Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Wall Street hovered near record highs Monday as tech stocks, led by a 32.6% surge in AMD after an OpenAI chip deal, drove gains.

as of 4 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 4 Oct 2025. Past performance is not a reliable indicator of future performance. as of 3 Oct 2025. Past performance is not a reliable indicator of future performance.

as of 3 Oct 2025. Past performance is not a reliable indicator of future performance. as of 3 Oct 2025. Past performance is not a reliable indicator of future performance.

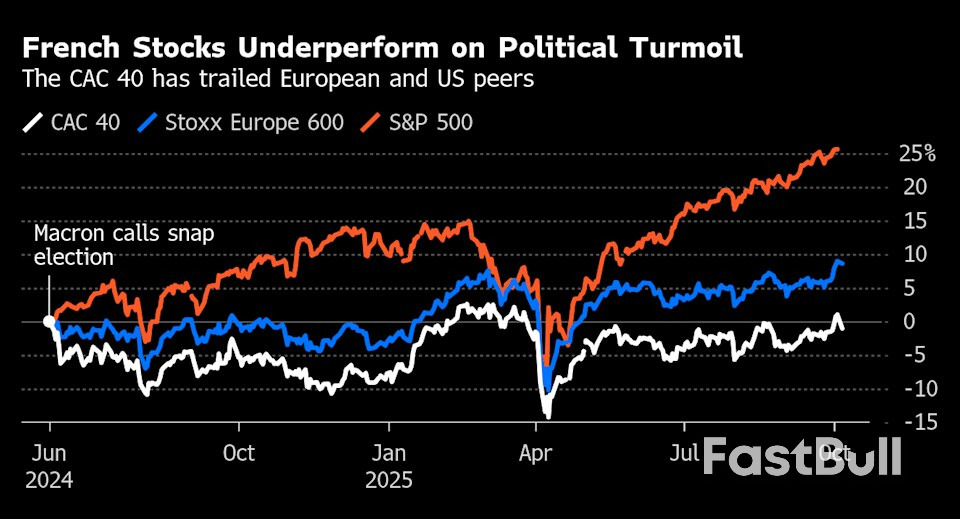

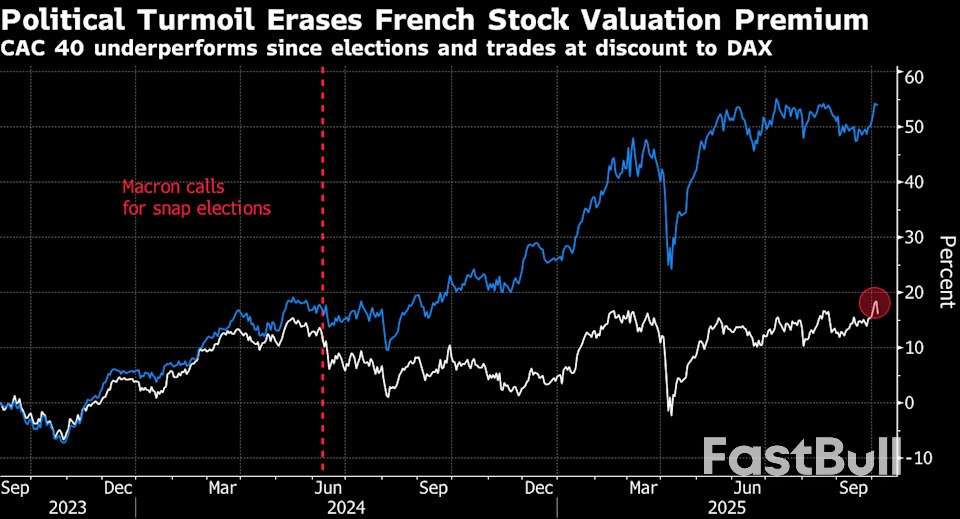

as of 3 Oct 2025. Past performance is not a reliable indicator of future performance.J.P. Morgan upgraded its stance on the euro zone to "overweight" from "neutral" on Monday, noting that the equities in the region have become more attractive after several months of underperformance and policy support.

