Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by ProductionA:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Oil Imports Changes

U.S. EIA Weekly Crude Oil Imports ChangesA:--

F: --

P: --

U.S. EIA Weekly Heating Oil Stock Changes

U.S. EIA Weekly Heating Oil Stock ChangesA:--

F: --

P: --

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.S. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)A:--

F: --

P: --

China, Mainland M1 Money Supply YoY (Nov)

China, Mainland M1 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M0 Money Supply YoY (Nov)

China, Mainland M0 Money Supply YoY (Nov)--

F: --

P: --

China, Mainland M2 Money Supply YoY (Nov)

China, Mainland M2 Money Supply YoY (Nov)--

F: --

P: --

Russia CPI YoY (Nov)

Russia CPI YoY (Nov)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-Longer Run (Q4)

U.S. Federal Funds Rate Projections-Longer Run (Q4)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-1st Year (Q4)

U.S. Federal Funds Rate Projections-1st Year (Q4)A:--

F: --

P: --

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)

U.S. Target Federal Funds Rate Lower Limit (Overnight Reverse Repo Rate)A:--

F: --

P: --

U.S. Federal Funds Rate Projections-2nd Year (Q4)

U.S. Federal Funds Rate Projections-2nd Year (Q4)A:--

F: --

P: --

U.S. Budget Balance (Nov)

U.S. Budget Balance (Nov)A:--

F: --

P: --

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)

U.S. Target Federal Funds Rate Upper Limit (Excess Reserves Ratio)A:--

F: --

P: --

U.S. Interest Rate On Reserve Balances

U.S. Interest Rate On Reserve BalancesA:--

F: --

P: --

U.S. Federal Funds Rate Projections-Current (Q4)

U.S. Federal Funds Rate Projections-Current (Q4)A:--

F: --

P: --

U.S. Federal Funds Rate Target

U.S. Federal Funds Rate TargetA:--

F: --

P: --

U.S. Federal Funds Rate Projections-3rd Year (Q4)

U.S. Federal Funds Rate Projections-3rd Year (Q4)A:--

F: --

P: --

FOMC Statement

FOMC Statement FOMC Press Conference

FOMC Press Conference Brazil Selic Interest Rate

Brazil Selic Interest RateA:--

F: --

P: --

U.K. 3-Month RICS House Price Balance (Nov)

U.K. 3-Month RICS House Price Balance (Nov)A:--

F: --

P: --

Australia Employment (Nov)

Australia Employment (Nov)A:--

F: --

P: --

Australia Full-time Employment (SA) (Nov)

Australia Full-time Employment (SA) (Nov)A:--

F: --

P: --

Australia Unemployment Rate (SA) (Nov)

Australia Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Australia Labor Force Participation Rate (SA) (Nov)

Australia Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Turkey Retail Sales YoY (Oct)

Turkey Retail Sales YoY (Oct)A:--

F: --

P: --

South Africa Mining Output YoY (Oct)

South Africa Mining Output YoY (Oct)--

F: --

P: --

South Africa Gold Production YoY (Oct)

South Africa Gold Production YoY (Oct)--

F: --

P: --

Italy Quarterly Unemployment Rate (SA) (Q3)

Italy Quarterly Unemployment Rate (SA) (Q3)--

F: --

P: --

IEA Oil Market Report

IEA Oil Market Report Turkey 1-Week Repo Rate

Turkey 1-Week Repo Rate--

F: --

P: --

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

South Africa Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Turkey Overnight Lending Rate (O/N) (Dec)

Turkey Overnight Lending Rate (O/N) (Dec)--

F: --

P: --

Turkey Late Liquidity Window Rate (LON) (Dec)

Turkey Late Liquidity Window Rate (LON) (Dec)--

F: --

P: --

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)

U.K. Refinitiv/Ipsos Primary Consumer Sentiment Index (PCSI) (Dec)--

F: --

P: --

Brazil Retail Sales MoM (Oct)

Brazil Retail Sales MoM (Oct)--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)--

F: --

P: --

U.S. Exports (Sept)

U.S. Exports (Sept)--

F: --

P: --

U.S. Trade Balance (Sept)

U.S. Trade Balance (Sept)--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)--

F: --

P: --

Canada Imports (SA) (Sept)

Canada Imports (SA) (Sept)--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)--

F: --

P: --

Canada Trade Balance (SA) (Sept)

Canada Trade Balance (SA) (Sept)--

F: --

P: --

Canada Exports (SA) (Sept)

