Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)A:--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)A:--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)A:--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)A:--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)A:--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)A:--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)A:--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports YoY (CNH) (Nov)

China, Mainland Imports YoY (CNH) (Nov)--

F: --

P: --

China, Mainland Imports YoY (USD) (Nov)

China, Mainland Imports YoY (USD) (Nov)--

F: --

P: --

China, Mainland Imports (CNH) (Nov)

China, Mainland Imports (CNH) (Nov)--

F: --

P: --

China, Mainland Trade Balance (CNH) (Nov)

China, Mainland Trade Balance (CNH) (Nov)--

F: --

P: --

China, Mainland Exports (Nov)

China, Mainland Exports (Nov)--

F: --

P: --

Japan Wages MoM (Oct)

Japan Wages MoM (Oct)--

F: --

P: --

Japan Trade Balance (Oct)

Japan Trade Balance (Oct)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

US homebuilder sentiment jumped to a six-month high in October amid hopes that declining mortgage rates would stimulate demand for housing and help reduce an inventory overhang that has hampered new housing construction.

US homebuilder sentiment jumped to a six-month high in October amid hopes that declining mortgage rates would stimulate demand for housing and help reduce an inventory overhang that has hampered new housing construction.

Economic uncertainty and a lackluster labor market are, however, likely to offset some of the anticipated boost to demand from lower borrowing costs. The Federal Reserve's Beige Book report on Wednesday described economic activity as little changed in recent weeks and said demand for labor was generally muted.

"Mortgage rates have fallen only slightly over the last three months and households remain anxious about the job market outlook, suggesting demand will remain weak ahead," said Samuel Tombs, chief US economist at Pantheon Macroeconomics.

"A meaningful recovery in housing demand, construction and transactions is unlikely before mid-2026."

The National Association of Home Builders/Wells Fargo Housing Market index increased five points to 37 this month, the highest reading since April, the NAHB said on Thursday.

But it remained below the 50 breakeven point for the 18th straight month. Economists polled by Reuters had forecast the index edging up to 33.

Higher mortgage rates have dampened housing demand, resulting in a glut of unsold new homes on the market. Mortgage rates have eased as the U.S. central bank resumed cutting interest rates. But the decline has not led to a surge in home buying as economic worries keep prospective buyers out.

"The housing market has some areas with firm demand, including ... ongoing solid conditions for the luxury market," said NAHB chairman Buddy Hughes. "However, most home buyers are still on the sidelines."

The survey is the latest to highlight what some economists are calling a K-shaped economy, where high-income households are driving much of activity. The Fed's Beige Book noted strong "spending by higher-income individuals on luxury travel and accommodation."

Higher goods prices from tariffs on imports as well as a stagnant labor market are hampering spending by lower-income and some middle-income households.

The NAHB survey's measure of current sales conditions increased four points to 38 this month, while its gauge of future sales jumped nine points to 54. A measure of prospective buyer traffic posted a four-point gain to 25.

Builders continued to reduce house prices to lure buyers. Thirty-eight percent reported cutting prices. The average price reduction rose to 6%, the largest cut in a year, after averaging 5% for several months.

New housing inventory decreased in August after hovering for several months at levels last seen in late 2007.

The government shutdown amid a standoff over funding has suspended the collection and publication of economic data.

It has also impacted the processing of flood insurance coverage, with realtors warning of severe disruptions to home sales in many states, including Maryland, Virginia, North Carolina and Florida.

The NAHB estimated new single-family building permits rebounded in September after plunging in August to the lowest level in more than two years.

"Based on modeling of historical data, the October increase for the HMI suggests an approximate 3% increase for the September single-family permit data on a seasonally adjusted annual rate basis," said NAHB chief economist Robert Dietz.

Key points:

Labor unions filed a lawsuit against the U.S. government on Thursday, alleging that the Trump administration violated the First Amendment rights of people who are legally in the United States by searching their social media for specific viewpoints, including criticism of Israel.The complaint is the latest legal challenge to the broad immigration crackdown initiated since President Donald Trump was inaugurated in January, which has seen unprecedented deportations of migrants, including some who had valid visas.