"The time is coming up to turn bullish on Eurozone equities," J.P. Morgan strategists, led by Mislav Matejka said.Euro Stoxx 50 (.STOXX50), has trailed the S&P 500 (.SPX), by nearly 18% since a strong first-quarter rally, but this relative underperformance could be used as a buying opportunity, Matejka said.The strategists noted that with relatively cheaper valuations than their U.S. counterparts, and potential catalysts such as German stimulus, and improving euro zone credit impulse, could renew sentiment in the region.

The 15% tariff on European Union goods has also put to rest one of the major overhangs on the region's equities, J.P. Morgan said.

The brokerage retained its positive stance on European defense stocks, as it expects capital expenditure to be constructive and boost parts of industrials, construction materials and utilities.

While the uncertainty in France could create an overhang, Matejka said, "We would use the weakness to buy, as we believe that any pressure will not be long-lasting."

The potential uptick in earnings and rise in share buybacks could also help underpin the euro zone's more optimistic outlook heading into next year.

The Wall Street brokerage reiterated its year-end target of 5,800 for the Euro Stoxx 50. The index is up 10.4% year-to-date, according LSEG data.

Last year Kemi Badenoch entered the Conservative Party conference competing with three of her Tory rivals for the leadership. As winner of that contest, this time around she confronts a more formidable foe: irrelevance.Since losing two-thirds of its seats in last year’s general election, dire poll ratings and defections have humbled the once-dominant party of UK government. If a vote were held today, a recent opinion survey showed, they’d collapse to fourth, trailing Nigel Farage’s Reform UK Party, the governing Labour Party, and the Liberal Democrats.

Rebuilding after 2024’s ballot-box rejection was always going to test Rishi Sunak’s successor. But doubts over Badenoch’s ability to lead the fightback mean she still has to guard against the mutinous instincts that led her party to cycle through five leaders in a decade.Should pollsters’ predictions hold at May’s local elections — her next test at the ballot box — many in the shadow cabinet speculate she will be replaced soon after, according to those who spoke to Bloomberg, asking for anonymity to share their views freely.

If rivals lack a greater zeal to depose her ahead of that, it’s because of skepticism that it would make any difference. Speaking before this year’s conference in Manchester, which got under way on Sunday, several of Badenoch’s colleagues voiced the concern that voters may be unlikely to return to them after just one term out of office.The next election isn’t due until 2029 and competing ever more successfully for former Conservative voters’ attention is Reform, which has succeeded in monopolizing the right-wing of British politics far more adeptly than its five parliamentary seats would suggest. That number had been four before a defection from the Conservatives.

In recent weeks, Labour Party Prime Minister Keir Starmer has sought to cast the next election as a head-to-head between his party and Reform. If voters buy into his framing, the Tories will find it harder to turn around their dire opinion-poll ratings.In interviews on the opening day of the conference, Badenoch — the first woman from an ethnic minority — to lead the party of Winston Churchill and Margaret Thatcher — urged patience on her colleagues. “The election is not tomorrow,” she told the BBC’s Laura Kuenssberg. “Nothing good comes quickly or fast. And it will pay off,” she said, insisting she had a plan.

Her party came out with hard lines on migration, which has eclipsed the economy in recent polls of voter concerns. She pledged to annually deport 150,000 people “who shouldn’t be here,” while declining to elaborate where they will go.Tomorrow in his speech, Shadow Chancellor of the Exchequer Mel Stride will identify what he says are £47 billion ($63 billion) of potential budget cuts, with almost half of that made up from slashing the welfare bill. Another £7 billion would be hacked off the foreign aid budget — almost half of current spending in an area that’s already suffered cuts to 0.5% of economic output from 0.7%.

The party’s challenge will be convincing voters it can tackle problems that went unaddressed over a 14-year stretch in government.

