Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

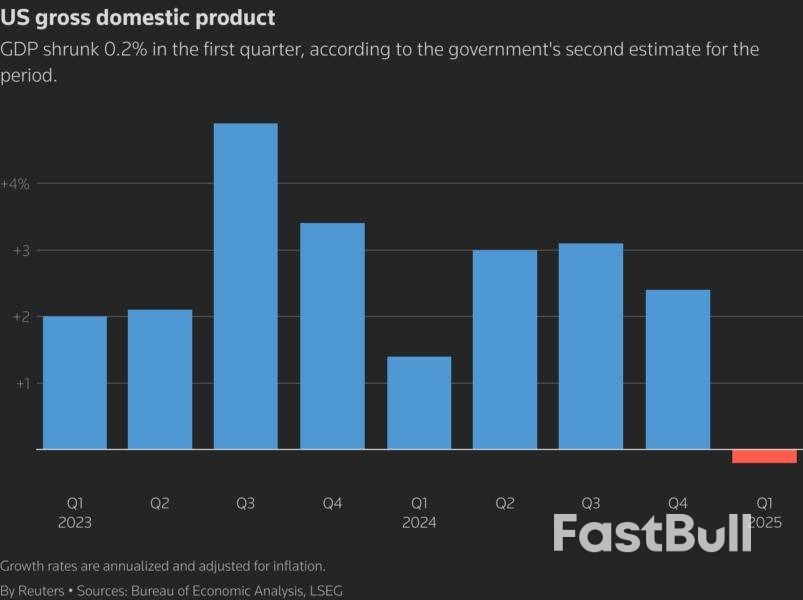

Weekly jobless claims increase 14,000 to 240,000.Continuing claims rise 26,000 to 1.919 million.Corporate profits fall $118.1 billion in first quarter.Economy contracts at 0.2% rate in Q1 by all measures.

The number of Americans filing new applications for jobless benefits increased more than expected last week and the unemployment rate appeared to have picked up in May, suggesting layoffs were rising as tariffs cloud the economic outlook.

The report from the Labor Department on Thursday showed a surge in applications in Michigan last week, the nation's motor vehicle assembly hub. The number of people collecting unemployment checks in mid-May was the largest in 3-1/2 years. The outlook for the economy is dimming with other data showing a sharp decline in corporate profits in the first quarter.

A U.S. trade court on Wednesday blocked most of Trump's tariffs from going into effect in a sweeping ruling that the president overstepped his authority. Economists said the ruling, while it offered some relief, had added another layer of uncertainty over the economy.

"This is a sign that cracks are starting to form in the economy and that the outlook is deteriorating," said Christopher Rupkey, chief economist at FWDBONDS. "There is nothing great about today's jobless claims data and the jump in layoffs may be a harbinger of worse things to come."

Initial claims for state unemployment benefits rose 14,000 to a seasonally adjusted 240,000 for the week ended May 24, the Labor Department said. Economists polled by Reuters had forecast 230,000 claims for the latest week.

Unadjusted claims increased 10,742 to 212,506 last week, lifted by a 3,329 jump in filings in Michigan. There were also notable increases in applications in Nebraska and California.

Despite the rise in claims, worker hoarding by employers following difficulties finding labor during and after the COVID-19 pandemic continues to underpin the jobs market.

Nonetheless, there has been an uptick in layoffs because of economic uncertainty asTrump's aggressive trade policy makes it challenging for businesses to plan ahead.

A report from the Bank of America Institute noted a sharp rise in higher-income households receiving unemployment benefits between February and April compared to the same period last year. Its analysis of Bank of America deposit accounts also showed notable rises among lower-income as well as middle-income households in April from the same period a year ago.

Economists expect claims in June to break above their 205,000-243,000 range for this year, mostly driven by difficulties adjusting the data for seasonal fluctuations, following a similar pattern in recent years.

Minutes of the Federal Reserve's May 6-7 policy meeting published on Wednesday showed while policymakers continued to view labor market conditions as broadly in balance, they "assessed that there was a risk that the labor market would weaken in coming months."

They noted that there was "considerable uncertainty" over the job market's outlook, adding "outcomes would depend importantly on the evolution of trade policy as well as other government policies."

The U.S. central bank has kept its benchmark overnight interest rate in the 4.25%-4.50% range since December as officials struggle to estimate the impact of Trump's tariffs, which have raised the prospect of higher inflation and slower economic growth this year.

U.S. stocks opened higher. The dollar eased against a basket of currencies after a brief rally. U.S. Treasury yields fell.

The number of people receiving benefits after an initial week of aid, a proxy for hiring, increased 26,000 to a seasonally adjusted 1.919 million during the week ending May 17, the claims report showed. The elevated so-called continuing claims reflect companies' hesitance to increase headcount because of the economic uncertainty.

Continuing claims covered the period during which the government surveyed households for May's unemployment rate. They increased between the April and May survey periods, suggesting an uptick in the unemployment rate this month. The jobless rate was at 4.2% in April.

Many people who have lost their jobs are experiencing long spells of unemployment. The median duration of unemployment jumped to 10.4 weeks in April from 9.8 weeks in March.

With profits under pressure, there is probably little incentive for businesses to boost hiring. Mass layoffs are, however, unlikely with a Conference Board survey of chief executive officers released on Thursday showing most captains of business anticipated no change in the size of their workforce over the next year even as about 83% said they expected a recession in the next 12-18 months.

