Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Rising Middle East tensions, inflation concerns, and delayed U.S. rate cuts are prompting caution on Wall Street, with JPMorgan and others warning of limited upside as stocks near record highs.

The specter of an Israeli attack on oil producer Iran has haunted crude markets for decades — but now that it’s finally arrived, prices seem oddly subdued.

True, futures saw their biggest surge in three years when Israel launched airstrikes June 13. But despite five days of hostilities, the US benchmark’s gains have stalled near $73 a barrel.

When oil hit record levels approaching $150 in 2008, it was driven in part by fears over an Israeli military training exercise. Traders appear less perturbed by the real thing.

This insouciance partly reflects the lack of disruption to facilities and exports, and the perceived improbability of extreme scenarios such as a closure of the critical Strait of Hormuz.

It’s also a matter of experience.

When the two adversaries exchanged missile fire a year ago, crude traders similarly held their nerve, refusing to be spooked while regional flows continued unabated.

Furthermore, oil markets have been toughened by an array of crises, from the 2019 drone attack on Saudi Arabia’s Abqaiq processing plant to sanctions on Russia following its invasion of Ukraine.

But two reports published today by the International Energy Agency — the watchdog of consuming nations — illustrate the deeper dynamics at play.

In its latest monthly update, the IEA noted that, unless the crisis strikes exports, “oil markets in 2025 look well supplied” as demand cools and OPEC+ ramps up production. World inventories ballooned by 1 million barrels a day in recent months, it said.

More importantly, the agency’s annual medium-term outlook reaffirmed that surplus conditions are set to persist for the rest of this decade.

Consumption in China, the engine of demand growth this century, is set to peak in 2027, a few years earlier than previously expected, as the country pivots more toward electric cars.

Meanwhile, oil supplies will continue swelling even as America’s shale boom fades, amid growing output in Brazil, Canada and Guyana, it said.

In short, crude traders’ calm amid the Persian Gulf turmoil fits the industry’s shift to an era of plenty.

Tanker rates for vessels carrying refined oil products from the Middle East surged as missile strikes between Israel and Iran made hauling fuel through the Strait of Hormuz more risky. The cost to ship fuels to East Asia climbed almost 20% in three sessions, according to data from the Baltic Exchange. Rates to East Africa jumped more than 40%.

Oil fluctuated between gains and losses as traders parsed comments from US President Donald Trump on the Middle East conflict. A gauge of market volatility is the highest since 2022.

Two tankers collided off the United Arab Emirates and caught fire, rattling oil and shipping markets that are monitoring navigation in the region. The incident is apparently unrelated to the Israel-Iran fighting.

US Senate Republicans released a bill to end tax credits for wind and solar in 2028 — years earlier than those for other clean-energy sources such as nuclear, hydropower and geothermal.

Gold is expected to sink below $3,000 an ounce in the coming quarters as a record-setting run peters out, Citigroup Inc. said, calling time on one of the standout rallies in commodities.

The US Strategic Petroleum Reserve is half empty after being used like an ATM, and Republicans are budgeting a fraction of the money needed to refill it, Bloomberg Opinion’s Javier Blas writes.

Global passenger jet fuel demand for June 17-23 will rise 1.1% week-on-week, reaching about 7.13 million barrels per day, BloombergNEF projects. This reflects growth of 3.9% year-on-year, based on schedules and implied demand derived from Bloomberg Terminal data. BNEF expects an increase across all regions except Sub-Saharan Africa. North America will lead the gains with about 21,800 barrels per day.

Keir Starmer stooping to recover the latest iteration of the UK’s trade agreement with President Donald Trump was an awkward symbol of the current shape of the negotiations. The deal must continually be dealt with. And the British prime minister will have do most of the bending.

The papers that slipped from Trump’s hands — a fumble he blamed on the wind on the sidelines of Group of Seven meetings in Kananaskis, Canada — give the UK something that has eluded other trading partners: a signed document promising preferential relief from US tariffs.

But even those reduced rates remain far above the levels British goods enjoyed before Trump’s return to office. And key elements such as a 25% tax on steel and aluminum remain subject to potentially difficult negotiations about the origins of materials.

Trump further complicated British efforts to make the most of a relative win, when he mistakenly described the deal as a “trade agreement with the European Union,” the bloc that the UK left five years ago. If the remark surprised Starmer, he didn’t let it shake the smile from his face.

“This a very good day for both of our countries, a real sign of strength,” Starmer said.

“Great people, great people,” Trump replied, pointing at Starmer.

More than three months after Trump and Starmer announced talks on a “new economic deal,” which the British side said would be focused on technology and AI, the discussions continue to morph with Trump’s evolving trade agenda.

