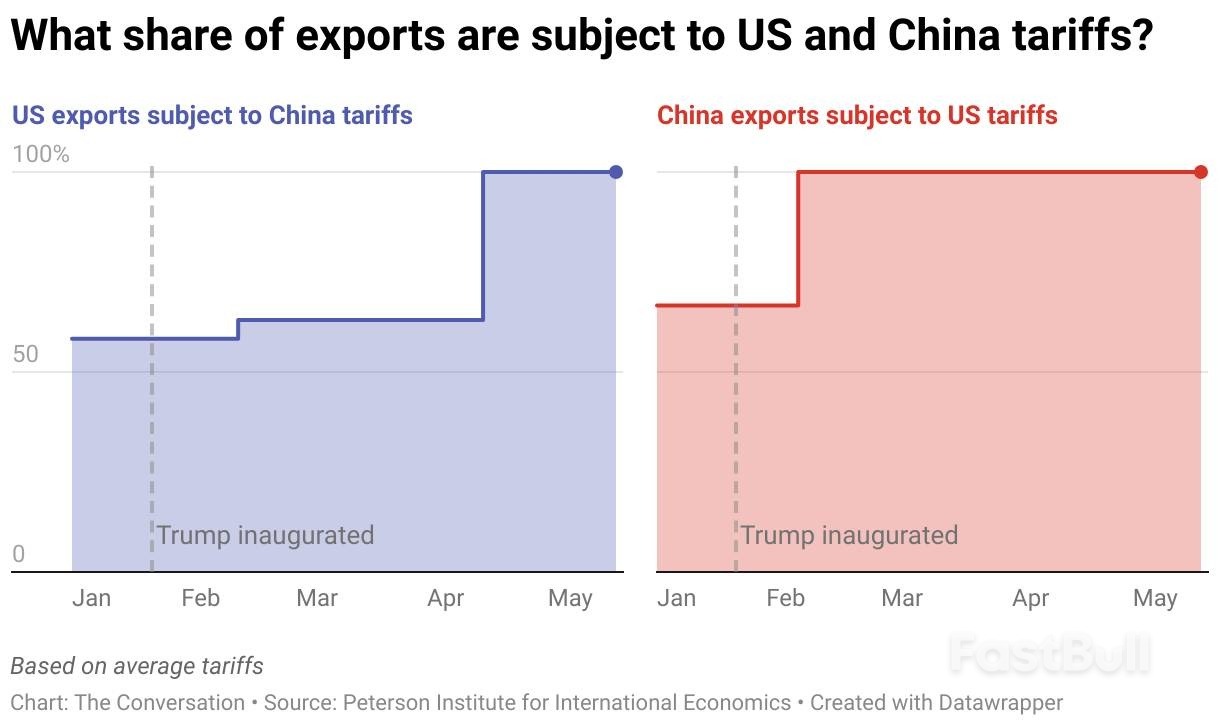

The good news is their recent tariff increases will be slashed. The U.S. has cut tariffs on Chinese imports from 145 percent to 30 percent, while China has reduced levies on U.S. imports from 125 percent to 10 percent. This greatly eases major bilateral trade tensions, and explains why financial markets rallied.

The bad news is twofold. First, the remaining tariffs are still high by modern standards. The U.S. average trade-weighted tariff rate was 2.2 percent on January 1 2025, while it is now estimated to be up to 17.8 percent. This makes it the highest tariff wall in the United States since the 1930s.

Overall, it is very likely a new baseline has been set. Bilateral tariff-free trade belongs to a bygone era.

Second, these tariff reductions will be in place for 90 days, while negotiations continue. Talks will likely include a long list of difficult-to-resolve issues. China’s currency management policy and industrial subsidies system dominated by state-owned enterprises will be on the table. So will the many non-tariff barriers Beijing can turn on and off like a tap.

China is offering to purchase unspecified quantities of U.S. goods in a repeat of the China-U.S. “Phase 1 deal” from Trump’s first presidency, which was not implemented. On his first day in office in January, amid a blizzard of executive orders, Trump ordered a review of that deal’s implementation. The review found China didn’t follow through on the agriculture, finance, and intellectual property protection commitments it had made.

Unless the United States has now decided to capitulate to Beijing’s retaliatory actions, it is difficult to see Washington being duped again.

Failure to agree on these points would reveal the ugly truth that both countries continue to impose bilateral export controls on goods deemed sensitive, such as semiconductors (from the U.S. to China) and processed critical minerals (from China to the U.S.).

