Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Euro Zone IHS Markit Construction PMI (Nov)

Euro Zone IHS Markit Construction PMI (Nov)A:--

F: --

P: --

Italy IHS Markit Construction PMI (Nov)

Italy IHS Markit Construction PMI (Nov)A:--

F: --

P: --

U.K. Markit/CIPS Construction PMI (Nov)

U.K. Markit/CIPS Construction PMI (Nov)A:--

F: --

P: --

France 10-Year OAT Auction Avg. Yield

France 10-Year OAT Auction Avg. YieldA:--

F: --

P: --

Euro Zone Retail Sales MoM (Oct)

Euro Zone Retail Sales MoM (Oct)A:--

F: --

P: --

Euro Zone Retail Sales YoY (Oct)

Euro Zone Retail Sales YoY (Oct)A:--

F: --

P: --

Brazil GDP YoY (Q3)

Brazil GDP YoY (Q3)A:--

F: --

P: --

U.S. Challenger Job Cuts (Nov)

U.S. Challenger Job Cuts (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Challenger Job Cuts YoY (Nov)

U.S. Challenger Job Cuts YoY (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

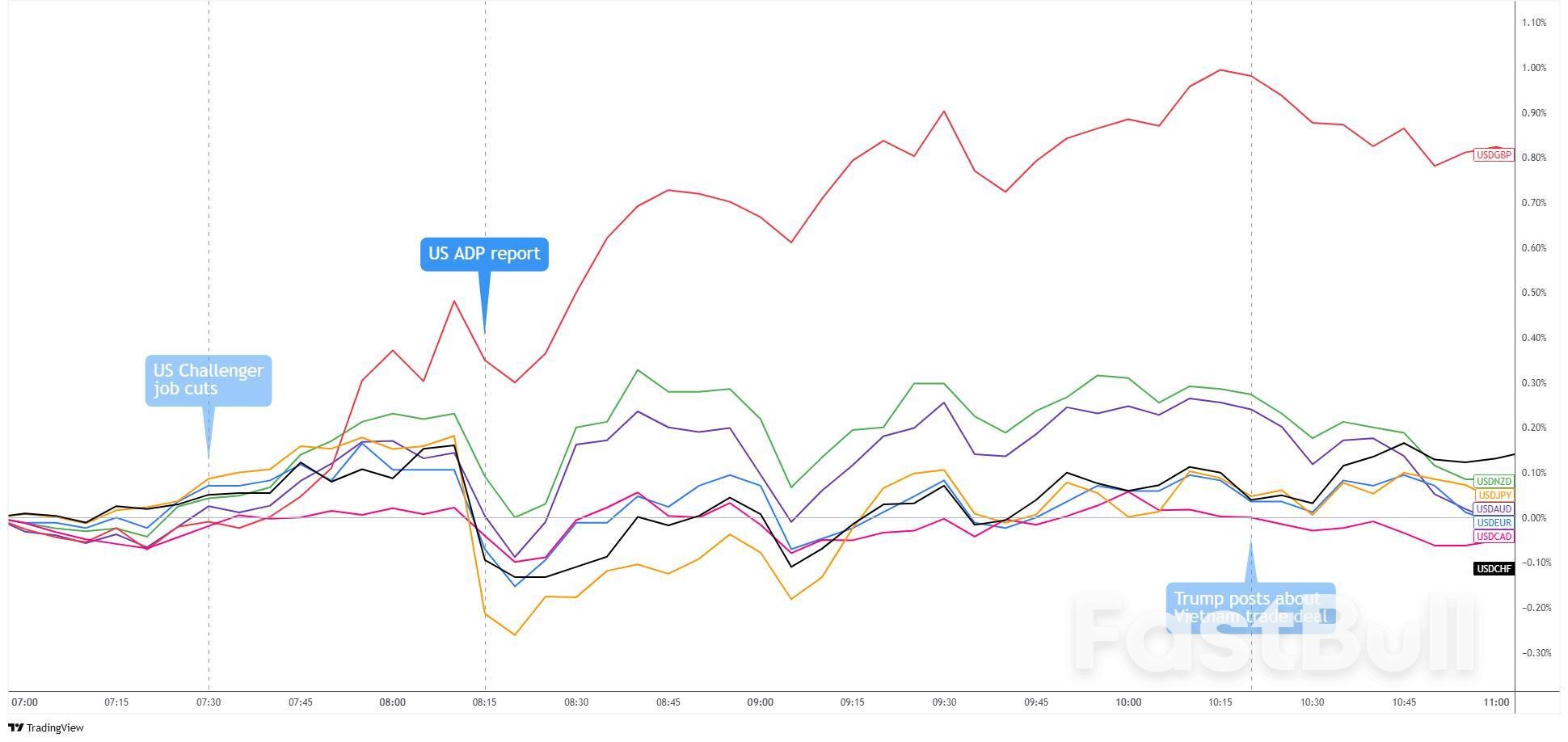

The U.S. private sector unexpectedly lost 33,000 jobs in June, a big miss compared to the forecast for a 95,000 gain. That’s the first drop since March 2023, and to make things worse, May’s figure was revised down to 29,000 from 37,000.

The U.S. private sector unexpectedly lost 33,000 jobs in June, a big miss compared to the forecast for a 95,000 gain. That’s the first drop since March 2023, and to make things worse, May’s figure was revised down to 29,000 from 37,000.

Most of the weakness came from services, with professional and business services down 56,000 and education and health services shedding 52,000. Still, there were a few bright spots: manufacturing, construction, and leisure and hospitality all added jobs.

Key points from the release:

ADP’s Chief Economist, Nela Richardson, noted that “though layoffs continue to be rare, a hesitancy to hire and a reluctance to replace departing workers led to job losses last month.”

The U.S. dollar had been cruising higher earlier in the session, likely from some profit-taking ahead of Thursday’s jobs report. But that momentum hit a wall when the ADP numbers came in way below expectations.

The dip didn’t last long, though. USD/JPY and USD/CHF picked up right where they left off after a quick breather, and EUR/USD crept up toward the 1.1700 mark.