Unveiled in hastily arranged speakerphone briefings in May, the first version of the agreement was immediately followed by questions about what it would take to remove elevated tariffs already then being paid by importers of British cars and metals.

The latest version, signed by both leaders to give it an added gloss of formality, committed them to measures to ease the trade of cars, agricultural and aerospace products. But it again fell short of an immediate cut to steel tariffs. Instead, the US agreed to exempt UK metals up to a certain quota that has not yet been set.

The UK in turn committed to “working to meet American requirements on the security of the supply chains of steel and aluminum” including on the “nature of ownership” of relevant steel plants.

That raises thorny issues for both of the UK’s main steel manufacturers: the Chinese-owned British Steel and the Indian-owned Tata Group, the latter of which can’t for the moment meet American requirements for its products to be entirely “melted and poured” in Britain.

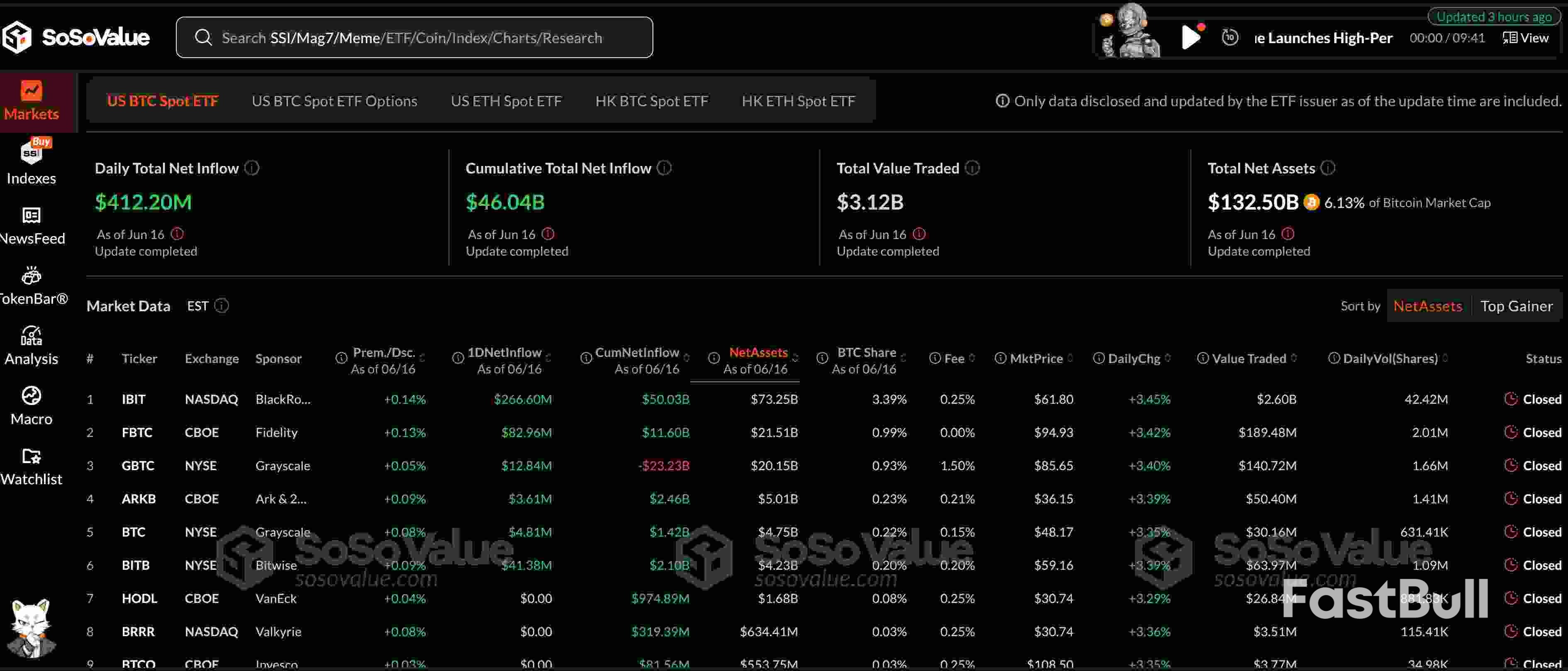

US spot Bitcoin exchange‑traded funds (ETFs) recorded $412.2 million in net inflows on June 16, extending their streak to six days and pushing total cumulative inflows to $46.04 billion.

The six-day run of inflows began on June 9 and has now absorbed over $1.8 billion in capital, according to data from SoSoValue. The run has continued despite escalating geopolitical tensions, including renewed conflict between Iran and Israel.

Daily contributions included $386.27 million on June 9, followed by a $431.12 million surge on June 10. Despite a slight dip mid-week, inflows rebounded sharply with $322.60 million on June 13 and the most recent $412.20 million on June 16.