Canada Exports (SA) (Sept)--

F: --

P: --

U.S. Wholesale Sales MoM (SA) (Sept)

U.S. Wholesale Sales MoM (SA) (Sept)--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks Change--

F: --

P: --

U.S. 30-Year Bond Auction Avg. Yield

U.S. 30-Year Bond Auction Avg. Yield--

F: --

P: --

Argentina CPI MoM (Nov)

Argentina CPI MoM (Nov)--

F: --

P: --

Argentina National CPI YoY (Nov)

Argentina National CPI YoY (Nov)--

F: --

P: --

Argentina 12-Month CPI (Nov)

Argentina 12-Month CPI (Nov)--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

Japan Industrial Output Final MoM (Oct)

Japan Industrial Output Final MoM (Oct)--

F: --

P: --

Japan Industrial Output Final YoY (Oct)

Japan Industrial Output Final YoY (Oct)--

F: --

P: --

Germany HICP Final YoY (Nov)

Germany HICP Final YoY (Nov)--

F: --

P: --

Germany HICP Final MoM (Nov)

Germany HICP Final MoM (Nov)--

F: --

P: --

Germany CPI Final MoM (Nov)

Germany CPI Final MoM (Nov)--

F: --

P: --

Germany CPI Final YoY (Nov)

Germany CPI Final YoY (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

U.S. private payrolls increased by 4,750 on average per week in the four weeks ending on November 22, according to a weekly update of the monthly ADP National Employment Report.

U.S. private payrolls increased by 4,750 on average per week in the four weeks ending on November 22, according to a weekly update of the monthly ADP National Employment Report.

The data comes after hiring in the American private sector notched its biggest drop in more than two and a half years in November.

However, analysts cautioned against reading too much into the figures, arguing that the monthly estimate has recently diverged from a separate gauge of the U.S. employment market from the Labor Department's Bureau of Labor Statistics.

The BLS is due to release its closely-monitored nonfarm payrolls report for November on December 16, after it was delayed by a record-long U.S. government shutdown. The October unemployment rate will also never be known, after having hovered around a four-year high of 4.4% in September.

But the economy is still tipped to have shed jobs in October, as thousands of federal workers accepted buyout packages which would take them off government payrolls.

Federal Reserve policymakers and investors alike have been forced to rely on alternative data sources because of the blackout of official data, intensifying the spotlight recently on some of these numbers.

On Tuesday, the Fed is due to begin its latest two-day policy gathering. Markets are widely betting that the central bank, assessing a slowing labor market, resilient consumer spending and sticky inflation, will slash interest rates by 25 basis points at the end of the meeting.

Spot Silver is holding steady on Tuesday, ahead of the December 10 Fed decision, with the market essentially coiling for the next catalyst. Traders have priced in a near-certain 25-bp cut, and that expectation has kept a steady bid under precious metals. When the cost of holding non-yielding assets falls, silver tends to attract interest — and that pattern is showing up again.

At 13:19 GMT, XAGUSD is trading $58.77, up $0.61 or +1.04%.

One of the strongest supports for the market has been persistent ETF demand. Nearly 590 tonnes flowed into silver ETFs over the past week, while November added 15.7 million ounces — the heaviest monthly intake since July.

That kind of buying isn't passive allocation; it's institutional money leaning into the trade. Sustained inflows across nine of the past eleven months tighten available supply and make short exposure harder to carry.

Traders aren't chasing every uptick, but they're willing to buy weakness, and the flow backdrop explains why.

Supply deficits now stretch into a fifth straight year. Exchange inventories sit at unusually low levels, and Shanghai warehouse stocks are at decade lows. China's decision to ship refined silver into London underscores how tight the physical market has become. Even if sentiment softens, the structural shortage acts like a cushion under prices and limits the depth of pullbacks.

The dollar index slipping under 100.000 recently has removed some pressure from metals, with dovish expectations for the Fed encouraging dollar sellers. It isn't the main driver this week, but it supports the broader bid for silver by making the metal more accessible to overseas buyers.

Strong demand from solar manufacturing, electric vehicles, and broader green technologies continues to provide a sturdy foundation. Silver's dual role — investment asset and industrial input — gives traders confidence that the metal has meaningful demand behind it, even if investment flows pause.

Daily Silver (XAG/USD)

Daily Silver (XAG/USD)The $56.46–$59.34 range reflects current trading behavior. The expected rate cut is largely baked in, so attention is locked on Chair Powell's guidance for 2026. A firmer stance on limiting further easing could trigger profit-taking toward support near $56.46. But a more accommodative message may encourage buyers to press through $59.34 and test the path toward $62, a level widely monitored by analysts.

