Markets

News

Analysis

User

24/7

Economic Calendar

Education

Data

- Names

- Latest

- Prev

Signal Accounts for Members

All Signal Accounts

All Contests

Japan Industrial Inventory MoM (Nov)

Japan Industrial Inventory MoM (Nov)A:--

F: --

P: --

Japan Retail Sales (Nov)

Japan Retail Sales (Nov)A:--

F: --

P: --

Japan Retail Sales YoY (Nov)

Japan Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Retail Sales YoY (Nov)

Russia Retail Sales YoY (Nov)A:--

F: --

P: --

Russia Unemployment Rate (Nov)

Russia Unemployment Rate (Nov)A:--

F: --

P: --

Argentina Retail Sales YoY (Oct)

Argentina Retail Sales YoY (Oct)A:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central Banks--

F: --

P: --

China, Mainland Industrial Profit YoY (YTD) (Nov)

China, Mainland Industrial Profit YoY (YTD) (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)--

F: --

P: --

US President Trump delivered a speech

US President Trump delivered a speech Russia IHS Markit Manufacturing PMI (Dec)

Russia IHS Markit Manufacturing PMI (Dec)A:--

F: --

P: --

India Manufacturing Output MoM (Nov)

India Manufacturing Output MoM (Nov)A:--

F: --

P: --

India Industrial Production Index YoY (Nov)

India Industrial Production Index YoY (Nov)A:--

F: --

P: --

France Unemployment Class-A (Nov)

France Unemployment Class-A (Nov)A:--

F: --

P: --

Canada National Economic Confidence Index

Canada National Economic Confidence IndexA:--

F: --

P: --

U.S. Pending Home Sales Index (Nov)

U.S. Pending Home Sales Index (Nov)A:--

F: --

U.S. Pending Home Sales Index MoM (SA) (Nov)

U.S. Pending Home Sales Index MoM (SA) (Nov)A:--

F: --

U.S. Pending Home Sales Index YoY (Nov)

U.S. Pending Home Sales Index YoY (Nov)A:--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks Change--

F: --

P: --

U.S. Dallas Fed General Business Activity Index (Dec)

U.S. Dallas Fed General Business Activity Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks Change--

F: --

P: --

U.S. Dallas Fed New Orders Index (Dec)

U.S. Dallas Fed New Orders Index (Dec)A:--

F: --

P: --

U.S. EIA Weekly Natural Gas Stocks Change

U.S. EIA Weekly Natural Gas Stocks ChangeA:--

F: --

P: --

U.S. Weekly Treasuries Held by Foreign Central Banks

U.S. Weekly Treasuries Held by Foreign Central BanksA:--

F: --

P: --

U.S. EIA Weekly Crude Stocks Change

U.S. EIA Weekly Crude Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Crude Demand Projected by Production

U.S. EIA Weekly Crude Demand Projected by Production--

F: --

P: --

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks Change

U.S. EIA Weekly Cushing, Oklahoma Crude Oil Stocks ChangeA:--

F: --

P: --

U.S. EIA Weekly Gasoline Stocks Change

U.S. EIA Weekly Gasoline Stocks ChangeA:--

F: --

P: --

South Korea Industrial Output MoM (SA) (Nov)

South Korea Industrial Output MoM (SA) (Nov)--

F: --

P: --

South Korea Retail Sales MoM (Nov)

South Korea Retail Sales MoM (Nov)--

F: --

P: --

South Korea Services Output MoM (Nov)

South Korea Services Output MoM (Nov)--

F: --

P: --

Russia IHS Markit Services PMI (Dec)

Russia IHS Markit Services PMI (Dec)--

F: --

P: --

Turkey Economic Sentiment Indicator (Dec)

Turkey Economic Sentiment Indicator (Dec)--

F: --

P: --

Euro Zone Total Reserve Assets (Nov)

Euro Zone Total Reserve Assets (Nov)--

F: --

P: --

Brazil Unemployment Rate (Nov)

Brazil Unemployment Rate (Nov)--

F: --

P: --

U.S. Weekly Redbook Index YoY

U.S. Weekly Redbook Index YoY--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index YoY (Oct)

U.S. S&P/CS 10-City Home Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 10-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (Not SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index YoY (Oct)

U.S. FHFA House Price Index YoY (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)

U.S. S&P/CS 20-City Home Price Index YoY (Not SA) (Oct)--

F: --

P: --

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)

