Markets

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

According To Sources Familiar With The Matter, The U.S. Department Of Justice Is Investigating Whether Several Major Commercial Fertilizer Manufacturers Conspired To Raise Prices

[Semiconductor ETF Rises 2%, Leading US Sector ETFs] On Wednesday (March 4), The Semiconductor ETF Closed Up 2.02%, While The Internet Stock Index ETF, Consumer Discretionary ETF, Global Technology Stock Index ETF, And Technology Sector ETF All Rose By At Least 1.70%, And The Energy Sector ETF Fell 0.60%. Among The 11 Sectors Of The S&P 500, The Consumer Discretionary Sector Rose 2.24%, The Information Technology/technology Sector Rose 1.27%, And The Energy Sector Fell 0.73%

Iran Delays Until Further Notice Ceremonies To Mourn Ayatollah Khamenei Which Were Due To Start On Wednesday, Official Tells State TV Preparations Are Underway

[Iranian Forces Attack Israeli Defense Ministry Building And Ben Gurion International Airport, Destroying 7 Radar Systems] On May 5th Local Time, The Iranian Islamic Revolutionary Guard Corps Announced That During The 17th Round Of Operation True Commitment 4, Iranian-launched Hypersonic Missiles And Attack Drones Penetrated The US THAAD System, Attacking The Israeli Ministry Of Defense Building And Ben Gurion International Airport. With More Than Seven Advanced Radar Systems Successfully Destroyed By Iran, The US And Israel Have Been "blind" In The Region. The Announcement Stated That Reconnaissance And Strikes Against The Aggressors Are Ongoing. The Intensity And Scope Of Attacks Will Further Expand In The Coming Days

According To Sources Familiar With The Matter, The White House Plans To Submit Its Budget Request For The Next Fiscal Year By The End Of March. The Trump Administration Particularly Hopes To Release The Budget Report On March 31

Toronto Stock Index .GSPTSE Unofficially Closes Up 157.92 Points, Or 0.47 Percent, At 33942.86

The S&P 500 Closed Up 0.8%, With The Consumer Discretionary Sector Up 2.2%, The Technology Sector Up 1.3%, And The Energy Sector Down 0.8%. The NASDAQ 100 Closed Up 1.5%, With Its Components Including Applovin Up 10.4%, Strategy Up 10.3%, Ross Stores Up 8%, Intel Up 5.9%, Datadog Up 5.9%, Axon Down 1.5%, Atlassian Down 2%, Microchip Technology Down 2.2%, KDP Down 2.3%, And Baker Hughes Down 2.8%

South Korea End-Feb Foreign Exchange Reserves At $427.62 Billion Versus$425.91 Billion At End-Jan - Central Bank

On Wednesday (March 4), The Bloomberg Electric Vehicle Price Return Index Fell 0.73% To 3492.02 Points In Late Trading. It Continued To Decline In Early Asian Trading, Hitting A Daily Low Of 3439.74 Points At 11:35 Beijing Time Before Gradually Recovering Its Losses

Chicago Wheat Futures Fell Over 1.2%, Soybean Meal Fell Over 1.7%, And Soybean Oil Rose 1%. On Wednesday (March 4), In Late New York Trading, The Bloomberg Grain Index Fell 0.54% To 30.5809 Points. CBOT Corn Futures Fell 0.62%, CBOT Wheat Futures Fell 1.22%. CBOT Soybean Futures Fell 0.34% To $11.6675 Per Bushel, Soybean Meal Futures Fell 1.72%, And Soybean Oil Futures Rose 1.03%. ICE Raw Sugar Futures Fell 1.58%, And ICE White Sugar Futures Fell 1.38%. ICE Arabica Coffee Futures Fell 0.14%, And Coffee "C" Futures Rose 0.95%. Robusta Coffee Futures Rose 0.89%. New York Cocoa Futures Rose 0.33% To $3025 Per Tonne. London Cocoa Futures Rose 1.50%. Chicago WCE Low-erucic Acid Canola Futures Rose 0.20%. ICE Cotton Futures Rose 0.20%

U.S. Senator Ron Wyden Pressured Several Artificial Intelligence (AI) Companies Over The Trump Administration's Policies Of Domestic Surveillance (domestic Espionage)

On Wednesday (March 4), The Dollar Fell 0.42% Against The Yen To 157.07 Yen In Late New York Trading, Trading Between 157.86 And 156.86 Yen During The Day. The Euro Fell 0.19% Against The Yen, And The Pound Fell 0.26% Against The Yen

