Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

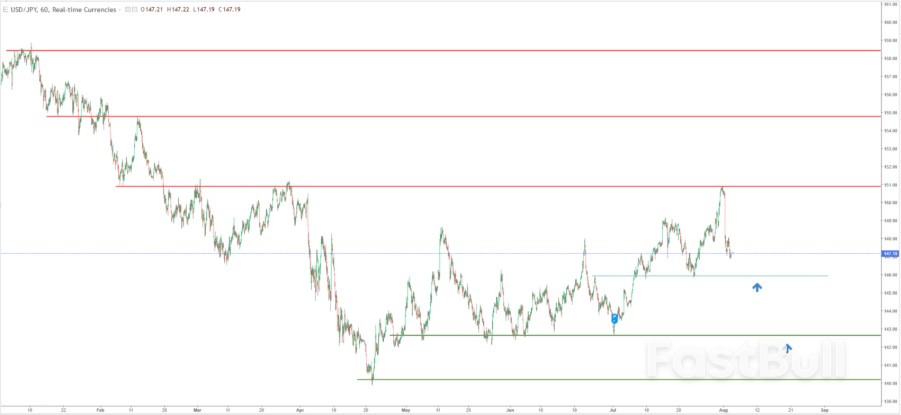

Diverging Fed–BoJ policies pressure USD/JPY, with U.S. rate cuts likely and Japan eyeing hikes. Key support at 146 is in focus; a break could open the path toward 143 and 140.

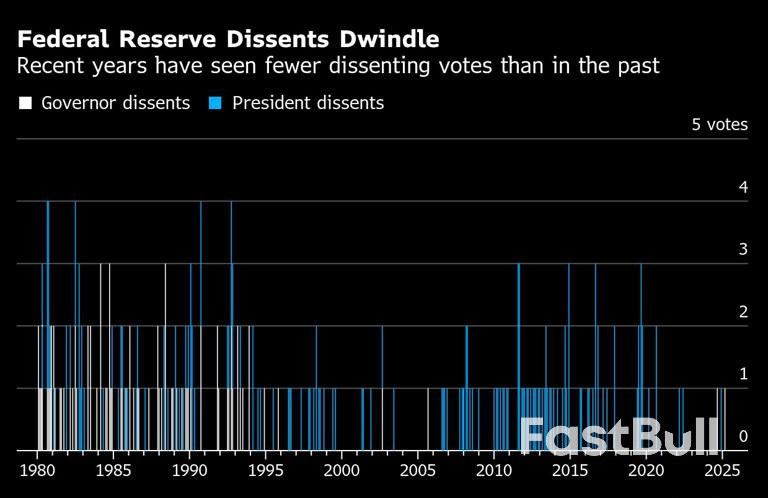

Federal Reserve Dissents Dwindle | Recent years have seen fewer dissenting votes than in the past

Federal Reserve Dissents Dwindle | Recent years have seen fewer dissenting votes than in the pastOfficial economic data is finally catching up to the fact that Americans have been feeling lousy about the job market for months.

The U.S. economy added just 73,000 nonfarm jobs in July, according to the latest jobs report from the Bureau of Labor Statistics. That's below market expectations and the roughly 80,000 benchmark for a healthy economy to support the growing population, says Laura Ullrich, Indeed's director of economic research for North America.

A lot of economists are also paying attention to the latest report, which helps show a monthly picture of where jobs are growing and shrinking, because it downwardly revised its May and June numbers to show the economy added just 33,000 jobs over the two-month period, compared to earlier estimates of 291,000 jobs.

Following the release of Friday's jobs report, President Donald Trump fired BLS commissioner Erika McEntarfer, suggesting without evidence that the weaker-than-expected report had been "rigged" by federal workers bent on sabotaging the president.

Revisions are a normal part of the data collection process, and estimates move up or down to become more precise with additional payroll data up to several months after a report releases, Ullrich tells CNBC Make It.

But "these revisions took the prior two jobs report [in May and June] from a range where they looked like pretty healthy job reports to where they looked quite weak," Ullrich says.

The latest numbers confirm the U.S. economy is slowing sharply, experts say. Here's what else job seekers should know about the state of the labor market:

At the beginning of the year, the labor market was primarily held up by jobs across three sectors: health care and social assistance, leisure and hospitality, and government hiring.

Leisure and hospitality job creation is down, driven in part by business pullback amid economic uncertainty, while government hiring is down following the Trump administration's work to slash the size of the federal government.

Meanwhile, health care and social assistance have accounted for 48.8% of total employment growth over the last year, despite making up just 14.6% of the economy, Ullrich says.

New jobs span nurses, nurses assistants, patient care techs, home health aides and other roles. "Hospitals employ just about everybody," Ullrich says.