U.S. S&P/CS 20-City Home Price Index MoM (SA) (Oct)--

F: --

P: --

U.S. FHFA House Price Index MoM (Oct)

U.S. FHFA House Price Index MoM (Oct)--

F: --

P: --

U.S. FHFA House Price Index (Oct)

U.S. FHFA House Price Index (Oct)--

F: --

P: --

U.S. Chicago PMI (Dec)

U.S. Chicago PMI (Dec)--

F: --

P: --

Brazil CAGED Net Payroll Jobs (Nov)

Brazil CAGED Net Payroll Jobs (Nov)--

F: --

P: --

U.S. Weekly Total Oil Rig Count

U.S. Weekly Total Oil Rig Count--

F: --

P: --

U.S. Weekly Total Rig Count

U.S. Weekly Total Rig Count--

F: --

P: --

FOMC Meeting Minutes

FOMC Meeting Minutes U.S. API Weekly Refined Oil Stocks

U.S. API Weekly Refined Oil Stocks--

F: --

P: --

U.S. API Weekly Crude Oil Stocks

U.S. API Weekly Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Cushing Crude Oil Stocks

U.S. API Weekly Cushing Crude Oil Stocks--

F: --

P: --

U.S. API Weekly Gasoline Stocks

U.S. API Weekly Gasoline Stocks--

F: --

P: --

South Korea CPI YoY (Dec)

South Korea CPI YoY (Dec)--

F: --

P: --

No matching data

Latest Views

Latest Views

Trending Topics

Top Columnists

Latest Update

White Label

Data API

Web Plug-ins

Affiliate Program

View All

No data

Ukraine attempted to attack Russian President Vladimir Putin's state residence in the Novgorod region using 91 drones, according to Russian Foreign Minister Sergei Lavrov.

Ukraine attempted to attack Russian President Vladimir Putin's state residence in the Novgorod region using 91 drones, according to Russian Foreign Minister Sergei Lavrov.

All drones were destroyed during the attack, Lavrov said, as reported by Russian news agencies TASS and Interfax on Monday.

Following the incident, Lavrov stated that Russia will retaliate, with targets and timing for a counterstrike already determined. Despite the attack, Russia plans to continue negotiations with U.S. and others, but will change its negotiating position.

The Russian foreign minister did not provide specific details about the planned countermeasures.

President Trump on Friday in a radio interview disclosed something which missed the attention of the US and global media. He let slip that a large land site had been knocked out by a strike from US forces in the Caribbean - however without specifying which country was hit (whether Venezuela or perhaps Colombia).

Trump may have actually assumed the attack which he disclosed publicly for the first time was already being reported on, but it had not. He was being interviewed by John Catsimatidis, the Republican billionaire who owns the WABC radio station in New York on his The Cats & Cosby Show, and the two were talking about the Venezuela campaign.

Illustrative: Venezuela coast, Wiki Commons

Illustrative: Venezuela coast, Wiki CommonsThe United States had knocked out "a big facility" last week, Trump described somewhat vaguely, in apparent reference to a drug facility on the Latin American coast.

"They have a big plant or a big facility where the ships come from," Trump said, though he did not explicitly identify the exact location or even country attacked. "Two nights ago we knocked that out."

"But every time I knock out a boat, we save 25,000 American lives. It's very simple. And what's happening is they're having a hard time employment-wise, they can't get anybody.

And we just talked out, I don't know if you read or you saw, they [Venezuela] have a big plant or a big facility where the ships come from. Two nights ago, we knocked that out. So we hit them very hard. But drugs are down over 97 percent. Can you believe it?"

Some unnamed American officials suggested to the New York Times that the Commander-in-Chief was referring to a drug facility in Venezuela:

Trump did not name the location of the facility, though American officials told the New York Times that the president was referring to a drug facility in Venezuela that was eliminated. The president's comment is the only report of such an attack. No other Latin American government, including Venezuela, has disclosed a strike of this sort.

But information or confirmation other than that disclosure remains a mystery, as neither the CIA nor Pentagon have commented, as the NY Times notes:

If Mr. Trump's suggestion that the United States had struck a site in the region proves accurate, it would be the first known attack on land since he began his military campaign against Venezuela. U.S. officials declined to specify anything about the site the president said was hit, where it was located, how the attack was carried out or what role the facility played in drug trafficking. There has been no public report of an attack from the Venezuelan government or any other authorities in the region.