The Department of State on Tuesday said it had revoked the visas of at least six people over social media comments made about the assassination of conservative activist Charlie Kirk.Three major trade unions — United Auto Workers, Communications Workers of America and American Federation of Teachers — sued the State Department, the Department of Homeland Security, the U.S. Citizenship and Immigration Service, Immigration and Customs Enforcement and the heads of these agencies at a federal court in New York.

Responding to a request for comment, State Department Principal Deputy Spokesperson Tommy Pigott said: "The United States is under no obligation to allow foreign aliens to come to our country, commit acts of anti-American, pro-terrorist, and antisemitic hate, or incite violence. We will continue to revoke the visas of those who put the safety of our citizens at risk.”Trump officials have argued that foreigners do not have the same constitutional rights as U.S. citizens and that a visa is a privilege not a right.

The complaint by the labor unions cites high-profile cases and the comments of officials themselves to argue that a government program uses artificial intelligence and other automated tools to monitor visa holders' posts and singles out individuals with negative views toward the U.S. government and the Trump administration in particular, U.S. culture and what the government deems "hateful ideology."

The federal government has broadly defined support for terrorism to include criticism of U.S. support for Israel, of Israel's actions and support of Palestinians and used this as a reason to cancel visas, they said. The complaint cited cases including green card holder Mahmoud Khalil, who was released in June following months in detention after the administration sought to deport him for taking part in pro-Palestinian protests.

The unions argue this has chilled the speech of thousands of their members by threatening immigration action if the government disapproves of their views.Many union members have stopped expressing their views because "the government has promised and proven that saying the wrong thing can trigger life-altering immigration consequences, particularly for visa holders and Lawful Permanent Residents," the complaint says.

Peyush Bansal founded eyewear-maker Lenskart Solutions Ltd. more than 15 years ago with partners he met on LinkedIn and grew it into a multi-billion dollar business. Now the 41-year-old entrepreneur and Indian television star is in line for a windfall.Lenskart is planning to list as early as next month in Mumbai, targeting a stock debut that would value the company at $9 billion, based on the IPO size according to people familiar with the matter, and calculations from the prospectus.That would give the entrepreneur a stake close to $800 million after selling a small portion of his shares in the IPO according to the Bloomberg Billionaires Index. His stock could cross $1 billion if Lenskart shares pop about 25% on debut.

Bansal’s path to a public offering shows how investor confidence is returning for some founder-led ventures after a period where the country’s leading startups struggled to survive and funding dried up. Lenskart has carved out a niche with robotic production in India using machines imported from Germany to produce its glasses, along with a website that makes it easy for customers to order and test their purchases remotely.Starting with a huge domestic market, Lenskart is already expanding across Southeast Asia where Bansal notes demand patterns in Indonesia and Vietnam mirror India’s trajectory a decade ago.“India is the myopia capital of the world, and a lot of our people need glasses,” Bansal said in an interview in Mumbai. “If we can solve that, everything else, including scale, profit and rising market capitalization, will follow.”

Bansal’s pitch is that he stands apart from earlier Indian consumer-tech listings and already makes money. The Gurugram-based company, which designs, manufactures and sells eyewear online and through retail outlets, reported its first-ever full-year profit in the year to March 31.He’s also got the tailwind of an established retail fanbase behind him. Outside of Lenskart, Bansal is a judge on the Indian franchise of the American show Shark Tank and has amassed more than 900,000 followers on Instagram.

In business, he says he has benefited from timing and persistence. Bansal jokes that he and co-founder Amit Chaudhary spend one day every week brainstorming new ideas, with mixed results.“Our hit rate is about 50%,” he said. “A coin toss might have worked just as well.”This year, he’s contended with a stock debut buffeted by trade wars and geopolitical headwinds in addition to more wary investors.