Hospitals added 196,000 jobs over the last year, which is 3.5% growth and "pretty strong," Ullrich says. Home health care services grew by 56,900 jobs, or 3.2%, over the last year.

A majority, 78.6%, of employees in this subsector are women, meaning 35% of all employment growth in the U.S. over the past year has been among women in health care and social assistance, Ullrich says.

Experts have long predicted the strength around health-care jobs to take care of an aging Baby Boomer population.

"Growth in that sector has remained robust," Ullrich says.

Other typically high-growth and high-paying sectors are shedding jobs, including professional and business services, manufacturing and government, which all lost more than 10,000 jobs each over the last month.

Some experts have dubbed the current environment a "white collar recession" among office workers. "Business and professional services added a ton of jobs in the post-pandemic period, but over the past year or so, it's been relatively soft," Ullrich says.

As for manufacturing, it's hard to say what combination of factors is keeping jobs down, whether it's new global tariffs, changing consumer habits, or overall economic uncertainty, among other things, Ullrich says.

Ullrich says the latest jobs numbers are just one more data point that add to a broader challenging economic picture, which could impact business plans and consumer spending.

"It's been clear through multiple sources of data, including this jobs report, that the economy is slowing down a bit, and so that can certainly impact sentiment," she says.

Another troubling sign: The number of people who've been unemployed for 27-plus weeks increased by 179,000 people to 1.8 million in July, according to BLS data. Long-term unemployed people make up roughly 1 in 4 people looking for a job right now.

Job postings are down on Indeed, Ullrich says, and economists have seen a disequilibrium in terms of what skills people have and what sectors are hiring.

Currently, "if you are somebody that's trying to find a job in manufacturing or business and professional services, it's likely a pretty tough job market right now," Ullrich says. "If you're graduating with a nursing degree, I feel pretty confident that there's someone out there looking to hire you."

Brazil is finalizing proposals to help companies mitigate the effects of steep US tariffs with debt extensions, cheaper credit and support for workers’ salaries, according to an official with knowledge of the plans.

The package is the cornerstone of President Luiz Inacio Lula da Silva’s efforts to counteract the 50% tariffs Donald Trump threatened to impose on Brazilian goods, and will target relief at sectors that weren’t among the nearly 700 exemptions the US leader outlined last week.

Lula’s government is waiting for the higher levies to take effect Wednesday to assess the overall impact on Brazilian companies, and has not yet finalized a cost estimate for the plans, the person said, requesting anonymity to discuss internal matters. Finance Minister Fernando Haddad said Tuesday that about 4% of Brazilian exports to the US will be affected by the tariffs.

While Haddad has said the tariff relief efforts will not fall outside fiscal rules, they will make it tougher for the government to reach its target of eliminating the primary budget deficit, excluding interest payments, this year. Moreover, the initiatives are likely to add to already-rising public debt levels that have generated investor concerns.

The Finance Ministry didn’t respond to a request for comment.

The program is set to include offers of credit for working capital through Brazil’s national development bank, known as BNDES, with the backing of an existing public guarantee fund, the official said.

The government simultaneously wants to help companies extend the timeline of loan repayments. It also wants to purchase some products from companies whose sales to the US are dented by tariffs. It plans to make improvements to export insurance programs, and in a bid to preserve jobs, temporarily help firms cover the cost of worker salaries, as Brazil did during the pandemic, according to the official.

The amount of aid companies receive is likely to be based on how much they sell to the US and the impact tariffs have on their business, the official said.

While it is still assessing those effects, Lula’s administration is likely to need to make additional contributions to the guarantee fund in order to support the cheaper credit initiative. Haddad’s team is currently determining whether it can use existing public money or if it will need to issue additional debt to bolster the fund, the official said.

It will also need to approve a resolution in Brazil’s National Monetary Council — made up of Haddad, Planning Minister Simone Tebet and central bank chief Gabriel Galipolo — to ensure that banks do not face penalties under prudential rules, according to the official.

Trump thrust Brazil into the center of his global trade war in July, when he threatened to impose the tariffs unless the country’s Supreme Court immediately dropped a case against former President Jair Bolsonaro, who is facing trial on coup attempt charges.

Lula’s government has sought to open talks with the US over the levies in order to “show them that there is no economic sense in these tariffs against Brazil,” Haddad said Monday, adding that he may soon speak with Treasury Secretary Scott Bessent.

Brazil’s Chamber on Foreign Trade also authorized the government to consult the World Trade Organization about the legality of Trump’s tariffs, Vice President Geraldo Alckmin told reporters Monday.

A lawsuit at the WTO is expected to be filed in the coming days, with the government planning to take action in the areas of intellectual property, patents and copyright.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up