Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street dipped as optimism from the U.S.-China tariff truce faded. UnitedHealth plunged 16% on DOJ fraud probe news, while retail and energy stocks fell amid weak economic data and sliding oil prices.

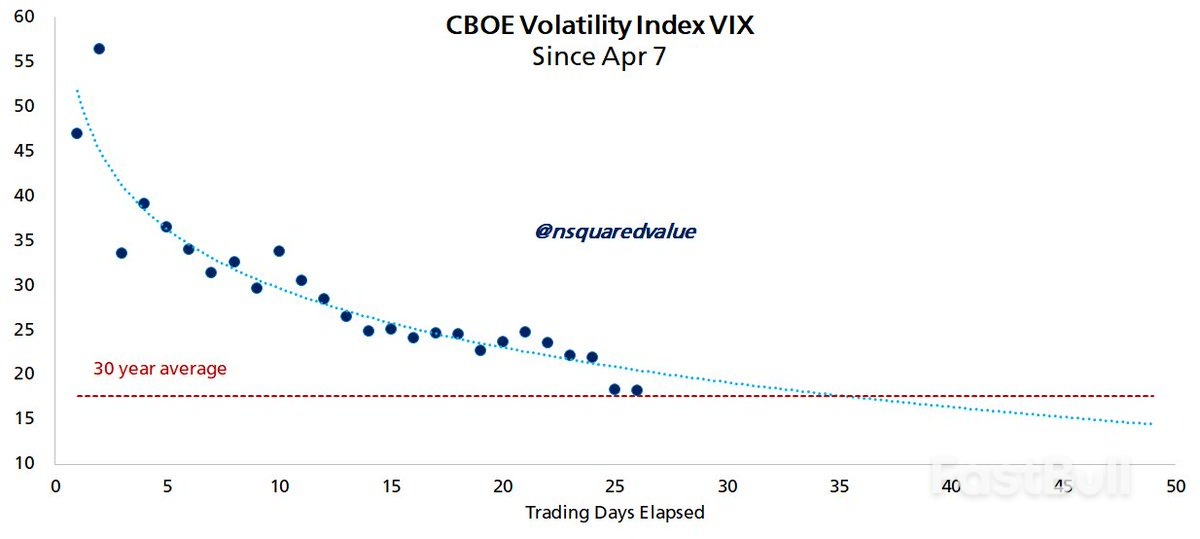

CBOE Volatility Index. Source: Timothy Peterson

CBOE Volatility Index. Source: Timothy Peterson

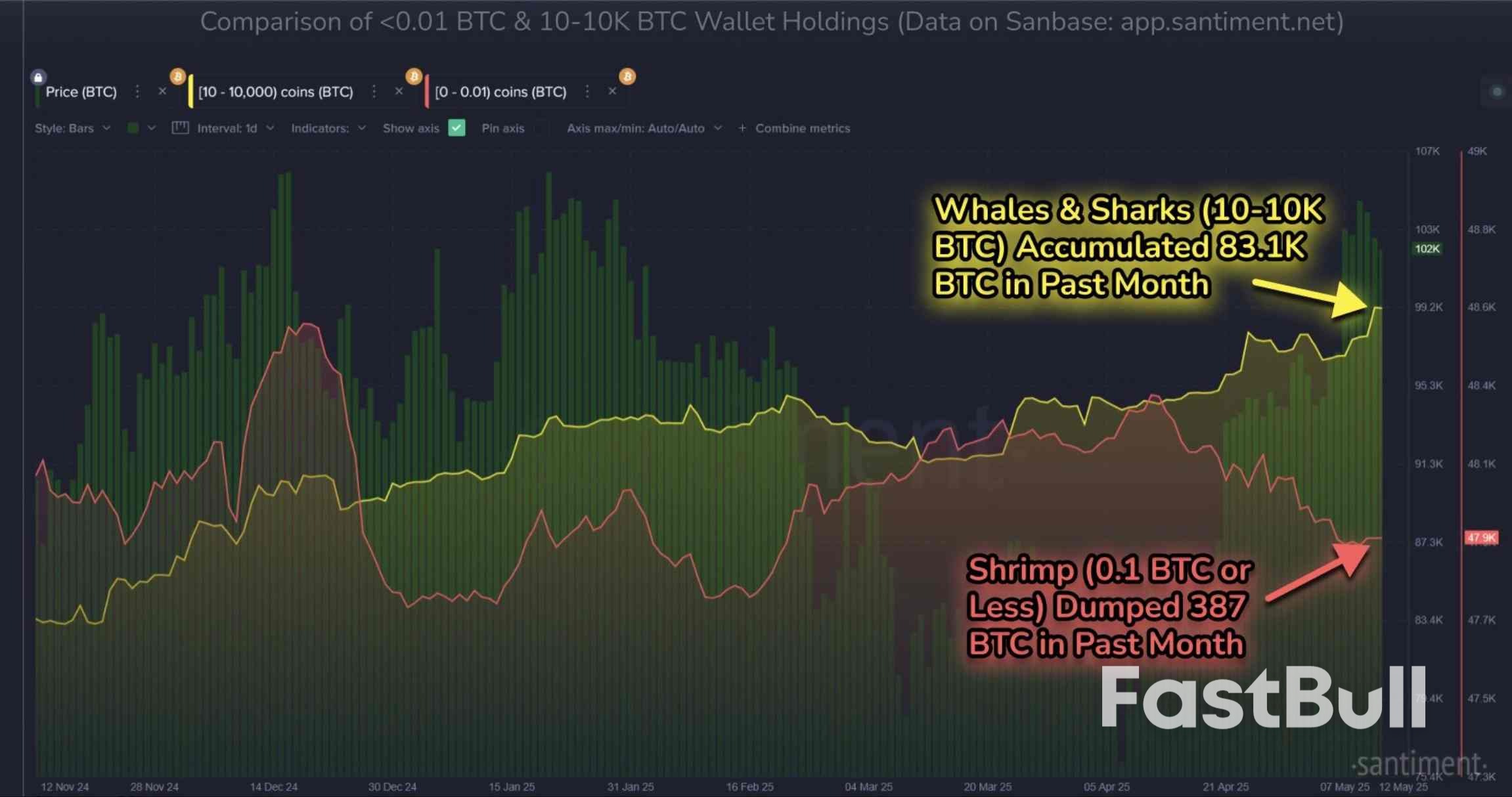

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

Bitcoin 10-10,000 BTC chart holdings. Source: Santiment

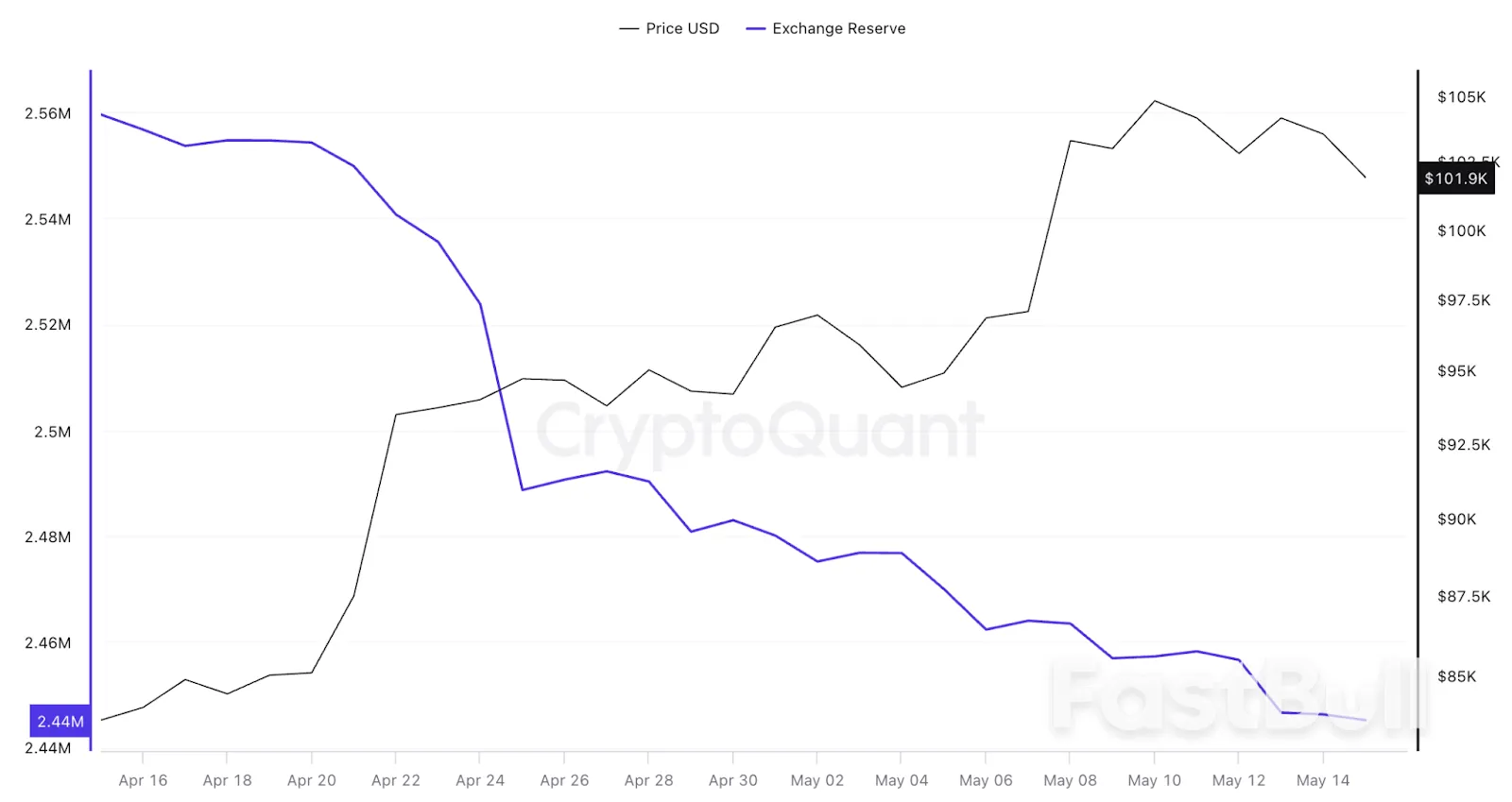

Source: Ted Boydston

Source: Ted Boydston

The AUDUSD continues to face strong resistance at the 200-day moving average, which capped rallies both on Monday and again today at the session high of 0.6457. Sellers leaned into that level, keeping upside momentum in check and maintaining the bearish pressure.