Speculation has quickly begun in an effort to identify which facility was hit and what damage was done. Some analysts have highlighted the below explosion reported by local Venezuelans, given the timing fits (Wednesday, Dec. 24).

The local reporter's commentary reads according to (machine) translation, A new large explosion was reported from the Industrial Zone of the San Francisco municipality, Zulia state, in the early morning of this December 24.

This is in Venezuela's second largest city, in the northwest corner of the country, and near the coast.

If the Pentagon did indeed take out a "large facility" on land, as Trump's words indicate, it suggests the US may not initiate a major war in quick 'shock and awe' style, but will opt for sporadic strikes which limit military action to specified targets. So the 'war' might be a slow burn after all - which also means the Pentagon force build-up in the Caribbean is there to stay for a while.

Russia has begun to wind down its provocations in eastern Europe to avoid escalating tensions with NATO, said a top intelligence official from one of the alliance's frontline members which has frequently raised the alarm about threats from Moscow.

"What we're still seeing today is that Russia currently has no intention of attacking any of the Baltic states or NATO more broadly," Estonian foreign intelligence chief Kaupo Rosin told the country's public broadcaster in an interview.

Rosin's words strike a different tone amid more serious warnings from western officials about Russian President Vladimir Putin's intentions. NATO Secretary General Mark Rutte said earlier this month that the alliance must prepare itself to fend off a Russian assault in the next five years, calling on Europeans to recall the scale of destruction caused by World War II.

Rosin said his agency's analysis also shows Russia is not specifically planning a military confrontation with the Baltic countries of Estonia, Latvia and Lithuania. However, he stressed the need for continued vigilance.

"So far, it's still clear that Russia respects NATO and is currently trying to avoid any open conflict," he said.

Earlier this month, Putin said that Russia was "ready for war" if Europe launched an attack, but stressed that Moscow was not planning any such conflict.

Tensions on Europe's eastern flank surged following Russia's full-scale invasion of Ukraine in 2022, prompting governments across the region to ramp up defense spending. The three Baltic nations and Poland, which share borders with Russia and Kremlin-ally Belarus and are staunch supporters of Kyiv, have born the brunt of incursions by Russian military jets and drones.

Russian fighter jets violated Estonian airspace for 12 minutes earlier this year, prompting the Baltic nation to call for an emergency meeting of the alliance.

But Rosin said Moscow has taken a more cautious approach as a result of NATO's forceful response to several such incidents. Russian jets and drones have become more careful with their flight paths over Ukraine and the Baltic Sea, Rosin said.

Eastern European NATO members also face an increasing number of acts of arson, cyberattacks and sabotage, which recently included attempted damage to a key rail line linking Poland to Ukraine. Officials have blamed the Russian intelligence services for those incidents, an accusation which Moscow has dismissed as hysteria.

In the interview, Rosin criticized the widespread description of those incidents as "hybrid attacks." He described that term as an unhelpful euphemism which "softens reality and gives an overly innocent impression of what's actually happening."

"We should call things by their proper names. If it's sabotage, then it's sabotage," said the Baltic nation's intelligence chief.

Rosin also said he believes Western sanctions on Russia — particularly those targeting oil exports and access to financial markets — are starting to pressure Moscow just as US President Donald Trump continues attempts to broker peace in Ukraine.

"Russia is facing more and more problems," Rosin said. "It's not going to collapse in the next few months or even within six months to a year, but the pressure is beginning to take a toll."

U.S. President Donald Trump said on Sunday that he and Ukrainian President Volodymyr Zelenskiy were "getting a lot closer, maybe very close" to an agreement to end the war in Ukraine, while acknowledging that the fate of the Donbas region remains a key unresolved issue.

The two leaders spoke at a joint news conference after meeting at Trump's Mar-a-Lago resort in Florida on Sunday afternoon. Both leaders reported progress on two of the most contentious issues in peace talks - security guarantees for Ukraine and the division of eastern Ukraine's Donbas region that Russia has sought to capture.

Both Trump and Zelenskiy offered few details and did not provide a deadline for completing a peace deal, although Trump said it will be clear "in a few weeks" whether negotiations to end the war will succeed. He said a few "thorny issues" around territory must be resolved.

Zelenskiy said an agreement on security guarantees for Ukraine has been reached. Trump was slightly more cautious, saying that they were 95% of the way to such an agreement, and that he expected European countries to "take over a big part" of that effort with U.S. backing.