Bottom line: silver is leaning higher, but the follow-through depends on how far Powell opens — or closes — the door to additional cuts next year.

The US 500 may enter a correction, but the medium-term uptrend remains intact. The US 500 forecast for today is negative.

The published core PCE figure came in at 2.8% year-on-year, below the forecast of 2.9% and the previous reading of 2.9%. For the market, this is an important signal, as the core PCE remains the Federal Reserve's key inflation gauge. The decline shows that inflationary pressure continues to ease, reducing the need for the Fed to maintain a tight monetary stance and increasing the likelihood of a more dovish rate path in the coming months.

For the US 500, such data is a moderately positive factor. The market reaction is likely to tilt upwards, as expectations of further easing in inflation reduce uncertainty around the Fed's decisions. However, the rise is unlikely to be sharp: the figure declined by only 0.1 percentage point, and inflation is already close to the range the Fed considers sustainable.

The US 500 index has formed a resistance level at 6,895.0 and a support level at 6,790.0. The uptrend is slowing as the index approaches a new all-time high, with a short-term correction likely. If the price fails to break below the support level, the uptrend will remain intact, with a potential upside target around 6,985.0.

The US 500 price forecast considers the following scenarios:

The core PCE price index declined to 2.8%, below the forecast and the previous reading, indicating easing inflation and reduced pressure on the Federal Reserve. The US stock market receives a moderately positive signal: bond yields may fall, and interest in risk assets may increase. For the US 500 index, this creates conditions for further growth, although the reaction may be restrained. A short-term correction within the broader uptrend also cannot be ruled out. From a technical perspective, the US 500 could rise towards 6,950.0.

The strength of the euro is amplifying the deflationary effect of China's export machine, which may end up being the catalyst that could jolt the European Central Bank out of its "good place" and into more interest rate cuts.

The euro is around $1.166, having hit a four-year high of $1.1918 in September and set for a gain of nearly 13% this year, the most since 2017.

The ECB's euro real effective exchange rate - essentially the basket of key trading partner currencies adjusted for inflation - hit a high of 98.68 in September, the most since May 2014. It was at 97.81 in November .

