Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)A:--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)A:--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)A:--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)A:--

F: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)A:--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)A:--

F: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig CountA:--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig CountA:--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)A:--

F: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)A:--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)A:--

F: --

P: --

Japan Nominal GDP Revised QoQ (Q3)

Japan Nominal GDP Revised QoQ (Q3)A:--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)A:--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)A:--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)A:--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)A:--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)A:--

F: --

P: --

Germany Industrial Output MoM (SA) (Oct)

Germany Industrial Output MoM (SA) (Oct)A:--

F: --

Euro Zone Sentix Investor Confidence Index (Dec)

Euro Zone Sentix Investor Confidence Index (Dec)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence Index--

F: --

P: --

U.K. BRC Like-For-Like Retail Sales YoY (Nov)

U.K. BRC Like-For-Like Retail Sales YoY (Nov)--

F: --

P: --

U.K. BRC Overall Retail Sales YoY (Nov)

U.K. BRC Overall Retail Sales YoY (Nov)--

F: --

P: --

Australia Overnight (Borrowing) Key Rate

Australia Overnight (Borrowing) Key Rate--

F: --

P: --

RBA Rate Statement

RBA Rate Statement RBA Press Conference

RBA Press Conference Germany Exports MoM (SA) (Oct)

Germany Exports MoM (SA) (Oct)--

F: --

P: --

U.S. NFIB Small Business Optimism Index (SA) (Nov)

U.S. NFIB Small Business Optimism Index (SA) (Nov)--

F: --

P: --

Mexico 12-Month Inflation (CPI) (Nov)

Mexico 12-Month Inflation (CPI) (Nov)--

F: --

P: --

Mexico Core CPI YoY (Nov)

Mexico Core CPI YoY (Nov)--

F: --

P: --

Mexico PPI YoY (Nov)

Mexico PPI YoY (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. JOLTS Job Openings (SA) (Oct)

U.S. JOLTS Job Openings (SA) (Oct)--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Year (Dec)--

F: --

P: --

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)

U.S. EIA Natural Gas Production Forecast For The Next Year (Dec)--

F: --

P: --

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)

U.S. EIA Short-Term Crude Production Forecast For The Next Year (Dec)--

F: --

P: --

EIA Monthly Short-Term Energy Outlook

EIA Monthly Short-Term Energy Outlook U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

South Korea Unemployment Rate (SA) (Nov)

South Korea Unemployment Rate (SA) (Nov)--

F: --

P: --

Japan Reuters Tankan Non-Manufacturers Index (Dec)

Japan Reuters Tankan Non-Manufacturers Index (Dec)--

F: --

P: --

Japan Reuters Tankan Manufacturers Index (Dec)

Japan Reuters Tankan Manufacturers Index (Dec)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index MoM (Nov)

Japan Domestic Enterprise Commodity Price Index MoM (Nov)--

F: --

P: --

Japan Domestic Enterprise Commodity Price Index YoY (Nov)

Japan Domestic Enterprise Commodity Price Index YoY (Nov)--

F: --

P: --

China, Mainland PPI YoY (Nov)

China, Mainland PPI YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Facing time constraints and mounting global pressure, the U.S. under President Trump is preparing to impose new tariffs on countries that fail to finalize bilateral trade agreements within the next 2–3 weeks...

Amid the doom and gloom of falling crude prices and weakening demand growth, oil bulls could find one nugget of cheer in the latest report from the International Energy Agency: a modest upward revision to historical consumption.

That may not seem terribly exciting, but it wiped out three years’ worth of apparent global oil stockbuilds and drained an ocean of “missing barrels.”

The world used about 330,000 barrels a day more in 2023 than was previously reported, according to the IEA. Africa accounted for three-quarters of that revision, with higher consumption in Egypt and Nigeria.

Because of the way forecasts are generated, that historical increase gets rolled forward into subsequent years, raising the level of demand for this year and next even if it does nothing for year-on-year growth.

Rather than predicting actual oil consumption for 195 countries, analysts tend to forecast incremental demand by region using assumptions about population and economic growth, and then applying those numbers to “known” historical consumption levels.

Raise the starting point and everything else rises, even as annual growth is unaltered.

At a stroke, the IEA’s revision wiped out all the stockbuilds it saw in 2022, 2023 and 2024.

Rather than adding 220 million barrels of oil to global inventories during those three years, the IEA now says we have drawn them down by nearly 75 million barrels. That swing is equivalent to almost three-quarters of the US strategic reserve.

Before we get too excited, though, the IEA still sees supply running ahead of demand in 2025 and 2026.

Even if OPEC+ pauses its output increases after the big hikes planned for this month and next, supply will still exceed demand by more than 1 million barrels a day in the third quarter, the agency says. And that’s before any possible return of Iranian barrels.

The spare oil will head for storage tanks that are a lot less full than previously believed.

