Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.K. Trade Balance Non-EU (SA) (Oct)

U.K. Trade Balance Non-EU (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance (Oct)

U.K. Trade Balance (Oct)A:--

F: --

P: --

U.K. Services Index MoM

U.K. Services Index MoMA:--

F: --

P: --

U.K. Construction Output MoM (SA) (Oct)

U.K. Construction Output MoM (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output YoY (Oct)

U.K. Industrial Output YoY (Oct)A:--

F: --

P: --

U.K. Trade Balance (SA) (Oct)

U.K. Trade Balance (SA) (Oct)A:--

F: --

P: --

U.K. Trade Balance EU (SA) (Oct)

U.K. Trade Balance EU (SA) (Oct)A:--

F: --

P: --

U.K. Manufacturing Output YoY (Oct)

U.K. Manufacturing Output YoY (Oct)A:--

F: --

P: --

U.K. GDP MoM (Oct)

U.K. GDP MoM (Oct)A:--

F: --

P: --

U.K. GDP YoY (SA) (Oct)

U.K. GDP YoY (SA) (Oct)A:--

F: --

P: --

U.K. Industrial Output MoM (Oct)

U.K. Industrial Output MoM (Oct)A:--

F: --

P: --

U.K. Construction Output YoY (Oct)

U.K. Construction Output YoY (Oct)A:--

F: --

P: --

France HICP Final MoM (Nov)

France HICP Final MoM (Nov)A:--

F: --

P: --

China, Mainland Outstanding Loans Growth YoY (Nov)

China, Mainland Outstanding Loans Growth YoY (Nov)A:--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)A:--

F: --

P: --

India CPI YoY (Nov)

India CPI YoY (Nov)A:--

F: --

P: --

India Deposit Gowth YoY

India Deposit Gowth YoYA:--

F: --

P: --

Brazil Services Growth YoY (Oct)

Brazil Services Growth YoY (Oct)A:--

F: --

P: --

Mexico Industrial Output YoY (Oct)

Mexico Industrial Output YoY (Oct)A:--

F: --

P: --

Russia Trade Balance (Oct)

Russia Trade Balance (Oct)A:--

F: --

P: --

Philadelphia Fed President Henry Paulson delivers a speech

Philadelphia Fed President Henry Paulson delivers a speech Canada Building Permits MoM (SA) (Oct)

Canada Building Permits MoM (SA) (Oct)A:--

F: --

P: --

Canada Wholesale Sales YoY (Oct)

Canada Wholesale Sales YoY (Oct)A:--

F: --

P: --

Canada Wholesale Inventory MoM (Oct)

Canada Wholesale Inventory MoM (Oct)A:--

F: --

P: --

Canada Wholesale Inventory YoY (Oct)

Canada Wholesale Inventory YoY (Oct)A:--

F: --

P: --

Canada Wholesale Sales MoM (SA) (Oct)

Canada Wholesale Sales MoM (SA) (Oct)A:--

F: --

P: --

Germany Current Account (Not SA) (Oct)

Germany Current Account (Not SA) (Oct)A:--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)

Japan Tankan Large Non-Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

U.K. Inflation Rate Expectations

U.K. Inflation Rate Expectations--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)--

