Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Tankan Small Manufacturing Outlook Index (Q4)

Japan Tankan Small Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)

Japan Tankan Large Non-Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Outlook Index (Q4)

Japan Tankan Large Manufacturing Outlook Index (Q4)A:--

F: --

P: --

Japan Tankan Small Manufacturing Diffusion Index (Q4)

Japan Tankan Small Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large Manufacturing Diffusion Index (Q4)

Japan Tankan Large Manufacturing Diffusion Index (Q4)A:--

F: --

P: --

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)

Japan Tankan Large-Enterprise Capital Expenditure YoY (Q4)A:--

F: --

P: --

U.K. Rightmove House Price Index YoY (Dec)

U.K. Rightmove House Price Index YoY (Dec)A:--

F: --

P: --

China, Mainland Industrial Output YoY (YTD) (Nov)

China, Mainland Industrial Output YoY (YTD) (Nov)A:--

F: --

P: --

China, Mainland Urban Area Unemployment Rate (Nov)

China, Mainland Urban Area Unemployment Rate (Nov)A:--

F: --

P: --

Saudi Arabia CPI YoY (Nov)

Saudi Arabia CPI YoY (Nov)A:--

F: --

P: --

Euro Zone Industrial Output YoY (Oct)

Euro Zone Industrial Output YoY (Oct)A:--

F: --

P: --

Euro Zone Industrial Output MoM (Oct)

Euro Zone Industrial Output MoM (Oct)A:--

F: --

P: --

Canada Existing Home Sales MoM (Nov)

Canada Existing Home Sales MoM (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

Canada New Housing Starts (Nov)

Canada New Housing Starts (Nov)A:--

F: --

U.S. NY Fed Manufacturing Employment Index (Dec)

U.S. NY Fed Manufacturing Employment Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing Index (Dec)

U.S. NY Fed Manufacturing Index (Dec)A:--

F: --

P: --

Canada Core CPI YoY (Nov)

Canada Core CPI YoY (Nov)A:--

F: --

P: --

Canada Manufacturing Unfilled Orders MoM (Oct)

Canada Manufacturing Unfilled Orders MoM (Oct)A:--

F: --

P: --

U.S. NY Fed Manufacturing Prices Received Index (Dec)

U.S. NY Fed Manufacturing Prices Received Index (Dec)A:--

F: --

P: --

U.S. NY Fed Manufacturing New Orders Index (Dec)

U.S. NY Fed Manufacturing New Orders Index (Dec)A:--

F: --

P: --

Canada Manufacturing New Orders MoM (Oct)

Canada Manufacturing New Orders MoM (Oct)A:--

F: --

P: --

Canada Core CPI MoM (Nov)

Canada Core CPI MoM (Nov)A:--

F: --

P: --

Canada Trimmed CPI YoY (SA) (Nov)

Canada Trimmed CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Manufacturing Inventory MoM (Oct)

Canada Manufacturing Inventory MoM (Oct)A:--

F: --

P: --

Canada CPI YoY (Nov)

Canada CPI YoY (Nov)A:--

F: --

P: --

Canada CPI MoM (Nov)

Canada CPI MoM (Nov)A:--

F: --

P: --

Canada CPI YoY (SA) (Nov)

Canada CPI YoY (SA) (Nov)A:--

F: --

P: --

Canada Core CPI MoM (SA) (Nov)

Canada Core CPI MoM (SA) (Nov)A:--

F: --

P: --

Canada CPI MoM (SA) (Nov)

Canada CPI MoM (SA) (Nov)A:--

F: --

P: --

Federal Reserve Board Governor Milan delivered a speech

Federal Reserve Board Governor Milan delivered a speech U.S. NAHB Housing Market Index (Dec)

U.S. NAHB Housing Market Index (Dec)--

F: --

P: --

Australia Composite PMI Prelim (Dec)

Australia Composite PMI Prelim (Dec)--

F: --

P: --

Australia Services PMI Prelim (Dec)