Moreover, in its so-called “reciprocal” negotiations with other countries, the United States is pressing trading partners to cut certain sensitive China-sourced goods from their exports destined for U.S. markets. China is deeply unhappy about these U.S. demands and has threatened to retaliate against trading partners that adopt them.

Overall, the announcement is best viewed as a truce that does not shift the underlying structural reality that the United States and China are locked into a long-term cycle of escalating strategic competition.

That cycle will have its ups (the latest announcement) and downs (the tariff wars that preceded it). For now, both sides have agreed to announce victory and focus on other matters.

For the U.S., this means ensuring there will be consumer goods on the shelves in time for Halloween and Christmas, albeit at inflated prices. For China, it means restoring some export market access to take pressure off its increasingly ailing economy.

As neither side can vanquish the other, the likely long-term result is a frozen conflict. This will be punctuated by attempts to achieve “escalation dominance,” as that will determine who emerges with better terms. Observers’ opinions on where the balance currently lies are divided.

Along the way, and to use a quote widely attributed to Winston Churchill, to “jaw-jaw is better than to war-war.” Fasten your seat belts, as there is more turbulence to come.

Significantly, the United States has not (so far) changed its basic goals for all its bilateral trade deals. Its overarching aim is to cut the goods trade deficit by reducing goods imports and eliminating non-tariff barriers it says are “unfairly” prohibiting U.S. exports. Washington also wants to remove barriers to digital trade and investments by tech giants and “derisk” certain imports that it deems sensitive for national security reasons.

The agreement between the U.S. and United Kingdom last week clearly reflects these goals in operation. While the U.K. received some concessions, the remaining tariffs are higher, at 10 percent overall, than on April 2 and subject to U.S.-imposed import quotas. Furthermore, the U.K. must open its market for certain goods while removing China-originating content from steel and pharmaceutical products destined for the United States.

For Washington’s Pacific defense treaty allies, including Australia, nothing has changed. Potentially difficult negotiations with the Trump administration lie ahead, particularly if the U.S. decides to use security dependencies as leverage to wring concessions in trade. Japan has already disavowed linking security and trade, and their progress in negotiations should be closely watched.

The United States has previously paused high tariffs on manufacturing nations in Southeast Asia, particularly those used by other nations as export platforms to avoid China tariffs. Vietnam, Cambodia, and others will face sustained uncertainty and increasingly difficult balancing acts. The economic stakes are higher for them.

They, like the Japanese, are long-practiced in the subtle arts of balancing the two giants. Still, juggling ties with both Washington and Beijing will become the act of an increasingly high-wire trapeze artist.

EURUSD failed to sustain earlier gains as price action today stalled just ahead of the 200-hour moving average (green line on the chart above) and the lower boundary of a key swing zone between 1.12657 and 1.1275. Sellers leaned into the level and have since pushed the pair back toward the 100-hour moving averages.

The current focus is on the swing area between 1.1193 and 1.1213, which previously marked key highs from 2024 (not shown). A confirmed break below this zone - and the 100 hour MA at 1.11876 - would be technically significant and likely accelerate selling momentum.

On the downside, immediate targets include the 1.1145 support area followed by the weekly low near 1.10648. These levels could attract additional sellers if the current pressure persists. To shift momentum back to the upside, EURUSD would need to reclaim 1.1213 and the 200 hour MA (and stay above) at 1.12578.

● Resistance: 1.1213, 200-hour MA at 1.12578, 1.12657–1.1275 (swing area)

● Support: 1.1193–1.1213 (swing zone), 1.11876 (100-hour MA), 1.1145, 1.10648

● Bias: Bearish below 1.1213; intensifies under 1.11876

The sellers remain in control as long as price stays capped below 1.1213. Watch for follow-through below key supports to confirm bearish continuation.

The Energy Information Administration (EIA) has reported a significant increase in its Crude Oil Inventories, pointing towards weaker demand for crude oil. The weekly change in the number of barrels of commercial crude oil held by US firms was recorded at 3.454 million barrels, an unexpected swing from the forecasted decrease of 2 million barrels.

This recent data release reveals a stark contrast to the projected estimates. Analysts had predicted a decrease of 2 million barrels, based on various market factors and trends. However, the actual inventory numbers have defied these forecasts, indicating a potential shift in the market dynamics.

When compared to the previous week’s data, the numbers also show a notable increase. The previous week saw a decrease of 2.032 million barrels, reflecting a stronger demand for crude oil. The sudden rise in the inventory this week, therefore, suggests a weakening demand, which could potentially impact crude prices in the bearish direction.

The level of inventories significantly influences the price of petroleum products, which, in turn, can have an impact on inflation. An increase in crude inventories is generally considered bearish for crude prices as it implies weaker demand.