The muted dollar reaction may have been caused by two things. One, ADP has a spotty track record predicting the official NFPs, so traders aren’t exactly scrambling to reposition just yet. And two, even with the ugly headline number, wage growth held steady at 4.4%, which signals the labor market isn’t falling apart just yet.

With the Fed still on pause and watching how tariffs ripple through inflation, rate cut expectations later in 2025 are keeping a lid on any serious dollar strength for now.

GBPJPY Daily Chart, July 30, 2025 – Source: TradingView

GBPJPY Daily Chart, July 30, 2025 – Source: TradingView

President Donald Trump’s unexpected visit to the Federal Reserve (FED) headquarters has hinted at a possible shift in the US interest rate policy. During his tour of the central bank’s renovation site with FED Chair Jerome Powell, Trump criticized the rising cost of the project but made it clear that his main concern remains the central bank’s reluctance to lower rates.

On Friday Trump told reporters that he had a productive meeting with Powell, leaving the impression that the FED may be open to cutting rates. According to a Bloomberg report, President Trump and Powell toured the FED’s headquarters renovation project in Washington on July 24, discussing the escalating costs and, more importantly, the direction of US rate cut policy.

Although Trump voiced concern over the estimated $25 billion renovation price tag, calling it excessive, he used the visit to reiterate his demand for immediate rate cuts, stressing that lower interest rates are essential for economic growth. Despite months of publicly criticizing the FED Chair, Trump’s face-to-face meeting with him ended without the political drama many had anticipated.

Instead, the rare visit seemed to ease the long-simmering tensions between the two figures, though Trump made clear his expectations of a rate cut remain high. The US President also suggested that he is not currently planning to fire Powell, regardless of ongoing frustrations over interest rates and a controversial renovation project that has drawn scrutiny from the administration.