Labour Home Secretary Shabana Mahmood said the Tories had “suddenly discovered a zeal for reform that they did not have when they were in office,” pointing to their failure to enforce secure borders: migrant crossings in small boats from France were virtually non existent in 2017, but had soared to more than 45,000 a year by 2022. Meanwhile, an effort to deport arrivals to Rwanda never got off the ground. It’s an issue Labour, too, are struggling to deal with.Several of Badenoch’s colleagues — both in her cabinet and the back benches — said they fear more high-profile defections to Reform, which has already claimed Tory former cabinet ministers in Nadine Dorries and Jake Berry. In her interview Kemi denigrated the insurgent right-wing party as a “one-man band.”

If Badenoch were challenged for the leadership of her party, erstwhile rival Robert Jenrick is a frontrunner but four of his colleagues voiced skepticism that he will do better against Farage. He’ll be Farage-lite, one said: and voters who want that kind of politics will just vote for the Reform leader himself.The other candidate on the up is Katie Lam, the 33-year old Goldman Sachs alumnus who is also on the right on immigration but — having won election in 2024 — has the advantage of not being associated with the old guard.

Some party centrists believe there to be an opportunity for a leader who can tack against the Tories’ current rightward shift and pivot back toward the center-ground to take advantage of Labour’s own collapse. There are also Liberal Democrat voters to be won back there: Ed Davey’s party took 60 seats off the Conservatives last year, and recent polls suggest they can win more next time around.

“Polls are not elections,” Badenoch said in her interview. Hers is not the only UK party nervously repeating this mantra.

Consumer concerns about inflation have fallen to their lowest level in nearly three years, according to Morgan Stanley’s latest U.S. Consumer Pulse Survey, even as analysts warn that tariffs could still lead to future price pressures.

In the bank’s 69th monthly survey of around 2,000 consumers conducted between Sept. 25 and 29, 56% of respondents cited inflation as their top concern, down from 60% in August and 63% a year earlier.

“While inflation remains the number one concern for consumers over the next 12 months, the proportion of consumers reporting it as their primary concern has dropped to the lowest level since 2022,” Morgan Stanley said.

The firm cautioned that the improvement might be premature. “Tariff price pass-through is likely not yet complete,” analysts wrote, noting that more than two-thirds of affected firms have yet to raise prices or expect further increases.

The bank’s analysis of corporate transcripts also found that companies are “increasingly discussing flexing pricing power to mitigate the impact of tariffs.”

Consumer sentiment toward the economy and household finances has also improved.

Morgan Stanley said thirty-six percent of respondents expect the economy to improve over the next six months, up from 33% last month, while those expecting conditions to worsen fell to 46% from 49%.

Morgan Stanley said this marks a “notable improvement from -16% last month,” though confidence remains below January highs.

The survey also highlighted the growing role of inheritance in household finances, with 17% of consumers having received one and 14% expecting to.

Morgan Stanley said inheritances are “primarily used for savings, retirement, or investments,” underscoring their link to long-term financial security.