Total net assets across all US Bitcoin (BTC) ETFs have reached $132.50 billion, now representing 6.13% of Bitcoin’s total market cap. Trading volume remained strong as well, with $3.12 billion in value exchanged on June 16 alone.

Spot Bitcoin ETF Inflows. Source: SoSoValue

Spot Bitcoin ETF Inflows. Source: SoSoValueBlackRock’s iShares Bitcoin Trust (IBIT) led the charge, which recorded a $266.60 million net inflow on June 16 and has now accumulated $50.03 billion in total.

Fidelity’s FBTC followed with $82.96 million, while Grayscale’s GBTC lagged behind with just $12.84 million and still shows a net outflow of $23.23 billion since inception.

“Despite rising tensions between Israel and Iran, institutions are looking past short-term volatility and focusing on long-term positioning,” Vincent Liu, chief investment officer of the Taiwan-based company Kronos Research, told Cointelegraph, adding:

“Steady Bitcoin ETF inflows reflect growing trust in BTC’s resilience, accessibility, and role as a hedge in a shifting macro environment.”

The unexpected Israeli strike on Iran on June 13 triggered a market sell-off, pulling Bitcoin down over 7% and ending the week in negative territory.

Under the hood, metrics showed signs of capitulation, Bitfinex analysts said in a June 16 report. They noted that Net Taker Volume hit a multi-week low at –$197 million, indicating aggressive selling.

“This selling, however, combined with a spike in liquidations, resembles past capitulation-style setups that often mark local bottoms,” the analysts said.

They added that if Bitcoin manages to hold the $102,000–$103,000 zone, it may suggest that selling pressure is being absorbed and that the market could be primed for recovery.

Ukrainian President Volodymyr Zelenskiy will on Tuesday urge the Group of Seven to provide more backing for the war against Russia even after U.S. President Donald Trump left the summit early due to developments in the Middle East.

Zelenskiy is due to meet Canadian Prime Minister Mark Carney in the morning before attending a G7 working breakfast on "A strong and sovereign Ukraine", accompanied by NATO Secretary-General Mark Rutte.

The Ukrainian embassy in Canada said Zelenskiy's travel plans had not changed.

Trump said on Monday he needed to be back in Washington as soon as possible due to the situation in the Middle East, where the escalating attacks between Iran and Israel have raised risks of a broader regional conflict.

"I'm very grateful for the President's presence and I fully understand why he must return," said Carney, who holds the rotating presidency of the G7.

A European Union diplomat said all other members wanted to stay to meet Zelenskiy and continue conversations.

The G7 has struggled to find unity over conflicts in Ukraine and the Middle East as Trump overtly expressed support for Russian President Vladimir Putin and has imposed tariffs on many of the allies present.

Trump did agree to a group statement calling for de-escalation of the Israel-Iran conflict.

"We urge that the resolution of the Iranian crisis leads to a broader de-escalation of hostilities in the Middle East, including a ceasefire in Gaza," the statement said.

The statement said Iran is the principal source of regional instability and terror and that Israel has the right to defend itself.

Last week Zelenskiy said he planned to discuss continued support for Ukraine, sanctions against Russia, and future financing for Kyiv's reconstruction efforts.

Trump said on Monday the then Group of Eight had been wrong to expel Russia after Putin ordered the occupation of Crimea in 2014.

Though the U.S. president stopped short of saying Russia should be reinstated in the group, his comments had already raised doubts about how much Zelenskiy could achieve in a scheduled Trump meeting.

Trump and British Prime Minister Keir Starmer said they had finalized a trade deal reached last month while Carney said he and the U.S. president had agreed to seal a new economic and trade relationship inside the next 30 days.

But the news was not as good for Japanese Prime Minister Ishiba Shigeru, who had been hoping to seal an agreement of his own on Monday. He told reporters he had had a frank discussion with Trump but did not reach a final agreement.

G7 leaders prepared several draft documents seen by Reuters, including on migration, artificial intelligence, and critical minerals. None of them have been approved by the United States, according to sources briefed on the documents.

Without Trump, it is unclear if there will be any declarations, a European diplomat said.

Carney also invited non-G7 members Mexico, India, Australia, South Africa, South Korea and Brazil, as he tries to shore up alliances elsewhere and diversify Canada's exports away from the United States.

Canada's relationship with India has been tense since former Canadian Prime Minister Justin Trudeau in 2023 accused India's government of involvement in the June 18, 2023, murder of Hardeep Singh Nijjar, a Sikh separatist leader in Canada.

Modi's government has denied involvement in Nijjar's killing and has accused Canada of providing a safe haven for Sikh separatists. It is Modi's first visit to Canada in a decade.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up