Given the importance of the EIA Crude Oil Inventories data, this unexpected increase will likely be closely monitored by investors and market analysts. The implications of this shift could be wide-ranging, influencing not only crude prices but also impacting broader market trends and the inflation outlook.

As the market continues to digest this unexpected data, the focus will now be on how this might influence the Federal Reserve’s approach to monetary policy, especially in the context of inflation concerns. The EIA’s next report will be eagerly awaited for further insights into the demand and supply dynamics of the crude oil market.

U.S. President Donald Trump secured a $600 billion commitment from Saudi Arabia to invest in the United States on the first day of a four-day tour of the Gulf, opening the way for a series of business deals.

Here is an overview of major deals and announcements made on the sidelines of Trump's Gulf visit:

* Saudi Aramco (2222.SE), opens new tab has signed 34 agreements with major U.S. companies, potentially worth as much as $90 billion, the oil giant said.

* Qatar Airways signed a deal to purchase jets from U.S. manufacturer Boeing (BA.N), opens new tab.

* Nvidia (NVDA.O), opens new tab said it will sell hundreds of thousands of AI chips in Saudi Arabia, with a first tranche of 18,000 of its newest "Blackwell" chips going to Humain, an AI startup the kingdom's sovereign wealth fund launched this week.

* Qualcomm Inc (QCOM.O), opens new tab said it signed a memo of understanding to develop and build a data centre central processor.

* Franklin Templeton (BEN.N), opens new tab said it has signed a non-binding memorandum of understanding with Saudi Arabia's Public Investment Fund to partner in investing up to $5 billion in the kingdom's financial markets.

* Neuberger Berman signed an agreement with PIF to invest up to $6 billion in the kingdom, and to launch a Riyadh-based multi-asset investment management platform.

* BlackRock Saudi Arabia (BLK.N), opens new tab and PIF signed a non-binding letter of intent at the Saudi-U.S. Investment Forum to formalise their strategic collaboration through potential new allocations to the BlackRock Riyadh Investment Management platform.

* Cisco (CSCO.O), opens new tab said it will collaborate with the AI Infrastructure Partnership, which is led by BlackRock (BLK.N), opens new tab, Global Infrastructure Partners, MGX, Microsoft (MSFT.O), opens new tab, Nvidia and xAI.

The company also said it will join Saudi Arabia's Humain and extend its strategic partnership with Abu Dhabi's G42 to advance AI innovation and infrastructure development.

* Infrastructure investment manager I Squared Capital said it has signed a memorandum of understanding with PIF to establish a dedicated infrastructure investment strategy focused on the Middle East.

* Amazon Web Services (AMZN.O), opens new tab and Saudi Arabia's AI startup Humain said they planned to invest $5 billion-plus in a strategic partnership to build an "AI Zone" in the kingdom.

* U.S. chip firm AMD (AMD.O), opens new tab and Humain said they would build AI infrastructure that will lead them to invest up to $10 billion to deploy 500 megawatts of AI computing capacity over the next five years.

* Saudi Arabian DataVolt plans to invest $20 billion in AI data centres and energy infrastructure in the United States.

* Google (GOOGL.O), opens new tab , DataVolt, Oracle (ORCL.N), opens new tab, Salesforce (CRM.N), opens new tab, AMD (AMD.O), opens new tab, and Uber (UBER.N), opens new tab say they will invest $80 billion in technologies in both countries.

* Construction consulting firms Hill International, Jacobs, Parsons, and AECOM are building infrastructure projects such as King Salman International Airport, King Salman Park, The Vault, Qiddiya City, and more, totalling $2 billion in U.S. services exports.

* Additional major exports include GE Vernova's (GEV.N), opens new tab gas turbines and energy solutions totalling $14.2 billion and Boeing 737-8 passenger aircraft for AviLease totalling $4.8 billion.

* Healthcare firm Shamekh IV Solutions will be investing $5.8 billion, including a plant in Michigan to launch a high-capacity IV fluid facility.

* Hassana Investment Company and Franklin Templeton signed a memorandum of understanding valued at $150 million to explore a strategic partnership related to investments in Saudi private credit opportunities.

* Saudi Aramco (2222.SE), opens new tab said it would sign memorandums of understanding with U.S. liquefied natural gas producer NextDecade (NEXT.O), opens new tab and utility Sempra (SRE.N), opens new tab.

* U.S.-based investment platform Burkhan World Investments said it signed memorandums of understanding with Saudi partners, totalling $15 billion in investment commitments.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up