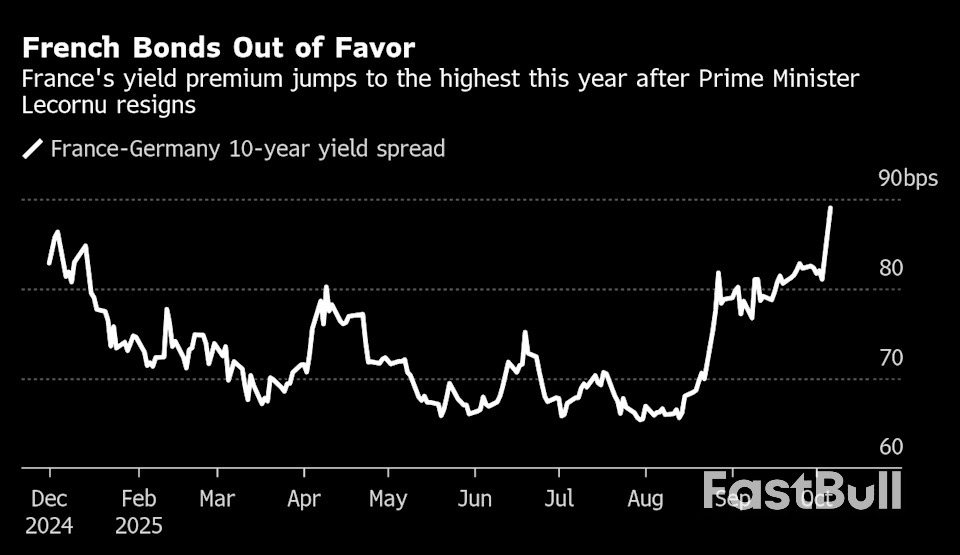

Domestic politics dominated global markets today, driving sharp moves in both European and Asian trading sessions. In Europe, political instability in France rattled sentiment, while in Japan, optimism over new leadership sparked a broad equity surge and a dramatic selloff in the Yen.

In European, CAC 40 slumped and Euro is sold off broadly, after French Prime Minister Sebastien Lecornu and his newly formed government resigned just hours after unveiling their cabinet lineup. The collapse, just 14 hours after formation, deepened France’s ongoing political turmoil and marked the shortest-lived administration in modern history.

Lecornu cited the impossibility of governing amid threats from both coalition partners and the opposition to topple his government. The fallout was immediate, with opposition parties calling on President Macron to resign or trigger early elections. The episode underscores growing public fatigue and political fragmentation that risk eroding investor confidence in French assets.

Yet, Yen’s dramatic selloff overshadowed Europe’s turmoil. The currency plunged below 150 per dollar for the first time since early August and touched a record low versus Euro, as Japanese equities soared. Traders rushed into risk assets, betting that Prime Minister-designate Sanae Takaichi’s incoming administration will prioritize fiscal expansion and encourage continued BoJ accommodation.

The move rippled across bond markets, sending short-term JGB yields to two-week lows as traders cut back expectations for further tightening. Market pricing for a BoJ hike by year-end fell sharply to near 40% from 68% at the end of last week, as confidence grew that the central bank will stay on hold through October.

Governor Kazuo Ueda’s cautious tone in recent weeks aligns with this view, suggesting that policymakers see little urgency to resume tightening. With political stability and fiscal stimulus prospects improving, investors appear comfortable re-engaging in carry trades, accelerating Yen’s decline.

For now, Dollar leads as the day’s strongest performer, followed by Loonie and Aussie. At the other end, Yen remains the weakest, trailed by Euro and Swiss Franc, while Sterling and Kiwi hover mid-pack in largely risk-driven trade.

In Europe, at the time of writing, FTSE is up 0.15%. DAX is up 0.25%. CAC is down -1.27%. UK 10-year yield is up 0.044 at 4.739. Germany 10-year yield is up 0.021 at 2.723. Earlier in Asia, Nikkei rose 4.75%. Hong Kong HSI fell -0.67%. China Shanghai SSE rose 0.52%. Singapore Strait Times rose 0.22%. Japan 10-year JGB yield rose 0.015 to 1.680.

ECB Chief Economist Philip Lane reiterated in a speech today that monetary policy will remain data-driven and meeting-by-meeting, with “no pre-commitment to a particular rate path.” He emphasized said the ECB’s policy decisions will hinge not only on the baseline inflation forecast but also on “shifts in the risk distribution”.

The downside inflation risks outlined in September include a stronger Euro, weaker export demand caused by higher global tariffs, and the possibility of rising market volatility linked to trade tensions.

Conversely, Lane highlighted several upside risks that could keep inflation elevated. These include “fragmentation of global supply chains”; surge in defence and infrastructure spending that boosts medium-term demand; and climate-related disruptions.

He elaborated that persistent Euro movements tends to have “multi-year impact” on both inflation and growth, with the size of the impact depending on its source. Appreciation stemming from external weakness or capital flows tends to depress inflation more sharply. On the other hand, changes driven by domestic demand strength or domestic risk premiums carry a smaller inflationary force.

Investor sentiment in the Eurozone improved in October, with Sentix Investor Confidence Index rising from -9.2 to -5.4, topping forecasts of -7.7. Current Situation Index advanced from -18.8 to -16.0, while Expectations climbed sharply from 0.8 to 5.8.