French President Emmanuel Macron, in an X post published after Trump met with Zelenskiy, said progress was made on security guarantees. Macron said countries in the so-called "Coalition of the Willing" would meet in Paris in early January to finalise their "concrete contributions."

Zelenskiy has said previously that he hopes to soften a U.S. proposal for Ukrainian forces to withdraw completely from Donbas, a Russian demand that would mean ceding some territory held by Ukrainian forces. While Moscow insists on getting all of Donbas, Kyiv wants the map frozen at current battle lines.

Both Trump and Zelenskiy said on Sunday the future of the Donbas had not been settled, though the U.S. president said discussions are "moving in the right direction." The United States, seeking a compromise, has proposed a free economic zone if Ukraine leaves the area, although it remains unclear how that zone would function in practical terms.

"It's unresolved, but it's getting a lot closer. That's a very tough issue," Trump said.

Nor did the leaders offer much insight into what agreements they had reached on providing security for Ukraine after the war ends, something Zelenskiy described Sunday as "the key milestone in achieving a lasting peace."

Russia has said any foreign troop deployment in Ukraine is unacceptable.

Zelenskiy said any peace agreement would have to be approved by Ukraine's parliament, or by a referendum. Trump said he would be willing to speak to parliament if that would secure the deal.

Shortly before Zelenskiy and his delegation arrived at Trump's Florida residence, Trump and Russian President Vladimir Putin spoke in a call described as "productive" by the U.S. president and "friendly" by Kremlin foreign policy aide Yuri Ushakov.

Ushakov, in Moscow, said Putin told Trump a 60-day ceasefire proposed by the European Union and Ukraine would prolong the war. The Kremlin aide also said Ukraine needs to make a decision regarding the Donbas "without further delay."

Trump said he and Putin spoke for more than two hours. He said the Russian president pledged to help rebuild Ukraine, including by supplying cheap energy. "Russia wants to see Ukraine succeed," Trump said. "It sounds a little strange."

As Trump praised Putin, Zelenskiy tilted his head and smiled.

Trump said he would call Putin again following the meeting with Zelenskiy.

The Kremlin expressed support for Trump's negotiations.

"The whole world appreciates President Trump and his team's peace efforts," Kirill Dmitriev, Putin's special envoy, posted on X early on Monday after Trump's talks with Zelenskiy.

U.S. negotiators have also proposed shared control over the Zaporizhzhia nuclear plant. Power line repairs have begun there after another local ceasefire brokered by the International Atomic Energy Agency, the agency said on Sunday.

Negotiators, Trump said, have made progress on deciding the fate of the plant, which can "start up almost immediately." The U.S. president said "it's a big step" that Russia had not bombed the facility.

Russia controls all of Crimea, which it annexed in 2014, and since its invasion of Ukraine nearly four years ago has taken control of about 12% of its territory, including about 90% of the Donbas, 75% of the Zaporizhzhia and Kherson regions, and slivers of the Kharkiv, Sumy, Mykolaiv and Dnipropetrovsk regions, according to Russian estimates.

The day before Zelenskiy arrived in Florida to meet with Trump, Russian forces attacked Kyiv and other parts of Ukraine with hundreds of missiles and drones, knocking out power and heat in parts of the Ukrainian capital. Zelenskiy has described the weekend attacks as Russia's response to the U.S.-brokered peace efforts, but Trump on Sunday said he believes Putin and Zelenskiy are serious about peace.

After Saturday's air attacks, Putin said Moscow would continue waging its war if Kyiv did not seek a quick peace. Russia has steadily advanced on the battlefield in recent months, claiming control over several more settlements on Sunday.

European heads of state joined at least part of Sunday's meeting by phone. European Commission President Ursula von der Leyen said on social media site X that "Europe is ready to keep working with Ukraine and our US partners," and added that having ironclad security guarantees will be of "paramount" importance.

A spokesman for U.K. Prime Minister Keir Starmer said European leaders "underlined the importance of robust security guarantees and reaffirmed the urgency of ending this barbaric war as soon as possible."

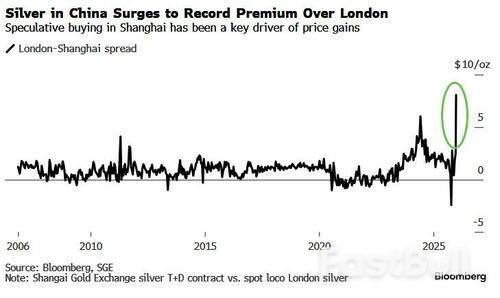

Silver tumbled dramatically overnight after initially smashing through $80 an ounce for the first time (topping $84 at its highs), halting a near vertical recent rise driven by Chinese speculative demand.