On the downside, a cluster of moving averages, all broken on the move lower, sits between 0.6419 and 0.6437 and now acts as a key resistance zone. This area includes:

● The 200-hour MA at 0.64376

● The 100-hour MA at 0.64254

● The 100-bar MA on the 4-hour chart at 0.6419

After the fall, the low price reached 0.6401, just above the psychological 0.6400 level, where support buyers emerged. However, the rebound stalled at 0.6422, unable to reclaim the broken MAs—giving sellers a short-term advantage below this cluster.

To shift the bias back to the upside, the pair needs to sustain a move above 0.6437, and then break through the 200-day MA at 0.6457. That would open the door toward 0.6513, the high for the year.

Conversely, a break below 0.6400 could see further downside toward the next support at 0.6388, followed by the broader swing area between 0.6321 and 0.63437. Beyond that, key support targets include:

● The 100-day MA at 0.62951

● The 38.2% retracement of the April rally at 0.62844

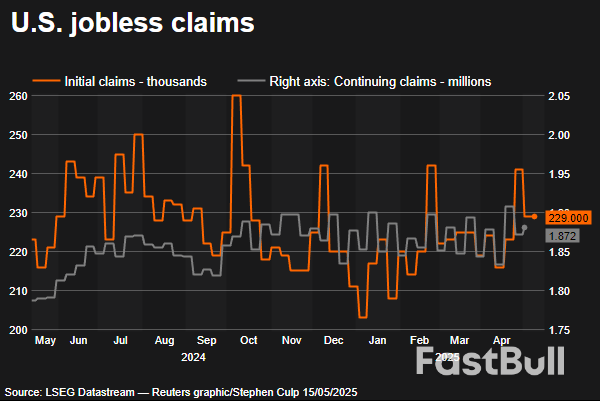