F: --

P: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

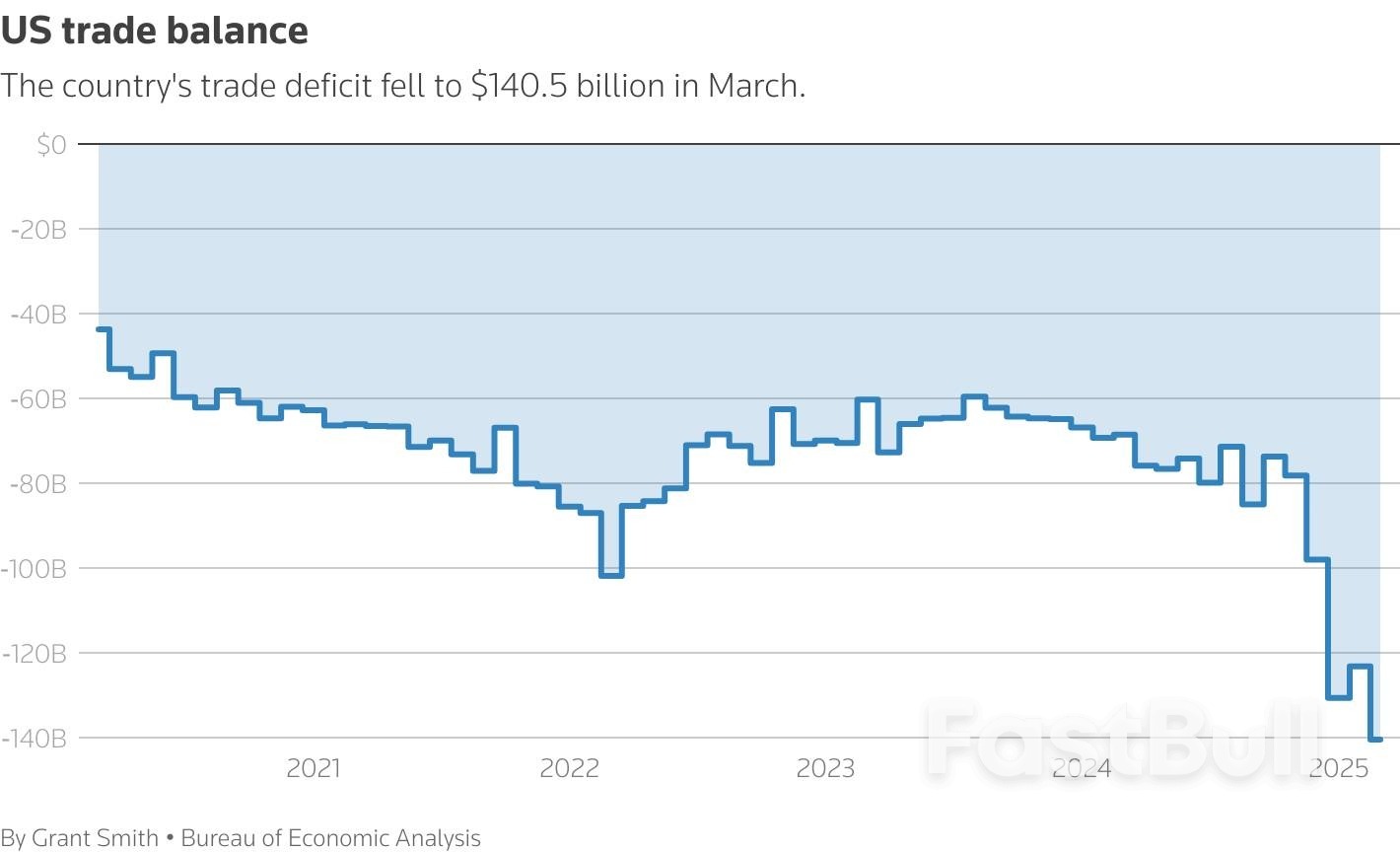

Companies rushed to stockpile foreign products ahead of April's 'Liberation Day'

The U.S. trade deficit widened to a record high in March as businesses boosted imports of goods ahead of President Donald Trump's sweeping tariffs, which dragged gross domestic product into negative territory in the first quarter for the first time in three years.

The report from the Commerce Department on Tuesday showed the nation imported a record amount of goods from 10 countries, including Mexico and Vietnam. Imports from China were, however, the lowest in five years and could drop further as Trump has hiked duties on Chinese goods to a staggering 145%.

While reciprocal tariffs with most of the United States' trade partners were suspended for 90 days, duties on Chinese goods came into effect in early April, triggering a trade war with Beijing.

"Businesses are clearly scrambling as they try to find a way through this time of unprecedented change, but the worst is undoubtedly yet to come because the import tariff collections did not start to roll in earnest until after the White House Liberation Day announcement on April 2," said Christopher Rupkey, chief economist at FWDBONDS. "There are still no trade deals announced in Trump 2.0."

The trade gap jumped 14.0%, or $17.3 billion, to a record $140.5 billion, the Commerce Department's Bureau of Economic Analysis (BEA) said on Tuesday. Economists polled by Reuters had forecast the trade deficit rising to $137.0 billion.

Imports vaulted 4.4% to an all-time high $419.0 billion in March. Goods imports soared 5.4% to a record $346.8 billion. They were boosted by a $22.5 billion jump in consumer goods to an all-time high, mostly pharmaceutical preparations.

Capital goods imports increased $3.7 billion to a record high, reflecting a solid rise in computer accessories. Imports of automotive vehicles, parts and engines increased $2.6 billion, driven by passenger cars.

But imports of industrial supplies declined $10.7 billion amid decreases in finished metal shapes and nonmonetary gold, which had accounted for the surge in the prior two months. Crude oil imports fell $1.2 billion.

Exports climbed 0.2% to $278.5 billion, also a record high. Exports of goods increased 0.7% to $183.2 billion, the highest since July 2022, lifted by industrial supplies and materials, which advanced $2.2 billion amid rises in natural gas and nonmonetary gold.

Automotive vehicles, parts and engines exports increased $1.2 billion. But exports of capital goods decreased $1.5 billion, weighed down by a $1.8 billion decline in shipments of civilian aircraft. The goods trade deficit ballooned 11.2% to a record $163.5 billion in March.