While India’s startup scene is one of the world’s largest, valuations have nosedived for several companies that struggled to grow and as investors ask tougher questions. The family office of tech billionaire Narayana Murthy recently pointed to steep discounts driven by funds that need to exit their investments. Oyo Hotels, which like Lenskart is also backed by SoftBank Group Corp. was once among India’s most valued startups, worth $10 billion in 2019 before its valuation nosedived and later recovered.Bansal’s approach has drawn backing from investors who prefer patience over flash. SoftBank, which owns about 15% of the company, has described its stake in Lenskart as an example of patient capital that can wait decades for compounding growth. Earlier this year, investor Fidelity Management & Research valued Lenskart at $6.1 billion.

The IPO will test whether the rebound in investor appetite for Indian consumer-technology stocks has staying power. Urban Co.’s blockbuster debut last month, which saw shares of the rent-a-service marketplace surge 62% on opening day, rekindled optimism after a string of disappointing post-market performances from other startups had cooled enthusiasm for the sector.Still, Lenskart remains dependent on China for more than one-third of its purchases, including frames, molds and raw materials, a reliance Bansal acknowledges but describes as manageable. Such dependence leaves the firm exposed to China’s supply-chain swings, where tariffs or export curbs could hit deliveries and erode margins.

Now Bansal is overseeing production of a new manufacturing facility in Hyderabad, which is expected to be the world’s largest, covering 50 acres with a production capacity of hundreds of thousands of glasses daily.A graduate in engineering from McGill University in Montreal, Bansal began his career at Microsoft Corp. in Redmond, Washington, before returning to India to pursue entrepreneurship. His first venture, a student-housing platform, gave way to a broader mission after he recognized a much larger gap in vision care. From a small office in Faridabad, on the outskirts of Delhi, he and three partners he met on LinkedIn began building Lenskart.

The company now controls nearly every link in its value chain, from lens design and manufacturing to last-mile delivery. It employs hundreds of ophthalmologists in Kolkata who provide remote eye consultations and is developing AI-based testing tools to reach smaller cities where eye care access remains limited.Lenskart plans to use proceeds from the share sale to open new stores across India, invest in technology and artificial intelligence capabilities, make acquisitions, and fund general corporate purposes, according to filings.

As of March, it operated 2,723 stores - across India and in markets such as the Middle East and Southeast Asia. Nearly 40% of its revenue now comes from outside India, underscoring its growing international footprint.Its next big bet is smart eyewear. A 70-member team is working on integrating features such as UPI, AI tools, cameras, and headphones.

“It’s tempting to go all in,” Bansal said. “But timing matters.”

Key points:

The Australian and New Zealand dollars were on the defensive on Friday as concerns over U.S. credit losses bruised risk sentiment, while also leading investors to wager on more aggressive Federal Reserve rate cuts.A resulting dive in Treasury yields weighed on the greenback, but the Antipodeans failed to benefit as they are highly correlated to risk. Instead, the Aussie lost ground to the safe-haven Japanese yen, while sliding to a six-month low on the Swiss franc.The Aussie dipped 0.1% on the greenback to $0.6480, though it was holding above the recent two-month low of $0.6438. Momentum is to the downside while it stays under $0.6535.

The kiwi dollar was pinned at $0.5725, after a bounce to $0.5755 overnight ran into selling. A break of the recent six-month trough at $0.5684 would risk a retreat to at least $0.5600.The Aussie was still smarting from a surprise jump in unemployment at home that led markets to ramp up bets for more rate cuts from the Reserve Bank of Australia.Futures now imply around an 85% chance the RBA will cut the 3.60% cash rate by a quarter point at its meeting on November 4, against 50% early in the week. A further move to 3.10% is also fully priced in.

Analysts at JPMorgan cautioned that spikes in the unemployment data tend to get unwound in following months, so the RBA was unlikely to react to just one figure."We retain our view for the RBA to hold at the November meeting, but highlight the decision is finely balanced as it debates the conflicting signals from inflation and labour data," they wrote in a note.

"There's clearly a lot riding on the upcoming 3Q CPI release."

The consumer price data are due on October 29 and a high reading for core inflation would lean heavily against a near-term easing.New Zealand releases its CPI report next week and analysts assume inflation will pop up to 3.0%, from 2.7%, the top of the Reserve Bank of New Zealand's target band of 1% to 3%.Yet the central bank fully expected such a move when it slashed interest rates by 50 basis points to 2.5% earlier this month, confident that inflation would soon retreat.