U.S. stocks fell Thursday, handing back some of the week’s hefty gains, as investors digest corporate earnings as well as weak economic data, raising slowdown fears.

At 09:35 ET (13:35 GMT), the Dow Jones Industrial Average fell 180 points, or 0.4%, the S&P 500 index dropped 15 points, or 0.3% and the NASDAQ Composite slipped 85 points, or 0.5%.

Despite today’s losses, the main averages are still on course for healthy gains this week as the trade deal between China and the U.S. eased fears of a prolonged tariffs war, potentially hitting economic growth.

With the trade turmoil seemingly settling down, investors are turning their attention to the economic data slate, looking for signs of damage being done to the world’s largest economy.

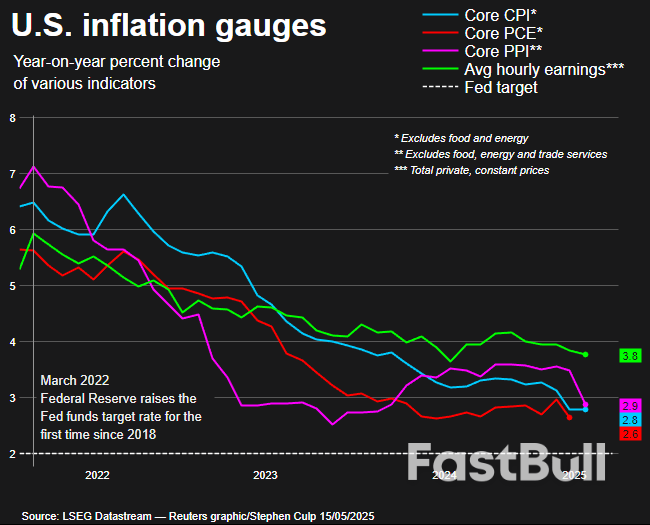

The latest producer price index showed that factory gate prices slumped on a monthly basis in April, in the latest sign of cooling inflationary pressures.