The government reported last week that the trade deficit cut a record 4.83 percentage points from GDP last quarter, resulting in the economy contracting at a 0.3% annualized rate, the first decline since the first quarter of 2022.

Trump sees the tariffs as a tool to raise revenue to offset his promised tax cuts and to revive a long-declining U.S. industrial base. Economists expect the flood of imports to ebb by May, which could help GDP to rebound in the second quarter.

They, however, caution that the lift from subsiding imports could be offset by a drop in exports as other nations boycott American goods and travel. There has been a decrease in visitors to the U.S., especially from Canada, in protest over the punitive tariffs as well as an immigration crackdown and Trump's musings about annexing Canada and Greenland.

Indeed, exports of services fell $0.9 billion to $95.2 billion in March, pulled down by a $1.3 billion drop in travel.

The rush to beat tariffs saw imports from Mexico, the United Kingdom, Ireland, the Netherlands, Belgium, France, Germany, Italy, India and Vietnam hitting all-time highs. But imports from China were the lowest since March 2020, when the world was grappling with the first wave of the COVID-19 pandemic.

The seasonally adjusted goods trade deficit with China narrowed to $24.8 billion from $26.6 billion in February. The trade deficit with Canada also declined to $4.9 billion from $7.4 billion in February. The trade gap with Mexico was little changed, while the surplus with the United Kingdom narrowed.

The report from the Commerce Department on Tuesday showed the nation imported a record amount of goods from 10 countries, including Mexico and Vietnam. Imports from China were, however, the lowest in five years and could drop further as Trump has hiked duties on Chinese goods to a staggering 145%.While reciprocal tariffs with most of the United States' trade partners were suspended for 90 days, duties on Chinese goods came into effect in early April, triggering a trade war with Beijing.

"Businesses are clearly scrambling as they try to find a way through this time of unprecedented change, but the worst is undoubtedly yet to come because the import tariff collections did not start to roll in earnest until after the White House Liberation Day announcement on April 2," said Christopher Rupkey, chief economist at FWDBONDS. "There are still no trade deals announced in Trump 2.0."

The trade gap jumped 14.0%, or $17.3 billion, to a record $140.5 billion, the Commerce Department's Bureau of Economic Analysis (BEA) said on Tuesday. Economists polled by Reuters had forecast the trade deficit rising to $137.0 billion.

Imports vaulted 4.4% to an all-time high $419.0 billion in March. Goods imports soared 5.4% to a record $346.8 billion. They were boosted by a $22.5 billion jump in consumer goods to an all-time high, mostly pharmaceutical preparations.

Capital goods imports increased $3.7 billion to a record high, reflecting a solid rise in computer accessories. Imports of automotive vehicles, parts and engines increased $2.6 billion, driven by passenger cars.

But imports of industrial supplies declined $10.7 billion amid decreases in finished metal shapes and nonmonetary gold, which had accounted for the surge in the prior two months. Crude oil imports fell $1.2 billion.

Exports climbed 0.2% to $278.5 billion, also a record high. Exports of goods increased 0.7% to $183.2 billion, the highest since July 2022, lifted by industrial supplies and materials, which advanced $2.2 billion amid rises in natural gas and nonmonetary gold.

Automotive vehicles, parts and engines exports increased $1.2 billion. But exports of capital goods decreased $1.5 billion, weighed down by a $1.8 billion decline in shipments of civilian aircraft. The goods trade deficit ballooned 11.2% to a record $163.5 billion in March.

The government reported last week that the trade deficit cut a record 4.83 percentage points from GDP last quarter, resulting in the economy contracting at a 0.3% annualized rate, the first decline since the first quarter of 2022.

Trump sees the tariffs as a tool to raise revenue to offset his promised tax cuts and to revive a long-declining U.S. industrial base. Economists expect the flood of imports to ebb by May, which could help GDP to rebound in the second quarter.

They, however, caution that the lift from subsiding imports could be offset by a drop in exports as other nations boycott American goods and travel. There has been a decrease in visitors to the U.S., especially from Canada, in protest over the punitive tariffs as well as an immigration crackdown and Trump's musings about annexing Canada and Greenland.

Indeed, exports of services fell $0.9 billion to $95.2 billion in March, pulled down by a $1.3 billion drop in travel.

The rush to beat tariffs saw imports from Mexico, the United Kingdom, Ireland, the Netherlands, Belgium, France, Germany, Italy, India and Vietnam hitting all-time highs. But imports from China were the lowest since March 2020, when the world was grappling with the first wave of the COVID-19 pandemic.

The seasonally adjusted goods trade deficit with China narrowed to $24.8 billion from $26.6 billion in February. The trade deficit with Canada also declined to $4.9 billion from $7.4 billion in February. The trade gap with Mexico was little changed, while the surplus with the United Kingdom narrowed.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up