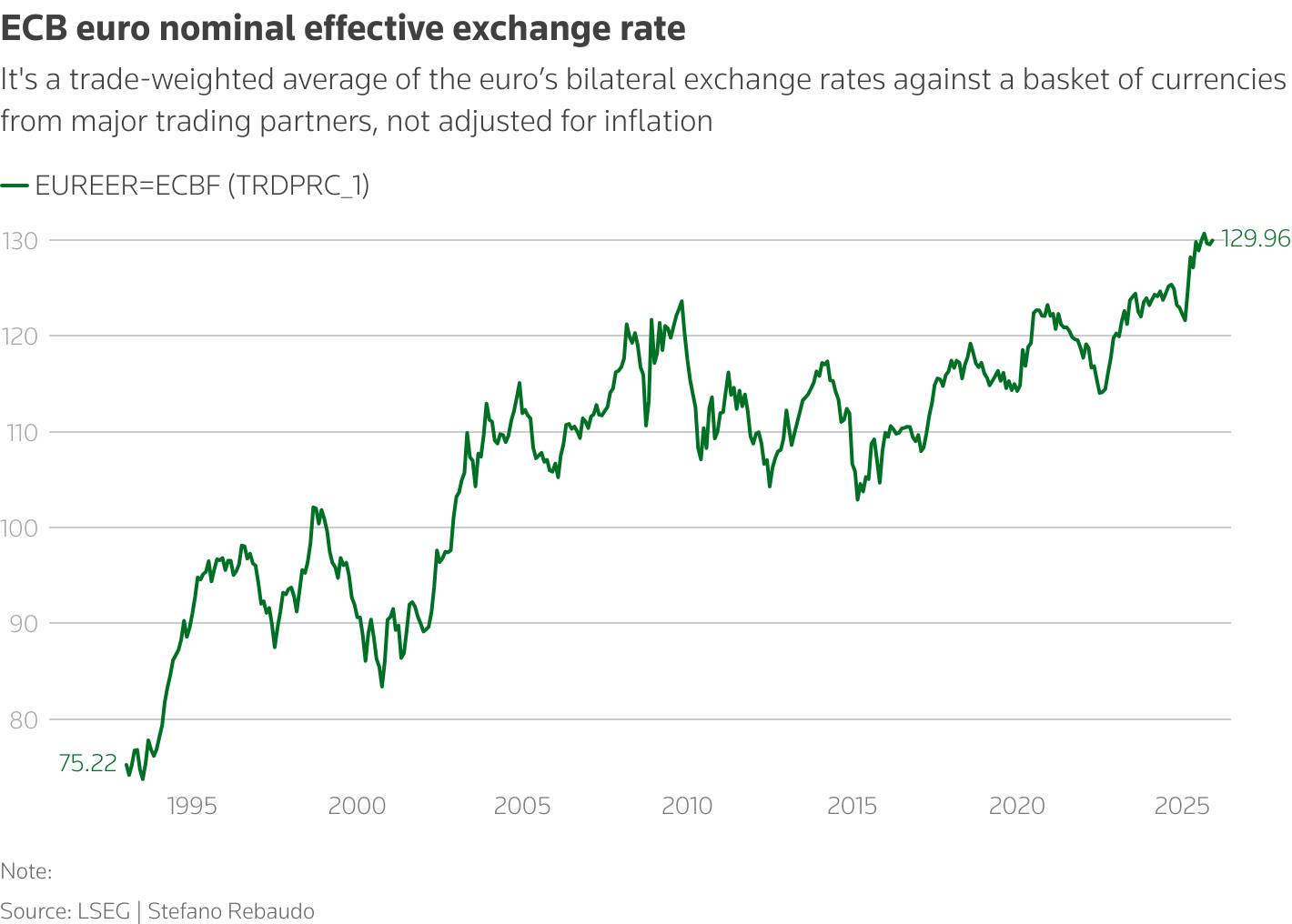

The nominal rate , which is around 129.96, hit a record 130.87 in September, having risen 5.7% so far in 2025.

The euro nominal effective exchange rate is close to its highest on record

The euro nominal effective exchange rate is close to its highest on record"The euro is a lot more expensive than meets the eye," said Themos Fiotakis, Barclays global head of forex strategy.

"If you look at the euro on a trade-weighted basis, and also against some of its more direct competitors, you'll see that the euro is at historically high levels," he argued, adding that factoring in U.S. tariffs offers a euro rate closer to $1.28.

One of the main drivers of the rise in the trade-weighted euro has been the 7% drop in the Chinese yuan in the offshore market this year .

China is Europe's largest trading partner. The most recent data show the euro zone had a trade deficit of 33 billion euros with China in September, compared with a 22.2-billion euro surplus with the United States, the region's second-largest partner.

Goldman Sachs recently delivered its biggest upgrade to China's growth outlook in a decade, saying Beijing's push to flood markets with cheap goods could stoke deflation, particularly in Europe.

Chinese exporters will be looking to expand their footprint in markets other than the United States and, given the country's grip on supply of critical rare earth materials, there may be little room for trade barriers.

ECB Vice President Luis de Guindos said in July the central bank can ignore an appreciation of the euro up to $1.20, but it would get "much more complicated" above that level.

"We're seeing only limited pass-through from the exchange rate so far, as margins are still being rebuilt—and that process may not be complete yet," said Simon Wells, chief European economist at HSBC.

"If the trade-weighted euro were to appreciate sharply from here, say by around 5%, that could well trigger further policy easing," he added, noting that in this case there would likely be more than one cut.

ECB official Martin Kocher said in September the exchange rate wasn't a risk, but further euro appreciation could "become problematic" for exporters, while Martins Kazaks recently said the exchange rate and Chinese trade flows were key risks to the central bank's policy outlook.

"What I'm telling clients is that our base case remains that rates will be unchanged, but the likelihood that the ECB will cut one or two more times between now and the summer of next year is still pretty high," said Carsten Brzeski, global head of macro research and chief euro zone economist at ING.

"The China story could be the tipping factor to push the ECB into rate cuts."

Markets show traders expect the ECB to be firmly on hold until at least March 2027. But tariffs and fears of a global trade war have seen that pricing come back from a low in April of 1.55%, when Trump slapped tariffs on all major trading partners.

Strategists say the outlook for the euro will remain dominated by the difference between euro zone and U.S. interest rates. The Federal Reserve is widely expected to deliver a series of cuts next year that could weigh on the dollar and, in turn, boost the euro.

"Lower rates and a weaker dollar go hand in hand," said Andreas Koenig, head of global currency management at Amundi Asset Management, arguing that Trump will influence the Fed toward more easing ahead of mid-term elections.

"I think that the first sequence is a lower dollar, then an accelerating (U.S.) economy."

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up