Sentix said the latest data initially looks like the long-awaited economic turning point, with strong improvements seen across Germany, Austria, and Switzerland as well. However, it cautioned that the improvement may not mark a lasting turnaround. Most country-level readings and the Eurozone composite still sit below August’s levels, implying that September’s pessimism was “negatively exaggerated”.

Meanwhile, Sentix also noted that inflation remains a key worry, with its related index barely rising to -17.75. Still, markets appear to expect that the ECB will maintain a steady policy stance, and perhaps even lean slightly supportive, despite mounting fiscal pressures. Sentix warned that such expectations may have a “limited half-life,” as growing debt levels and persistent inflation could restrain the scope for policy easing in the months ahead.

Eurozone retail sales rose 0.1% mom in August, matching expectations and signaling only a modest pickup in consumer activity. The increase was driven by 0.3% rise in food, drinks, and tobacco sales and 0.4% gain in automotive fuel, partly offset by a -0.1% decline in non-food product demand.

Across the wider European Union, retail sales were flat on the month. Among member states, Lithuania (+1.7%), Cyprus and Malta (+1.5%), and Sweden (+1.1%) posted the strongest gains, while Romania (-4.0%), Poland (-0.8%), and Luxembourg and Portugal (both -0.7%) recorded notable declines.

The BoJ’s Regional Economic Report released today painted a mixed picture of recovery, with assessments for eight regions left unchanged and one downgraded. Most local economies were described as “recovering moderately” or “picking up” .

Businesses in some areas reported that they may scale back wage hikes if tariffs begin to bite into profits, a risk that could slow Japan’s nascent wage-led inflation. Still, several regions pointed to ongoing wage pressures from tight labor markets and rising living costs, suggesting that the underlying trend in income growth remains intact for now.

The survey also revealed continued commitment to capital investment, particularly in automation and IT-related projects, as firms seek efficiency gains. However, a number of companies plan to delay or reassess spending amid uncertainty over global demand and the evolving impact of tariffs.

Oil prices recovered modestly in today after the OPEC+ alliance confirmed a small production increase of 137,000 barrels per day for November, matching the rise announced for October. The restrained decision eased fears of a larger supply boost.

Following Sunday’s ministerial meeting, OPEC+ said the move was made “in view of a steady global economic outlook and current healthy market fundamentals.” The statement emphasized low global inventories as evidence that supply-demand conditions remain tight enough to justify a gradual output approach.

The limited hike contrasts with speculation that major producers—particularly Saudi Arabia and Russia—might push for a faster restoration of supply to reclaim market share. Instead, the decision reflects caution amid volatile demand signals and lingering uncertainty over global growth.

Technically, for WTI oil, some consolidations would be seen above 60.62 temporary low for the near term. But risk will stay on the downside as long as 63.49 minor resistance holds.

Break of 60.62 will resume the whole decline from 78.87. Next target is 100% projection of 71.34 to 61.90 from 66.70 at 57.26. However, firm break of 63.49 will bring stronger rebound back to 66.70 resistance instead.

Daily Pivots: (S1) 0.8704; (P) 0.8717; (R1) 0.8727;

EUR/GBP’s fall from 0.8750 resumed by breaking through 0.8688 and intraday bias is back on the downside for 0.8631 support. Decisive break there will indicate near term reversal and turn outlook bearish. On the upside, though, above 0.8728 will bring retest of 0.8750 first. Firm break there will resume the larger rally towards 0.8867 fibonacci level.

In the bigger picture, rise from 0.8221 medium term bottom is seen as a corrective move. While further rally cannot be ruled out, upside should be limited by 61.8% retracement of 0.9267 to 0.8221 at 0.8867. Considering bearish divergence condition in D MACD, firm break of 0.8631 support will be the first sign that this corrective bounce has completed. Sustained trading below 55 W EMA (now at 0.8539) will confirm, and bring retest of 0.8221 low.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up