Though Powell’s term as Chair ends in May 2026, there’s no indication he plans to step down early. Meanwhile, Trump continues to press for lower rates, stating, “I just want to see one thing happen—interest rates have come down.” He has framed monetary policy as a top concern for his administration moving forward, signaling that pressure on the FED to lower rates is unlikely to quiet down soon.

Following his recent high-profile visit to the Federal Reserve, Trump escalated his campaign for lower interest rates during a closed-door session with United Kingdom (UK) Prime Minister Keir Starmer. In a pointed critique of Powell, Trump told Starmer and assembled global leaders that US rates must be cut to 1%, describing it as both an economic necessity and a personal frustration with the FED Chair’s leadership.

He emphasized the potential financial impacts of reduced rates, stating that they should be at least 3% points lower than they are now. He claimed this difference amounts to nearly $1 trillion in potential savings for the US economy, estimating that each percentage point equals approximately $360 billion in reduced costs. By raising this issue in a diplomatic setting, the US President signaled his willingness to challenge central bank policy on a global stage.

President Donald Trump said he would impose a 25% levy on Indian goods starting Friday and threatened an additional penalty over the country’s energy purchases from Russia. That’s a steeper hit than the 15% to 20% range applied on several regional peers.India’s stock benchmark has lagged most major global peers this year amid concerns over a slowdown in its economy and corporate earnings. The underperformance has deepened this month as foreign investors have accelerated their withdrawals, turning attention to cheaper or more attractive markets like Hong Kong and South Korea. The value of India’s stock market is down $248 billion since reaching a record on July 2.

“India is known to be a tough negotiator when it comes to trade, and this time the toughness seems to have effected an undesirable outcome,” said Tomo Kinoshita, global market strategist at Invesco Asset Management. “The 25% tariff should have a moderate negative impact on India’s stock market, especially for export sector stocks.”The MSCI India Index is on track for its weakest month since February. While it has eked out a gain this year, its performance trails the almost 14% jump in MSCI Asia Pacific Index and pales in comparison to the 36% surge in the MSCI Korea Index, which has rallied on optimism surrounding bold reforms under a new president.

Futures contracts on the local benchmark NSE Nifty 50 Index dropped 0.6% after Trump’s announcement while the iShares MSCI India ETF slid 1.5%. The situation remains fluid, as the US president later said negotiations with India continue and whether or not a trade deal can be reached will be known “at this end of this week.”India’s once-lauded relative insulation from global turmoil is losing its shine. With earnings offering few positive surprises and valuations remaining among the highest in the region, investors are likely to stay cautious in the near term. The MSCI India trades at almost 22 times its one-year forward earnings, well above its long-term average and gauges of Chinese and Korean shares.

Even as stocks decline, India’s equity capital market is humming. Fundraising from initial public offerings, share placements to large investors and block trades has topped $6 billion for a third straight month. That level of issuance — last seen in late 2024 — coincided with a double-digit correction in local shares.“High valuations and slowing profits are inverting buyer-seller incentives,” said Prateek Parekh, a strategist with Nuvama Institutional Equities. Business founders and private equity investors are on a “selling spree,” while domestic flows are slowing. “Foreign fund flows are now critical.”

That boost will be key, as foreign investors — who have withdrawn more than $2 billion from local shares this month — weigh whether earnings can justify the rich valuations. The April-June results season so far has done little to ease concerns. Earnings from key technology and financial firms, the two sectors that together make up about 40% of the market’s value, have largely underwhelmed.Yet some believe the tide could still turn. Interest-rate cuts and a pick-up in economic growth could end the “flat-to-weak” positioning of local stocks and lay the foundation for an earnings rebound in the second half of the year through March, according to Emkay Global Financial Services’ strategist Seshadri Sen.

Rahul Chadha, founder and chief investment officer at New York-based Shikhara Investment Management LP. Chadha, said his fund has raised exposure to Korean stocks in recent months due to benefits including improved corporate governance.“Honestly, 2025 looks challenging for India to close the performance gap,” he added.