Italy Unemployment Rate (SA) (Jan)

Italy Unemployment Rate (SA) (Jan)A:--

F: --

P: --

U.K. Services PMI Final (Feb)

U.K. Services PMI Final (Feb)A:--

F: --

P: --

U.K. Composite PMI Final (Feb)

U.K. Composite PMI Final (Feb)A:--

F: --

P: --

U.K. Total Reserve Assets (Feb)

U.K. Total Reserve Assets (Feb)A:--

F: --

P: --

U.K. Official Reserves Changes (Feb)

U.K. Official Reserves Changes (Feb)A:--

F: --

P: --

Euro Zone Unemployment Rate (Jan)

Euro Zone Unemployment Rate (Jan)A:--

F: --

P: --

Euro Zone PPI MoM (Jan)

Euro Zone PPI MoM (Jan)A:--

F: --

P: --

Euro Zone PPI YoY (Jan)

Euro Zone PPI YoY (Jan)A:--

F: --

Brazil PPI MoM (Jan)

Brazil PPI MoM (Jan)A:--

F: --

P: --

U.S. MBA Mortgage Application Activity Index WoW

U.S. MBA Mortgage Application Activity Index WoWA:--

F: --

P: --

Brazil IHS Markit Composite PMI (Feb)

Brazil IHS Markit Composite PMI (Feb)A:--

F: --

P: --

Brazil IHS Markit Services PMI (Feb)

Brazil IHS Markit Services PMI (Feb)A:--

F: --

P: --

U.S. ADP Employment (Feb)

U.S. ADP Employment (Feb)A:--

F: --

Canada Labor Productivity QoQ (SA) (Q4)

Canada Labor Productivity QoQ (SA) (Q4)A:--

F: --

P: --

U.S. IHS Markit Services PMI Final (Feb)

U.S. IHS Markit Services PMI Final (Feb)A:--

F: --

P: --

U.S. IHS Markit Composite PMI Final (Feb)

U.S. IHS Markit Composite PMI Final (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Employment Index (Feb)

U.S. ISM Non-Manufacturing Employment Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Inventories Index (Feb)

U.S. ISM Non-Manufacturing Inventories Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing Price Index (Feb)

U.S. ISM Non-Manufacturing Price Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing New Orders Index (Feb)

U.S. ISM Non-Manufacturing New Orders Index (Feb)A:--

F: --

P: --

U.S. ISM Non-Manufacturing PMI (Feb)

U.S. ISM Non-Manufacturing PMI (Feb)A:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

BOC Gov Macklem Speaks

BOC Gov Macklem Speaks Russia Retail Sales YoY (Jan)

Russia Retail Sales YoY (Jan)A:--

F: --

P: --

Russia Unemployment Rate (Jan)

Russia Unemployment Rate (Jan)A:--

F: --

P: --

The U.S. Senate held its first vote on Iran's "war powers resolution."

The U.S. Senate held its first vote on Iran's "war powers resolution." Australia Exports MoM (SA) (Jan)

Australia Exports MoM (SA) (Jan)--

F: --

P: --

Australia Trade Balance (SA) (Jan)

Australia Trade Balance (SA) (Jan)--

F: --

P: --

France Industrial Output MoM (SA) (Jan)

France Industrial Output MoM (SA) (Jan)--

F: --

P: --

Germany Construction PMI (SA) (Feb)

Germany Construction PMI (SA) (Feb)--

F: --

P: --

Euro Zone IHS Markit Construction PMI (Feb)

Euro Zone IHS Markit Construction PMI (Feb)--

F: --

P: --

Italy IHS Markit Construction PMI (Feb)

Italy IHS Markit Construction PMI (Feb)--

F: --

P: --

Italy Retail Sales MoM (SA) (Jan)

Italy Retail Sales MoM (SA) (Jan)--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Feb)

U.K. Markit/CIPS Construction PMI (Feb)--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. Yield--

F: --

P: --

Euro Zone Retail Sales MoM (Jan)

Euro Zone Retail Sales MoM (Jan)--

F: --

P: --

Euro Zone Retail Sales YoY (Jan)

Euro Zone Retail Sales YoY (Jan)--

F: --

P: --

Brazil Unemployment Rate (Jan)

Brazil Unemployment Rate (Jan)--

F: --

P: --

U.S. Challenger Job Cuts YoY (Feb)