Australia Services PMI Prelim (Dec)--

F: --

P: --

Australia Manufacturing PMI Prelim (Dec)

Australia Manufacturing PMI Prelim (Dec)--

F: --

P: --

Japan Manufacturing PMI Prelim (SA) (Dec)

Japan Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. 3-Month ILO Employment Change (Oct)

U.K. 3-Month ILO Employment Change (Oct)--

F: --

P: --

U.K. Unemployment Claimant Count (Nov)

U.K. Unemployment Claimant Count (Nov)--

F: --

P: --

U.K. Unemployment Rate (Nov)

U.K. Unemployment Rate (Nov)--

F: --

P: --

U.K. 3-Month ILO Unemployment Rate (Oct)

U.K. 3-Month ILO Unemployment Rate (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Including Bonuses) YoY (Oct)--

F: --

P: --

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)

U.K. Average Weekly Earnings (3-Month Average, Excluding Bonuses) YoY (Oct)--

F: --

P: --

France Services PMI Prelim (Dec)

France Services PMI Prelim (Dec)--

F: --

P: --

France Composite PMI Prelim (SA) (Dec)

France Composite PMI Prelim (SA) (Dec)--

F: --

P: --

France Manufacturing PMI Prelim (Dec)

France Manufacturing PMI Prelim (Dec)--

F: --

P: --

Germany Services PMI Prelim (SA) (Dec)

Germany Services PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Manufacturing PMI Prelim (SA) (Dec)

Germany Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

Germany Composite PMI Prelim (SA) (Dec)

Germany Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Composite PMI Prelim (SA) (Dec)

Euro Zone Composite PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Services PMI Prelim (SA) (Dec)

Euro Zone Services PMI Prelim (SA) (Dec)--

F: --

P: --

Euro Zone Manufacturing PMI Prelim (SA) (Dec)

Euro Zone Manufacturing PMI Prelim (SA) (Dec)--

F: --

P: --

U.K. Services PMI Prelim (Dec)

U.K. Services PMI Prelim (Dec)--

F: --

P: --

U.K. Manufacturing PMI Prelim (Dec)

U.K. Manufacturing PMI Prelim (Dec)--

F: --

P: --

U.K. Composite PMI Prelim (Dec)

U.K. Composite PMI Prelim (Dec)--

F: --

P: --

Euro Zone ZEW Economic Sentiment Index (Dec)

Euro Zone ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Germany ZEW Current Conditions Index (Dec)

Germany ZEW Current Conditions Index (Dec)--

F: --

P: --

Germany ZEW Economic Sentiment Index (Dec)

Germany ZEW Economic Sentiment Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (Not SA) (Oct)

Euro Zone Trade Balance (Not SA) (Oct)--

F: --

P: --

Euro Zone ZEW Current Conditions Index (Dec)

Euro Zone ZEW Current Conditions Index (Dec)--

F: --

P: --

Euro Zone Trade Balance (SA) (Oct)

Euro Zone Trade Balance (SA) (Oct)--

F: --

P: --

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)

U.S. Retail Sales MoM (Excl. Automobile) (SA) (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Stocks headed for a fourth straight day of declines as investors questioned sky-high valuations amid a deluge of earnings reports from retailers, with a closely watched Federal Reserve symposium to come later this week.

Stocks headed for a fourth straight day of declines as investors questioned sky-high valuations amid a deluge of earnings reports from retailers, with a closely watched Federal Reserve symposium to come later this week.

The S&P 500 Index was down 0.1% after the open, led by the information technology and consumer discretionary sectors. Target Corp. was the worst-performing stock in the index after the company picked an insider to lead a turnaround. The tech-heavy Nasdaq 100 Index fell 0.3%, extending losses after a sharp mega-cap led selloff a day earlier. The blue-chip Dow Jones Industrial Average rose 0.1%, trading near a record high.

“Stocks are expensive relative to what I call fundamentals or you might call reality,” Howard Marks, co-chairman of Oaktree Capital Management, said in an interview on Bloomberg TV on Wednesday.