The Federal Reserve's decision to avoid signaling imminent rate cuts despite relentless political pressure underscores its prevailing caution and has forced investors to dial back expectations for an easing at the next policy meeting.

The Federal Open Market Committee held interest rates on Wednesday in a split decision that gave little indication of when borrowing costs might be lowered. It also drew dissent from two Fed governors, both appointees of President Donald Trump who agree with him that monetary policy is too tight.

The overnight policy rate controlled by the Fed remains in a 4.25%-4.50% range. The last rate cut was in December and the Fed hiked rates from March 2022 to July 2023 to fight inflation.The lack of a clear signal that the Fed was warming to interest rate cuts as soon as the next meeting in September lifted Treasury yields and the dollar in late trade and turned stocks lower."I think the Fed has pushed out the probability of a rate cut," Sonu Varghese, global macro strategist at Carson Group.

"They're going to wait for more data, but more data means more time, and more time means rates are going to remain restrictive for a few more months," Varghese said.Fed funds futures traders are pricing in a 46% probability of a rate cut by September, down from about 65% a day ago, according to the CME Group's FedWatch Tool. They are no longer pricing in two full 25 basis point cuts by year-end as they were in recent days.Fed Chair Jerome Powell was careful to keep his options open on monetary policy. "We have made no decisions about September," he said in a press conference. He also noted there was still time to take in a wide range of data before the central bank next met in mid-September.

"There was some possibility that (Powell) would softly signal that a September rate cut is the base case, and (that it) would only not happen if the data didn't play out in a way that's consistent with that," said David Seif, chief economist for Developed Markets at Nomura in New York."I'd say he did not do that at all."Bond yields climbed on Wednesday as Powell reiterated the economy was showing resilience despite interest rates remaining "modestly restrictive". Benchmark Treasury 10-year yields and two-year yields both rose by about two basis points after those remarks.

Investor positioning may have amplified the bond market reaction, said Jamie Patton, co-head of global rates at TCW."I think the market had gotten a bit ahead of itself thinking we already had enough data to justify a cut in September," said Patton, who remains bullish on short-term bonds due to expectations of imminent interest rate cuts.Powell has come under intense pressure from the White House to lower interest rates, with President Trump regularly berating him for being too slow to lower borrowing costs.Powell's reticence in guiding when the Fed may start cutting rates will leave investors to parse two more months' worth of inflation and employment data for the timing of policy easing, and put some pressure on small-cap stocks in the near term, investors said.

The Russell 2000 small-cap index, which had been outperforming the S&P 500 index on the day before Powell took the stage, finished the session down 0.47% against a 0.12% loss for the large-cap benchmark.For the dollar, which has come under intense selling pressure this year, the Fed's relatively hawkish message gave some support, lifting the currency to a two-month high against a basket of peers. The dollar index ended up 1%, leaving it down about 8% for the year."We still envision medium-term weakness for the USD, but in the near-term the risk profile is more two-way," BofA Global Research strategists said in a note.

Higher rates in the U.S. help boost the allure of the dollar relative to other developed market currencies."This patience from the Fed and strength of the U.S. economy coming through is putting a little bit of a pause to that dollar depreciation," Vishal Khanduja, head of broad markets fixed income at Morgan Stanley Investment Management, said.Khanduja, however, warned against reading too much into the market's reaction to the Fed meeting."Overall, I thought they did not change their stance at all," he said.Khanduja expects three to five cuts by the end of next year, though he sees the next two inflation releases as important."They're still going to be wait-and-see, still very convinced that inflation is going to be slightly higher in the next two prints," he said. "But they are still very convinced it's going to be a one-time bump."

Australia’s quarterly inflation outcome this week was close to the Reserve Bank’s expectations, Deputy Governor Andrew Hauser said, while adding the board is debating the extent of labor market tightness.

In a fireside chat at the Barrenjoey Economic Forum in Sydney on Thursday, the RBA’s No.2 official said “the data yesterday was very welcome,” adding that the 2.7% annual trimmed mean number was “very much as we had expected.”