U.S. Challenger Job Cuts YoY (Feb)--

F: --

P: --

U.S. Challenger Job Cuts (Feb)

U.S. Challenger Job Cuts (Feb)--

F: --

P: --

U.S. Challenger Job Cuts MoM (Feb)

U.S. Challenger Job Cuts MoM (Feb)--

F: --

P: --

U.S. Import Price Index YoY (Jan)

U.S. Import Price Index YoY (Jan)--

F: --

P: --

U.S. Unit Labor Cost Prelim (SA) (Q4)

U.S. Unit Labor Cost Prelim (SA) (Q4)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Export Price Index YoY (Jan)

U.S. Export Price Index YoY (Jan)--

F: --

P: --

U.S. Import Price Index MoM (Jan)

U.S. Import Price Index MoM (Jan)--

F: --

P: --

U.S. Export Price Index MoM (Jan)

U.S. Export Price Index MoM (Jan)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

ECB President Lagarde Speaks

ECB President Lagarde Speaks U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

South Korea CPI YoY (Feb)

South Korea CPI YoY (Feb)--

F: --

P: --

Euro Zone GDP Final YoY (Q4)

Euro Zone GDP Final YoY (Q4)--

F: --

P: --

Euro Zone GDP Final QoQ (Q4)

Euro Zone GDP Final QoQ (Q4)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q4)

Euro Zone Employment Final QoQ (SA) (Q4)--

F: --

P: --

No matching data

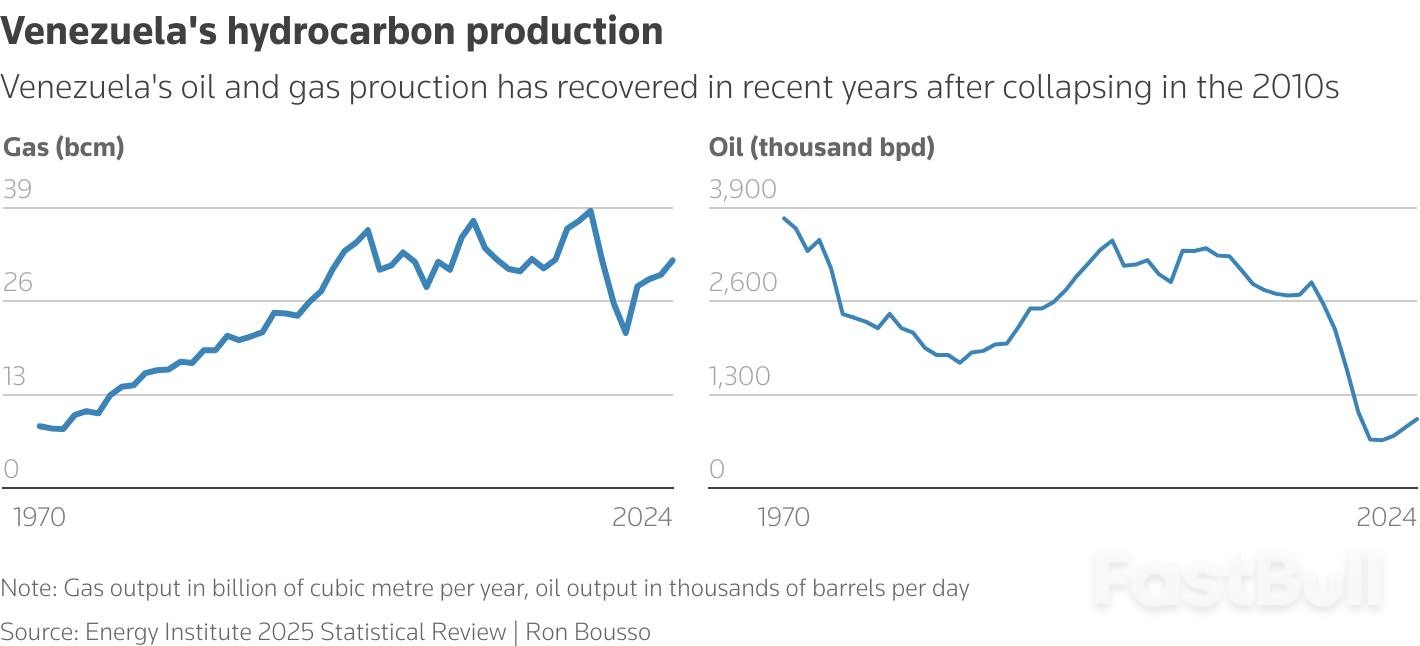

Despite vast reserves, Venezuela's oil revival poses immense costs and political hazards for US energy firms.

