Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

U.S. Challenger Job Cuts MoM (Nov)

U.S. Challenger Job Cuts MoM (Nov)A:--

F: --

P: --

U.S. Initial Jobless Claims 4-Week Avg. (SA)

U.S. Initial Jobless Claims 4-Week Avg. (SA)A:--

F: --

P: --

U.S. Weekly Initial Jobless Claims (SA)

U.S. Weekly Initial Jobless Claims (SA)A:--

F: --

P: --

U.S. Weekly Continued Jobless Claims (SA)

U.S. Weekly Continued Jobless Claims (SA)A:--

F: --

P: --

Canada Ivey PMI (SA) (Nov)

Canada Ivey PMI (SA) (Nov)A:--

F: --

P: --

Canada Ivey PMI (Not SA) (Nov)

Canada Ivey PMI (Not SA) (Nov)A:--

F: --

P: --

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)

U.S. Non-Defense Capital Durable Goods Orders Revised MoM (Excl. Aircraft) (SA) (Sept)A:--

F: --

U.S. Factory Orders MoM (Excl. Transport) (Sept)

U.S. Factory Orders MoM (Excl. Transport) (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Sept)

U.S. Factory Orders MoM (Sept)A:--

F: --

P: --

U.S. Factory Orders MoM (Excl. Defense) (Sept)

U.S. Factory Orders MoM (Excl. Defense) (Sept)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

Saudi Arabia Crude Oil Production

Saudi Arabia Crude Oil ProductionA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

Japan Foreign Exchange Reserves (Nov)

Japan Foreign Exchange Reserves (Nov)A:--

F: --

P: --

India Repo Rate

India Repo RateA:--

F: --

P: --

India Benchmark Interest Rate

India Benchmark Interest RateA:--

F: --

P: --

India Reverse Repo Rate

India Reverse Repo RateA:--

F: --

P: --

India Cash Reserve Ratio

India Cash Reserve RatioA:--

F: --

P: --

Japan Leading Indicators Prelim (Oct)

Japan Leading Indicators Prelim (Oct)A:--

F: --

P: --

U.K. Halifax House Price Index YoY (SA) (Nov)

U.K. Halifax House Price Index YoY (SA) (Nov)A:--

F: --

P: --

U.K. Halifax House Price Index MoM (SA) (Nov)

U.K. Halifax House Price Index MoM (SA) (Nov)A:--

F: --

P: --

France Current Account (Not SA) (Oct)

France Current Account (Not SA) (Oct)A:--

F: --

P: --

France Trade Balance (SA) (Oct)

France Trade Balance (SA) (Oct)A:--

F: --

P: --

France Industrial Output MoM (SA) (Oct)

France Industrial Output MoM (SA) (Oct)A:--

F: --

P: --

Italy Retail Sales MoM (SA) (Oct)

Italy Retail Sales MoM (SA) (Oct)A:--

F: --

P: --

Euro Zone Employment YoY (SA) (Q3)

Euro Zone Employment YoY (SA) (Q3)A:--

F: --

P: --

Euro Zone GDP Final YoY (Q3)

Euro Zone GDP Final YoY (Q3)A:--

F: --

P: --

Euro Zone GDP Final QoQ (Q3)

Euro Zone GDP Final QoQ (Q3)A:--

F: --

P: --

Euro Zone Employment Final QoQ (SA) (Q3)

Euro Zone Employment Final QoQ (SA) (Q3)A:--

F: --

P: --

Euro Zone Employment Final (SA) (Q3)

Euro Zone Employment Final (SA) (Q3)A:--

F: --

Brazil PPI MoM (Oct)

Brazil PPI MoM (Oct)--

F: --

P: --

Mexico Consumer Confidence Index (Nov)

Mexico Consumer Confidence Index (Nov)--

F: --

P: --

Canada Unemployment Rate (SA) (Nov)

Canada Unemployment Rate (SA) (Nov)--

F: --

P: --

Canada Labor Force Participation Rate (SA) (Nov)

Canada Labor Force Participation Rate (SA) (Nov)--

F: --

P: --

Canada Employment (SA) (Nov)

Canada Employment (SA) (Nov)--

F: --

P: --

Canada Part-Time Employment (SA) (Nov)

Canada Part-Time Employment (SA) (Nov)--

F: --

P: --

Canada Full-time Employment (SA) (Nov)