“There hasn’t been a serious market correction in 16 years so people get out of the habit of thinking about market corrections,” he said.

Wednesday’s move comes amid a flurry of retail earnings report, which painted a mixed picture for the consumer sector. Target missed expectations while TJ Maxx parent TJX Cos. raised its full-year earnings guidance. Better-than-expected margins helped Lowe’s Cos. beat estimates for the second quarter. Elsewhere in the consumer sector, Guess? Inc. shares soared after it agreed to be taken private for $1.4 billion.

“Consumer spending is under downward pressure from slowing job growth, student loan payments restarting and deportations lowering the number of consumers,” Torsten Slok, Apollo Management’s chief economist, said in a note to clients Wednesday.

US President Donald Trump called on Fed Governor Lisa Cook to resign in a social media post on Wednesday. The demand comes a day before a Fed symposium in Jackson Hole, Wyoming, is set to begin. The annual retreat is being closely watched for clues to the central bank’s interest-rate path, highlighted by a speech from Chair Jerome Powell on Friday.

“Investors have high hopes that Jerome Powell will use Jackson Hole to set the stage for a September rate cut, given the recent weakness in the labor market,” said Carol Schleif, chief market strategist at BMO Private Wealth.

Investors will get more insight into the Fed’s policy trajectory with the release of the Federal Open Market Committee’s meeting minutes at 2 p.m. New York time.

Gold – Chart

Gold – Chart

Dollar Index Daily Chart, August 19, 2025

Dollar Index Daily Chart, August 19, 2025

The dollar fell on Wednesday after U.S. President Donald Trump called on Federal Reserve Governor Lisa Cook to resign, as investors also waited on a speech by Fed Chair Jerome Powell on Friday for clues on interest rate policy.

Trump cited a call by the head of the U.S. Federal Housing Finance Agency urging the Department of Justice to probe Cook over alleged mortgage fraud. Spokespeople for Cook and the Fed did not immediately respond to requests for comment.

“The market has voted with its pocketbook that it doesn't like when the president interferes with the Federal Reserve,” said Marc Chandler, chief market strategist at Bannockburn Global Forex in New York.

Trump has been critical of Powell for being to slow to cut rates, and traders expect he will replace the Fed Chair with a more dovish appointment when his term ends in May.

But Powell may stay on the board of governors, which would limit how many appointments Trump may make and could crimp plans to form a more dovish composition of policymakers.

“This is just a thinly veiled attempt to get control of the Federal Reserve, because if Powell doesn't step down as Governor when his chair ends, Trump's only appointment is the Kugler seat that he gave to Miran temporarily,” Chandler said.

Trump earlier this month said he would nominate Council of Economic Advisers Chairman Stephen Miran to serve out the final few months of a vacant Fed seat after Fed Governor Adriana Kugler unexpectedly resigned.

The dollar index, which measures the greenback against a basket of currencies including the yen and the euro, was last down 0.16% on the day at 98.16, with the euroup 0.15% at $1.1664.

The Japanese yenstrengthened 0.21% against the greenback to 147.37 per dollar.

Traders are focused this week on whether Powell will push back against market expectations for a rate cut at the Fed’s September 16-17 meeting when he speaks at the U.S. central bank’s Jackson Hole meeting on Friday, following a weak jobs report for July.

Powell has said he is reluctant to cut rates on expectations that Trump’s tariff policies will increase inflation this summer.

Consumer price inflation data for July showed limited impact from tariffs but hotter than expected producer price inflation has tempered expectations for how many cuts are likely this year.

Fed funds futures traders are currently pricing in 85% odds of a cut next month, and 54 basis points of cuts by year-end.

Later on Wednesday, the Fed will issue the minutes of its July 29–30 meeting, when it held rates steady, although they may offer limited insight as the meeting came before the weak jobs numbers.