The U.S. government is presenting American energy giants with a historic opportunity: the chance to rebuild Venezuela’s shattered oil industry. But for companies like Exxon Mobil, Chevron, and ConocoPhillips, it’s an offer that might be too risky to accept.

Following the hypothetical ouster of Venezuelan President Nicolas Maduro, the Trump administration reportedly plans to meet with oil executives to map out a strategy for boosting the nation's crude production. The prize is access to the world’s largest oil reserves, totaling over 300 billion barrels—roughly one-fifth of the entire global supply. Yet, a closer look reveals a minefield of economic and political challenges.

The potential upside in Venezuela is immense. After years of mismanagement and crippling U.S. sanctions, the country's oil output has plummeted. From a peak of over 3.5 million barrels per day (bpd) in the 1970s, when it accounted for 8% of global supply, production fell below 1 million bpd last year, making up less than 1% of the world's total.

An opening of this magnitude is rare. It echoes historic moments like the fall of the Soviet Union in the 1990s and the aftermath of Saddam Hussein's rule in Iraq, both of which saw Western energy majors scramble for control of valuable assets. The timing also seems opportune, as company boards have recently approved billions in new investments to expand their global market share.

However, reviving Venezuela’s oil sector is far from a straightforward proposition.

Serious operational and financial hurdles lie beneath the ground, casting doubt on the profitability of Venezuelan oil.

Technical and Cost Hurdles

Most of Venezuela's reserves, concentrated in the Orinoco belt, consist of heavy and extra-heavy crude. This highly viscous oil is difficult and expensive to handle. It must be blended with lighter diluents and processed through specialized upgraders before it can be extracted, transported, and refined.

This energy-intensive upgrading process also carries a significant carbon footprint. As governments worldwide move toward taxing emissions, the cost of producing these carbon-heavy grades could rise even further.

Unfavorable Breakeven Economics

According to consultancy Wood Mackenzie, the breakeven cost for key grades in the Orinoco belt already averages over $80 a barrel. This places Venezuelan production at the high end of the global cost curve for new projects. For comparison, heavy oil from Canada has an average breakeven point of around $55 a barrel.

These figures clash with the current strategies of U.S. majors, which are focused on low-cost fields.

• Exxon Mobil is targeting a global production breakeven of $30 a barrel by 2030, driven by assets in Guyana and the U.S. Permian shale basin.

• Chevron has a similar target.

• ConocoPhillips aims to generate free cash flow even if oil prices drop to $35 a barrel.

With crude oil currently trading around $60, and boards demanding strict spending discipline, convincing executives to invest billions in high-cost Venezuelan barrels is a tough sell. Carlos Bellorin, an analyst at Welligence Energy, notes, "The opportunity must be compelling enough to offset the substantial political risk that will persist in the years ahead." Unless a new, industry-friendly government in Venezuela dramatically reforms tax and royalty policies, the numbers simply don't add up.

Beyond the geology and economics, the political landscape in Venezuela presents an even greater deterrent.

Investing in Deep Uncertainty

Oil companies are accustomed to political risk, having operated for decades in volatile regions like Libya, Iraq, and Angola. But the current situation in Venezuela—marked by an uncertain power transition—is exceptionally hazardous.

Without a stable government in Caracas capable of earning the trust of international investors and banks, major firms will be hesitant to make long-term commitments. The appeal of buying cheap assets evaporates if the contracts underpinning them cannot be trusted.

The Peril of Aligning with U.S. Foreign Policy

U.S. oil majors have spent decades carefully cultivating an image of independence from American foreign policy, assuring investors that their decisions are driven solely by shareholder returns. Being seen as instruments of the U.S. president’s agenda could damage that reputation.

This creates a difficult dynamic. President Trump claimed he spoke with major U.S. energy firms about his plans for Venezuela, a statement company executives refuted. While contradicting the White House carries its own risks, especially as government involvement in the economy grows, openly aligning with its foreign policy is equally perilous.

Ultimately, the oil giants will likely signal a willingness to explore opportunities in Venezuela, partly to appease the administration. But the real question is whether they will commit billions of dollars to a country synonymous with corruption and economic chaos. For now, that seems to be a risk too great to take.

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

Log In

Sign Up