Canada Full-time Employment (SA) (Nov)--

F: --

P: --

U.S. Personal Income MoM (Sept)

U.S. Personal Income MoM (Sept)--

F: --

P: --

U.S. Dallas Fed PCE Price Index YoY (Sept)

U.S. Dallas Fed PCE Price Index YoY (Sept)--

F: --

P: --

U.S. PCE Price Index YoY (SA) (Sept)

U.S. PCE Price Index YoY (SA) (Sept)--

F: --

P: --

U.S. PCE Price Index MoM (Sept)

U.S. PCE Price Index MoM (Sept)--

F: --

P: --

U.S. Personal Outlays MoM (SA) (Sept)

U.S. Personal Outlays MoM (SA) (Sept)--

F: --

P: --

U.S. Core PCE Price Index MoM (Sept)

U.S. Core PCE Price Index MoM (Sept)--

F: --

P: --

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)

U.S. UMich 5-Year-Ahead Inflation Expectations Prelim YoY (Dec)--

F: --

P: --

U.S. Core PCE Price Index YoY (Sept)

U.S. Core PCE Price Index YoY (Sept)--

F: --

P: --

U.S. Real Personal Consumption Expenditures MoM (Sept)

U.S. Real Personal Consumption Expenditures MoM (Sept)--

F: --

P: --

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)

U.S. 5-10 Year-Ahead Inflation Expectations (Dec)--

F: --

P: --

U.S. UMich Current Economic Conditions Index Prelim (Dec)

U.S. UMich Current Economic Conditions Index Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Sentiment Index Prelim (Dec)

U.S. UMich Consumer Sentiment Index Prelim (Dec)--

F: --

P: --

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)

U.S. UMich 1-Year-Ahead Inflation Expectations Prelim (Dec)--

F: --

P: --

U.S. UMich Consumer Expectations Index Prelim (Dec)

U.S. UMich Consumer Expectations Index Prelim (Dec)--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Consumer Credit (SA) (Oct)

U.S. Consumer Credit (SA) (Oct)--

F: --

P: --

China, Mainland Foreign Exchange Reserves (Nov)

China, Mainland Foreign Exchange Reserves (Nov)--

F: --

P: --

China, Mainland Exports YoY (USD) (Nov)

China, Mainland Exports YoY (USD) (Nov)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

A tougher-than-expected consumer inflation report followed a surprisingly soft producer price report. This divergence clearly reflects the price volatility facing the economy and the complexity of assessing the central bank’s next steps.

A tougher-than-expected consumer inflation report followed a surprisingly soft producer price report. This divergence clearly reflects the price volatility facing the economy and the complexity of assessing the central bank’s next steps.

The consumer price index rose 0.4% last month, the highest since January and more than the expected 0.3%. A day earlier, average forecasts were 0.4 percentage points higher than the actual producer price figures, showing a decline instead of the expected 0.3% growth. The annual rate of consumer price growth accelerated to 2.9% overall and remained at 3.1% in the core index, which excludes food and energy.

In this context, today’s CPI estimates appear to be well within expectations. After the initial surge in the dollar, driven by high-frequency robots processing headlines, the market nevertheless moved towards selling the USD, based on the assumption that PPI dynamics would soon shift to CPI, i.e. that inflation would slow down. At the very least, today’s data does not overshadow the importance of the weak labour market indicators we learned about last Friday.