Profits from current production with inventory valuation and capital consumption adjustments dropped $118.1 billion in the first quarter, the Commerce Department's Bureau of Economic Analysis (BEA) said in a separate report. Profits surged $204.7 billion in the October-December quarter.

Companies ranging from airlines and retailers to motor vehicle manufacturers have either withdrawn or refrained from giving financial guidance for 2025, citing the uncertainty caused by the on-again and off-again nature of some duties.

Businesses front-loaded imports and households engaged in pre-emptive buying of goods last quarter to avoid higher costs, making it difficult to get a clear picture of the economy.

The deluge of imports sent gross domestic product declining at a 0.2% annualized rate in the January-March quarter, the BEA said in its second estimate of GDP. The economy was initially estimated to have contracted at a 0.3% pace. It grew at a 2.4% rate in the fourth quarter.

Other alternative measures of growth, gross domestic income and gross domestic output also showed the economy contracting at a 0.2% pace in the first quarter.

Daily Natural Gas

Daily Natural GasThe second release of first quarter real GDP growth was left broadly unchanged, showing a very modest contraction of 0.2% quarter-over-quarter annualized (previously -0.3%) – a tenth below the consensus forecast. Recall, this is a notable deceleration from the 2.9% annualized rate of expansion averaged over the prior two quarters and is the first quarterly contraction in three-years.

Consumer spending rose 1.2% (previously 1.8%), or roughly a third of the rate of expansion in the prior quarter. The downgrade was largely due to softer services spending (2.2% from 2.7%).

Non-residential fixed investment rose 10.4% (previously 9.8%), with a surge in equipment spending (24.7%) accounting for the bulk of the gain – reflecting companies ramping up purchases ahead of the tariffs. Investment in intellectual property products (+4.6%) was also healthy, rising at the fastest annualized pace in a year.

Residential investment was revised to a small contraction of 0.6% (previously +1.3%).

The bulk of the pullback in GDP came from net exports. Imports surged by 42.6%, largely owing to a strong gain in goods imports (53.3%). Meanwhile, exports rose by a more modest 2.4%, resulting in net trade subtracting 4.9 percentage points (pp) from headline growth. Roughly half of the uptick in imports showed up in inventory investment, which added 2.6pp to Q1 GDP.

Government spending contracted by 0.7%, as outlays from both federal defense (-7.1%) and non-defense (-1.2%) declined.

Final sales to private domestic purchasers – the best gauge of underlying domestic activity – expanded by a healthy 2.5%.

Real Gross Domestic Income (GDI) also contracted by 0.2% in the first quarter. Corporate profits fell 11.3% annualized or $118 billion after accounting for inventory valuation and capital consumption adjustments. However, this was partially offset by another solid gain in employee compensation (5.4%), which accounts for roughly two-thirds of total national income.

The second estimate of first quarter real GDP did not change the underlying narrative. Economic growth was heavily weighed down by a surge in import activity, as businesses scrambled to pull forward purchases ahead of the tariffs. Looking through the import shock, underlying domestic demand remained reasonably healthy, but this too likely captures behavior shifts related to tariffs in investment and consumer purchases, such as autos.

As of May 28th, the U.S. Court of International Trade struck down all of President Trump’s tariffs related to the International Emergency Economic Powers Act, including the Canada/Mexico/China fentanyl tariffs, the universal 10% tariffs currently in effect and the delayed reciprocal tariffs that were slated to come back into effect as of July 9th. The court ruling has no impact on sectoral tariffs, including the steel & aluminum and auto related tariffs. While the administration has already said that they plan to appeal the ruling, timelines remain unclear. At the very least, yesterday’s announcement weakens the U.S. position in trade talks that were underway with more than a dozen nations, most notably the EU and China.

Of the Q2 data released, there’s only moderate evidence that domestic spending has slowed in response to heightened trade uncertainty. But the pullback in Q1 corporate profits – the largest quarterly decline since Q4’2020 – is a warning sign that firms were coming under pressure, and this was before the bulk of the tariffs had even come into effect. Tomorrow’s release of the April personal income and spending will provide a more fulsome snapshot of how the consumer fared last month, and whether there’s any evidence of a softening in discretionary spending trends.

Recurring applications for US jobless benefits jumped to the highest level since November 2021, possibly presaging a rise in the unemployment rate this month.

Continuing claims, a proxy for the number of people receiving benefits, increased by 26,000 to 1.92 million in the week ended May 17. That exceeded the median forecast of 1.89 million in a Bloomberg survey of economists. The period includes the reference week for the government’s employment report for the month of May, which is due June 6.

The numbers suggest the combined impact of the Trump administration’s trade policy and government spending initiatives are starting to take a larger toll on the labor market as those out of work increasingly struggle to find new positions. So far, it’s yet to show up meaningfully in the monthly jobs report — the unemployment rate stood at 4.2% in April, a level it first reached in July 2024.

“We see some early signs that the labor market is starting to soften in this report, notwithstanding the risks of reading too much into one week’s numbers,” said Oliver Allen, senior US economist at Pantheon Macroeconomics. “This continuing claims number covers the employment report survey week and points to a slight uptick in the unemployment rate in next Friday’s numbers.”

That said, the numbers are still consistent with a low-hiring, low-firing state of affairs. Initial claims increased by 14,000 last week to 240,000, a level which remains in the range of the past year.

Separate data from the Bureau of Economic Analysis Thursday showed US gross domestic product decreased at a 0.2% annualized pace in the first quarter as consumer spending and net exports were revised lower.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up