While it’s not a recipe for rising prices, erasure of the missing barrels might help put a floor under them, at least for a little while.

Exports of US crude are tumbling as OPEC+ restores production into a market grappling with weakening demand because of the trade war and reduced refinery capacity. Average US oil exports dropped 10% to 3.76 million barrels a day in the four weeks through May 9, according to Energy Information Administration data. That’s the slowest pace since January and well below seasonal levels from the past two years.

US Treasury officials met with Hong Kong banks in April to warn them against facilitating Iranian oil shipments to China, just a month before sanctioning nine non-bank entities allegedly involved in such trades, people familiar with the matter said.

Canadian oil tycoon Adam Waterous’ Strathcona Resources Ltd. announced plans to make a takeover bid for MEG Energy Corp. that values the oil-sands company at about C$6 billion ($4 billion).

Vistra Corp. agreed to buy seven gas-fired power plants for $1.9 billion, the latest big US generator betting on the fossil fuel to feed the voracious appetite of artificial intelligence.

Taiwan is shutting its last nuclear reactor this weekend, putting pressure on the island’s energy-guzzling chipmakers in the face of soaring demand for their products.

Ice-cream cones will likely cost more this summer as the price of coconut oil, a key ingredient, keeps setting records, Bloomberg Opinion’s Javier Blas writes.

China’s liquefied natural gas demand may see limited benefit from the recent slash in US tariffs, according to BloombergNEF. The existing levies, domestic economic malaise and elevated LNG prices are set to curb Chinese buying interest. Imports may reach 68 million metric tons — 1.1 million tons more than forecast last month during the peak of the trade war. Yet that’s still 8.2 million tons, or 11%, lower year-on-year.

Join us in Doha for the Qatar Economic Forum on May 20-22. Since 2021, the forum powered by Bloomberg has convened more than 6,500 influential leaders to explore bold ideas and tackle the challenges shaping the global economy. Request an invitation today.

President Trump has departed Abu Dhabi aboard Air Force One, concluding a historic week in the Middle East that saw the signing of more than a trillion dollars in deals aimed at advancing his 'America First' agenda.

Ahead of his departure from the Middle East, President Trump addressed business leaders in Abu Dhabi, stating that his administration will unilaterally set tariff rates for U.S. trading partners within the next two to three weeks.

"We just reached a fantastic trade deal with the United Kingdom. And we have another big one that we reached with China," the president said.

He continued, "At the same time, we have 150 countries that want to make a deal—but you're not able to see that many countries." He added that Treasury Secretary Scott Bessent and Commerce Secretary Howard Lutnick "will be sending letters out essentially telling people what "they'll be paying to do business in the United States."

"I think we're going to be very fair. But it's not possible to meet the number of people that want to see us," Trump said.

The president did not specify which countries want to make deals, nor the ones that will receive letters.

Talks remain ongoing with top trading partners, including Japan, South Korea, India, the EU, and China, with recent progress...

However, the administration appears to have abandoned comprehensive negotiations in favor of setting terms directly for many countries due to what Bloomberg says "the lack of manpower and capacity makes it impossible to hold concurrent negotiations with all the countries caught up in the president's so-called reciprocal tariffs plan."

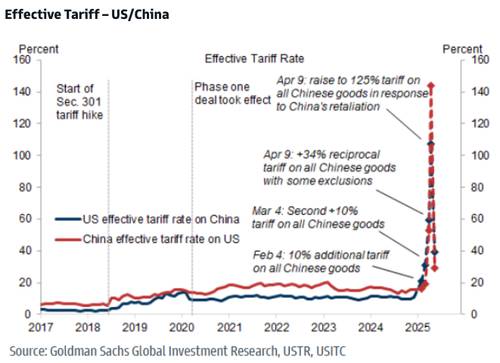

Earlier this week, the U.S. and China announced a breakthrough trade agreement that temporarily lowered tariffs on each other's products for 90 days. The U.S. dropped its 145% on Chinese goods to 30%, while China lowered levies from 125% to 10%.

Goldman illustrates the rollercoaster ride of the tit-for-tat trade war between the U.S. and China in recent months, as well as the temporary cooling period aimed at de-escalating tensions.

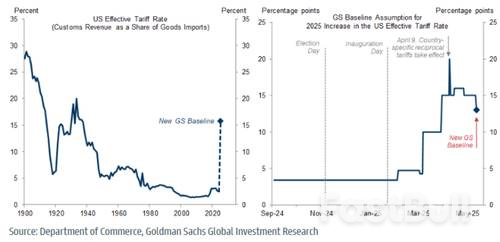

On Wednesday morning, Goldman analyst Jerry Shen told clients, "We Now Expect the Effective Tariff Rate to increase by 13pp."

Last week, Trump stated, "We have four or five other deals coming immediately. We have many deals coming down the line. Ultimately, we're just signing the rest of them in."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up