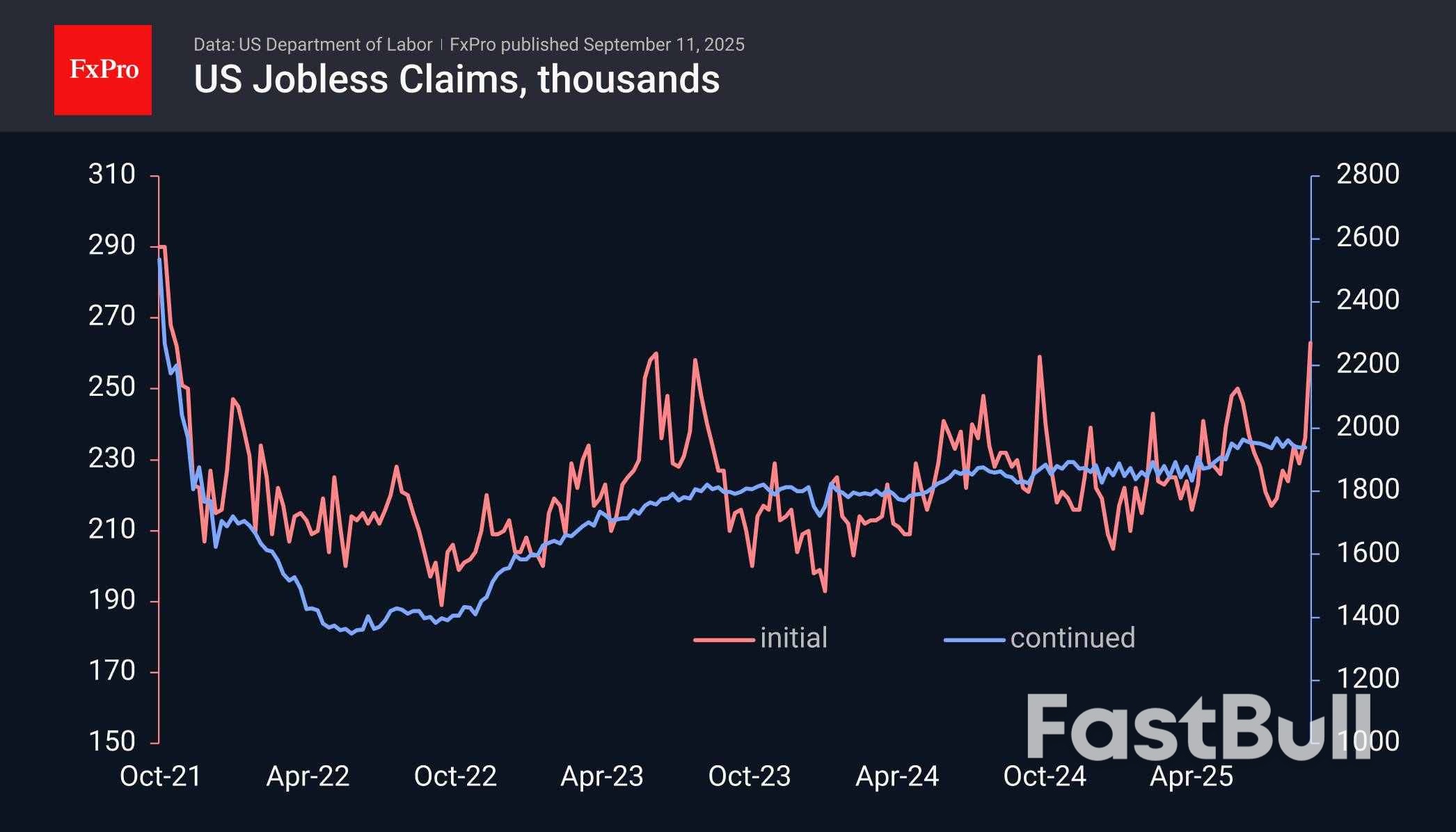

Another worrying labour market indicator is the surge in weekly jobless claims to 263,000, the highest in almost four years. Such data will likely finally switch the Fed into a mode of consistent rate cuts in an attempt to keep the economy from falling into recession. This is bad news for the dollar, but at this stage, it is quite good for stocks, as there have been no signs of a noticeable decline in consumption so far, only caution due to tariff uncertainty.

Singapore's reputation as a safe harbor for wealthy mainland Chinese families is fading, reversing an inflow that came at the expense of rival wealth hubs like Hong Kong and Japan. Its allure for China's wealthy surged after 2019, when a wave of pro-democracy protests in Hong Kong led to a clampdown by Beijing and the introduction of a national security law the next year. These events pushed mainland Chinese families in Hong Kong to seek distance from Beijing's grip.

Political stability, a favorable family-office regime, independent courts, and Mandarin fluency made Singapore a natural draw for China's super-rich. In the wake of a 3 billion Singapore dollar ($2.3 billion) money-laundering scandal in 2023 — dubbed the "Fujian case" where the culprits hailed from — Singapore's regulators and banks embarked on an aggressive clean-up, tightening rules and re-screening of wealthy clients. "When the Fujian news broke, a lot of these wealthy Chinese left. So literally, almost all … they go to Hong Kong, the Middle East, Japan," said Ryan Lin, a director at Bayfront Law in Singapore .