The New Zealand dollardropped 1.04% to $0.5831, a four month low, after the country’s central bank cut its policy rate by 25 basis points to a three-year low of 3.00% and flagged further reductions in coming months as policymakers warned of domestic and global headwinds to growth.

The Swedish crownstrengthened 0.1% to 9.59 after Sweden's central bank held its key interest rate at 2.00% as expected.

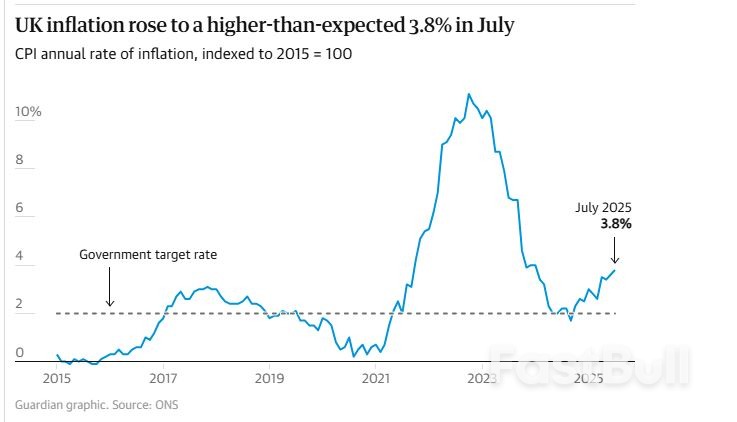

Sterling weakened 0.07% to $1.3481 after British inflation hit its highest in 18 months in July, but was not seen as swaying Bank of England policy.

"The BoE is more concerned about food inflation, which hasn't changed much in today's release," ING's head of research Chris Turner said.

In cryptocurrencies, bitcoinfell 0.22% to $113,324.

Key points:

Chinese refineries have purchased 15 cargoes of Russian oil for October and November delivery as Indian demand for Moscow's exports falls away, two analysts and one trader said on Tuesday.India has emerged as the leading buyer of Russian seaborne oil, which has sold at a discount since some Western nations shunned purchases and imposed restrictions on Russian exports over Moscow's 2022invasion of Ukraine.Indian state refiners paused Russian oil purchases last month, however, as those discounts narrowed. And U.S. PresidentDonald Trumpis also threatening to punish countries for buying Russian crude.

China had secured 15 Russian Urals cargoes for October–November delivery by the end of last week, said Richard Jones, a Singapore-based crude analyst at Energy Aspects.

Kpler senior analyst Xu Muyu wrote in an August 14 report that China has likely purchased about 13 cargoes of Urals and Varandey crude for October delivery, along with at least two Urals cargoes for November.The additional Russian Urals supply could curb Chinese refiners' appetite for Middle Eastern crude, which is $2 to $3 per barrel more expensive, Xu said.This, in turn, could add further pressure to the Dubai market which is already losing momentum as seasonal demand fades while competition from arbitrage supply intensifies, she added.

A trade source agreed with Kpler's estimate, adding that the cargoes were booked mostly at the beginning of this month by Chinese state-owned and independent refineries.China, the world's top oil importer and largest Russian oil buyer, primarily buys ESPO crude exported from the Russian Far East port of Kozmino due to its proximity. Its year-to-date imports of Urals crude stood at 50,000 barrels per day, Kpler data showed.

Urals and Varandey crude are typically shipped to India, Kpler data showed.

Indian state-refiners have backed out Russian crude imports by approximately 600,000 to 700,000 bpd, according to Energy Aspects' Jones."We do not expect China to absorb all of the additional Russian volumes, as Urals is not a baseload grade for Chinese majors," he said, referring to Chinese state refineries which are not designed to solely process the Russian grade.Chinese refiners will also be wary about the possibility of U.S. secondary sanctions if Trump's push for a Ukraine peace deal breaks down, he added.

Trump said on Friday he did not immediately need to consider retaliatory tariffs on countries such as China for buying Russian oil but might have to "in two or three weeks".

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up