"A reacceleration in imported inflation is driving the move higher, while domestic price pressures continue to cool, on balance," said Mary Jo Vergara, an economist at Kiwibank."There is significant spare capacity still sloshing in the economy, keeping downward pressure on medium-term inflation," she added. "In 2026, inflation is set to slow below the mid-point of the target band."

The recent dip in the broader crypto market was led by the gloomy momentum recorded in Bitcoin price.

Besides, the altcoins also followed suit, erasing around 1% from the global crypto market cap to $3.78 trillion, indicating a cautious stance of traders.

Notably, the dip in the recent BTC USD value could be attributed to a flurry of factors, including geopolitical tensions and waning institutional interest.

For context, Donald Trump has fueled the market concern with his threat to impose hefty tariffs on China.

In retaliation, China also said that the country would stand firm against the decision, which has spooked the investors.

As a result, the crypto market bleeds heavily, falling from the brief $4.15 trillion market cap of last week.

Simultaneously, Bitcoin price also slipped last week, falling to as low as $104k amid a broader market selloff.

Now, some analysts have further fueled concerns, saying that the BTC USD bull cycle is coming to an end.

So, let’s take a quick tour of the recent performance of the BTC price and the potential reasons behind the selloff.

Besides, we would also explore what lies ahead for the flagship crypto in the coming days.

BTC price today was down more than 0.5% and traded at $111,479, and its one-day volume fell 10% to $73 billion.

Notably, the crypto has touched a 24-hour high and low of $112,294 and $109,721, respectively.

The massive selloff has resulted in a weekly crash of over 10% in Bitcoin price. Besides, its monthly loss was recorded at 4%.

As said earlier, this dip could be attributed to the geopolitical tensions and waning institutional interest.

According to CoinGlass data, the BTC USD Futures Open Interest fell 0.4% over the last 24 hours to $653.94k BTC.

However, on the CME Exchange, the Open Interest (OI) was up around 2.35%, while Binance saw the largest decline of 2.42%.

So, here we take a look at the potential reason behind the dip in Bitcoin price before exploring what may lie ahead for the asset.

A flurry of factors may have weighed on the sentiment, triggering a widespread selloff in the market.

However, it appears that the soaring geopolitical tensions might have caused the most damage in the market, acting as a negative catalyst for the decline.

The trade war tensions have so far weighed on the investors’ sentiment, causing volatility across the financial market, let alone the crypto sector.

Having said that, the recent tensions between the US and China might have fueled the concerns. This has also forced the retail traders as well as institutions to stay on the sidelines.

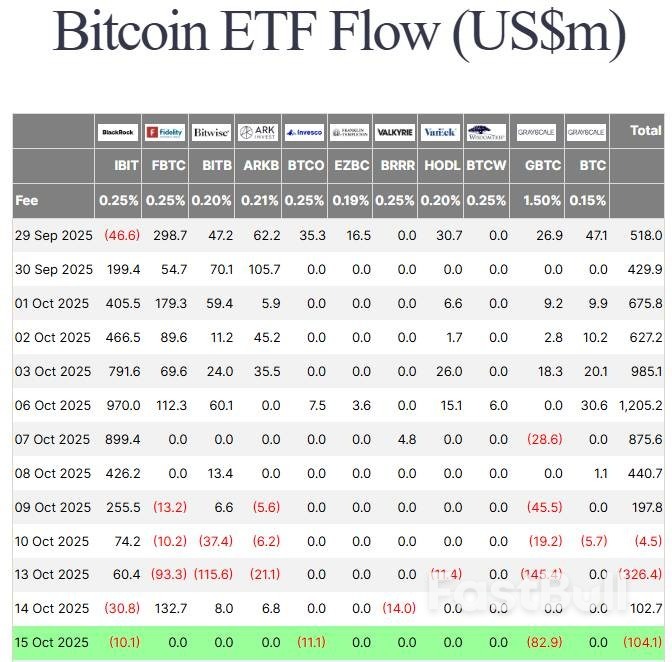

For context, Farside Investors’ data showed that the US Spot Bitcoin ETF has once again recorded an outflow of $104.1 million on Wednesday, October 15.