That departure has accelerated since then. Multiple layers of checks Lin, who vets and processes applications from wealthy Chinese individuals seeking to establish family offices or reside in Singapore, fielded 50% fewer applications from mainland clients now compared to 2022, especially as compliance checks and other new regulations come into force. From their point of view, [wealthy mainland clients] are thinking: Do I really need to declare my illegitimate son just because I want to manage wealth in Singapore? director at Bayfront Law Ryan Lin The Monetary Authority of Singapore's (MAS) push to strengthen compliance, particularly around crypto, has further chilled interest , especially for those who found wealth in this specific space.

In 2025, Singapore introduced regulations requiring platforms operating in Singapore offering products such as cryptocurrencies, stablecoins or tokenized equities, to customers outside the city-state, to be licensed. Singapore's central bank signaled approvals would be rare, while imposing steep compliance costs, including a SG$250,000 minimum capital requirement alongside strict anti-money laundering, technology risk, and conduct rules. Crypto firms offering services to customers within Singapore are already regulated under existing laws. "So for this year, those who are in the crypto space particularly, they have all gone because of this particular legislation by the MAS," Lin said. "It's already very hard to apply for a license in Singapore, and then you come out with another legislation targeting even services to people outside Singapore.

So all of them left." "I still think [the exodus] is very driven by regulations. So as the regulations become stricter, these Chinese just say: forget it. My patience is gone," he added. In response to CNBC's query, Singapore's MAS said that the money laundering case has not changed its position on regulatory standards. "Singapore welcomes legitimate wealth. MAS is working with financial institutions in Singapore to improve our practices so that they are sound, effective and efficient," said an MAS spokesperson. The fallout from Singapore's money-laundering scandal and high-profile crypto failures like Three Arrows Capital and FTX triggered an aggressive compliance push in 2024, according to Iris Xu, founder of corporate services firm Jenga, whose clients are wealthy mainland Chinese in Singapore. Banks and financial institutions undertook sweeping "clean-ups" — redoing know-your-customer (KYC) checks, re-screening family office applications, and in some cases closing accounts altogether. That left many wealthy Chinese clients in limbo, unable to access or open new accounts.

"After the whole year, it destroyed some of the clients' patience and confidence. "If you don't give them accounts, where are they going to do business?" Xu said, noting that frustrated clients began moving funds to Japan, Hong Kong and Dubai instead. The barriers go beyond finance. Applicants for permanent residence and family offices must undergo extensive background checks, including disclosures about their family and dependents — requirements they see as invasive, said Lin. "From their point of view, they're thinking: Do I really need to declare my illegitimate son just because I want to manage wealth in Singapore?" he told CNBC. Is Singapore losing its wealth hub status?

According to Henley & Partners, an advisory firm that helps wealthy clients to obtain residency through investments, Singapore is set to see a sharp slowdown in wealth migration in 2025, with a projected net inflow of 1,600 millionaires — less than half the 3,500 expected in 2024 . Carman Chan, founder of Click Ventures, a single-family office, similarly noted that many of her family office peers who set up businesses in Singapore are relocating back to Hong Kong. Chan, whose single-family office has a presence in both locations, cited challenges like longer KYC screenings and hiring quotas for the wealthy to run a family office in Singapore. Family offices in the city-state that want to qualify for tax exemption schemes must hire a minimum number of investment professionals in Singapore, who must have taxable income in the country.

For small outfits, this requirement can feel like a near one-to-one ratio of local to foreign staff, since a two-person office must already include a local hire. "If they don't have enough locals, that's also a bottleneck because you can't just fly people from outside and relocate them to Singapore," Chan said. Coupled with tougher compliance checks, Chan noted that some KYC approvals took over a year, prompting some investors to shift operations elsewhere. Comparatively, it reportedly takes about two to six months in Dubai's International Financial Centre . For Hong Kong, securing residency or a work visa for family office professionals is usually uncomplicated, relative to Singapore, according to advisory firm Acclime . When they lived in Hong Kong before, they might be partying at four or five in the morning with friends. And they like that lifestyle. Partner at Pandan Investments Christopher Aw "It's a long queue, and that's why some people actually relocate back to Hong Kong," she added. This year, Hong Kong rolled out additional measures like tax incentives to attract wealthy individuals and institutions.