The RBA wrong-footed investors earlier this month by keeping borrowing costs unchanged at 3.85% against widespread bets on a cut. Governor Michele Bullock later said the board wanted to see the quarterly consumer price data for confirmation that pressures were abating.

Official data on Thursday showed all measures of inflation cooled further last quarter. That’s bolstered bets for the central bank to deliver its third interest-rate cut for the year as early as its August meeting.

Hauser was also asked about the state of the labor market. He opened by reiterating that the June increase in the jobless rate to 4.3% from 4.1% meant it was exactly where the central bank predicted in its most recent forecasts. The RBA will release an updated outlook next month.

“There’s a lively debate about exactly how tight the market is, and we have that debate on the board, and we have it outside the board and I think that’s a good thing,” said Hauser, who is the first foreign official to join the RBA’s top ranks. “There are different views on the board about exactly how tight the labor market is but on any measure unemployment is historically still very low.”

Hauser said businesses are still struggling to find the right staff. “So whether you call that tight or full or whatever you might call it this is a labor market that is close to whatever full employment means.”

Economists anticipate three more rate reductions from the RBA between now and early 2026, according to the median estimate in a Bloomberg survey.

Australia’s economic momentum remains subdued with consumer confidence and household spending tepid. Global uncertainty is also elevated in the run-up to President Donald Trump’s tariff deadline on Aug. 1.

Trade uncertainty has been weighing on business investment and prompting firms to rethink hiring plans, economists say. Even though Australia got off lightly with a 10% baseline tariff rate, as an export-reliant economy its fortunes are heavily geared to those of its trading partners.

“Real incomes have been very weak,” said Hauser, adding that there is also a debate on the board about how much momentum there is in the economy at present.

“There are reasons for optimism for the future,” he said. “One of which is obviously the real income growth really has begun to grow quite strongly now.”

Hauser, who ended a 30-plus year career at the Bank of England to move to Australia in February 2024, said the goal of policy is to try to keep the economy “close to balance,” with inflation near the midpoint of the RBA’s 2-3% target and employment at its maximum sustainable level.

“That won’t be an easy thing to pull off,” he added.

The deputy governor said in response to a question that the status of public appearances and speeches by the RBA’s independent board members remains a work in progress.

“It will be important when individual members speak, just as it is when I speak and the governor speaks, that we don’t identify the views of other individuals or indeed of ourselves,” he said.

“So the challenge will be to ensure that we do throw light onto the range of debates in the economy without breaching that important principle,” Hauser said.

Canada intends to recognize a Palestinian state at a meeting of the United Nations in September, Prime Minister Mark Carney announced on Wednesday, adding more pressure on the government of Israeli Prime Minister Benjamin Netanyahu as the humanitarian crisis in Gaza deepens.

The announcement came after France said last week it would recognize a Palestinian state, and a day after Britain said it would recognize the state at the UN if the fighting in Gaza, part of the Palestinian territories occupied by Israel, had not stopped by then.

"We are working ourselves with others, to preserve the possibility of a two-state solution, to not allow the facts on the ground, deaths on the ground, the settlements on the ground, the expropriations on the ground, to get to such an extent that this is not possible," Carney said.

He told reporters the planned move was predicated on the Palestinian Authority's commitment to reforms, including commitments to reform its governance and to hold general elections in 2026 in which Hamas "can play no part."

The announcements by some of Israel's closest allies reflect the growing international outrage over the dire humanitarian crisis in Gaza. A global hunger monitor has warned that a worst-case scenario of famine is unfolding in the enclave.

The Gaza health ministry reported seven more hunger-related deaths on Wednesday, including a two-year-old girl with an existing health condition. The Hamas-run government media office in Gaza said the Israeli military killed at least 50 people within three hours on Wednesday as they tried to get food from UN aid trucks coming into the northern Gaza Strip.

"Israel rejects the statement by the Prime Minister of Canada," said Israel's foreign ministry in a statement.