The producer price index for final demand fell 0.5% in April, the first monthly fall since 2023, after the previous month’s figure was revised to flat from a fall of 0.4%.

Taking out more volatile items like fuel and food, so-called “core” PPI also fell on a monthly basis, down 0.4%.

Data released earlier this week showed that the more widely-watched consumer price index grew by 2.3% in the 12 months to April, compared with expectations that it would match March’s pace of 2.4%.

It was the lowest annual rate of inflation since February 2021, shortly before pent-up pandemic-fueled demand and supply constraints led to soaring prices.

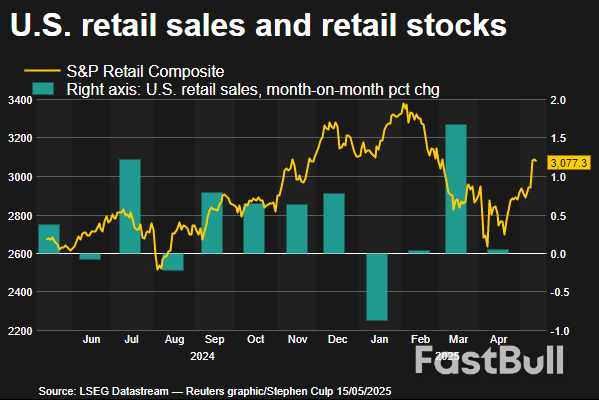

Additionally, retail sales fell 1.0% on the month in March, a more substantial loss than the 0.5% expected.

A surge of buying before the implementation of Trump’s punishing tariffs led to the largest increase in the metric in more than two years in March. Separate surveys have indicated that households have widely been anticipating that the levies will push up prices.

Elsewhere, Federal Reserve Chair Jerome Powell is set to deliver remarks at a conference in Washington, D.C. Last week, the Fed left interest rates unchanged, with Powell noting strength in the broader economy but rising risks from inflation and unemployment.

The main corporate release Thursday comes from retail giant Walmart (NYSE:WMT), with the retail giant posting better-than-anticipated first-quarter earnings, although its finance chief warned that tariff tensions could soon drive prices higher..

Known for its low prices and massive selections, Walmart has become something of a bellwether for shopper sentiment. In February, the company issued downbeat guidance for the year, although CFO John David Rainey said American consumers remain "resilient" and focused on value.

Elsewhere, Chinese e-commerce titan Alibaba (NYSE:BABA) missed earnings expectations for its fiscal fourth quarter on both the top and bottom line, while agricultural equipment manufacturer Deere & Company (NYSE:DE) reported better-than-expected second quarter results, but lowered the bottom end of its full-year net income forecast range amid challenging market conditions.

Cisco Systems (NASDAQ:CSCO) raised its annual results forecast, betting on steady demand from cloud customers for its networking equipment, driven by the artificial intelligence boom.

UnitedHealth (NYSE:UNH) stock slumped after the Wall Street Journal reported the company was being investigated by the Department of Justice over alleged criminal fraud involving Medicare.

The investigation marks a new headwind for UnitedHealth, which is already nursing a sharp selldown in its shares this year on concerns over government scrutiny, weakening financials, and signs of internal strife. The company abruptly replaced its CEO this week.

Foot Locker (NYSE:FL) stock soared after Dick’s Sporting Goods (F:DKS) confirmed it is exploring a deal to buy the company for roughly $2.3 billion.

Oil prices fell sharply Thursday, extending recent losses, as the growing expectations for a potential U.S.-Iran nuclear deal added to demand concerns following a surprise build in U.S. inventories.

At 09:35 ET, Brent futures dropped 2.5% to $64.45 a barrel, and U.S. West Texas Intermediate crude futures fell 2.4% to $61.56 a barrel.

Both benchmarks lost just under 1% on Wednesday, ending a four-day rally and slipping from the two-week high reached earlier this week.

A U.S.-Iran nuclear deal could potentially allow Tehran to export more of its crude into the world market, loosening the global crude supply-demand balance.

Additionally, data from the Energy Information Administration showed crude stockpiles rose by 3.5 million barrels in the week ended May 9, suggesting that demand may be cooling in the world’s largest energy consumer.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up