Surging Chinese investment demand has pulled the metal higher, with premiums for spot silver in Shanghai rising above $8 an ounce over London prices, the biggest spread on record...

As Bloomberg reports, the blistering rally has provoked extreme measures in China's investment landscape, with the country's only pure-play silver fund turning away new customers after its repeated risk warnings went unheeded.

The fund's manager announced the unusual step Friday after multiple actions - from tighter trading rules to cautionary advice about "unsustainable" gains - failed to quell an eruption of interest fueled by social media.

However, Goldman Sachs Asia trading desk noted 'no smoking gun' for the reversal:

While there are only 3 days ahead of New Year, China commodities remain volatile. Silver surged 9.25% by lunch break and people are asking what factors investors are pricing for silver.

However, risk off in the afternoon without smoking gun. Precious had significant correction.

Palladium and platinum both ended at limit down and silver's early gain was almost wiped out and ended +0.51% only while gold lost 0.91%.

Open interest across the 4 precious metal contract all declined.

Although they do point out that GFEX tightened measure to curb excessive trading of palladium and platinum a few days ago and investors were leaving the market and prices corrected notably today.

Bloomberg macro strategist Adam Linton agrees with Goldman on 'no smoking gun', but...

"While there was no clear driver for the silver pullback, the low levels of liquidity and silver's parabolic rise means that it is vulnerable to a snap back.

Macro drivers and liquidity remain light, meaning that such erratic price action in the metals space could be a feature of trade for what is left of 2025."

The Chinese measures are effectively a rollover of previous policies and were first announced by the Ministry of Commerce on Oct. 30.

Although the country ranks among the top three global producers of silver - largely as a byproduct of industrial metals - it's also the world's largest consumer and therefore not a major exporter.

"The speculative atmosphere is very strong," said Wang Yanqing, an analyst with China Futures Ltd.

"There's hype around tight spot supply, and it's a bit extreme now."

Additionally, as we warned previously, some exchanges are moving to rein in risk.

The margins for some Comex silver futures contracts will be raised from Monday, according to a statement from CME - a move that Wang said would help reduce speculation.

Arguably, silver's rapid ascent needed a breather - perhaps this is it.

PFR ExtremeHurst, a model for spotting herd behavior that generates a self-reinforcing frenzy, has triggered a top exhaustion signal on silver, echoing a similar alert on gold that preceded its 11% correction in October.

Some attributed the sudden downward shift to comments during the weekend from Elon Musk, who highlighted the growing investor frenzy around precious metals, replying to a tweet on Chinese export restrictions by saying on X:

"This is not good. Silver is needed in many industrial processes."

For now, the decline is stable and hardly indicative of a herd rushing for the exits. But a thin liquidity holiday-shortened week could exacerbate any moves.

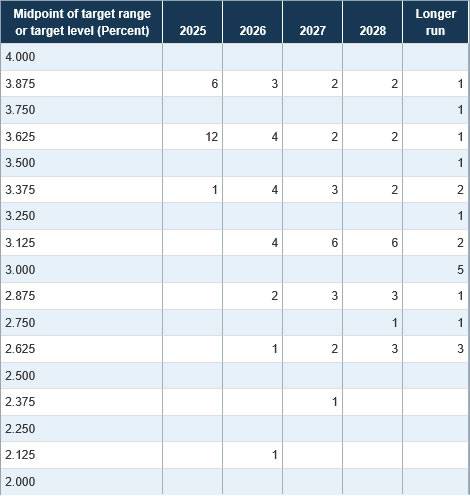

There is little on the economic calendar for the final week of the year, leaving Fed minutes from the December meeting as the lone focal point for markets during the New Year holiday stretch. The minutes are expected to shed light on the internal debate that produced a rare three-way split. Chicago Fed President Austan Goolsbee and Kansas City Fed President Jeffrey Schmid both voted to hold rates steady. At the opposite extreme, ultra-dove Governor Stephen Miran dissented in favor of a larger 50bp cut. The remaining policymakers backed the consensus move, delivering a 25bp reduction that lowered the target range to 3.50–3.75%.