"The change in the position of the Canadian government at this time is a reward for Hamas and harms the efforts to achieve a ceasefire in Gaza and a framework for the release of the hostages."

A White House official, speaking on condition of anonymity, said “As the president stated, he would be rewarding Hamas if he recognizes a Palestinian state, and he doesn’t think they should be rewarded. So he is not going to do that. President Trump’s focus is on getting people fed (in Gaza).”

The official did not respond to a question on whether the U.S. was given advance notice of Carney's announcement.

U.S. special envoy Steve Witkoff will travel to Israel on Thursday to discuss the next steps to address the situation in Gaza, a U.S. official said. U.S. President Donald Trump said earlier this week he expects centers to be set up in order to feed more people in the enclave.

Earlier on Wednesday, the Israeli security cabinet member Zeev Elkin said Israel could threaten to annex parts of Gaza to increase pressure on Hamas, an idea that would deal a blow to Palestinian hopes of statehood on land Israel now occupies.

Accusing Hamas of trying to drag out ceasefire talks to gain Israeli concessions, Elkin told public broadcaster Kan that Israel may give the group an ultimatum to reach a deal before further expanding its military actions.

"The most painful thing for our enemy is losing lands," he said. "A clarification to Hamas that the moment they play games with us they will lose land that they will never get back would be a significant pressure tool."

Mediation efforts aimed at reaching a deal that would secure a 60-day ceasefire and the release of remaining hostages held by Hamas ground to a halt last week, with the sides trading blame for the impasse.

Though recognition of a Palestinian state is largely seen as a symbolic move, Gazan man Saed al-Akhras said he hoped it marked a "real shift in how Western countries view the Palestinian cause."

"Enough! Palestinians have lived for more than 70 years under killing, destruction, and occupation, while the world watches in silence," he said.

Families of Israeli hostages still held in Gaza appealed for no recognition of a Palestinian state to come before their loved ones were returned.

"Such recognition is not a step toward peace, but rather a clear violation of international law and a dangerous moral and political failure that legitimises horrific war crimes," the Hostages Family Forum said.

Israeli Prime Minister Benjamin Netanyahu on Tuesday said Britain's decision "rewards Hamas' monstrous terrorism." Israel made similar comments last week after France's announcement.

Two Hamas officials did not respond to requests for comment on the demand for the group to hand its weapons to the PA, which now has limited control of parts of the Israeli-occupied West Bank. Hamas has previously rejected calls to disarm, while Israel has ruled out letting the PA run Gaza.

Netanyahu said this month he wanted peace with Palestinians but described any future independent state as a potential platform to destroy Israel, so control of security must remain with Israel.

His cabinet includes far-right figures who openly demand the annexation of all Palestinian land. Finance Minister Bezalel Smotrich said on Tuesday that reestablishing Jewish settlements in Gaza was "closer than ever," calling Gaza "an inseparable part of the Land of Israel."

A 2-year-old girl being treated for a build-up of brain fluid died overnight of hunger, her father told Reuters on Wednesday.

"Mekkah, my little daughter, died of malnutrition and the lack of medication," Salah al-Gharably said by phone from Deir Al-Balah. "Doctors said the baby has to be fed a certain type of milk... but there is no milk," he said. "She starved. We stood helpless."

The deaths from starvation and malnutrition overnight raised the toll from such causes to 154, including at least 89 children, since the war's start, most in recent weeks.

Israel said on Sunday it would halt military operations for 10 hours a day in parts of Gaza and designate secure routes for convoys delivering food and medicine.

The U.N. Office for the Coordination of Humanitarian Affairs said the United Nations and its partners had been able to bring more food into Gaza in the first two days of pauses, but the volume was "still far from enough."

The war began on October 7, 2023, when Hamas attacked communities in southern Israel, killing some 1,200 people and taking another 251 hostage, according to Israeli tallies.

Since then, Israel's offensive in the Gaza Strip has killed more than 60,000 people and laid waste to much of the territory, the Gaza health ministry says.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up