The investment instrument recorded an inflow of $102.7 million the previous day, on October 14, which has allayed some concerns of traders.

However, the continuing outflow since October 10 has weighed on the sentiment, indicating that the institutions are shifting focus from Bitcoin.

US Spot Bitcoin ETF Fund Flow | Source: Farside Investors

US Spot Bitcoin ETF Fund Flow | Source: Farside InvestorsAmid the gloomy momentum, analyst Captain Faibik has further fueled concern with his latest Bitcoin price prediction.

In a recent X post, the expert said, “I’m not bullish on Bitcoin anymore. That’s it.”

Besides, he said that “Bitcoin bull run is nearing its end.” This comment has sparked discussions among traders, with his prediction of a massive correction ahead further fueling market concerns.

Bitcoin Price Analysis | Source: Captain Faibik, X

Bitcoin Price Analysis | Source: Captain Faibik, XHowever, expert Michael van de Poppe has shared a different outlook, evaluating the monthly chart of BTC USD. Poppe noted that the monthly chart looks “pretty much fine.”

BTC USD Price Action | Source: Michael van de Poppe, X

BTC USD Price Action | Source: Michael van de Poppe, XBesides, he has advised traders to buy the dip, predicting that an all-time high is incoming.

According to Poppe, BTC USD finds major support at $107k, and as long as the support holds, the future trajectory looks bullish.

In addition, his chart reveals that Bitcoin price faces major resistance at $119,504. Once this support is broken, BTC could target a new all-time high.

Bitcoin Price Prediction | Source: Michael van de Poppe, X

Bitcoin Price Prediction | Source: Michael van de Poppe, XHowever, investors should tread cautiously amid the ongoing volatile scenario in the market.

With the geopolitical tensions weighing on traders’ sentiment, the market may face a major pullback in the coming days.

The post Bitcoin Price Slips: Bull Run Coming To An End? appeared first on The Coin Republic.

Minneapolis Federal Reserve President Neel Kashkari said Thursday he does not think that there is a big chance the labor market will weaken sharply or inflation will surge, though of the two, "there’s more risk of a labor market negative surprise than a big uptick in inflation."

"On the other hand, if I were to guess which mistake we’re more likely making, I think we’re more likely betting that the economy is really slowing more than it really is," Kashkari told a town hall in Rapid City, South Dakota.

Kashkari supported the Fed’s quarter-point interest-rate cut in September and feels two more such cuts will be warranted by the end of the year, he said last month. Like many of his colleagues, he sees the rate cuts as a form of insurance against dire outcomes that may not actually materialize.

Last year, for instance, the Fed cut rates to shore up what many policymakers feared was a rapidly softening labor market, and the economy proved to be unexpectedly resilient, he said.

As for inflation, Kashkari said Thursday that he thinks it is unlikely the inflation rate will rise to 4% or 5%, "because we can do the math of what tariff rates translate into what inflation. So I think the risk of inflation is more of one of persistence - that it’s not so much of a one time event, but that it stays at 3% for an extended period of time."

The Fed targets 2% inflation; in August it was 2.7% by the Fed’s targeted measure. Some of Kashkari’s policymaking colleagues say the Fed should be cautious about cutting rates when the inflation rate is too-high and rising

Though the ongoing federal government shutdown is delaying the publication of economic data, Fed policymakers have enough unofficial data through private sources and their own community and business outreach efforts to have a pretty good idea of economic conditions, Kashkari said.

"We can make our way through while the shutdown is happening," Kashkari said. "But the longer it goes on, the less confidence I have that we are reading the economy appropriately, because there’s no substitute for the gold standard government data that we rely on."

President Donald Trump has his sights once again on ending the Ukraine conflict, announcing another meeting with Russian Vladimir Putin after a first summit in Alaska failed to yield progress.