The accompanying statement tweak was just as important as the vote itself. By implying a higher hurdle for additional cuts, the Fed effectively endorsed market pricing for a January hold, even as longer-term expectations remain unsettled. That uncertainty is evident in futures markets, where odds of a March cut hover around 50%.+

Meanwhile, the dot plot exposed just how divided the committee remains. Excluding Miran, policymakers were almost evenly split, with four projecting one cut in 2025 and seven seeing no cuts at all—including scenarios involving renewed tightening. At the same time, seven officials penciled in two or more cuts in 2026. This wide dispersion suggests it will take a meaningful shift in data to pull expectations decisively away from the median one-cut outlook.

With that backdrop, it is premature to draw firm conclusions, at least not before the December non-farm payrolls report on January 9, which is likely to be the next genuine catalyst for repricing Fed expectations.

Attention is also firmly on geopolitics. US President Donald Trump said talks with Ukrainian President Volodymyr Zelenskyy were "getting very close" to a peace agreement, though he acknowledged major unresolved issues, including the fate of the Donbas region. Security guarantees also remain another sticking point. Zelenskyy said agreement had been reached in principle, while Trump was more cautious, suggesting Europe would need to shoulder much of the responsibility with US backing. Zelenskyy later said he had requested security guarantees lasting up to 50 years and that any peace deal should be put to a referendum during a 60-day ceasefire.

In the currency markets, Yen is leading gains for the day so far, followed by Dollar and Euro. While Kiwi, Aussie, and Loonie lag, and Sterling and Swiss Franc trade near the middle of the pack.

In Europe, at the time of writing, FTSE is down -0.01%. DAX is down -0.10%. CAC is up 0.09%. UK 10-year yield is down -0.09 at 4.495. Germany 10-year yield is down -0.021 at 2.845. Earlier in Asia, Nikkei fell -0.44%. Hong Kong HSI fell -0.71%. Chian Shanghai SSE rose 0.04%. Singapore Strait Times fell -0.05%. Japan 10-year JGB yield rose 0.017 to 2.058.

The latest Summary of Opinions from the BoJ's December 18–19 meeting reinforced a clear tightening bias, with many policymakers arguing that the December rate hike should not mark the end of the cycle.

One opinion noted there was "still considerable distance" to neutral levels, explicitly calling for rate hikes at "intervals of a few months". Another linked Yen weakness and rising long-term yields partly to the policy rate being too low relative to inflation, suggesting delayed normalization risks exacerbating financial distortions.

Inflation concerns featured prominently throughout the discussion. Several members described recent price pressures as "sticky". One opinion highlighted spring wage negotiations as a key test, arguing that a third consecutive year of target-consistent wage growth would confirm underlying inflation has reached 2%.

Still, not all voices favored an aggressive path. Some policymakers urged caution, citing uncertainty around the neutral rate and shifting global rate environments. They argued flexibility should take precedence over targeting a specific policy level.

At the meeting, the BoJ raised its policy rate to a 30-year high of 0.75%.

Daily Pivots: (S1) 0.7868; (P) 0.7886; (R1) 0.7914;

Intraday bias in USD/CHF remains neutral and more consolidations would be seen above 0.78670 temporary low. While stronger recovery cannot be ruled out, further fall is expected as long as 0.7986 resistance holds. Break of 0.7860 will target 0.7828 low. Decisive break there will confirm larger down trend resumption.

In the bigger picture, outlook will stay bearish as long as 0.8332 support turned resistance holds (2023 low). Long term down trend from 1.0342 (2017 high) is still in progress. Next target is 100% projection of 1.0146 (2022 high) to 0.8332 from 0.9200 at 0.7382.

White Label

Data API

Web Plug-ins

Poster Maker

Affiliate Program

The risk of loss in trading financial instruments such as stocks, FX, commodities, futures, bonds, ETFs and crypto can be substantial. You may sustain a total loss of the funds that you deposit with your broker. Therefore, you should carefully consider whether such trading is suitable for you in light of your circumstances and financial resources.

No decision to invest should be made without thoroughly conducting due diligence by yourself or consulting with your financial advisors. Our web content might not suit you since we don't know your financial conditions and investment needs. Our financial information might have latency or contain inaccuracy, so you should be fully responsible for any of your trading and investment decisions. The company will not be responsible for your capital loss.

Without getting permission from the website, you are not allowed to copy the website's graphics, texts, or trademarks. Intellectual property rights in the content or data incorporated into this website belong to its providers and exchange merchants.

Not Logged In

Log in to access more features

FastBull Membership

Not yet

Purchase

Log In

Sign Up