For one, Hong Kong has lowered the barriers for wealthy people to qualify for residency through investment after revamping its Capital Investment Entrant Scheme earlier this year. Instead of proving they've held 30 million Hong Kong dollars in assets for two years, applicants now only need six months, and they can count family-held wealth or invest via family-owned companies. "I was quite surprised, because I think a lot of these wealthy Chinese have very short memories. They forgot why they came to Singapore in the first place," Bayfront Law's Lin said. Beyond regulations, softer factors like lifestyle differences play a role, especially for the younger rich. "When they lived in Hong Kong before, they might be partying at four or five in the morning with friends. And they like that lifestyle," said Christopher Aw, a partner at Pandan Investments who also noted that several wealthy Chinese peers in Singapore have relocated to Dubai or Hong Kong.

Dominic Volek, group head at Henley & Partners, frames the trend as one of rebalancing and hedging jurisdictional exposure. "Rising regulatory scrutiny, tightening compliance regimes, and social shifts may contribute to their desire for greater privacy and flexibility elsewhere," he said. Singapore has been a "booming" hub, but now "it's cooling down, cleaning up, cooling down," Jenga's Xu said. "The past few years have definitely been a good time for Singapore, and having some corrections now is normal," she added.

U.S. Secretary of State Marco Rubio on Thursday said the United States would respond, without specifying how, after former Brazilian President Jair Bolsonaro was convicted of plotting a coup to remain in power after losing the 2022 election.

"The political persecutions by sanctioned human rights abuser Alexandre de Moraes continue, as he and others on Brazil's supreme court have unjustly ruled to imprison former President Jair Bolsonaro," Rubio wrote on X.

"The United States will respond accordingly to this witch hunt," he said.

Brazil's Foreign Ministry called Rubio's comment a threat that "attacks Brazilian authority and ignores the facts and the compelling evidence in the records." The ministry said Brazilian democracy would not be intimidated by the United States.

Bolsonaro, who had close ties to U.S. President Donald Trump during his first term in the White House, became the first former president in Brazilian history to be convicted for attacking democracy after a majority of five justices on Brazil's Supreme Court voted to convict him on Thursday. He was sentenced to 27 years and three months in prison.

"Well, I watched that trial. I know him pretty well--foreign leader. I thought he was a good president of Brazil, and it's very surprising that could happen very much like they tried to do with me, but they didn't get away with it at all," Trump told reporters when asked about Bolsonaro being found guilty and if that means additional sanctions.

"But I can always say this: I knew him as president of Brazil. He was a good man, and I don't see that happening."

Trump, who also faced a variety of criminal charges and ultimately became the first former U.S. president convicted of a crime last year, has criticized the Brazilian judicial system and threatened tariffs on the South American country for its persecution of Bolsonaro.

In July, he imposed 50% tariffs on most Brazilian goods to fight what he has called a "witch hunt" against Bolsonaro. He later exempted some Brazilian exports, including passenger vehicles and a large number of parts and components used in civil aircraft.

That same month, the U.S. Treasury Department sanctioned Brazilian Supreme Court Justice Alexandre de Moraes, who presided over Bolsonaro's criminal case, accusing him of authorizing arbitrary pre-trial detentions and suppressing freedom of expression.

Prime Minister Keir Starmer faces a further challenge to his authority after Labour lawmakers put a former cabinet minister he sacked on the ballot in the party’s deputy leadership election.

Lucy Powell, a minister who lost her job in last week’s government reshuffle, joins Education Secretary Bridget Phillipson in the final two for the post, which is vacant following the resignation of its previous holder, Angela Rayner, in a tax scandal.

The contest for the key party role comes at a dangerous time for Starmer, whose judgment and leadership is facing questions after the loss of two high profile members of his administration in two weeks.

In addition to Rayner’s departure, Starmer was also forced to sack his ambassador to the US, Peter Mandelson, on Wednesday following a Bloomberg News investigation into his links to disgraced financier Jeffrey Epstein.

Powell will be viewed as the candidate who would challenge Starmer’s administration from the political left on policy areas from public spending, welfare and the conflict in Gaza. She is also seen as an outrider for Andy Burnham, the Greater Manchester mayor who some consider a potential future leadership contender. Phillipson is seen as 10 Downing Street’s preferred candidate.

Labour party members will vote for their preferred choice next month. The winner will be announced Oct. 25.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up