The president framed the decision, announced after he spoke with Putin for more than two hours Thursday, as a plan to bring peace at last to a conflict that he once claimed he’d solve within a day. But it also deflates any pressure that had been building on Putin in recent weeks as Trump vented frustration with the Russian leader’s foot-dragging to end the war.

Trump’s call with Putin also preempted a meeting he’s set to have on Friday with Ukrainian President Volodymyr Zelenskiy. Trump had adopted an increasingly warmer tone toward Zelenskiy in recent weeks as he cooled on Putin — a stark change from his more frigid stance toward the Ukrainian leader earlier in his administration, including a public dressing down in the Oval Office earlier this year.

Even more worrying for Zelenskiy, Trump equivocated on Thursday about both the possibility of sending long-range Tomahawk missiles as well as a Senate push for punishing sanctions against Russia.

“We need Tomahawks for the United States of America, too,” Trump told reporters in the Oval Office. “So I don’t know what we can do about that.” Of sanctions, he said the Republican push for tough new measures “may not be perfect timing, but it could happen in a week or two.”

Both Ukraine and Russia have sought to take advantage of Trump’s momentum after the Gaza summit that halted fighting between Hamas and Israel — though to opposite ends. Zelenskiy believes Trump’s growing frustration with Putin could lead him to apply the pressure the White House has so far resisted. He’ll renew pleas for air defense and assistance in sourcing new energy supplies along with the coveted Tomahawks.

But Trump has yet to sign off on issuing those to Ukraine, and Putin in his call with Trump warned the US president doing so “would cause significant damage to relations between our countries, not to mention the prospects for a peaceful settlement,” according to a readout by the Kremlin.

Sergey Radchenko, a Cold War historian and professor at the Johns Hopkins School of Advanced International Studies, said it was “almost foolhardy” for Trump to agree to another meeting given that the Alaska summit in August produced no agreement despite all the fanfare. What’s needed, he said, was to combine pressure with communication.

“I’m seeing a lot of efforts at dialogue,” Radchenko said. “I’m not yet seeing maximum pressure.”

Instead the US president appears to be relying on carrots to lure Putin to the table. Trump noted the two leaders spoke extensively about the prospects for trade after the war ends. According to the Kremlin, Trump stressed the economic opportunities would be “colossal.”

With the plans for lower-level dialogue and an eventual leaders’ summit, “Putin is essentially buying time, delaying the delivery of much-needed United States weapons to Ukraine and the implementation of the energy sanctions that Trump has promised,” according to Maria Snegovaya, senior fellow for Russia and Eurasia with the Europe, Russia, and Eurasia Program at the Center for Strategic and International Studies.

The venue of Trump’s planned summit with Putin — Budapest — is also likely to be viewed with skepticism from European allies as an attempt by the Russian leader to drive a wedge between the US and Europe. Hungarian Prime Minister Viktor Orban has been the target of fierce criticism from its European Union and NATO allies for maintaining close ties with Russia, even after Putin invaded Ukraine. This has included speaking out against EU sanctions on Moscow, barring the delivery of weapons to Ukraine and locking Hungary into a long-term gas contract with Russia.

Trump has put the onus on Europe to cut off all energy supplies from Russia as a precondition for the US to take tough measures on Russia. But after the European Union drastically cut purchases of Russian oil and gas since the onset of its war on Ukraine, Hungary has been one of the few countries in the bloc to continue to rely on Russian imports.

Despite the European tensions, Trump has long seen Orban as a close ally on the world stage, part of a small cohort of MAGA-allied foreign leaders. As such, the American president may see Budapest as friendly territory for a summit with his Russian counterpart.

The Hungarian leader said in a post on social media platform X that preparations for the “USA-Russia peace summit” were underway, adding that “Hungary is the island of PEACE!”

For Trump, holding a second Putin summit carries considerable risk if there’s no plan by the White House to simultaneously impose costs on Russia, according to Celeste Wallander, an adjunct senior fellow at the Center for a New American Security and a top Pentagon official in charge of Russia and Europe during the Biden administration.

If the summit ends with no acceptable agreement, it would once again “allow Putin to use the opportunity to send a message to the world that he’s kind of in control of the narrative,” she said.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up